|

市场调查报告书

商品编码

1639513

企业文件同步与共用:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Enterprise File Synchronization And Sharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

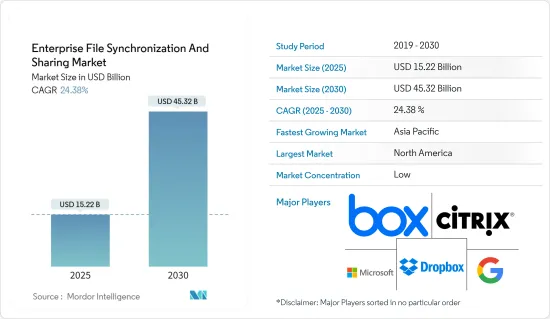

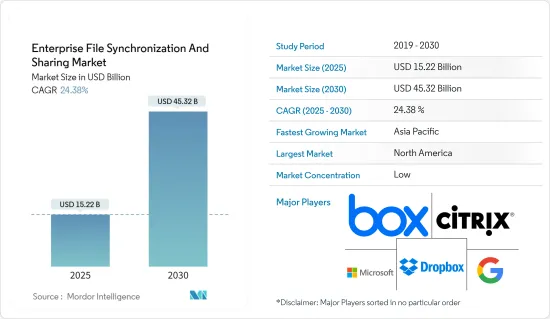

2025 年企业文件同步和共用市场规模估计为 152.2 亿美元,预计到 2030 年将达到 453.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.38%。

企业文件同步和共用(EFSS) 是一种软体服务,使组织能够安全地同步和共用文件、照片、影片和文件。

主要亮点

- 企业正在采用这些技术,使其员工能够储存、存取和管理资料,而无需基于消费群的文件共用应用程式和软体。例如,企业工作站主要使用Windows,Mac OS和Linux OS。同时,员工使用的行动装置(如平板电脑和智慧型手机)大多都是Android或iOS。建立解决方案来支援这些平台对组织来说提出了重大挑战。这导致市场上出现了多个提供 EFSS 解决方案的参与者。

- 企业使用 EFSS 来改善内容管理、协作和安全的文件共用,利用即时评论、文件版本追踪和工作流程管理等功能,允许使用者储存、编辑和审查文件,以便可以共用。

- 它还提供在审核时追踪和追踪与发票和采购订单相关的文件的选项。利用 EFSS 的大型企业需要灵活地添加存取策略来管理组织对特定内容的可存取性。这些产品包括身份验证、资料加密、容器化和追踪功能等安全功能,以保护公司资料。公司正在寻求这些解决方案来实现即时协作和想法共用,节省员工的协作时间并提高公司内部的工作效率。

- 越来越多地采用 BYOD 政策正在推动市场的发展。不断上升的行动和数位化工作场所趋势正在推动市场成长。对于受 BYOD 政策推动的日益增长的行动资讯工作者来说,文件共用和同步工具已成为必不可少的生产力资源。

- 随着对内容和资讯安全的需求不断增加,企业正在寻求比云端更先进的解决方案。云端安全弱点包括盗窃、针对应用程式提供者的复杂攻击、以及无法监控进出应用程式的资料。为了克服这些问题,公司正在推出新的解决方案。

- 但为了确保资料安全和工作质量,公司也鼓励在现行的混合工作模式下采用分散式硬体。这些措施可能会危及EFSS市场,限制BYOD等概念带来的领先成长。本公司继续在公司专用设备上使用 EFSS 解决方案进行远端工作。

- 此外,由于员工在家工作的可行性,预计 COVID-19 疫情将增加对企业文件同步和共用的需求,尤其是在 IT 和通讯领域。这导致对更安全的企业文件存取、同步和共用解决方案的需求大幅增加。在居家办公 (WFH) 浪潮的推动下,企业纷纷提供多种网路基地台和新时代功能来促进销售并确保客户组织顺利完成关键任务。

企业文件同步与共用市场趋势

BFSI 部门预计将占据主要市场占有率

- 资本密集型金融机构通常拥有多条业务线,这意味着技术解决方案和能力分散。这就产生了对整个组织统一应用程式的需求。

- 大多数 BFSI 参与者都在投资 EFSS,以开发关键任务银行解决方案,进行风险评估和业务前景缓解,以最大限度地减少资料外洩。云端内容管理、资料管理、安全控制以及使用核准的解决方案在防火墙外共用文件是银行和保险业正在部署的关键 EFSS 功能。银行机构正在大力投资。

