|

市场调查报告书

商品编码

1639523

马来西亚的黏合剂和密封剂:市场占有率分析、行业趋势、成长预测(2025-2030)Malaysia Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

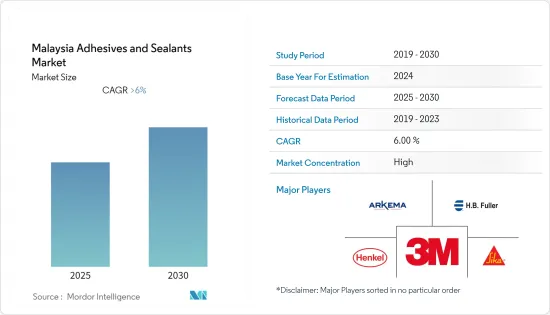

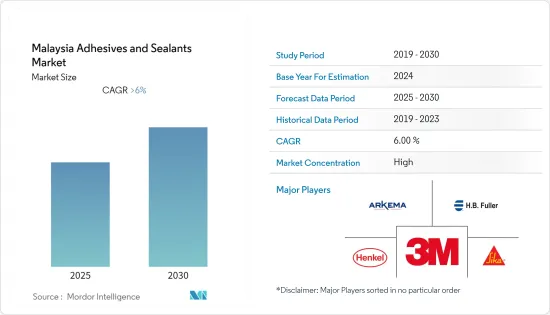

马来西亚黏合剂和密封剂市场预计在预测期内复合年增长率将超过 6%

主要亮点

- 该地区包装行业的扩张可能会在未来几年显着推动市场发展。

- 然而,有关无挥发性有机化合物使用的严格规定预计将阻碍市场成长。

- 生物基和混合黏合剂的发展预计将是未来的一个机会。

马来西亚黏合剂和密封剂市场的趋势

包装产业需求增加

就保护和提高产品安全性和寿命而言,包装在设计和技术方面是一个快速发展的行业。

- 在马来西亚,消费者忙碌的生活方式、不断增长的消费能力及相关因素正在推动对快速包装商品的需求。由于新冠肺炎 (COVID-19) 大流行,全国范围内的封锁和製造设施的暂时关闭导致了多种问题,包括供应链、进出口中断。

- 随着人们寻求便利,不断增长的电子商务行业预计将推动包装的发展。物流公司不断涌现,帮助製造商、经销商、批发商和零售商运送包裹。因此,它正在显着推动市场。

- 例如,2021年,电子商务产业对GDP的总贡献将从2020年的11.6%提高到13%。自2015年以来,电子商务对马来西亚GDP的贡献不断上升。

- 此外,促进该国包装产业发展的一个重要因素是製药、食品加工、製造、快速消费品、医疗及辅助产业对包装商品的需求不断增长。

- 例如,2022年1月至4月,马来西亚的食品和饮料销售额年增11.5%,在140亿美元的批发销售额中贡献了近17亿美元。该国的食品店正在迅速扩张,高端杂货店和便利商店越来越受欢迎。

- 因此,由于上述因素,包装产业的扩张可能会在预测期内推动市场。

扩大水性黏合剂的采用

- 水性黏合剂是全国最常用的黏合剂技术,因为其特性使其适合多种应用和最终用户产业。

- 水基黏合剂通常被设计为分散体或乳化。分散的聚合物(乳胶)颗粒呈球形,直径50至300 nm。高分子量通常在乳液聚合中实现,因为每个胶乳颗粒内形成的链的浓度很浅。

- 这些黏合剂通常用于木工和製鞋行业,以黏合木材、纸张、纺织品、皮革和其他多孔基材。

- 丙烯酸水性黏合剂因其成本低廉、环保性能好而成为主要的树脂类型。它还易于在多种基材上使用,并且具有适中的强度以及对温度和其他环境因素的抵抗力。

- 水性黏合剂是环保的,VOC 含量可以忽略不计,因此不会损害生产车间工人的安全,并且比其他类型的技术更便宜。

- 因此,预计这些因素将在未来几年推动水性黏合剂的需求。

马来西亚黏合剂和密封剂产业概况

马来西亚的黏合剂和密封剂市场是一体化的。主要企业包括(排名不分先后)3M、阿科玛集团、西卡股份公司、HB Fuller Company、汉高股份公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求增加

- 其他司机

- 抑制因素

- 关于VOC排放的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(以金额为准、以销售额为准))

- 树脂黏合剂

- 聚氨酯

- 丙烯酸纤维

- 硅胶

- 氰基丙烯酸酯

- VAE・EVA

- 其他的

- 溶剂型

- 黏合剂的技术

- 溶剂型被覆剂

- 反应性

- 热熔胶

- UV固化胶

- 树脂密封剂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 其他的

- 最终用户产业

- 建筑/施工

- 纸/纸板包装

- 运输

- 木工/细木工

- 鞋类/皮革

- 医疗保健

- 电力/电子

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- HB Fuller Company

- Arkema Group

- AVERY DENNISON CORPORATION

- Mohm Chemical SDN. BHD.

