|

市场调查报告书

商品编码

1639511

欧洲企业防火墙:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Enterprise Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

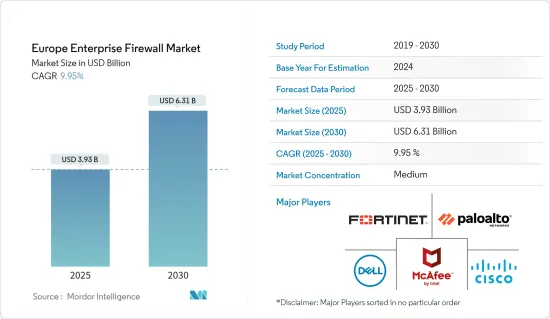

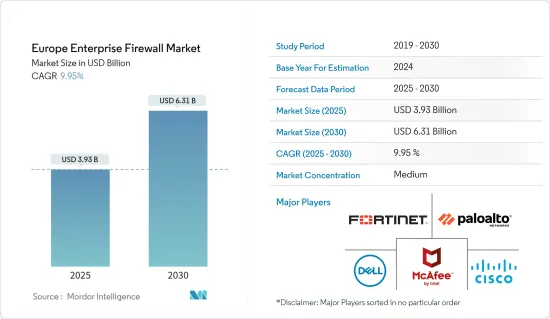

预计2025年欧洲企业防火墙市场规模为39.3亿美元,预估至2030年将达63.1亿美元,预测期间(2025-2030年)复合年增长率为9.95%。

随着网路安全技能差距的不断扩大,企业可能会在未来几年将防火墙作为首选解决方案,因为它们更易于管理,并且配置和监控所需的专业知识更少。

主要亮点

- 企业防火墙是网路安全的重要单元。防火墙根据预先定义的一组值检查公司网路内资料封包的入境和出站流量,以侦测网路内的恶意活动。

- 此外,欧洲拥有世界上最严格的资料保护条例,例如《一般资料保护规范》(GDPR)。例如,欧洲资料保护委员会 (EDPB) 是一个独立组织,负责确保整个欧盟一致遵守资料保护法。 《一般资料保护规范》(GDPR)创建了 EDPB。在该地区运营的公司被迫实施强有力的安全措施,包括防火墙,以确保遵守这些法规并保护用户资料。

- 此外,强调「永不信任,始终检验」原则的零信任安全模型也获得了支持。防火墙在根据使用者身分、设备姿态和其他环境因素实施存取控制方面发挥关键作用。根据 Okta 的报告,82% 的欧洲组织在 2021 年增加了零信任支出,而该地区没有一家公司报告支出减少。此时正值预算削减的普遍时期,凸显了零信任作为安全解决方案的重要性。

- 云端技术的出现导致了防火墙的采用,捆绑的解决方案使得防火墙可以在任何设备上使用,扩展到任何流量工作负载,并在整个组织内实施统一的政策。

- 网路应用程式的快速采用、云端技术的快速采用以及为减轻网路攻击风险而对安全服务的需求不断增长也在推动欧洲企业防火墙市场的成长。网路安全防火墙越来越多地被各种终端用途的企业采用,以保护资料和资讯免受安全漏洞和网路攻击。从而推动了整个网路安全防火墙市场的成长。

- 然而,该地区拥有旧有系统和过时网路架构的组织在部署现代防火墙解决方案时可能需要相容性问题方面的协助。这可能会减慢或阻止先进防火墙的采用。

欧洲企业防火墙市场趋势

企业越来越多地采用云端服务将推动市场成长

- 提供扩充性、灵活性和资源存取的云端服务正在改变组织流程。然而,随着越来越多的个人采用云端服务,对强大的安全措施(如企业防火墙)的需求也日益增长,以保护云端基础的环境中使用的资料、应用程式和基础设施。

- 欧洲各地的公司正在进行数位转型,以提高生产力、重组工作流程并进行创新以满足不断变化的消费者需求。云端服务透过提供可扩展的基础架构、软体即服务 (SaaS) 应用程式和平台即服务 (PaaS) 选项,充当此转变的框架。但这种转变需要正确的安全解决方案来保护您的云端基础的资产。

