|

市场调查报告书

商品编码

1639509

生物有机酸 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Bio-Organic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

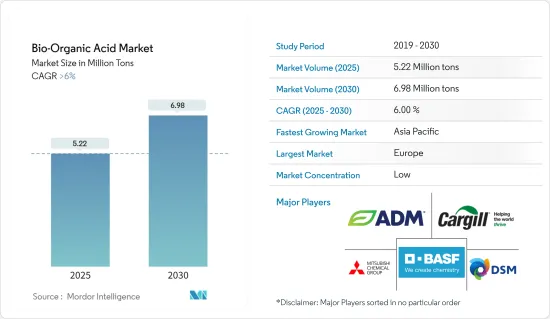

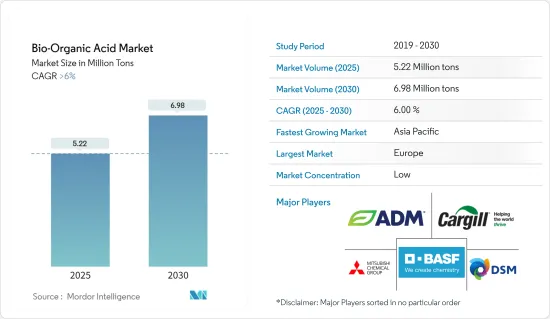

预计2025年生物有机酸的市场规模为522万吨,预计2030年将达到698万吨,预测期间(2025-2030年)复合年增长率将超过6%。

由于全国范围内的封锁、严格的社交距离措施和供应链中断,COVID-19 大流行对市场产生了负面影响。这些因素对食品饮料、纺织品和涂料市场产生了负面影响,进而影响了生物有机酸市场。不过,限购解除后,市场稳定復苏。由于食品和饮料、纺织品和涂料等终端用户行业生物有机酸消费量的增加,市场已显着復苏。

对传统有机酸的严格监管以及医疗应用中对生物基聚合物不断增长的需求预计将推动生物有机酸市场的发展。

生物基化学品的高製造成本预计将阻碍市场成长。

转向环保产品预计将在预测期内创造市场机会。

预计亚太地区将主导市场。由于製药、纺织品、被覆剂和食品应用中对生物有机酸的需求不断增加,预计在预测期内复合年增长率将达到最高。

生物有机酸市场趋势

食品饮料产业主导市场

- 预计食品和饮料最终用户产业将在预测期内主导生物有机酸市场。生物有机酸及其衍生物经常用于饮料、食品和饲料的生产。酸性添加剂可以充当调节酸度的缓衝剂、抗氧化剂、防腐剂、增味剂和螯合剂。

- 北美和欧洲是世界上最大的食品和饮料市场。根据美国人口普查局的数据,2023 年 11 月美国零售和食品服务业的月度零售额约为 7,057 亿美元,而 9 月为 7,049 亿美元。这样,食品饮料市场的扩张将带动该国生物有机酸市场的发展。

- 此外,根据美国农业部的数据,墨西哥拥有美洲第三大食品加工业,仅次于美国和巴西。根据农业市场咨询小组 (GCMA) 的资料,该国粮食产量预计将从 2022 年的 2.87 亿吨增至 2023 年的 2.9 亿吨。

- 食品和饮料产业是欧洲最大的製造业之一。根据FoodDrinkEurope统计,2022年第四季食品饮料产业销售额较上季成长2.3%,2021年第四季较去年同期成长19.2%。因此,食品和饮料市场的销售成长预计将推动该地区的生物有机酸市场。

- 德国是欧洲最大的食品和饮料市场。食品工业是该国第四大工业部门。德国食品饮料工业联合会(BVE)资料显示,2022年,该国食品饮料加工总收入达207亿美元,与前一年同期比较去年同期成长17.9%。因此,食品和饮料行业的成长预计将推动该地区生物有机酸市场的发展。

