|

市场调查报告书

商品编码

1639512

中东和非洲的热电联产 -市场占有率分析、行业趋势、统计数据、成长预测(2025-2030)Middle East And Africa Combined Heat And Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

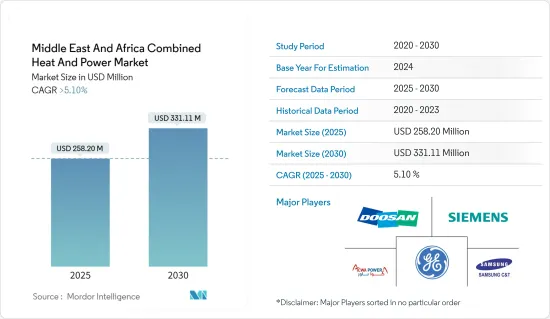

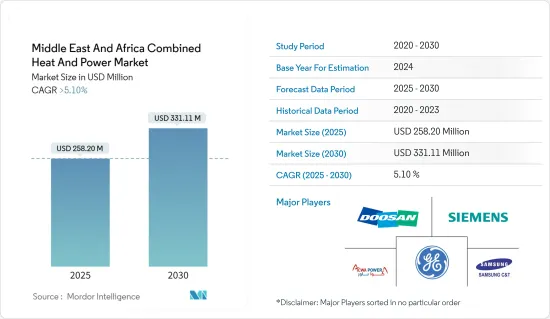

预计2025年中东和非洲热电市场规模为2.582亿美元,预测期内(2025-2030年)复合年增长率超过5.1%,2030年达到3.3111亿美元。

主要亮点

- 从中期来看,市场发展的增加以及对能源效率的需求预计将在预测期内推动市场发展。

- 另一方面,太阳能等再生能源来源的渗透率不断提高预计将阻碍预测期内的市场成长。

- 可与再生能源来源整合的热电联产系统预计将为中东和非洲的热电联产市场带来重大商机。

- 由于该地区能源需求不断增加,沙乌地阿拉伯预计将成为市场的主导地区。

中东和非洲热电联产市场趋势

生物质市场预计将显着成长

- 中东和非洲拥有多种生物质库存,例如农业残留物和有机废弃物,可以供应当地生产的可再生能源。该区域资源与生物质燃料生产的策略结合强化了生物质作为热电联产系统燃料选择的形象。

- 此外,追求区域能源安全和减少对石化燃料的依赖与生物质的特性产生了深刻的共鸣。生物质的使用满足了两个重要需求:利用热量高效发电和透过将有机废弃物转化为能源来减少废弃物。

- 生物质热电联产系统与该地区减少碳排放的战略目标无缝对接,为能源结构多元化和提高能源独立性开闢了道路。

- 例如,根据能源研究所《2023年世界能源统计回顾》显示,2021年至2022年该地区生质燃料消费量成长了9.3%,2012年至2022年年平均成长率为11.3%。这意味着该地区生质燃料消耗的增加,也可以推断为航空业生质燃料使用量的增加。

- 此外,生物质燃料的社会和环境效益也证明了其优越性。生物质的使用减少了温室气体排放和垃圾掩埋废弃物,有助于实现当地和全球的永续性目标。随着环保意识的增强,生物质已成为一种可行的解决方案,增加了其在热电联产市场中的吸引力。

- 中东和非洲生质能的优势牢固地植根于区域资源可用性、能源安全需求和永续性愿望。随着该地区走上更清洁、更有效率的能源系统的轨道,将生物质作为热电联产的主要燃料正在重新定义能源产出、加强环境管理并迈向更永续的未来。大地促进该地区的旅行。

- 因此,鑑于上述情况,预计在预测期内中东和非洲热电联产市场将以生物质燃料为主。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯的能源多元化方针以及减少碳排放、加强能源安全和优化资源利用的承诺与热电联产系统的特性一致。沙乌地阿拉伯庞大的基础设施,加上其最大化能源来源价值的雄心,为热电联产解决方案的普及创造了有利的环境。

