|

市场调查报告书

商品编码

1640416

特种界面活性剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Specialty Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

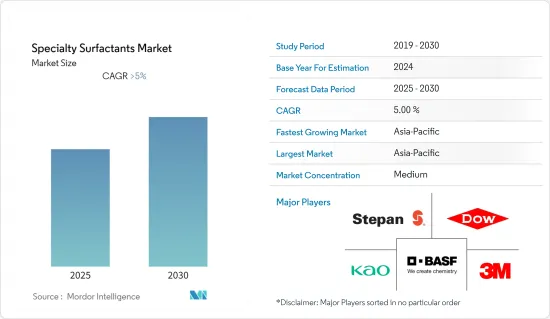

预测期内,特种界面活性剂市场预计将以超过 5% 的复合年增长率成长。

COVID-19 对特种界面活性剂市场产生了相当复杂的影响。由于家庭清洗和个人保健产品的需求增加,市场蓬勃发展。同时,关闭和旅行限制减少了对工业和商务用清洁剂、农产品、润滑剂和燃料添加剂的需求。然而,随着限制的放宽,市场从 2021 年开始加速发展,并且很可能在预测期内遵循类似的轨迹。

主要亮点

- 推动市场发展的关键因素是个人护理行业的成长和亚太地区油脂化学品市场的成长。

- 然而,对环境法规的日益关注阻碍了市场的成长。

- 食品加工产业对特种界面活性剂的需求不断增长,这可能会在不久的将来增加所研究市场的成长潜力。

- 亚太地区占据了最大的份额,预计未来几年仍将保持这一势头。

特种表面活性剂市场趋势

家用肥皂和清洁剂应用占市场主导地位

- 清洁剂和肥皂中含有的专用界面活性剂与水混合后会附着在衣服和其他清洗表面的污垢上。这会降低表面张力并有助于去除污垢。

- 自动洗碗机清洁剂的界面活性剂含量低于手动清洁剂,以最大限度地减少洗碗机中的泡沫。主要界面活性剂有LAS和醇乙氧基硫酸盐(AES)。

- 根据国际肥皂、清洁剂和保养产品协会预测,2021年欧洲家庭护理产品市场总值将超过400亿美元。超过80%的市场是由家庭护理产品构成的。

近年来,美国对清洁剂的需求不断增加。人们对健康和卫生的担忧日益加剧,加上感染疾病的不断增加,可能会进一步促进清洁剂的销售。美国领先的清洁剂品牌包括 Tide、Gain、Arm &Hammer、All、Purex、Xtra、Persil、Dreft 和 Seventh Generation。 2022 年,汰渍在美国清洁剂产业占据主导地位,销售额约 24 亿美元。

亚太地区占市场主导地位

- 2022 年,亚太地区将主导特种界面活性剂市场,预计在预测期内仍将保持主导地位。印度、中国和日本的个人护理和工业清洗行业的成长将在未来几年推动市场发展。

- 人口的不断增长推动了该国对化妆品的需求。中国是美国等新兴经济体化妆品出口的主要市场之一。根据中国国家统计局数据,2021年中国化妆品零售额超过580亿美元,占全球化妆品市场的17%以上。

- 近年来,都市化进程加快和消费支出增加导致对更高品质产品的需求不断增长。预计未来几年领先的家居清洁公司提供的创新产品将提高市场集中度。例如,2022 年 7 月,Godrej Consumer Products 推出了印度首款即用型沐浴乳Godrej Magic Bodywash,售价仅 0.57 美元。此外,2021 年 9 月,RP-Sanjiv Goenka Group 推出护肤和护髮产品,进军个人护理领域。

特种界面活性剂产业概况

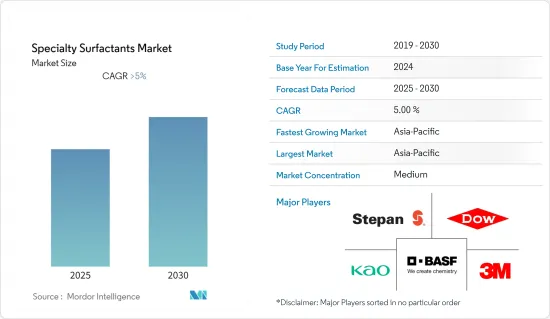

全球特种界面活性剂市场中等分散,大部分市场占有率由多家参与者瓜分。市场的主要企业包括BASF SE、陶氏、3M、Stepan Company 和 Koa Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区个人护理产业的成长

- 油脂化学品市场的成长

- 限制因素

- 对环境法规的兴趣增加

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 按产地

- 合成界面活性剂

- 生物基界面活性剂

- 按类型

- 阴离子界面活性剂

- 阳离子界面活性剂

- 非离子界面活性剂

- 两性界面活性剂

- 硅胶表面活性剂

- 其他类型

- 按应用

- 家用肥皂和清洁剂

- 个人护理

- 润滑油和燃料添加剂

- 工业和公共设施清洗剂

- 食品加工

- 油田化学品

- 农业化学品

- 纺织加工

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- 3M

- Akzo Nobel NV

- Arkema

- Ashland

- BASF SE

- Clariant

- Croda International Plc

- Dow

- ELEMENTIS PLC

- Emery Oleochemicals

- Evonik Industries AG

- GALAXY

- GEO

- Godrej Industries Limited

- Huntsman International LLC

- Innospec

- KAO CORPORATION

- KLK OLEO

- Lonza

- Mitsui & Co., Ltd.

