|

市场调查报告书

商品编码

1640413

欧洲 BIM(建筑资讯模型):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe BIM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

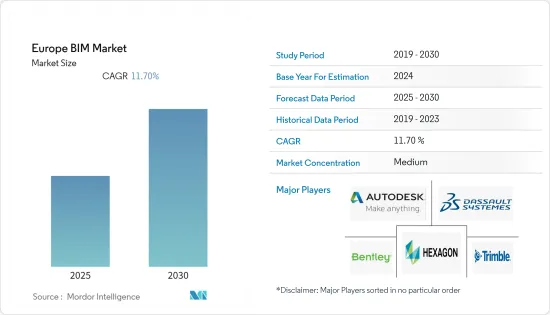

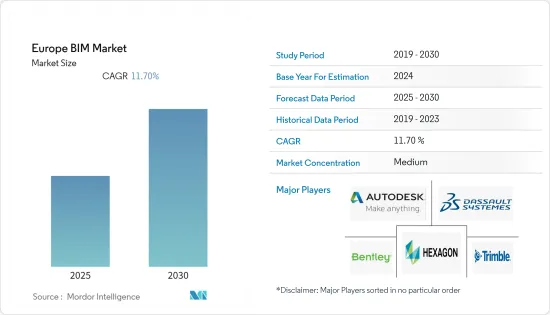

预计预测期内欧洲建筑资讯模型 (BIM) 市场将以 11.7% 的复合年增长率成长。

主要亮点

- 由于 BIM 具有众多优势,其在 AEC 行业中的使用已变得十分流行。现代 AEC 业务的复杂性、交货方式的分散、施工问题以及流程中涉及的多方相关人员,使得 BIM 得到广泛应用。这主要是因为与 AEC 行业实施 BIM 相关的政府立法越来越多,以及建筑业对自动化模型的需求日益增长以提高业务效率。

- 在建筑领域,支援BIM的新技术、新方法层出不穷。将 AR/VR 与 BIM 结合的概念越来越受欢迎,它允许用户查看虚拟世界并与之互动。 BIM 与 AR/VR 的整合日益普及,增强了相关人员之间的沟通,为设计师、工程师和其他相关人员提供了更好的视觉化效果,并提供了一对一、完全沉浸式的体验。

- 新冠疫情对建筑资讯模型业务的扩张产生了重大影响,因为它推动了 BIM 的广泛采用,即使参与者无法亲自见面,计划也可以在虚拟和数位环境中推进。疫情迫使人们寻找更安全、更有效的方式来建造办公室和住宅。

- 该地区各国政府为在公共和私人基础设施建设中实施BIM解决方案而製定的法规和政策正在推动BIM市场的成长。在欧洲,大多数国家已强制要求商业计划使用 BIM。

欧洲 BIM(建筑资讯模型)市场趋势

物联网在建设产业越来越受欢迎

- 建筑业的物联网使建模和订购程序变得更加简单,并确保正确的材料直接运送到建筑工地,从而无需耗时的订单。预製建筑可以从物联网技术中受益。使用预製建筑构件取代传统的建筑方法可以提供更快、更具成本效益的解决方案,同时也能减少建筑废弃物。

- 另一方面,对于大型商业建筑计划使用预製可能难以与整个施工生命週期相协调。因此,物联网(IoT)可以帮助解决这个问题。随着 Trimble、ES Track 和 Pillar Technologies 等公司在建设产业开发和部署物联网技术,未来前景光明。他们鼓励建设公司业主研究这项技术,亲自发现它能带来多大的好处。

- 该技术可用于追踪工作中的人员并使他们远离危险。它还可用于创建施工现场的即时地图,以便每个人都知道谁在那里以及正在做什么。在真正关键的情况下,您还可以在地图上突出显示危险区域或仅限管理员的区域,以防止其他人在没有必要的情况下进入这些区域。物联网设备可以现场收集所有这些资讯并将其用于计划中。

