|

市场调查报告书

商品编码

1639535

法国玻璃包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)France Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

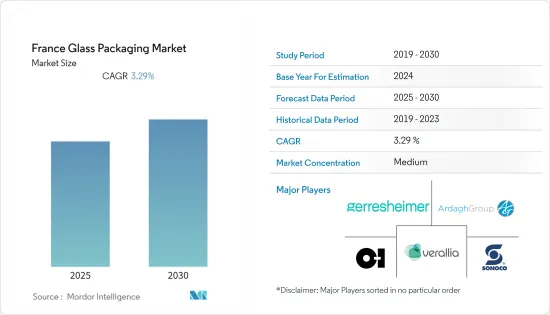

预计预测期内法国玻璃包装市场的复合年增长率为 3.29%。

主要亮点

- 法国是欧盟的饮料生产国,拥有广阔的培育环境,促进了各种酒精饮料和相应的优质包装解决方案的发展,重点是香槟和干邑白兰地。

- 法国玻璃产业机械化程度很高,特别是冷藏操作环节,分类、装卸都实现了机械化。有些业务是外包的。剩下的都是最技术性的东西,像是玻璃成型和铸造。法国全国各地拥有许多着名的玻璃艺术家。

- 但德国和法国却无力维持瓶罐等玻璃包装材料的流通。过去40年来,德国几乎失去了玻璃押金制度。这使得塑胶在一系列终端用户产业中得到广泛应用。法国政府最近提案了一项塑胶回收而非重复使用的押金计划。专家表示,全球塑胶回收率仅25%,这是一项有缺陷的政策。政府需要製定全面的计划来替代随着时间的推移而损失的塑胶。

- 然而,人们希望这将增加牛奶和其他食品等日常用品使用玻璃瓶的数量。 Bruni Glass France 为杜松子酒製造商提供更轻的玻璃瓶,为干邑白兰地製造商提供更重、底部更厚的玻璃瓶。

法国玻璃包装市场的趋势

饮料业预计将占据主要市场占有率

- 使用玻璃瓶包装葡萄酒的趋势仍然是法国葡萄酒爱好者的主导选择。新形式的兴起对传统玻璃包装带来了一些挑战。该资料得到了法国玻璃工业联合会和法国玻璃协会于 2021 年 4 月至 5 月期间对全国 1,000 名葡萄酒爱好者进行的最新调查的证实。

- 法国玻璃工业联合会也正在进行多项宣传活动,例如2021年5月在社交网路上启动的「#MyUniverre」宣传活动(「verre」在法语中是「玻璃」的意思)。此类宣传活动直接促进了该国所研究市场的成长。

- 此外,根据国际葡萄与葡萄酒组织 (OIV) 的数据,义大利的葡萄酒产量超过其他国家,法国则位居第二。由于玻璃的特性非常适合葡萄酒的性质,并且无法与塑胶或金属相比,因此市场体现出成长潜力。

- 此外,冰茶也是受欢迎的饮料之一,在某些市场领域需求旺盛。例如,可口可乐的 Fuze Tea 子公司正在协助开发针对法国市场以及荷兰、比利时、挪威、瑞典和德国等新兴市场的产品。 CCEP在其袜子工厂投资了一条新的玻璃瓶生产线。

个人护理领域预计将显着成长

- 法国也是化妆品行业规模领先的国家之一。玻璃是化妆品包装最常用的材料之一,因为它可以确保产品的最佳保存,并且可回收。

- 此外,玻璃是化妆品包装的首选,因为它是一种很酷的材料,并且具有纯净自然的吸引力。坚固感增强了对品质的认知,并且常常成为化妆品行业的差异化因素。

- 日本拥有一些世界知名的时尚、化妆品和个人护理品牌,这推动了该国对玻璃包装的需求。例如,根据 ITA 的资料,法国约有 430 家化妆品公司,僱用了 55,000 名员工。 Marionnaud、欧莱雅、丝芙兰、Douglas和Nocibe是化妆品产业分销链的重要参与者。药局、百货公司等大众分销产业也扮演着重要角色。

法国玻璃包装产业概况

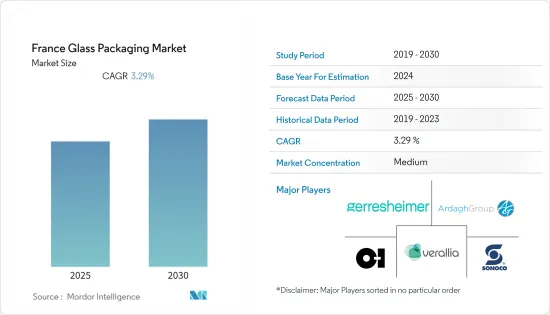

法国玻璃包装市场竞争适中,有许多地区和全球参与者。然而,玻璃的特性及其在饮料、化妆品和其他领域的优势使得玻璃瓶、容器、管瓶、安瓿瓶等的使用越来越多。参与者正在采用产品创新、合作伙伴关係、合併和收购等策略来扩大市场占有率并进一步获得市场吸引力。

- 2022 年 3 月-可口可乐欧洲太平洋合作伙伴将其可回收玻璃瓶计画扩展到法国的饭店、餐厅和咖啡馆。据CCEP称,玻璃瓶最多可以重新填充25次。 CCEP 表示,新的可再填充瓶产生的温室气体 (GHG)排放减少了三倍,并估计这将在 2022 年防止生产超过 1500 万个一次性玻璃瓶。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 增加可支配收入并融入高端包装

- 改进技术以提供更好的解决方案

- 市场挑战

- 替代包装解决方案带来的激烈竞争

- 营运和后勤问题

第六章 市场细分

- 按产品

- 瓶子和容器

- 瓶子

- 管瓶

- 注射器

- 安瓿

- 其他产品

- 按行业

- 饮料

- 食物

- 化妆品

- 药品

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Ardagh Packaging Group PLC

- Owens-illinois Inc.