- 此外,资料外洩和身分盗窃的增加使得企业选择主动文件管理变得至关重要,特别是在银行业。

- 大部分外洩的机密记录来自 BFSI 部门。根据moneycontrol.com报道,2022年8月,印度财政部国务部长指出,政府记录了印度248起资料外洩事件,包括信用卡详细资料外洩以及其他业务和非业务资料窃盗。这些数据表明银行业需要严格而强大的云端存取和远端檔案管理软体。

- 所以这个市场备受关注。许多银行都拥有先进的文件共用和同步服务,这些服务与其现有的 IT 架构相容,并且能够保护所有存取设备上的资料,包括监控、预防和解决资料外洩。

- Lockton 是一家领先的美国保险仲介公司之一,拥有 5,600 多名员工和 48,000 名客户,为其专家提供了独特的文件共用权限。 Lockton 使用 DropBox 解决方案 ShareFile 作为单一解决方案来满足行动性需求,同时实现与客户轻鬆、安全的檔案共用。

预计北美将占很大份额

- 由于美国和加拿大等国家的存在,该地区在託管服务、专业服务、云端、IT 和通讯以及零售领域形成了庞大的市场。美国在IT和通讯及支援产业占有重要份额,并且在预测期内可能会进一步扩大。 BYOD 和智慧型装置的全球流行极大地推动了 EFSS 市场的成长。美国占智慧型设备销售额的很大份额。

- 由于越来越多的企业选择外包非核心功能,该地区对託管服务的需求也是 EFSS 发展的驱动力。该地区也是大型託管服务供应商的所在地,这些供应商正在进一步发展以增强其能力。

- 微软、Dropbox、Citrix、Google、 VMware等EFSS供应商集中在美国。在此背景下,该地区正在推动需求。此外,由于中小企业发展率高,北美预计将产生可观的收益。该地区的中小企业越来越多地将行动和云端等现代技术与传统的EFSS相结合,从而带来成本效益。

- 随着越来越多的企业满足全球和本地客户的需求,资料隐私越来越成为人们关注的问题。该地区的政府已经采取一定措施来规范其公民的资料隐私。例如,《加州消费者隐私法案》(CCPA)于2020年1月生效,适用于收集或处理加州居民资料或在加州开展业务的企业。 CCPA 赋予消费者与 GDPR 类似的权利,包括存取个人资讯和请求个人资料的权利。

- 此外,加拿大法律《个人资讯保护和电子文件法案》(PIPEDA)强制执行资料隐私,并规范私人组织在业务过程中如何收集、使用和揭露个人资讯。随着这些发展和区域需求的不断增长,许多供应商瞄准文件和资料的无缝管理,以解决需要采取更严格措施避免资料外洩的区域和跨境营运问题。

企业文件同步与共用产业概览

企业文件同步和共用市场分散且竞争激烈。参与者正在采用新产品发布、伙伴关係和业务扩展等策略来扩大其在该市场的影响力。玩家共用资源,实现互利共赢。客户利用服务供应商提供的解决方案来增强其核心能力。

- 2023 年 10 月-云端基础檔案共用公司 Dropbox Inc. 宣布开始对其新的基于人工智慧的搜寻功能 Dropbox Dash 进行公开 Beta 测试,同时对其基于人工智慧的摘要功能 Dropbox AI 进行增强。该公司还宣布推出 Dropbox Studio,一款用于影片拍摄、编辑和回馈的全新一体化工具。

- 2023 年 5 月-微软宣布为职场或学校提供新的 OneDrive 体验,该体验从 OneDrive 主页开始,并涵盖整个 Microsoft 365 的文件体验。这是一次视觉和功能的升级,旨在让您更快地存取您的檔案并以多种方式组织您的内容。新功能和升级的设计可让您更快存取 OneDrive 中的所有个人、共用和团队文件,从而帮助您提高工作效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 各行业对 BYOD 的采用日益增多

- 市场限制

- 智慧型手机和笔记型电脑日益普及

- 资料隐私挑战

6. COVID-19 对企业文件同步与共用市场的影响

第七章 市场区隔

- 按服务

- 託管服务

- 专业服务

- 按公司规模

- 中小企业

- 大型企业

- 依部署类型

- 本地

- 云

- 按最终用户产业

- 资讯科技/通讯

- 银行、金融服务和保险

- 零售

- 製造业

- 教育

- 政府

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Box, Inc.

