|

市场调查报告书

商品编码

1639508

东南亚塑胶 -市场占有率分析、产业趋势、成长预测(2025-2030)South-East Asia (SEA) Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

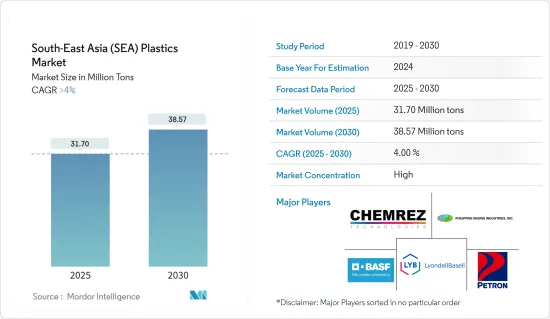

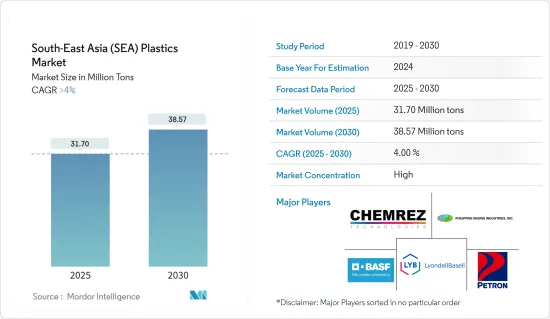

东南亚塑胶市场规模预计到2025年为3,170万吨,预计2030年将达到3,857万吨,在预测期内(2025-2030年)复合年增长率超过4%。

COVID-19 大流行严重影响了东南亚国家。疫情影响了塑胶的生产和供应,从而影响了市场。然而,在大流行期间,由于线上食品和零售电子商务服务的使用增加,包装领域的需求激增。然而,在新冠疫情之后,由于包装、电气电子、建筑、汽车和运输行业的需求增加,市场出现了强劲的成长。

主要亮点

- 从中期来看,食品和饮料包装需求的增加以及下游加工能力的快速增加预计将推动市场成长。

- 然而,政府有关塑胶使用的法规和对进口原材料的过度依赖是阻碍所研究市场成长的主要因素。

- 航太领域的潜在成长和可分解塑胶使用的增加预计将为市场成长提供各种机会。

东南亚塑胶市场趋势

射出成型技术主导市场

- 射出成型技术用于製造大量用于各行业的塑胶产品。塑胶射出成型技术用于多种应用,包括建筑、消费品、包装、电子、汽车和医疗产业。

- 就食品包装而言,该地区是世界领先的食品工业之一。这些国家对食品不断增长的需求是包装领域的主要驱动力,进一步增加了该地区对包装的需求。根据美国农业部对外农业服务部的数据,2022 年包装食品零售总额为 3,751 万美元,而上年度一年为 3,297 万美元。此外,到2023年,印尼食品电子商务市场预计将达到63.295亿美元。因此,该国食品市场的成长预计将推动该国的塑胶需求。

- 此外,泰国对塑胶包装的需求正在增加。全国有食品饮料加工企业1万多家,其中大多数是中小型企业。食品和饮料业是该国第三大产业,占国内生产总值(GDP)的21%。这些因素正在推动该地区食品包装的需求。

- 泰国是最大的旅游中心之一。目前正在大力投资扩建和建造购物中心和豪华酒店。芭堤雅马奎斯万豪酒店是泰国在建项目中最大的计划,预计将于 2024 年投入运作,拥有 900 多间客房。新的万豪侯爵酒店将成为两个房地产开发项目的一部分,包括拥有 398 间客房的 JW 万豪酒店和芭堤雅海滩度假村及水疗中心。到2027年,万豪可能会在泰国曼谷和芭达雅开设三个品牌的四家新酒店。

- 越南的汽车工业发展迅速。 2022年11月,现代汽车在该国开设了一家新汽车工厂,产能为10万辆汽车。 2023年1月,中国电动车巨头比亚迪宣布计画在越南建厂生产汽车零件。因此,汽车工业的成长预计将增加该国对塑胶的需求。

- 因此,射出成型技术预计将在预测期内主导东南亚塑胶市场。

印尼主导市场

- 印尼是该地区重要的塑胶市场。塑胶用于各种最终用户行业,包括包装、电气和电子、建筑、汽车和家具行业。在印尼,汽车和包装行业取得了显着的成长,并推动了该国的塑胶需求。

- 印尼是东南亚最重要的汽车生产基地。 2022年,印尼汽车产量达1,470,146辆,较上年度的11,219,967辆成长31%。因此,汽车行业的成长预计将推动该国的塑胶需求。