- 例如,根据欧盟统计局的数据,购买云端处理服务的绝大多数(94%)欧盟公司至少使用过一种云端软体即服务 (SaaS) 产品,包括安全软体应用程式即云端服务。 。此外,据报道,所有规模的企业对云端 SaaS 的采用率约为 94%,表明包括安全解决方案在内的云端基础的应用程式被广泛采用。如此高的采用率表明企业正在采用云端基础的工具来增强业务,包括网路安全。

- 此外,云端运算的成长造成了日益复杂的威胁情势,凸显了对现代安全解决方案的需求,这些解决方案可以抵御恶意软体和勒索软体攻击的快速成长,并在整个云端系统提供一致的安全性。根据 SonicWall 2022 年网路威胁报告,欧洲的恶意软体攻击和勒索软体攻击显着增加,年与前一年同期比较增加了 29% 和 63%。此外,勒索软体攻击最多的11个国家中有7个位于欧洲(英国、义大利、德国、荷兰、挪威、波兰和乌克兰),这显示该地区的网路威胁情势正在改变。

英国可望占据主要市场占有率

- 英国拥有强大且成熟的网路安全生态系统,包括一系列网路安全公司、研究机构和技术专家。这个生态系统促进了先进的网路安全解决方案的创新和发展,包括企业防火墙技术。

- 英国作为金融和商业中心,拥有许多跨国公司、金融机构和科技公司。由于这些企业需要先进的网路安全解决方案来保护敏感资料、智慧财产权和消费者资料,因此企业防火墙的需求量很大。

- 中国也正在积极推动各产业的数位转型。随着企业实现业务现代化、采用云端服务和拥抱物联网设备,对保护这些倡议的先进防火墙解决方案的需求变得至关重要。

- 此外,根据 DSIT UK 的数据,2022 年,大多数英国註册的网路安全公司都提供专业的网路服务,包括提供与网路安全相关的指导、产品和解决方案。网路安全的占比约为61%,被记录为公司提供的第二大重要服务。这些重要的网路安全註册者与企业防火墙的功能紧密结合,在保护网路免受未授权存取、资料外洩、恶意软体和其他网路攻击方面发挥关键作用。

- 此外,该国拥有大量知识渊博的网路安全专业人员,他们为防火墙系统的建置、应用和管理做出了贡献。例如,根据英国国家统计局的报告,到 2022 年 9 月,英国创新产业的 IT、软体和电脑服务子部门的员工数量预计将超过 100 万人,低于去年的 94 万人。记录下来。其中约108,000人为自营业者。劳动力的显着成长支持了各行各业推出先进的安全措施。

欧洲企业防火墙产业概况

由于全球和本地参与者的存在,欧洲企业防火墙市场预计将半整合。参与者正在积极建立伙伴关係关係,透过结合各自在行业内的专业知识来加强他们的解决方案。企业防火墙市场的领先公司包括思科系统、戴尔公司、Palo Alto Networks、Fortinet 公司等。

2023 年 5 月,Palo Alto Networks 宣布将在 Microsoft Azure 上提供其由 ML 驱动的新一代防火墙 (NGFW),作为完全託管的 Azure 原生 ISV 服务。适用于 Azure 的云端 NGFW 提供了完整的安全解决方案,具有进阶威胁预防、进阶 URL 过滤、WildFire 和 DNS 安全性等进阶功能。此外,该公司指出,Azure 的云端 NGFW 现已在西欧推出。

2023 年 2 月,英国网路安全服务供应商 Sophos 宣布推出两款新的企业级 XGS 系列设备,扩展其新一代防火墙产品组合。新款 XGS 7500 和 8500 型号为大型企业和校园提供最佳性能和保护,有可能扩大其支援的通路合作伙伴的市场前景。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 企业越来越多采用云端服务

- 网路威胁环境发展

- 增强对资料隐私和资料外洩后果的认识

- 市场限制

- 难以将防火墙整合到现有网路基础架构中

- 由于专业知识有限,防火墙的部署与管理十分复杂

第六章 技术简介

第七章 市场区隔

- 依部署类型

- 本地

- 云

- 按解决方案

- 硬体

- 软体

- 按服务

- 按组织规模

- 中小企业

- 大型组织

- 按最终用户产业

- 卫生保健

- 製造业

- 政府

- 零售

- 教育

- 金融服务

- 其他行业

- 按国家

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

第八章 竞争格局

- 公司简介

- Fortinet Inc.

- Palo Alto Networks

- McAfee(Intel Security Group)

- Dell Inc.