- Sonoco Products Company

- Verallia Packaging SAS

- Gerresheimer AG

- APG Europe

- Bormioli Pharma SpA

- Saver Glass Inc.

- Stolzle Glass Group(CAG Holding GmbH)

- Quadpack Industries SA

- SGD Pharma

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 51095

The France Glass Packaging Market is expected to register a CAGR of 3.29% during the forecast period.

Key Highlights

- France is a dominant beverage producer in the European Union, with an extensively cultivated environment aiding the development of different indigenous alcohol forms and their appropriate premium packaging solutions, primarily champagne and cognac.

- The French glass industry labored through increasing mechanization, particularly in the cold operations section, where sorting, loading, and unloading are mechanized. Several operations have been outsourced. Remnant areas only include the most technical additions, such as glass forming and molding. France benefits from many recognized glass artists present throughout the country.

- However, Germany and France cannot keep glass packaging materials, like bottles and jars, in circulation. Over the last 40 years, it lost most of its glass deposit systems. It led to an overuse of plastics in various end-user industries. The French Government recently proposed a deposit system to recycle plastic instead of reusing it. According to experts, this is a flawed policy, as the global recycling of plastics stalled at 25%. The government needs a comprehensive plan to replace the plastics lost in recycling over time.

- It, however, is expected to create opportunities for enhanced use of glass bottles for daily-use products, such as milk and other food items. Bruni Glass France is offering lighter glass bottles to gin manufacturers and heavier and thick-bottomed glass bottles for cognac.

France Glass Packaging Market Trends

Beverages Segment is Expected to Hold a Significant Market Share

- The trend of using glass bottles for wine packaging remained the dominant choice amongst wine lovers in France. The rise of new formats poses a little challenge for traditional glass packaging. The data is substantiated by a recent survey made between April and May 2021 by the Federation of Glass Industries and France's glass association, with the participation of 1,000 wine lovers across the country.

- The French Glass Industry Federation also engaged in several campaigns, like the #MyUniverre ('verre' meaning 'glass' in French) campaign launched on social networks in May 2021. Such campaigns directly support the studied market growth in the county.

- Further, according to the OIV (The International Organization of Vine and Wine (OIV)), Italy is the leading producer of wine than any country, and France comes in the second spot. As the properties of glass are well suited to the nature of wine, unmatched by plastic or even metals, the market reflects a potential growth.

- Further, iced tea is another popular beverage that is witnessing demand from specific regions in the market. For instance, Coke-owned Fuze Tea supports its product development for the French market and export markets, such as the Netherlands, Belgium, Norway, Sweden, and Germany. CCEP invested in a new glass bottle production line at its Socx plant.

Personal Care Segment Expected to Witness Significant Growth

- France is also among the leading countries in terms of the size of the cosmetics industry. Glass is one of the most used materials in cosmetics packaging, as the material guarantees optimum product preservation and is also recyclable.

- Additionally, Glass is preferred for cosmetics packaging because it's a cold material and appeals to pure nature. The sensation of heaviness drives a feeling of quality which often act as a differentiating factor in the cosmetics industry.

- The country is home to some of the globally recognized fashion, cosmetics, and personal care brands which is driving the demand for glass packaging in the country. For instance, according to data provided by ITA, there are approximately 430 cosmetics companies in France with 55,000 employees. Marionnaud, L'Oreal, Sephora, Douglas, and Nocibe are vital players in the cosmetic industry's distribution network. The mass distribution sectors, such as pharmacies and department stores, also play a significant role.

France Glass Packaging Industry Overview

The French glass packaging market is moderately competitive, with many regional and global players. However, the properties of glass and its benefits to beverages, cosmetics, and other sectors are leading to the increased adoption of glass bottles, containers, vials, and ampoules. Players adopt strategies, such as product innovation, partnerships, mergers, and acquisitions, to increase their market shares and further drive the market.

- March 2022 - Coca-Cola Europacific Partnersexpanded the returnable glass bottle program for French hotels, restaurants, and cafes. The glass bottles are refillable up to 25 times, according to CCEP. With CCEP stating that the new refillable bottle includes three times fewer greenhouse gas (GHG) emissions, it is estimated that this will prevent the production of more than 15 million single-use glass bottles in 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Disposable Income and Integration in Premium Packaging

- 5.1.2 Improved Technology Offering Better Solutions

- 5.2 Market Challenges

- 5.2.1 High Competition from Substitute Packaging Solutions

- 5.2.2 Operation and Logistical Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Bottles and Containers

- 6.1.2 Jars

- 6.1.3 Vials

- 6.1.4 Syringes

- 6.1.5 Ampoules

- 6.1.6 Other Products

- 6.2 By End-user Vertical

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ardagh Packaging Group PLC

- 7.1.2 Owens-illinois Inc.

- 7.1.3 Sonoco Products Company

- 7.1.4 Verallia Packaging SAS

- 7.1.5 Gerresheimer AG

- 7.1.6 APG Europe

- 7.1.7 Bormioli Pharma SpA

- 7.1.8 Saver Glass Inc.

- 7.1.9 Stolzle Glass Group (CAG Holding GmbH)

- 7.1.10 Quadpack Industries SA

- 7.1.11 SGD Pharma

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219