|

市场调查报告书

商品编码

1640329

欧洲阻燃化学品:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

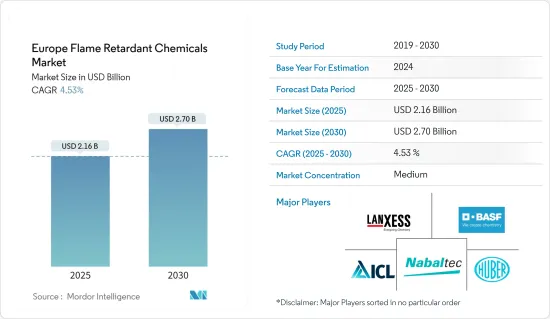

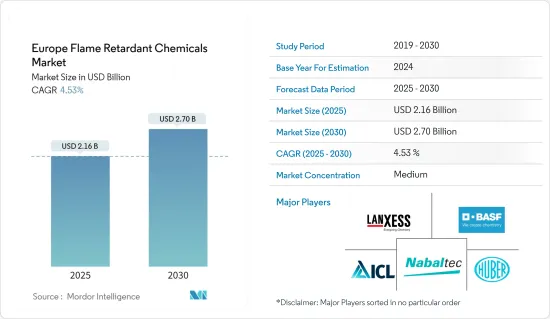

预计2025年欧洲阻燃化学品市场规模为21.6亿美元,预计2030年将达27亿美元,预测期间(2025-2030年)的复合年增长率为4.53%。

2020 年,欧洲阻燃化学品市场受到了 COVID-19 的负面影响。然而,在新冠疫情之后,建设产业正在迅速復苏,预计未来几年将会成长,从而刺激阻燃化学品市场的需求。

主要亮点

- 预计消费电气和电子产品製造业的增加、建筑安全标准的提高以及东欧国家生活水准的提高将推动对阻燃化学品的需求。

- 相反,有关溴化阻燃化学品的环境和健康问题预计会阻碍市场成长。

- 然而,人们对环保阻燃化学品的认识不断提高以及对非卤化阻燃化学品的积极研究和开发预计将为所调查的市场提供有利的成长机会。

- 德国在阻燃化学品市场占据主导地位,并将在预测期内实现最高的复合年增长率。

欧洲阻燃化学品市场趋势

建筑业主导市场成长

- 在欧洲建设产业中,阻燃化学品主要用于结构隔热材料。住宅和其他建筑物中使用隔热材料来保持舒适的温度并节省能源。

- 阻燃化学品在建筑暖通空调应用(如隔音和管道绝缘)中使用的聚烯发泡体中也被广泛应用。

- 在欧洲,所有建筑和建筑材料(包括硬质聚氨酯泡沫)必须符合 EN13501 的防火要求。该法规正在推动欧洲建设产业对阻燃化学品的需求。

- 据欧洲建筑业联合会称,欧盟27国建筑业的总投资正在大幅增长,推动对阻燃化学品的需求。

- 在欧洲,德国是建设产业最大的市场之一。例如,根据德国联邦统计局(Destatis)的数据,2023 年 3 月,德国获准建造约 24,500 套住宅。与2022年3月相比,建筑许可数量减少了约10,300份(约29.6%)。

- 近年来,英国建设产业经历了显着成长。例如,根据Trading Economics的数据,2023年3月英国建筑业产量与去年同期相比成长了近4.1%。新建筑成长 2.8%,而维修和保养活动成长 6.1%。

- 预计上述因素将在预测期内增加欧洲建设产业对阻燃化学品的需求。

德国占据市场主导地位

- 德国经济是欧洲最大、世界第五大经济体。工业成长、政府支出增加和建筑业繁荣支撑了 2022 年的成长。

- 德国领先欧洲汽车市场,其41个组装和引擎生产厂占欧洲汽车总产量的三分之一。德国是汽车工业的主要製造地之一,拥有众多领域的製造商。其中包括设备製造商、材料和零件供应商、引擎製造商和系统整合商。

- 根据国际汽车工业组织 (OICA) 的数据,2022 年德国轻型商用车和轿车总产量将达到 3,677,820 辆,较 2021 年的 3,038,692 辆增长约 11%。

- 德国是欧洲最大的建筑业国家,正在经历强劲成长,主要原因是住宅建设活动的增加。

- 根据德国联邦统计局(Statistisches Bundesamt:Destatis)的数据,2023年前三个月共颁发了68,700份住宅建筑许可证,较2022年同期下降25.7%。这主要是因为建材价格飞涨所致。

- 德国的电子产业规模位居欧洲第一、世界第五。电气和电子产业占德国工业总产值的 10% 以上,占国内生产总值(GDP) 的 3% 左右。

- 德国是欧洲最大的家具市场,消费者购买力强,为製造商创造了进一步的创新机会。德国家具产业的主要企业包括Huls AG &Co.KG、Topstar GmbH和Rauch GmbH &Co.KG。 2022 年 5 月,Woody Trading 报告称,2022 年第一季德国家具产业销售额成长 16.1%,达到约 48 亿欧元(51 亿美元)。

- 因此,预计预测期内此类产业趋势将推动该国阻燃化学品的消费。

欧洲阻燃化学品产业概况

欧洲阻燃化学品市场本质上是部分整合的。该市场的主要企业包括(不分先后顺序)ICL、LANXESS、 BASF SE、JM Huber Corporation和Nabaltec AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 消费性电子电气製造业成长