- 根据能源研究所的《世界能源统计回顾》,沙乌地阿拉伯的发电量从2021年到2022年成长了2.2%,但从2012年到2022年,年均成长率为3.6%,由于基础设施活动的扩张表示电力消耗增加。

- 此外,沙乌地阿拉伯强大的工业基础正在推动对高效能能源解决方案的需求。该国快速成长的工业,从石化到製造业,都需要电力和热能。热电联产系统可以捕获并再利用电力生产过程中产生的废弃物,为满足工业的双重能源需求、提高业务效率和竞争力提供了一种实用的方法。

- 此外,沙乌地阿拉伯正在投资创新和技术以巩固其优势。沙乌地阿拉伯的研发工作,特别是在能源效率和永续性的研发工作,与热电联产系统的创新主导性质产生了共鸣。将先进技术融入热电联产解决方案中,与沙乌地阿拉伯追求现代化和技术领先地位完美契合。

- 例如,2022年9月,韩国领先的发电EPC公司之一斗山能源宣布订单在沙乌地阿拉伯开发热电联产系统计划的订单。该计划耗资3.85亿美元,位于沙乌地阿拉伯东部的阿尔霍夫地区。计划计划于2024年第四季完工。

- 综上所述,预计沙乌地阿拉伯将在预测期内主导中东和非洲热电联产市场。

中东和非洲热电联产产业概况

中东和非洲热电联产市场适度分割。该市场的主要企业(排名不分先后)包括通用电气公司、西门子公司、三星物产公司、ACWA POWER 和斗山公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 工业成长加速

- 能源效率

- 抑制因素

- 替代能源能源的普及

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 燃料类型

- 天然气

- 煤炭

- 油

- 生物量

- 其他燃料类型

- 市场分析:2028年以前按地区分類的市场规模和需求预测(按地区)

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东/非洲

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- Key Companies Profiles

- General Electric Company

- Siemens AG

- Samsung C&T Corp.

- Doosan Corp.

- Engie SA

- ABB Ltd

- Saudi Electricity Company

- Saudi Arabian Oil Co.

- Market Ranking

第七章市场机会与未来趋势

- 与其他再生能源来源的整合

简介目录

Product Code: 50873

The Middle East And Africa Combined Heat And Power Market size is estimated at USD 258.20 million in 2025, and is expected to reach USD 331.11 million by 2030, at a CAGR of greater than 5.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing industrial development coupled with demand for energy efficiency is expected to drive the market during the forecast period.

- On the other hand, increasing penetration of renewable energy sources such as solar energy is expected to hinder the growth of the market during the forecasted period.

- Nevertheless, the ability of combined heat and power systems to be integrated with renewable energy sources is expected to create huge opportunities for the Middle-East and Africa Combined Heat and Power Market.

- Saudi Arabia is expected to be a dominant region for the market due to the increasing demand for energy in the region.

MEA Combined Heat & Power Market Trends

Biomass Expected to See Significant Market Growth

- The Middle-East and Africa's diverse biomass speed stock, including agricultural residues and organic waste, offers a locally sourced and renewable energy supply. This strategic alignment between regional resources and biomass fuel production bolsters its prominence as an optimal fuel option for combined heat and power systems.

- Moreover, the region's quest for energy security and reduced dependence on fossil fuels resonates profoundly with the attributes of biomass. The utilization of biomass addresses two critical imperatives: the efficient generation of electricity in heat and the mitigation of waste through organic waste to energy conversions.

- Biomass combined heat and power systems alliance seamlessly with the region's strategic goal of reducing carbon emissions and offering an avenue to diversify the energy mix and enhance energy to self-reliance.

- For instance, according to the Energy Institute Statistical Review Of World Energy 2023, biofuel consumption in the region increased by 9.3% between 2021 and 2022, while an annual average growth rate of 11.3% was recorded between 2012 and 2022. This signifies an increase in the consumption of biofuels in the region, which can be extrapolated to the increasing use of biofuels in the aviation industry.

