|

市场调查报告书

商品编码

1640422

积层製造与材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Additive Manufacturing and Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

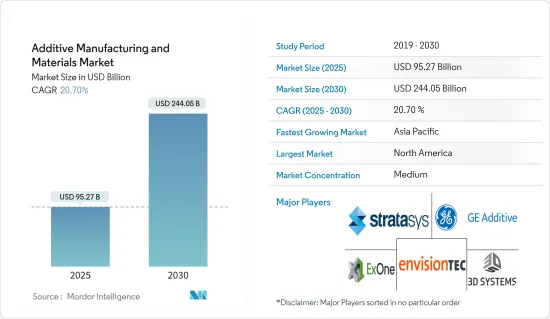

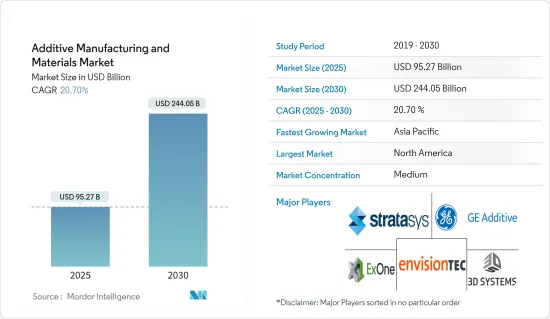

积层製造和材料市场规模在2025年预估为952.7亿美元,预计到2030年将达到2,440.5亿美元,预测期间(2025-2030年)的复合年增长率为20.7%。

如今,各种规模的製造商都积层製造视为其工厂的重要组成部分。积层製造使产业能够生产重新设计的成品,这些成品更坚固、更轻、零件更少,同时也能克服供应链中断的问题。

主要亮点

- 工业3D列印技术对于工厂实现即插即用运作至关重要。根据 Sculpteo 的调查,41% 的公司确认积层製造改善了他们的流程,使他们能够更有效率地完成任务。受近期生物基材料兴起的推动,59% 的用户希望使用更多永续材料。同时,47% 的 3D 列印减少了对多种资源的需求,因为有些设计透过传统技术是「不可能实现的」。

- 积层製造广泛应用于许多产业,航太业是最早采用 3D 列印的产业之一。在医疗保健领域,3D 列印用于医疗设备和牙科的假牙、嵌体和其他植入。为了进一步发展 3D 列印,影像处理方法将测量患者的膝盖或下巴,并将所需植入的 CAD 设计直接发送到 3D 列印机,印表机将立即开始生产。

- 新冠疫情让 3D 列印得以应对挑战。该技术可以快速生产 3D 列印口罩和防护罩。随着新的 3D 列印材料、机器和积层製造技术进入市场,拥有 3D 列印架构专业知识的公司可以扩展其服务,因为产业正在向他们寻求创新技术。

- 总部位于英国的本特利汽车公司已向 3D 列印领域投资 300 万美元。此项投资用于多喷射熔合技术和 FDM 机器。基于粉末的技术使该汽车製造商能够在一天半的时间内生产出批量的零件,比同行提高了生产率。

积层製造和材料市场趋势

汽车业预计将占很大份额

- 3D 列印在生产最终汽车零件方面非常有用。大众、宝马和福特等汽车製造商使用积层技术来製造其汽车的最终零件。熔融长丝製造技术 (3F 或 FFF) 是 3D 列印领域的最新进展,人们正在探索一系列具有与塑胶相似特性的材料。 3D 列印使公司能够创建所需的零件和设计,从而无需依赖外部供应商,使其生产过程更加高效。

- 积层製造可以实现无工俱生产,并且具有几乎无限的设计灵活性。例如,福特汽车使用3D列印技术来生产零件。该公司整合AI和3D技术来增强其业务能力。 2022年3月,该公司开发了操作3D列印机的机器人系统。此介面将使来自不同供应商的机器能够使用相同的语言并自主操作生产线的各个部分。

- 通用汽车计划在2035年实现其所有车型零排放。积层製造在设计复杂零件、轻量化车辆和提高电池性能方面发挥关键作用。当通用汽车遇到交付2022 年雪佛兰 Tahoe 所需零件生产中断时,它转向了惠普的 3D 列印平台。在转用惠普的多射流熔融 (MJF) 3D 列印技术后,通用汽车能够缩短干燥时间并加快其全尺寸 SUV 的生产进度。在五週的时间里,他们成功生产并打磨了约30,000辆汽车所需的60,000个零件。

预计亚太地区将出现显着成长

- 作为「中国製造2025」策略的一部分,中国设定了提高工业竞争力的目标。我们透过投资 3D 列印等最尖端科技和培养未来的劳动力来实现这一目标。根据Materialise对中国製造企业所做的调查,30%的企业同意3D列印的使用将变得比传统製造业更重要。