- 提高建筑施工安全标准

- 东欧生活水准不断提高

- 限制因素

- 溴化阻燃剂对环境与健康的危害

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 非卤化

- 无机

- 氢氧化铝

- 氢氧化镁

- 硼化合物

- 磷光

- 氮化合物

- 其他类型

- 卤化

- 溴化合物

- 氯基化合物

- 非卤化

- 按最终用户产业

- 电气和电子

- 建筑和施工

- 运输

- 纺织品和家具

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析**/排名分析

- 主要企业策略

- 公司简介

- Albemarle Corporation

- BASF SE

- CLARIANT

- DIC Corporation

- Dow

- Eti Maden

- ICL

- Italmatch Chemicals SpA

- JM Huber Corporation

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- RTP Company

- THOR

- TOR Minerals

第七章 市场机会与未来趋势

- 人们对环保阻燃化学品的认识不断提高

- 积极研发无卤阻燃化学品

The Europe Flame Retardant Chemicals Market size is estimated at USD 2.16 billion in 2025, and is expected to reach USD 2.70 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

The European flame retardant chemical market was negatively impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the construction industry is recovering fast and is estimated to rise in the coming years, stimulating the demand for the flame retardant chemical market.

Key Highlights

- Rising consumer electrical and electronic goods manufacturing, rising safety standards in building construction, and rising living standards in Eastern European countries will likely drive the demand for flame-retardant chemicals.

- Conversely, environmental and health concerns regarding brominated flame retardants are expected to hinder the market's growth.

- Nevertheless, the rising awareness of environment-friendly flame retardants and active R&D of non-halogenated flame retardants are projected to create lucrative growth opportunities for the studied market.

- Germany dominates the flame retardant chemicals market and will also witness the highest CAGR during the forecast period.

Europe Flame Retardant Chemicals Market Trends

Buildings and Construction Segment to Dominate the Market Growth

- In the European building and construction industry, flame retardants are primarily used in structural insulation. Insulation is used in homes and other buildings to keep the temperature comfortable and to save energy.

- Flame retardants also find major applications in polyolefin foams used in buildings in HVAC applications, such as sound insulation, thermal insulation for pipes, etc.

- In Europe, all materials for building and construction (including rigid PU foams) must meet the fire requirements, according to EN 13501. This regulation is driving the demand for flame retardants in the European building and construction industry.

- According to the European Construction Industry Federation, the total investments in the construction industry of EU-27 countries are increasing significantly, thereby driving the demand for flame retardants.

- In Europe, Germany is one of the largest markets for the building and construction industry. For instance, according to Statistisches Bundesamt (Destatis), the construction of around 24,500 dwellings was permitted in March 2023 for Germany. It was reduced by around 10,300 building permits (nearly 29.6%) compared to March 2022.

- The construction industry witnessed significant growth in the United Kingdom over the past few years. For instance, according to Trading Economics, in March 2023, the construction output in the UK increased by nearly 4.1% year-on-year. The new construction work showed a growth of 2.8%, and 6.1% growth was seen in repair and maintenance activities.

- The factors above are expected to create demand for flame retardants in the European construction industry during the forecast period.

Germany to Dominate the Market

- The German economy is the largest in Europe and the fifth-largest globally. Increased industrial growth, higher state spending, and booming construction helped support growth in 2022.

- Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. Germany, one of the leading manufacturing bases of the automotive industry, is home to manufacturers from different segments. It includes equipment manufacturers, material and component suppliers, engine producers, and system integrators.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022 Germany's total LCV and car production accounted for 3,677,820 units, an increase of around 11% compared to 2021, which stood at 3,308,692 units.

- Germany's largest construction industry in Europe is growing significantly and is primarily driven by the increasing number of residential construction activities.

- According to Statistisches Bundesamt (Destatis), 68,700 building permits for dwellings were issued from January to March 2023, which decreased by 25.7% compared to the same period in 2022. It is mainly due to the surge in the coat of building materials.

- The German electronic industry is the largest in Europe and the fifth-largest worldwide. The electrical and electronics industry accounted for more than 10% of the total German industrial production and about 3% of the country's gross domestic product (GDP).

- Germany is the largest market for furniture in Europe, and the high consumer purchasing power further creates an opportunity for manufacturers to innovate. Some key players in the German furniture industry include Huls AG & Co. KG, Topstar GmbH, and Rauch GmbH & Co. KG. In May 2022, Woody Trading stated that in the first quarter of 2022, the furniture industry sales in Germany increased by 16.1% to around EUR 4.8 billion (USD 5.1 billion).

- Hence, such industrial trends are projected to drive the consumption of flame-retardant chemicals in the country during the forecast period.

Europe Flame Retardant Chemicals Industry Overview

The Europe flame retardant chemical market is partially consolidated in nature. Some of the major players in the market include ICL, LANXESS, BASF SE, J.M. Huber Corporation, and Nabaltec AG, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Consumer Electrical and Electronic Goods Manufacturing

- 4.1.2 Rise in Safety Standards in Building and Construction

- 4.1.3 Rise in Standard of Living in the Eastern European Countries

- 4.2 Restraints

- 4.2.1 Environmental and Health Concerns Regarding Brominated Flame Retardants

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 Market Segmentation

- 5.1 Product Type

- 5.1.1 Non-halogenated

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus

- 5.1.1.3 Nitrogen

- 5.1.1.4 Other Types

- 5.1.2 Halogenated

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-halogenated

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 BASF SE

- 6.4.3 CLARIANT

- 6.4.4 DIC Corporation

- 6.4.5 Dow

- 6.4.6 Eti Maden

- 6.4.7 ICL

- 6.4.8 Italmatch Chemicals S.p.A

- 6.4.9 J.M. Huber Corporation

- 6.4.10 LANXESS

- 6.4.11 MPI Chemie BV

- 6.4.12 Nabaltec AG

- 6.4.13 RTP Company

- 6.4.14 THOR

- 6.4.15 TOR Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness on Environment-friendly Flame Retardants

- 7.2 Active R&D of Non-Halogenated Flame Retardants