- 因此,食品和饮料最终用户产业预计将在预测期内主导生物有机酸市场。

亚太地区主导市场成长

- 由于该地区製药、纺织、涂料以及食品和饮料终端用户行业的需求不断增长,预计亚太地区将主导生物有机酸市场。

- 中国和印度是该地区最大的食品和饮料市场。根据中国国家轻工业委员会统计,2022年年销售额超过280万美元的主要食品生产企业收益累计超过1.53兆美元。与2021年与前一年同期比较,总收入年增5.6%,显示食品业成长强劲。

- 同样,在印度,食品和饮料行业预计将显着成长。 IBEF预计,2022年印度食品加工市场规模预计将达到307.2兆美元,2028年将达到547.3兆美元。因此,食品加工市场的成长预计将增加该国生物基有机酸的使用量。

- 製药业对生物有机酸的需求不断增加。印度是世界製药中心,向 200 多个国家出口药品。 2022-2023年上半年,流入医药产业的外商直接投资成长25%。根据IBEF预测,到2024年,製药业的收益预计将达到650亿美元。因此,医药市场的扩大将带动目前的研究市场。

- 此外,在中国,纺织业的市场成长显着。根据中国国家统计局数据,2022年中国纺织品产量达382亿米,去年同期为235亿米。 12月份,我国服饰布料产量约34.7亿公尺。每月纺织品产量始终超过30亿公尺。

- 由于上述因素,亚太生物有机酸市场预计在预测期内将显着成长。

生物有机酸产业概况

生物有机酸市场分散。市场的主要企业包括(排名不分先后)BASF、帝斯曼、三菱化学公司、嘉吉公司和 ADM。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 常规有机酸的严格规定

- 医疗应用对生物基聚合物的需求不断增长

- 其他司机

- 抑制因素

- 生物基化学品的製造成本上升

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 原料

- 生物量

- 玉米

- 玉米

- 糖

- 其他原料

- 产品类型

- 生物乳酸

- 生物醋酸

- 生物己二酸

- 生物丙烯酸

- 生物琥珀酸

- 其他产品种类(生物柠檬酸、生物富马酸等)

- 应用领域

- 聚合物

- 药品

- 纺织产品

- 涂层

- 饮食

- 其他用途(个人护理、化学等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ADM

- Abengoa

- BASF SE

- BioAmber Inc

- Braskem

- Cargill, Incorporated

- Corbion

- Cosun

- DSM

- Genomatica

- Gfbio

- Mitsubishi Chemical Corporation

- NatureWorks LLC

- Novozymes

- PTT Global Chemical Public Company Limited

第七章 市场机会及未来趋势

- 转向环保产品

- 其他机会

The Bio-Organic Acid Market size is estimated at 5.22 million tons in 2025, and is expected to reach 6.98 million tons by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market due to nationwide lockdowns, strict social distancing measures, and disruption in supply chains. These factors negatively affected the food and beverage, textile, and coating markets, thereby affecting the market for bio-organic acids. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of bio-organic acids in food and beverage, textile, and coating end-user industries.

The stringent regulations over conventional organic acids and the growing demand for bio-based polymers in healthcare applications are expected to drive the market for bio-organic acids.

The higher production cost of bio-based chemicals is expected to hinder the growth of the market.

The shifting focus towards eco-friendly products is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for bio-organic acids in pharmaceuticals, textiles, coatings, and food products applications.

Bio-Organic Acid Market Trends

Food and Beverage Industry to Dominate The Market

- The food and Beverage end-user industry is expected to dominate the market for bio-organic acid during the forecast period. Bio-organic acids and their derivatives are frequently used in beverage, food, and feed production. Acidic additives may act as buffers to regulate acidity, antioxidants, preservatives, flavor enhancers, and sequestrants.

- North America and Europe are the largest markets for food and beverages across the globe. According to the U.S. Census Bureau, monthly retail sales from U.S. retail and food services were valued at around USD 705.7 billion in November 2023, as compared to USD 704.9 billion in September. Thus, the increasing market for food and beverage products will drive the market for bio-organic acids in the country.

- Furthermore, according to the USDA, Mexico is the third-largest food processing industry in the Americas, after the United States and Brazil. According to data from the Agricultural Markets Advisory Group (GCMA), the country's food production is anticipated to reach 290 million tons in 2023, growing from 287 million tons in 2022.