- Furthermore, the societal and environmental benefits of biomass fuel underscore its dominance. Using biomass reduces greenhouse gas emissions and landfill waste, contributing to local and global sustainability objectives. As environmental consciousness gains traction, biomass emerges as a viable solution, elevating its appeal within the combined heat and power market.

- The dominance of biomass within the Middle East and Africa region is firmly rooted in regional resource availability, energy security imperatives, and sustainability aspirations. As the region embarks on a trajectory towards cleaner and more efficient energy systems, the integration of biomass as a primary fuel source for combined heat and power emerges as a transformative force poised to redefine energy generation, enhance environmental stewardship, and contribute significantly to the region's journey toward a more sustainable future.

- Therefore, as per the above points, the biomass fuel type is expected to dominate the combined heat and power market in Middle-East and Africa during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia's approach to energy diversification and its commitment to reducing carbon emissions, enhancing energy security, and optimizing resource utilization aligns harmoniously with the attributes of combined heat and power systems. Saudi Arabia's expansive infrastructure, coupled with its ambition to maximize the value extracted from energy sources, establishes a favorable environment for the widespread adoption of combined heat and power solutions.

- According to the Energy Institute Statistical Review Of World Energy, the electricity generation in Saudi Arabia increased by 2.2% between 2021 and 2022, while an average annual growth rate of 3.6% was recorded between 2012 and 2022, signifying the increasing consumption of electricity in the country due to expanding infrastructure activities.

- Moreover, Saudi Arabia's robust industrial base fuels the demand for efficient energy solutions. The nation's burgeoning industries, from petrochemicals to manufacturing, necessitate electricity and thermal energy. Combined heat and power systems that capture and repurpose waste generated during electricity production offer a pragmatic approach to fulfill the dual energy requirements of industries, thereby enhancing operational efficiency and competitiveness.

- Furthermore, it moves the country's investment in innovation and technology to cement its dominance. Saudi Arabia's commitment to research and development, particularly in energy efficiency and sustainability, resonance with the innovation-driven attributes of combined heat and power systems. Integrating advanced technologies within combined heat and power solutions aligns seamlessly with Saudi Arabia's modernization and technological leadership pursuit.

- For instance, in September 2022, Doosan Energy, one of the central power generation EPC companies in South Korea, announced that it had been awarded a contract to develop a combined heat and power system project in Saudi Arabia. The USD 385 Million project is located in the Al Hofuf region in eastern Saudi Arabia. The project is expected to be completed in the fourth quarter of 2024.

- Therefore, per the above points, Saudi Arabia is expected to dominate the combined heat and power market of the Middle East and Africa during the forecasted period.

MEA Combined Heat & Power Industry Overview

The Middle-East and African combined heat and power market is moderately fragmented. Some of the key players in this market (in no particular order) include General Electric Company, Siemens AG, Samsung C&T Corp., ACWA POWER, and Doosan Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Industrial Growth

- 4.5.1.2 Energy Efficiency

- 4.5.2 Restraints

- 4.5.2.1 Penetration of Alternative Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Fuel Type

- 5.1.1 Natural Gas

- 5.1.2 Coal

- 5.1.3 Oil

- 5.1.4 Biomass

- 5.1.5 Other Fuel Types

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 Saudi Arabia

- 5.2.2 South Africa

- 5.2.3 United Arab Emirates

- 5.2.4 Rest of the Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profiles

- 6.3.1 General Electric Company

- 6.3.2 Siemens AG

- 6.3.3 Samsung C&T Corp.

- 6.3.4 Doosan Corp.

- 6.3.5 Engie SA

- 6.3.6 ABB Ltd

- 6.3.7 Saudi Electricity Company

- 6.3.8 Saudi Arabian Oil Co.

- 6.4 Market Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration with Other Renewable Energy Sources

02-2729-4219

+886-2-2729-4219