- Cisco Systems Inc.

- The Hewlett-Packard Company

- Juniper Networks

- Check Point Software Technologies

- Huawei Technologies Inc.

- Sophos Group PLC

- Netasq SA

- WatchGuard Technologies

- SonicWall Inc.

第九章投资分析

第十章:市场的未来

The Europe Enterprise Firewall Market size is estimated at USD 3.93 billion in 2025, and is expected to reach USD 6.31 billion by 2030, at a CAGR of 9.95% during the forecast period (2025-2030).

As the cybersecurity skills gap persists, enterprises in the coming years may seek firewalls as an optimal solution that is easier to manage and requires less specialized expertise for configuration and monitoring.

Key Highlights

- Enterprise firewalls are essential units of network security. They examine the flow of inbound and outbound data packets in an enterprise network against a set of predefined values to detect any malicious activity in the network.

- Moreover, Europe has some of the strictest data protection regulations worldwide, such as the General Data Protection Regulation (GDPR). For example, the European Data Protection Board (EDPB) is an independent organization responsible for ensuring that data protection laws are consistently followed across the entire European Union. The General Data Protection Regulation (GDPR) created the EDPB. Enterprises operating in the region are compelled to implement robust security measures, including firewalls, to ensure compliance with these regulations and protect user data.

- Moreover, the zero trust security model gained traction, emphasizing the principle of "never trust, always verify." Firewalls played a key role in enforcing access controls based on user identity, device posture, and other contextual factors. According to Okta's report, in 2021, 82% of European organizations boosted their Zero Trust expenditures, while no company in the region reported a drop. This occurs when budget cuts have been prevalent, highlighting the significance of Zero Trust as a security solution.

- With the emergence of cloud technology, firewalls are now being deployed, which offer a bundled solution that ensures the availability of a firewall on any device, addresses any traffic workload, and enforces similar policies across the organization.

- The rapid use of web applications, rapid adoption of cloud technologies, and the increasing demand for security services to mitigate the risk of cyberattacks are also driving the growth of the enterprise firewall market in Europe. In order to protect the data & information from security breaches and cyber-attacks, the implementation of network security firewalls is growing across various end-use enterprises. Consequently, driving the growth of the overall network security firewalls market.

- However, organizations with legacy systems or outdated network architectures in the region might need help with compatibility issues when implementing modern firewall solutions. This could delay or hinder the adoption of advanced firewalls.

Europe Enterprise Firewall Market Trends

Increasing adoption of Cloud Services among Enterprises to Drive the Market Growth

- Organizational processes have been significantly altered by cloud services, which offer scalability, flexibility, and accessibility to resources. However, as more individuals utilize cloud services, the demand for strong security measures, such as corporate firewalls, to safeguard the data, apps, and infrastructure used in cloud-based environments is rising.

- Businesses all around Europe are undertaking a digital transformation to increase productivity, reorganize workflows, and innovate in response to shifting consumer needs. By delivering scalable infrastructure, Software as a Service (SaaS) applications, and Platform as a Service (PaaS) options, cloud services serve as a framework for this transformation. However, this transition requires adequate security solutions to protect cloud-based assets.

- For instance, the majority (94%) of EU businesses who purchased cloud computing services also utilized at least one cloud Software as a Service (SaaS), which includes security software applications as a cloud service, according to Eurostat. Additionally, the adoption of cloud SaaS across all corporate sizes has been reported to be approximately 94%, which signifies the widespread adoption of cloud-based applications, including security solutions. This high adoption rate indicates businesses are embracing cloud-based tools to enhance their operations, including cybersecurity.

- Also, the complexities of the threat landscape increase with the growth of cloud computing, highlighting the need for modern security solutions that can defend against the upsurge in malware and ransomware assaults and offer consistent security across cloud systems. As per SonicWall Cyber Threat Report 2022, Malware assaults and ransomware efforts significantly increased in Europe by 29% and 63%, respectively, year over year. In addition, seven of the top 11 ransomware target nations in terms of volume were in Europe (United Kingdom, Italy, Germany, Netherlands, Norway, Poland, and Ukraine), indicating a change in the region's cyber threat environment.

United Kingdom is Expected to Hold a Significant Market Share

- The United Kingdom boasts a robust and mature cybersecurity ecosystem that includes various cybersecurity companies, research institutions, and skilled professionals. This ecosystem fosters innovation and the development of advanced cybersecurity solutions, including enterprise firewall technologies.