- The food and beverage sector is one of the largest manufacturing industries in Europe. According to FoodDrinkEurope, the food and beverage industry turnover increased by 2.3% in Q4 2022, compared to the previous quarter, and increased by 19.2% Y-o-Y compared to Q4 2021. Thus, the growth in food and beverage market turnover is expected to drive the market for bio-organic acid in the region.

- Germany is the largest market for food and beverage products in Europe. The food industry represents the fourth-largest industrial sector in the country. According to data from the Federation of German Food and Drink Industries (BVE), in 2022, the total revenue of food and beverage processing in the country reached USD 20.7 billion, at a growth rate of 17.9% as compared to the previous year. Thus, the growth in the food and beverage sector is expected to drive the market for bio-organic acids in the region.

- Thus, the food and beverage end-user industry is expected to dominate the market for bio-organic acid during the forecast period.

Asia-Pacific Region to Dominate the Market Growth

- The Asia-Pacific region is expected to dominate the market for bio-organic acid due to rising demand from pharmaceuticals, textiles, coatings, food and beverage end-user industries in the region.

- China and India are the largest food and beverage markets in the region. According to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6%, indicating strong growth in the food industry.

- Similarly, in India, the food and beverage sector is expected to register a significant growth rate. According to IBEF, Indian food processing market size reached USD 307.2 trillion in 2022 and is expected to reach USD 547.3 trillion by 2028. Thus, the growth in food processing markets will increase the usage of bio-based organic acids in the country.

- The demand for bio-organic acids is increasing in the pharmaceutical sector. India is a global pharmaceutical hub, exporting pharmaceuticals to over 200 countries. In the first half of 2022-2023, foreign direct investment inflows into the pharmaceutical industry increased by 25%. According to IBEF, the pharmaceutical industry revenue is expected to reach USD 65 billion by 2024. Thus, the increasing market for pharmaceuticals will drive the current studied market.

- Furthermore, in China, the textile industry registered significant market growth. According to the National Bureau of Statistics of China, China's textile production volume accounted for 38.2 billion meters in 2022, compared to 23.5 billion meters during the same period in the previous year. In December, approximately 3.47 billion meters of clothing fabric were produced in China. Monthly textile production volume was consistently above three billion meters.

- Owing to the above-mentioned factors, the market for bio-organic acid in the Asia-Pacific region is projected to grow significantly during the forecast period.

Bio-Organic Acid Industry Overview

The bio-organic acid market is fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, DSM, Mitsubishi Chemical Corporation, Cargill, Incorporated, and ADM, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Stringent Regulations Over Conventional Organic Acids

- 4.1.2 Growing Demand for Bio-based Polymer in Healthcare Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Production Cost of Bio-based Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Biomass

- 5.1.2 Corn

- 5.1.3 Maize

- 5.1.4 Sugar

- 5.1.5 Other Raw Materials

- 5.2 Product Type

- 5.2.1 Bio Lactic Acid

- 5.2.2 Bio Acetic Acid

- 5.2.3 Bio Adipic Acid

- 5.2.4 Bio Acrylic Acid

- 5.2.5 Bio Succinic Acid

- 5.2.6 Other Product Types (Bio Citric Acid, Bio Fumaric Acid, etc.)

- 5.3 Application

- 5.3.1 Polymers

- 5.3.2 Pharmaceuticals

- 5.3.3 Textile

- 5.3.4 Coatings

- 5.3.5 Food and Beverage

- 5.3.6 Other Applications (Personal Care, Chemicals, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Abengoa

- 6.4.3 BASF SE

- 6.4.4 BioAmber Inc

- 6.4.5 Braskem

- 6.4.6 Cargill, Incorporated

- 6.4.7 Corbion

- 6.4.8 Cosun

- 6.4.9 DSM

- 6.4.10 Genomatica

- 6.4.11 Gfbio

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 NatureWorks LLC

- 6.4.14 Novozymes

- 6.4.15 PTT Global Chemical Public Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Eco-Friendly Products

- 7.2 Other Opportunities