云端基础的BIM(建筑资讯模型)软体的兴起

- 由于疫情的影响,越来越多的人在家工作。建筑师和结构工程师可以使用数位协作工具和云端基础的软体远端规划未来计划。因此,云端基础的软体市场预计将蓬勃发展。工程师和建筑承包商还可以使用 BIM 软体远端管理客户合约、计划管理、销售和其他活动。

- 许多建筑商和业主认为,现在是提升员工技能并为他们提供基础数位工具以提高生产力的最佳时机。在这次危机期间,软体公司也在帮助建筑商和承包商充分利用这些解决方案。

- Autodesk 免费提供 3,100 万个 360 Docs 标题、8,100 万个 360 Design 标题、Fusion 360、Fusion Team 和其他产品的存取权。在复杂的 COVID 疫情中,Autodesk 希望为计划经理、工作人员、团队成员和所有者提供灵活性,并帮助计划经理维持高效的现场运作。由于新冠疫情的影响,建筑资讯模型软体的需求可能会激增。

欧洲BIM(建筑资讯模型)产业概况

欧洲建筑资讯模型市场竞争激烈,有许多国内外大大小小的供应商提供解决方案。随着新参与企业的不断涌入,市场似乎处于高度分散的阶段。市场的主要企业正在采用产品和服务创新、併购等策略。市场的主要企业包括 Autodesk Inc.、Bentley Systems Inc.、Dassault Systemes SA 和 Hexagon AB。

- 2021 年 7 月工业软体公司 AVEVA 与数位建设公司RIB Software 合作,扩展其针对流程工业和工厂工业的专案执行产品组合。此次合作将为 RIB MTWO 平台提供 AVEVA Unified Project Execution 解决方案的附加功能,包括改进的估算和计划成本管理,以及更强大的仪表板和 KPI 监控。

- 2021 年 6 月 SPIDA Software 是一家专门生产用于设计、分析和管理电线杆系统的软体製造商,已被 Bentley Systems 收购。 SPIDA 与 Bentley 的 OpenUtilities 工程软体和数位双胞胎云端服务的整合支援向新可再生能源的过渡。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 增加政府倡议

- 提高建筑业的技术

- 市场限制

- 产品高成本

第六章 市场细分

- 按类型

- 软体

- 服务

- 依部署类型

- 本地

- 云

- 按应用

- 商业的

- 住宅

- 产业

- 按国家

- 英国

- 德国

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Autodesk Inc.

- Dassault Systmes SE

- Hexagon AB

- Bentley Systems Inc.

- Trimble Inc.

- Aveva Group PLC

- Bimeye Inc.

- Topcon Positioning Systems Inc.

- Asite Solutions Ltd

第八章投资分析

第九章:市场的未来

The Europe BIM Market is expected to register a CAGR of 11.7% during the forecast period.

Key Highlights

- The usage of BIM has become more common in the AEC industry due to the numerous benefits connected with this technology. Because of the fragmented delivery methods, building problems, and various parties involved in the process, the contemporary AEC business is complicated, allowing for the widespread use of BIM. This is mostly due to a growth in the number of government laws pertaining to BIM adoption in the AEC industry, as well as the growing need for automated models in the construction arena to improve operational efficiencies.

- BIM-supporting technology and methods are continually emerging in the building sector. The concept of BIM integration with AR/VR, where users may view and interact with a virtual world, has grown in popularity. The growing popularity of BIM integration with AR/VR is good for market growth since it enhances communication among stakeholders and provides better visualization for designers, engineers, and other stakeholders, allowing for a one-to-one, completely immersive experience.

- The COVID-19 pandemic had had little influence on the expansion of the building information modeling business since the COVID-19 lockdown allowed for widespread adoption of BIM, allowing projects to proceed in a virtual and digital environment even when participants were unable to meet in person. The epidemic has compelled people to seek out safer and more efficient methods to construct offices and houses.