- Citrix Systems, Inc.

- Dropbox Inc.

- Microsoft Corporation(Microsoft OneDrive)

- Google, Inc.(Alphabet Inc.)

- IBM Corporation

- BlackBerry Limited

- VMware Inc.(Dell Technologies)

- Thru Inc.

- SugarSync Inc.

- Qnext Corp.

- Acronis Inc.

- CTERA Networks Inc.

第九章投资分析

第十章:市场的未来

The Enterprise File Synchronization And Sharing Market size is estimated at USD 15.22 billion in 2025, and is expected to reach USD 45.32 billion by 2030, at a CAGR of 24.38% during the forecast period (2025-2030).

Enterprise file synchronization and sharing (EFSS) is a software service that enables organizations to synchronize and share documents, photos, videos, and files securely.

Key Highlights

- Organizations adopt these technologies to help employees avoid using consumer-based file-sharing applications and software to store, access, and manage to ensure data security. For instance, an enterprise workstation dominantly uses Windows, Mac OS, and Linux OS. In contrast, their employees use mobile devices, such as tablets and smartphones, use Android and iOS as the dominant operating systems. It creates a considerable challenge for an organization/institution to create a solution supporting these platforms. This led to the emergence of multiple players in the market that offer EFSS solutions.

- Businesses use EFSS to improve content management, collaboration, and secure file sharing and include features such as live commenting, document version tracking, and workflow process management to help users store, edit, review, and share files.

- It also offers the option to track and trace the document related to any invoice or order in auditing. Large enterprises that utilize EFSS require the flexibility to add access policies that govern the organization's accessibility to access specific content. These products include security capabilities, such as authentication, data encryption, containerization, and tracking features to protect enterprise data. Enterprises have been trying to improve their internal work efficiency by saving their employees time consumed in collaboration, as these solutions enable real-time collaboration and sharing of ideas.

- The increasing adoption of the BYOD policy is driving the market. The growing mobile and digital workplace trends have positively driven the market's growth. File sharing and synchronization tools have become an essential productivity-enabling resource for increasingly mobile information workers, driven by the BYOD policy.

- With the increasing demand for content and information security, enterprises are looking for more advanced solutions than the cloud. Weaknesses in cloud security include theft, sophisticated attacks against the application provider, and the inability to monitor data moving to and from applications. To overcome these, enterprises are launching new solutions.

- However, the organizations also encourage distributing their hardware for the prevalent hybrid work models to ensure uncompromised data security and work quality. Such measures potentially threaten the EFSS market, limiting the precedented growth with concepts like BYOD. The companies continue to use EFSS solutions on their proprietary devices for remote working.

- Further, the COVID-19 pandemic worldwide was anticipated to augment the demand for enterprise file synchronization and sharing, especially among the IT and telecom sectors, due to the feasibility of employees' working from home. This significantly drove the demand for safer enterprise file access, synchronization, and sharing solutions. As a result of the WFH onslaught, companies witnessed stepped-up sales, providing multiple access points and new-age features to ensure smooth and mission-critical performance in client organizations.

Enterprise File Synchronization And Sharing Market Trends

BFSI Segment Is Expected To Account For Significant Market Share

- Capital-intensive financial institutions generally have multiple business lines, leading to several disconnected technology solutions and functions. This has created a demand for unified applications within the overall organization.

- Most BFSI players invest in EFSS to develop mission-critical banking solutions for risk assessment and mitigation in the business prospects preventing the least data breaches. Cloud content management, data, and security management, and using unsanctioned solutions to share files outside the firewall have become primary EFSS functions for deployment among the banking and insurance sectors. Banking institutions have made significant investments.

- Further, the increasing data breaches and incidences of identity thefts make it immensely important for companies to opt for active file management, especially in the banking sector.

- The BFSI sector accounted for the majority of exposed sensitive records. According to moneycontrol.com, in August 2022, the Indian Minister of State in the Ministry of Finance mentioned that the government recorded 248 successful data breaches, comprising card data breaches and other business and non-business data thefts in India. Such figures suggest the need for stringent and robust cloud access and remote file management software in the banking sector.

- Thus, the market studied has been gaining traction. Many banks have been hosting advanced file sharing and synchronization services, which are compatible with their existing IT architecture and capabilities to protect data across all accessing devices, including monitoring, preventing, and resolving any instances of data leakage.