- 印尼的建设活动正在增加。印尼的高层建筑数量显着增加。印尼政府近日宣布,将投资3,359万美元在婆罗洲岛兴建新首都,耗时10年完工。

- 此外,由于政府投资增加,该国的基础设施建设活动正在增加。印尼政府计划在2024年投资约4,300亿美元用于公共基础建设发展,比先前的3,592亿美元投资成长20%。

- 同样,印尼的住宅建设也在增加。此外,印尼政府还启动了一项计划,在印尼各地建造约 1,000 万住宅,并为此专门累计约 10 亿美元。因此,住宅和基础设施建设活动的成长将推动该国对塑胶的需求。

- 由于电子商务行业需要产品包装,印尼塑胶的使用量正在增加。包括丰益集团、Mayora 和 Indofood 在内的多家快速消费品公司已在印尼建立了综合包装生产工厂。埃克森美孚也投资印尼塑胶产业,于2022年11月与PT Indomobil Prima Energi (IPE)签署谅解备忘录,在印尼大规模应用先进塑胶回收技术。

- 因此,汽车工业和住宅工业的成长预计将在预测期内扩大塑胶市场。

东南亚塑胶产业概况

东南亚塑胶市场正在整合。市场的主要企业包括(排名不分先后) BASF SE、Chemrez Technologies, Inc.、LyondellBasell Industries Holdings BV、Petron Corporation 和 Philippine Resins Industries, Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料包装的需求增加

- 下游加工能力快速提升

- 其他司机

- 抑制因素

- 政府对塑胶污染的严格监管

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 类型

- 传统塑料

- 工程塑料

- 生质塑胶

- 科技

- 吹塑成型

- 挤出成型

- 射出成型

- 其他的

- 目的

- 包装

- 电力/电子

- 建筑/施工

- 汽车和交通

- 家居用品

- 家具/寝具

- 其他的

- 地区

- 印尼

- 泰国

- 马来西亚

- 新加坡

- 菲律宾

- 越南

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Plastic Resin Manufacturers

- AGC Chemicals Vietnam Co., Ltd.

- BASF SE

- Chemrez Technologies, Inc.

- Dow

- DuPont

- JG summit Petrochemical Corporation

- LyondellBasell Industries Holdings BV

- Nan Ya Plastics Corporation(Formosa)

- NPC Alliance Corporation

- Petron Corporation

- Philippine Resins Industries, Inc.

- Plastic Product Manufacturers

- Ampac Holdings, LLC

- Bavico Ltd.

- Binh Minh Plastic

- Chan Thuan Thanh Plastic Mechanical & Trading Co. Ltd.

- Cholon Plastic Co. Ltd.

- City Long(Cambodia)Co., Ltd.

- Duy Tan Plastics Corporation

- Plastic Resin Manufacturers

第七章 市场机会及未来趋势

- 航太领域的潜在成长?

- 增加可分解塑胶的使用

The South-East Asia Plastics Market size is estimated at 31.70 million tons in 2025, and is expected to reach 38.57 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic severely affected countries across Southeast Asia. The pandemic affected the production and supply of plastics, thereby affecting the market. However, the demand from the packaging segment surged due to the increasing use of online food and retail e-commerce services during the pandemic. However, post-COVID pandemic, the market registered a significant growth rate due to rising demand from packaging, electrical and electronics, building and construction, automotive, and transportation industries.

Key Highlights

- Over the medium term, The rising demand from the food and beverage packaging, and the rapid increase in the downstream processing capacity additions are expected to drive the market's growth.

- However, government regulations on the use of plastics and over-reliance on the imports of raw materials are the major factors hindering the growth of the studied market.

- The potential growth in the aerospace sector and the increasing usage of bio-degradable plastics are expected to offer various opportunities for the growth of the market.

Southeast Asia Plastics Market Trends

Injection Molding Technology to Dominate the Market

- Injection molding technology is used to manufacture high-volume plastic products used in various industries. The plastic injection molding technology is used in various applications, such as building and construction, consumer goods, packaging, electronics, automotive, and healthcare industries.

- In terms of food packaging, the region has one of the major food industries in the world. The growing demand for food in these countries is a major driving factor for the packaging sector, which further increases the demand for packaging in the region. According to USDA Foreign Agriculture Services, the retail sales value of packaged foods registered at USD 37.51 million in 2022, compared to USD 32.97 million registered in the previous year. Furthurmore, the Indonesian Food e-commerce market is predicted to reach USD 6,329.5 million by 2023. Thus, the growth in the country's food market is expected to drive the demand for plastics in the country.

- Further, the demand for plastic packaging is increasing in Thailand. The country has more than 10,000 10,000 F&B processing companies, of which most of them are small-to-medium size. The food and beverage industry is the country's third-largest industry, contributing 21% to the country's Gross Domestic Product (GDP). Such factors are driving the demand for food packaging in the region.