- Policies and regulations implemented by governments for the deployment of BIM solutions in the construction of public and private infrastructure across different countries in this region foster the growth of the BIM market. In Europe, in most countries, the use of BIM for commercial projects has been made mandatory.

Europe Building Information Modelling Market Trends

IoT is Becoming More Popular in the Construction Industry

- Modeling and ordering procedures can become more straightforward with IoT in construction, and the appropriate material can be supplied straight to the building site, eliminating the time required for ordering. Prefabrication can benefit from IoT technologies. Using prefabricated building components instead of traditional building methods can result in faster and more cost-effective solutions, as well as reduced construction waste.

- Using prefab for major commercial building projects, on the other hand, might be challenging to coordinate with the entire construction lifecycle. As a result, the Internet of Things (IoT) can assist in resolving this issue. Companies like Trimble, ES Track, Pillar Technologies, and others are developing and deploying IoT technologies in the construction industry, so the future seems bright. They are pushing construction company owners to check out the technology and discover for themselves how beneficial it is.

- This technology may be used to track down people on the job and keep them out of harm's way. It may be used to produce a real-time map of the construction site so that everyone is aware of who is there and what is being done. Some danger zones and managers' only zones can be highlighted on the map in a genuinely grave scenario, and others can be prevented from visiting such regions if it is not essential. IoT Devices might collect all of this information on the site and utilize it for the projects.

Increasing Cloud-based BIM Software

- As a result of the pandemic, more people are working from home. Designers and structural engineers may plot future projects using digital collaboration tools and cloud-based software from remote places. The cloud-based software market is predicted to develop as a result of this. Engineers and builders may also remotely manage client contracts, project management, sales, and other activities using BIM software.

- According to numerous builders and owners, now is a great moment to upskill employees and provide fundamental foundation knowledge with digital tools to improve productivity. During the crisis, software companies also assist builders and contractors in getting the most out of these solutions.

- Autodesk Inc. provided free access to its 31 million 360 Docs, 81 million 360 Design, Fusion 360, Fusion Team, and other products. In this complicated context of the COVID epidemic, the organization wanted to give project managers, workers, team members, and owners flexibility-this aided project managers in retaining high-productivity onsite work. As a result of the epidemic, demand for building information modeling software is likely to skyrocket.

Europe Building Information Modelling Industry Overview

The European building information modeling market is highly competitive owing to the presence of many small and large vendors providing solutions in the domestic and international markets. The market appears to be a highly fragmented stage with new players in the market. Major players in the market are adopting strategies like product and service innovation and mergers and acquisitions. Some of the major players in the market are Autodesk Inc., Bentley Systems Inc., Dassault Systemes SA, and Hexagon AB, among others.

- July 2021: AVEVA, an industrial software company, partnered with RIB Software, a digital construction company, to expand its Project Execution portfolio for the process and plant industries. The connection will deliver additional features from the RIB MTWO platform to the AVEVA Unified Project Execution solution, such as improved estimating and project cost management, as well as more robust dashboards and KPI monitoring.

- June 2021: SPIDA Software, a producer of specialized software for the design, analysis, and administration of utility pole systems, was bought by Bentley Systems. SPIDA's integration with Bentley's OpenUtilities engineering software and grid digital twin cloud services will aid in the transition to new renewable energy sources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Initiatives

- 5.1.2 Technological Upgradation in the Construction Sector

- 5.2 Market Restraints

- 5.2.1 High Cost of Product

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Commercial

- 6.3.2 Residential

- 6.3.3 Industrial

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk Inc.

- 7.1.2 Dassault Systmes SE

- 7.1.3 Hexagon AB

- 7.1.4 Bentley Systems Inc.

- 7.1.5 Trimble Inc.

- 7.1.6 Aveva Group PLC

- 7.1.7 Bimeye Inc.

- 7.1.8 Topcon Positioning Systems Inc.

- 7.1.9 Asite Solutions Ltd