- 中国航空业已开始在其下一代军用飞机中使用尖端的 3D 列印技术,其中 3D 列印零件已用于製造最近首飞的飞机。

- 3D生物列印技术由韩国浦项科技大学(POSTECH)开发,用于列印逼真的人造器官。据该研究所称,3D 列印与人工智慧和机器人技术相结合,可实现更自动化、更复杂的替代器官生成方式。

- 日本企业集团 JGC Holdings Corporation 引进了 COBOD 3D 列印机用于建筑工程。采用COBOD技术,可显着减少模板施工所需的时间。该公司计算得出,3D 列印可以将这一过程从 16 天缩短至 8 天。

积层製造和材料产业概况

积层製造和材料市场竞争激烈。拥有巨大市场占有率的领先公司正专注于开发 3D 列印技术的衍生设计能力。透过采用针对积层製造优化的软体功能,这些公司希望扩大其在国际市场的基本客群,并利用策略合作倡议来增加市场占有率和盈利。 Stratasys、ExOne 和 3D Systems Corporation 是服务该行业的一些主要公司。

- 2022 年 8 月-聚合物 3D 列印公司 Stratasys 收购科思创股份公司 (Covestro AG),积层製造和材料业务提供支援。这种创新材料非常适合 3D 列印的新使用案例,特别是用于生产牙齿矫正器和汽车零件等最终用途零件。此次收购使 Stratasys 能够推进其策略,提供业界最好、最完整的聚合物 3D 列印产品组合。这也使我们能够加快对 3D 列印材料尖端开发的投资。

- 2022 年 8 月-Carbon 收购积层製造软体供应商 ParaMatters。此次收购将使 Carbon 的产品开发团队能够使用该软体的自动化技术在更短的时间内创造出更高效能的零件设计。这些设计具有先进的几何形状和改进的性能特征。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 新技术和改进技术推动产品客製化

- 汽车和航太工业对轻量化结构的需求

- 市场限制

- 对智慧财产权保护的担忧

第六章 市场细分

- 依技术分类

- 立体光刻技术

- 熔融沉积建模

- 雷射烧结

- 黏着剂喷涂列印

- 其他技术

- 按最终用户

- 航太和国防

- 车

- 卫生保健

- 产业

- 其他最终用户

- 按材质

- 塑胶

- 金属

- 陶瓷

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 以色列

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- 3D Systems Corporation

- General Electric Company(GE Additive)

- EnvisionTEC GmbH

- EOS GmbH

- Exone Company

- Mcor Technologies Ltd

- Materialise NV

- Optomec Inc.

- Stratasys Ltd

- SLM Solutions Group AG

第八章投资分析

第九章:市场的未来

The Additive Manufacturing and Materials Market size is estimated at USD 95.27 billion in 2025, and is expected to reach USD 244.05 billion by 2030, at a CAGR of 20.7% during the forecast period (2025-2030).

Production companies of all sizes currently view Additive Manufacturing as an essential component of their factories. With additive manufacturing, industries can manufacture finished goods that are stronger, lighter, and redesigned to have fewer parts while overcoming supply chain interruption.

Key Highlights

- Industrial 3D printing technology is essential for factories to operate in plug-and-play mode. According to a survey by Sculpteo, 41% of the companies confirm that Additive Manufacturing has helped them complete their task more efficiently while improvising their process. 59% of users desire to use more sustainable materials, driven by the increasing number of bio-based materials in recent years. At the same time, 47% of 3D printing reduces the need for multiple resources because some designs are 'impossible' to achieve using traditional techniques.

- Additive Manufacturing is used widely in many industries, and the aerospace industry was the first to embrace 3D printing. In healthcare, medical devices and dentistry use 3D printing in items such as dental prostheses, inlays, and other implants. For further developments in 3D printing, imaging methods will measure the patient's knee or jaw and then send a CAD blueprint of the required implant directly to the 3D printer, which will immediately start building it.

- The Covid-19 pandemic allowed 3D printing to rise to the challenge. The rapid production of 3D-printed face masks and shields was possible using this technology. When new 3D printing materials, machines, and additive manufacturing techniques enter the market, companies proficient in 3D printing architectures can expand their services as the industries will approach them for innovative skills.

- UK-based Bently Motors adopted 3D printing with an investment of 3 million USD. This investment was used in multi-jet fusion technology and FDM machines. With powder-based technology, the automotive player could manufacture a batch of parts in a day and a half, thereby increasing its productivity compared to its counterparts.