- Many international enterprises, financial institutions, and technological firms operate in the United Kingdom, a major financial and business center. Enterprise firewalls are in considerable demand as a result of these enterprises' necessity for advanced cybersecurity solutions to safeguard their confidential data, intellectual property, and consumer data.

- Also, the country is actively pursuing digital transformation across various industries. As organizations modernize their operations, adopt cloud services, and embrace IoT devices, the need for advanced firewall solutions to secure these digital initiatives becomes crucial.

- Moreover, in 2022, according to DSIT UK, most of the United Kingdom's registered cyber security companies provided professional cyber services, including offering guidance, products, or solutions associated with cyber security. Network security was recorded to be registering around 61%, the second most significant service that businesses offered the most frequently. Such significant network security registered firms in the country align closely with the functionalities of enterprise firewalls, which play a crucial role in safeguarding networks from unauthorized access, data breaches, malware, and other cyber attacks.

- Additionally, the nation is host to a pool of knowledgeable cybersecurity experts who contribute to the creation, application, and administration of firewall systems. For instance, the Office for National Statistics (UK) reported that the IT, software, and computer services sub-sector in the UK's creative industries employed more than one million individuals as of September 2022, compared with the previous year, recording 940,000. About 108,000 of these individuals were self-employed. Such a significant growth rate in the workforce supports the deployment of sophisticated security measures across industries.

Europe Enterprise Firewall Industry Overview

The Europe enterprise firewall market is expected to be Semi consolidated owing to the presence of global and local players. The players are actively engaging in partnerships and collaborations to enhance their solutions through combined expertise in the industry. Prominent players in the enterprise firewall market include Cisco Systems, Dell Inc., Palo Alto Networks, and Fortinet Inc.

In May 2023, Palo Alto Networks announced that as a fully managed Azure-native ISV service, the firm will deliver its ML-powered next-generation Firewall (NGFW) to Microsoft Azure. Cloud NGFW for Azure provides a complete security solution with advanced capabilities, including Advanced Threat Prevention, Advanced URL Filtering, WildFire, and DNS Security. Moreover, the firm mentioned that Cloud NGFW for Azure is made available in West Europe.

In February 2023, Sophos, a United Kingdom-based cybersecurity service provider, announced the expansion of its next-generation firewall portfolio with two new enterprise-grade XGS Series appliances. The new XGS 7500 and 8500 models may offer large enterprises and campus installations optimal performance and protection, expanding market prospects for the supporting channel partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing adoption of Cloud Services among Enterprises

- 5.1.2 Developing Cyber Threat Environment

- 5.1.3 Increasing Awareness of Data Privacy and Consequences of Data Breaches

- 5.2 Market Restraints

- 5.2.1 Difficulty in Integrating Firewalls with Existing Network Infrastructure

- 5.2.2 Complexity of Deploying and Managing Firewalls due to Limited Expertise

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Type of Deployment

- 7.1.1 On-premises

- 7.1.2 Cloud

- 7.2 By Solution

- 7.2.1 Hardware

- 7.2.2 Software

- 7.2.3 Services

- 7.3 By Size of the Organization

- 7.3.1 Small to Medium Organizations

- 7.3.2 Large Organizations

- 7.4 By End-User Verticals

- 7.4.1 Healthcare

- 7.4.2 Manufacturing

- 7.4.3 Government

- 7.4.4 Retail

- 7.4.5 Education

- 7.4.6 Financial Services

- 7.4.7 Other End-User Verticals

- 7.5 By Country

- 7.5.1 Germany

- 7.5.2 United Kingdom

- 7.5.3 France

- 7.5.4 Russia

- 7.5.5 Spain

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fortinet Inc.

- 8.1.2 Palo Alto Networks

- 8.1.3 McAfee (Intel Security Group)

- 8.1.4 Dell Inc.

- 8.1.5 Cisco Systems Inc.

- 8.1.6 The Hewlett-Packard Company

- 8.1.7 Juniper Networks

- 8.1.8 Check Point Software Technologies

- 8.1.9 Huawei Technologies Inc.

- 8.1.10 Sophos Group PLC

- 8.1.11 Netasq SA

- 8.1.12 WatchGuard Technologies

- 8.1.13 SonicWall Inc.