- Thailand is one of the largest hubs for tourists. It has been witnessing considerable investments in the expansion and construction of malls, luxury hotels, etc. The Pattaya Marriott Marquis Hotel is the largest project in Thailand's pipeline, which may be in operation by 2024, with over 900 guest rooms. This new Marriott Marquis will be part of a dual-property development, which will also include the 398-room JW Marriott and the Pattaya Beach Resort & Spa. Marriott may add four new hotels under three of its brands across Bangkok and Pattaya in Thailand by 2027.

- The automotive industry is growing at a significant rate in Vietnam. In November 2022, Hyundai opened a new car factory in the country with a capacity of 100,000 units. Chinese electric vehicle player BYD, in January 2023, revealed its plan to build a plant in Vietnam to produce car parts. Thus, the growth of the automotive industry is expected to increase the demand for plastics in the country.

- Thus, Injection molding technology is expected to dominate the Southeast Asia plastics market during the forecast period.

Indonesia Country to Dominate the Market

- Indonesia is a significant market for plastics in the region. Plastics are used in various end-user industries such as packaging, electrical and electronics, building and construction, automotive, and furniture industries. In Indonesia, the automotive and packaging industries registered a significant growth rate, thereby driving the demand for plastics in the country.

- Indonesia is Southeast Asia's most significant automotive production hub. In 2022, the production volume of automotive vehicles in Indonesia registered at 1,470,146 units as compared to 11,21,967 units manufactured in the previous year, at a growth rate of 31%. Thus, the growth in the automotive industry is expected to drive the demand for plastics in the country.

- The building and construction activities are increasing in Indonesia. The number of high-rise buildings in Indonesia has been growing significantly. Recently, the government of Indonesia revealed that the new capital city would be built on the island of Borneo with an investment of USD 33.59 million, and construction would take ten years.

- Furthermore, infrastructural construction activities are increasing in the country with the rising government investments. The government of Indonesia has planned to invest around USD 430 billion in public infrastructure development by the year 2024, a 20% increase compared to its previous investment of USD 359.2 billion.

- Similarly, residential construction activities are increasing in Indonesia. Moreover, the Indonesian government has started a program to build about 10,00,000 housing units across Indonesia, for which the government has allocated about USD 1 billion in the budget. Thus, the growth in residential and infrastructural construction activities will drive the demand for plastics in the country.

- The usage of plastics in Indonesia is expanding since the e-commerce industry necessitates the packaging of items. Several FMCG companies, including Wilmar Group, Mayora, and Indofood, have established integrated packaging production units in Indonesia. Exxon Mobil is also investing in the Indonesian plastic industry and signed a memorandum of understanding with PT Indomobil Prima Energi (IPE) in November 2022 regarding the application of advanced plastic recycling technology on a large scale in Indonesia.

- Thus, the growth in the automotive and residential industries is expected to increase the market for plastics during the forecast period.

Southeast Asia Plastics Industry Overview

The South-East Asia plastics market is consolidated. Some of the major players in the market (not in any particular order) include BASF SE, Chemrez Technologies, Inc., LyondellBasell Industries Holdings B.V.,Petron Corporation, and Philippine Resins Industries, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Food and Beverage Packaging

- 4.1.2 Rapid Increase in the Downstream Processing Capacity Additions

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations against Plastic Pollution

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Thailand

- 5.4.3 Malaysia

- 5.4.4 Singapore

- 5.4.5 Philippines

- 5.4.6 Vietnam

- 5.4.7 Rest of South-East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Plastic Resin Manufacturers

- 6.4.1.1 AGC Chemicals Vietnam Co., Ltd.

- 6.4.1.2 BASF SE

- 6.4.1.3 Chemrez Technologies, Inc.

- 6.4.1.4 Dow

- 6.4.1.5 DuPont

- 6.4.1.6 JG summit Petrochemical Corporation

- 6.4.1.7 LyondellBasell Industries Holdings B.V.

- 6.4.1.8 Nan Ya Plastics Corporation (Formosa)

- 6.4.1.9 NPC Alliance Corporation

- 6.4.1.10 Petron Corporation

- 6.4.1.11 Philippine Resins Industries, Inc.

- 6.4.2 Plastic Product Manufacturers

- 6.4.2.1 Ampac Holdings, LLC

- 6.4.2.2 Bavico Ltd.

- 6.4.2.3 Binh Minh Plastic

- 6.4.2.4 Chan Thuan Thanh Plastic Mechanical & Trading Co. Ltd.

- 6.4.2.5 Cholon Plastic Co. Ltd.

- 6.4.2.6 City Long (Cambodia) Co., Ltd.

- 6.4.2.7 Duy Tan Plastics Corporation

- 6.4.1 Plastic Resin Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Growth in the Aerospace Sector?

- 7.2 Increasing Usage of Bio-degradable Plastics