- VITAL TECHNICAL SDN BHD

- Aica Kogyo Co.Ltd.

- Henkel AG & Co. KGaA

- Syarikat Chemibond Enterprise Sdn Bhd

- Sika AG

- Bostik

- AICA ADTEK SDN. BHD.

第七章 市场机会及未来趋势

简介目录

Product Code: 50967

The Malaysia Adhesives and Sealants Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The expanding packaging industry in the region will likely drive the market significantly in the coming years.

- However, the strict regulations on the usage of VOC-free content are expected to hinder the market's growth.

- The development of bio-based and hybrid Adhesives is expected to be an opportunity in the future.

Malaysia Adhesives & Sealants Market Trends

Increasing Demand from Packaging Industry

Packaging is a fast-growing industry in terms of design and technology for protecting and enhancing products' safety and longevity.

- The demand for quick and on-the-go packaged items is increasing due to consumers' busier lifestyles, greater spending power, and related factors in the country. Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions in supply chains, imports, and exports.

- The growing e-commerce sector is expected to boost packaging as people move toward convenience. Logistics companies are coming into play to support manufacturers, distributors, wholesalers, and retailers in delivering their packages. Hence, driving the market significantly.

- For instance, in 2021, the gross value contributed by the e-commerce sector to the GDP increased to 13 percent from 11.6 percent in 2020. Since 2015, there has been an upward trend in the contribution of e-commerce to the Malaysian GDP.

- Also, some of the significant factors contributing to the development of the packaging industry in the country are the growing demand for packaged goods from pharmaceutical, food processing, manufacturing, FMCG, healthcare, and ancillary industries.

- For instance, from January to April 2022, Malaysia's food and beverage sales increased by 11.5 percent over the same time last year, contributing almost USD 1.7 billion to the USD 14 billion total wholesale sales value. The country's food shops are quickly expanding, with upscale grocery and convenience stores becoming increasingly popular.

- Thus, owing to the factors mentioned above, expanding the packaging industry will likely drive the market during the forecast period.

Growing Adoption of Water-borne Adhesives

- Water-borne is the majorly consumed adhesive technology across the country due to its favorable properties for multiple applications or end-user industries.

- Water-borne adhesives are often designed as dispersions or emulsions. The distributed polymer (latex) particles have a spherical form with a diameter of 50 - 300 nm. Since the concentration of the developing chains within each latex particle is shallow, high molecular weights are typically attained in emulsion polymerization.

- These adhesives are commonly used in the woodworking and footwear industries for bonding wood, paper, textiles, leather, and other porous substrates.

- Acrylic waterborne adhesives are the major resin type due to their cheaper cost and favorable environmental properties. They are also easier to use with multiple substrates and have moderate strength and resistance to temperature and other environmental factors.

- Waterborne adhesives are more environmentally friendly, have negligible VOC content that does not hamper the safety of workers at manufacturing sites, and are less expensive than other types of technologies.

- Thus, these factors are expected to boost demand for waterborne adhesives over the coming years.

Malaysia Adhesives & Sealants Industry Overview

The Malaysia Adhesives and Sealants Market is consolidated in nature. The major companies include 3M, Arkema Group, Sika AG, HB Fuller Company, and Henkel AG & Co. KGaA, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Packaging Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Revenue)

- 5.1 Adhesives by Resin

- 5.1.1 Polyurethane

- 5.1.2 Acrylic

- 5.1.3 Silicone

- 5.1.4 Cyanoacrylate

- 5.1.5 VAE/EVA

- 5.1.6 Other Resins

- 5.1.7 Solvent-borne

- 5.2 Adhesives by Technology

- 5.2.1 Solvent-borne Coatings

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-Cured Adhesives

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Buildings and Construction

- 5.4.2 Paper, Board, and Packaging

- 5.4.3 Transportation

- 5.4.4 Woodworking and Joinery

- 5.4.5 Footwear and Leather

- 5.4.6 Healthcare

- 5.4.7 Electrical and Electronics

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 H.B. Fuller Company

- 6.4.3 Arkema Group

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 Mohm Chemical SDN. BHD.

- 6.4.6 VITAL TECHNICAL SDN BHD

- 6.4.7 Aica Kogyo Co.Ltd.

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Syarikat Chemibond Enterprise Sdn Bhd

- 6.4.10 Sika AG

- 6.4.11 Bostik

- 6.4.12 AICA ADTEK SDN. BHD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219