- Lockton (US Insurance Firm), one of the prominent, privately-owned insurance brokerage firms with over 5,600 associates and over 48,000 clients, provided unique file-sharing access to experts. Lockton used ShareFile, a DropBox solution, as a single solution to address mobility requirements while allowing easy and secure file sharing with its clients.

North America is Expected to Hold Major Share

- The region is home to significant markets for managed services, professional services, cloud, IT and telecom, and retail due to the presence of countries such as the United States and Canada. The United States holds a significant share in IT and telecom and its supporting sectors, which may grow even further over the forecast period. The penetration of BYOD and smart device worldwide is significantly driving the market growth for EFSS. The United States holds a prominent share in smart device sales.

- The region's demand for managed services is another driving factor for EFSS, as more and more enterprises opt for outsourcing non-core functionalities. The region is also home to significant vendors in managed services space, and such vendors are growing even further to increase their capabilities.

- EFSS vendors, such as Microsoft, Dropbox, Citrix, Google, VMware, etc., are concentrated in the United States. Because of such scenarios, the region is driving the demand. Also, North America is expected to attain prominent revenue generation due to the high development rate of small and medium businesses. SMEs in the region are increasingly integrating modern technologies, such as mobile and cloud, within conventional EFSS, offering cost benefits.

- The growing number of enterprises catering to global and local clientele increases data privacy concerns. Governments in the region are taking certain steps to regulate citizens' data privacy. For instance, the California Consumer Privacy Act (CCPA) came into effect in January 2020, which applied to a business that collects and processes California residents' data or does business in California. The CCPA also grants rights to consumers similar to the GDPR, including disclosing personal information and requests for personal data.

- Also, the Canadian law Personal Information Protection and Electronic Documents Act (PIPEDA) enforces data privacy and governs how private sector organizations collect, use, and disclose personal information in their businesses. Due to such developments and increasing regional demand, many vendors focus on their regional operations and cross-border operations, which further need even more strict measures to avoid data breaches, targeting seamless management of files and data.

Enterprise File Synchronization And Sharing Industry Overview

The enterprise file synchronization and sharing market is fragmented and intensely competitive. Players use strategies such as new product launches, partnerships, expansions, and others to increase their footprints in this market. The players share resources for mutual benefits. The client companies leverage the solutions the service providers offer to bolster some major functionalities.

- October 2023 - The cloud-based file-sharing company Dropbox Inc. revealed the launch of its new artificial intelligence-based search feature, Dropbox Dash, into open beta test along with enhancements to its AI-powered summarization experience Dropbox AI. The company also announced a new all-in-one tool, Dropbox Studio, allowing customers to capture, edit, and get feedback videos.

- May 2023 - Microsoft announced a new OneDrive experience for work and school that starts with the OneDrive home page and spans file experiences across Microsoft 365. It's a visual and functional upgrade designed to help you get to files quickly and keep your content organized in multiple ways. The new features and upgraded design make it faster to get to all your personal, shared, and team files in OneDrive so you can be more productive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of BYOD across Various Industries

- 5.2 Market Restraints

- 5.2.1 Growing Penetration of Smartphones and Laptops

- 5.2.2 Data Privacy Challenges

6 IMPACT OF COVID-19 ON THE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

7 MARKET SEGMENTATION

- 7.1 Service

- 7.1.1 Managed Service

- 7.1.2 Professional Service

- 7.2 Size of Enterprise

- 7.2.1 Small and Medium Enterprises

- 7.2.2 Large Enterprises

- 7.3 Deployment Type

- 7.3.1 On-premise

- 7.3.2 Cloud

- 7.4 End-user Vertical

- 7.4.1 IT & Telecom

- 7.4.2 Banking, Financial Services and Insurance

- 7.4.3 Retail

- 7.4.4 Manufacturing

- 7.4.5 Education

- 7.4.6 Government

- 7.4.7 Other End-user Verticals

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Box, Inc.

- 8.1.2 Citrix Systems, Inc.

- 8.1.3 Dropbox Inc.

- 8.1.4 Microsoft Corporation (Microsoft OneDrive)

- 8.1.5 Google, Inc. (Alphabet Inc.)

- 8.1.6 IBM Corporation

- 8.1.7 BlackBerry Limited

- 8.1.8 VMware Inc. (Dell Technologies)

- 8.1.9 Thru Inc.

- 8.1.10 SugarSync Inc.

- 8.1.11 Qnext Corp.

- 8.1.12 Acronis Inc.

- 8.1.13 CTERA Networks Inc.