Additive Manufacturing Materials Market Trends

Automotive to is expected Hold a Significant Share

- 3D printing is very helpful in manufacturing the final car parts. Automotive players like Volkswagen, BMW, and Ford use additive technology to manufacture final car parts. Fused Filament Fabrication (3F or FFF) is the latest improvement in 3D printing, where different materials are examined to have properties similar to plastics. With a 3D printer, the required parts and designs can be created, which makes the companies independent of external suppliers and further streamlines the production processes.

- Additive Manufacturing allows for toolless production with almost endless design flexibility. For instance, Ford Automotive uses 3D printing technology for production parts. The company is integrating AI with 3D technology to enhance its business capabilities. In March 2022, the automotive leader developed a robotic system to operate 3D printers. This interface allows machines from different suppliers to speak to each other in the same language and operate parts of the production line autonomously.

- General Motors plans to turn its entire fleet into zero-emission vehicles by 2035. Additive Manufacturing plays a vital role in designing intricate parts and lightweight vehicles with extended battery performance. When General Motors faced hindrances in producing a component needed to deliver the 2022 Chevrolet Tahoe, it turned to HP's 3D printing platform. After switching to HP's Multi Jet Fusion (MJF) 3D printing technology, GM was able to reduce the drying time, which sped up the manufacturing schedule for full-sized SUVs. Over five weeks, the necessary 60,000 parts for about 30,000 vehicles were successfully made and polished.

Asia Pacific is expected to witness significant growth rate

- China has set targets to increase industrial competitiveness as part of its Made in China 2025 strategy. They will do this by investing in cutting-edge technologies, like 3D printing, and preparing the future workforce. A survey conducted by Materialise among Chinese manufacturing companies stated 30% of companies agree that the use of 3D printing that will become more important than traditional manufacturing.

- China's aviation sector has begun using cutting-edge 3D printing technologies on next-generation warplanes, with 3D printed components being used to construct aircraft that had their maiden flight recently.

- The 3D bio-printing technique was developed by the Pohang University of Science and Technology (POSTECH) in South Korea for realistic engineered organs. As per the research institute, more automatized and elaborate methods for generating organ substitutes would be possible if 3D printing is integrated with AI and robotic technologies.

- JGC Holdings Corporation, a Japanese conglomerate, installed COBOD 3D printer in its construction work. Adopting COBOD technology will drastically reduce formwork construction time. The firm calculated that 3D printing might have cut this process from 16 days down to eight.

Additive Manufacturing Materials Industry Overview

The additive manufacturing and materials market is quite competitive. The major players with a significant market share are concentrating on developing generative design capabilities for 3D printing techniques. By adopting software capabilities optimized for additive manufacturing, companies want to increase their customer bases across international markets and utilize strategic collaborative initiatives to increase their market share and profitability. Stratasys, ExOne, and 3D Systems Corporation are some of the major players serving this industry.

- August 2022 - The polymer 3D printing company Stratasys acquired Covestro AG, which supports the additive manufacturing materials business. Innovative materials are proficient in creating new use cases for 3D printing, particularly in producing end-use parts like dental aligners and automotive components. Through this acquisition, Stratasys can advance its business strategy of providing the industry's best and most complete polymer 3D printing portfolio. The company can also accelerate its investments in cutting-edge developments in 3D printing materials.

- August 2022 - Carbon acquired ParaMatters, which provides software for additive manufacturing. The acquisition will help the product development teams of Carbon to create higher-performance part designs in less time using automation techniques of this software. These designs will feature advanced geometries and improved performance characteristics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMNICS

- 5.1 Market Drivers

- 5.1.1 New and Improved Technologies to Drive Product Customization

- 5.1.2 Demand for Lightweight Construction in Automotive and Aerospace Industries

- 5.2 Market Restraints

- 5.2.1 Concerns over Intellectual Property Protection

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Stereo Lithography

- 6.1.2 Fused Deposition Modelling

- 6.1.3 Laser Sintering

- 6.1.4 Binder Jetting Printing

- 6.1.5 Other Technologies

- 6.2 By End User

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive

- 6.2.3 Healthcare

- 6.2.4 Industrial

- 6.2.5 Other End Users

- 6.3 By Material

- 6.3.1 Plastic

- 6.3.2 Metals

- 6.3.3 Ceramics

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Israel

- 6.4.5.4 South Africa

- 6.4.5.5 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Corporation

- 7.1.2 General Electric Company (GE Additive)

- 7.1.3 EnvisionTEC GmbH

- 7.1.4 EOS GmbH

- 7.1.5 Exone Company

- 7.1.6 Mcor Technologies Ltd

- 7.1.7 Materialise NV

- 7.1.8 Optomec Inc.

- 7.1.9 Stratasys Ltd

- 7.1.10 SLM Solutions Group AG