- Nouryon

- Reliance Industries Limited

- Sanyo Chemical Industries, Ltd.

- Sasol

- Solvay

- Stepan Company

- Sumitomo Corporation

第七章 市场机会与未来趋势

- 食品加工产业对特种界面活性剂的需求不断增加

The Specialty Surfactants Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 had a rather mixed impact on the market for specialty surfactants. The market experienced a boom as a result of the rise in demand for household cleaning and personal care products. On the other hand, the market also saw a decrease in demand for industrial and institutional cleaners, agricultural products, lubricants, and fuel additives as a result of lockdowns and travel restrictions. However, with the ease in regulations, the market has started to gather pace since 2021, and the market is likely to follow a similar trajectory during the forecast period as well.

Key Highlights

- The major factors driving the market are the growing personal care industry in Asia-Pacific and the growth of the oleochemicals market.

- However, increasing focus on environmental regulations is hindering the growth of the market studied.

- In the near future, the growing need for specialty surfactants in the food processing industry is likely to give the market under study a number of chances to grow.

- Asia-Pacific had the biggest share of the market, and it's likely that it will continue to do so for the next few years.

Specialty Surfactants Market Trends

Household Soap and Detergent Application to Dominate the Market

- Applications in laundry detergents and soaps for use in the home accounted for the majority of the specialty surfactant market.The specialty surfactants incorporated in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce the surface tension and remove the dirt from the concerned surface.

- The surfactant level in automatic dishwasher detergents is lower than in hand dishwashing detergents to minimize foaming in the dishwasher. The major surfactants used are LAS and alcohol ethoxy sulfates (AES).

- The International Association for Soaps, Detergents, and Maintenance Products says that the total market value of household care products in Europe will be more than USD 40 billion in 2021. More than 80% of the market will be made up of household care products.

Demand for detergent has increased in the United States in recent years. The rising prevalence of infectious diseases, coupled with growing concerns related to health and hygiene, will further increase the sales of detergent. Leading detergent brands in the United States include Tide, Gain, Arm & Hammer, All, Purex, Xtra, Persil, Dreft, and Seventh Generation. Tide dominated the U.S. detergent industry in 2022 and generated sales of nearly $2.40 billion.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the specialty surfactants market in 2022 and is expected to continue its dominance over the forecast period. Growing personal care and industrial cleaning industries in India, China, and Japan will propel the market in the future.

- Continuous population growth is a factor fueling the demand for cosmetics in the country. China is one of the leading markets for cosmetics exports from developed economies, such as the United States. According to the National Bureau of Statistics of China, in 2021, the retail sales of cosmetics in China surpassed USD 58 billion and accounted for more than 17% of the global cosmetics market.

- Increasing urbanization followed by rising expenditure has increased the demand for better-quality products over the past few years. Innovative product offerings by leading household cleaning companies are expected to increase market concentration over the coming years. For instance, in July 2022, Godrej Consumer Products unveiled Godrej Magic Bodywash, India's first ready-to-mix body wash, at just USD 0.57. Furthermore, in September 2021, the RP-Sanjiv Goenka Group entered the personal-care segment by launching skin and hair care products.

Specialty Surfactants Industry Overview

The global specialty surfactants market is moderately fragmented, as the majority of the market share is divided among many players. Some of the key players in the market include BASF SE, Dow, 3M, Stepan Company, and Koa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry In Asia-pacific

- 4.1.2 Growth Of The Oleo Chemicals Market

- 4.2 Restraints

- 4.2.1 Increasing Focus On Environmental Regulations

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market size in Value)

- 5.1 Origin

- 5.1.1 Synthetic Surfactants

- 5.1.2 Bio-based Surfactants

- 5.2 Type

- 5.2.1 Anionic Surfactants

- 5.2.2 Cationic Surfactants

- 5.2.3 Non-ionic Surfactants

- 5.2.4 Amphoteric Surfactants

- 5.2.5 Silicone Surfactants

- 5.2.6 Other Types

- 5.3 Application

- 5.3.1 Household Soap and Detergent

- 5.3.2 Personal Care

- 5.3.3 Lubricants and Fuel Additives

- 5.3.4 Industry and Institutional Cleaning

- 5.3.5 Food Processing

- 5.3.6 Oilfield Chemicals

- 5.3.7 Agricultural Chemicals

- 5.3.8 Textile Processing

- 5.3.9 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Clariant

- 6.4.7 Croda International Plc

- 6.4.8 Dow

- 6.4.9 ELEMENTIS PLC

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 GALAXY

- 6.4.13 GEO

- 6.4.14 Godrej Industries Limited

- 6.4.15 Huntsman International LLC

- 6.4.16 Innospec

- 6.4.17 KAO CORPORATION

- 6.4.18 KLK OLEO

- 6.4.19 Lonza

- 6.4.20 Mitsui & Co., Ltd.

- 6.4.21 Nouryon

- 6.4.22 Reliance Industries Limited

- 6.4.23 Sanyo Chemical Industries, Ltd.

- 6.4.24 Sasol

- 6.4.25 Solvay

- 6.4.26 Stepan Company

- 6.4.27 Sumitomo Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Specialty Surfactants in Food Processing Industry