|

市场调查报告书

商品编码

1640432

奈米纤维:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Nanofiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

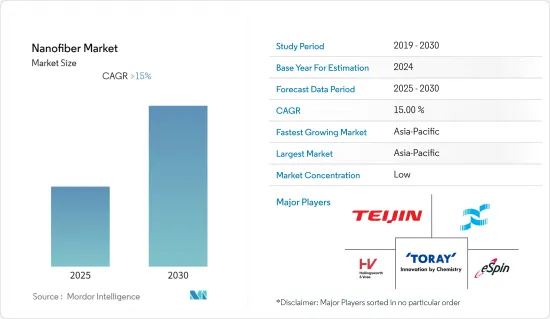

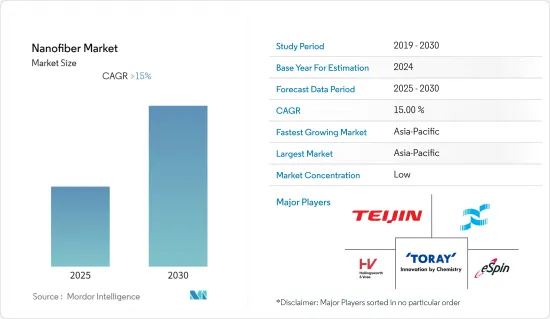

预测期内,奈米纤维市场预计将以超过 15% 的复合年增长率成长。

COVID-19 疫情为全球奈米纤维市场带来了不确定性。然而,疫情过后,由于暖通空调系统需求激增,市场一直稳定成长。

关键亮点

- 从长远来看,医药产业的需求不断增长是推动市场成长的主要因素。

- 另一方面,碳奈米纤维的尺寸小且复杂,难以从实验室规模过渡到工厂规模,缺乏灵敏的仪器来校准奈米纤维的特性,这是研究市场成长的主要障碍。

- 在预测期内,对纤维素奈米纤维和高潜力市场的研究和开发不断增加可能为所研究的市场提供机会。

- 亚太地区占据全球市场主导地位,奈米纤维的需求主要受到电子、能源、航太、医疗和国防等产业不断增长的应用和需求的推动。

奈米纤维市场趋势

水和过滤领域主导市场需求

- 基于电纺奈米纤维的过滤介质具有高表面体积比、低压降、良好的空隙互连性以及可控的连通性和形态,使其适用于卓越的过滤。由于这些因素,奈米纤维被用于高效微粒空气 (HEPA) 过滤器。

- HEPA 过滤器用于工业应用,以保持指定环境(例如无尘室)不受颗粒污染物。在大多数国家,HEPA 过滤器必须满足严格的要求。

- 美国能源局(DOE) 标准要求 HEPA 过滤器能够去除至少 99.97% 的直径为 0.3 μm 的空气传播颗粒。

- 欧洲标准中,HEPA 有不同的等级,且各有具体要求。电纺过滤膜以其高过滤效率和性能而闻名,可能适用于 HEPA 过滤器。

- 近年来,由金属氧化物半导体合成的奈米纤维已被积极研究用于许多化学和气体感测应用,包括空气品质检测、有毒和易燃气体测试以及环境监测。这些奈米纤维能够在短时间内检测各种还原和氧化气体。

- 典型的 N95 口罩使用聚丙烯纤维製成,但自 COVID-19 大流行以来,一些新兴企业一直在使用电纺奈米纤维来製造口罩。据说使用奈米纤维的口罩能更好地捕获气溶胶飞沫,同时透气性也更好。

- 奈米纤维也在水处理领域用作压力膜和渗透膜製程中TFC(薄膜复合材料)膜的骨架。此外,它也用于水处理的热驱动MD(膜蒸馏)製程。

- 包括中国、美国、科威特和沙乌地阿拉伯在内的许多国家的水处理产业不断发展,可能会推动对奈米纤维的需求。根据沙乌地阿拉伯统计总局统计,2021年沙乌地阿拉伯部署了133座污水处理厂,与前一年同期比较成长14.66%。 2021年回用处理水近4.19亿立方米,较2020年成长23.60%。

- 此外,2022 年 3 月,沙乌地阿拉伯宣布了价值 350 亿沙特里亚尔(93.3 亿美元)的 60 多个水利计划,巩固了其作为全球最大海水淡化市场的地位。沙乌地阿拉伯正在增加对清洁能源、电力和水资源的投资。

- 在日本,污水处理的使用率日益提高,2021年日本约有92.6%的人口使用污水处理系统处理,高于2020年的92.1%。

- 因此,预计预测期内所有这些市场趋势都将推动水和过滤应用中对奈米纤维的需求。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率的主导地位。医疗、航太和国防、能源以及汽车等产业的需求不断增长,推动着市场成长。

- 中国医疗产业规模位居世界第二,仅次于美国。预计到2030年中国将占全球医疗保健产业收益占有率的25%。预计这将促进药物传输、组织工程、干细胞治疗、癌症治疗和创伤治疗等领域对奈米纤维复合材料的需求。

- 此外,中国是亚太地区最大的伤口敷料市场之一,预计未来五年复合年增长率将达到 6.7%。中国拥有多家从事伤口敷料业务的国内外伤口管理公司,其中包括Chinamed和Exciton Technologies。其中大部分位置在上海、广州等全国各大城市週边。

- 中国是世界上最大的汽车工业。根据中国工业协会(CAAM)的数据,2022年10月汽车产量为259万辆,高于2021年10月的233万辆。

- 医疗保健是印度最大的产业之一。医疗保健支出占 GDP 的比例正在快速增长,部分原因是政府专注于改善医疗保健。此外,印度是医疗旅游最受欢迎的目的地之一,由于其提供价格合理且优质的医疗服务,医疗旅游也呈现高速成长。

- 此外,印度的医疗保健产业也在成长,这可能会刺激该国研究市场的需求。预计到 2022 年,该国的医疗保健产业规模将达到 3,720 亿美元,主要推动力是健康意识的增强、保险覆盖率的扩大、收入的增加以及疾病的增加。此外,印度政府还计划推出价值 5,000 亿印度卢比(68 亿美元)的信贷奖励计划,以加强该国的医疗保健基础设施。

- 由于这些市场趋势,预计亚太地区将主导全球市场。

奈米纤维产业概况

奈米纤维市场部分细分,众多参与企业占据微不足道的份额,各自影响着市场动态。其他主要企业包括(不分先后顺序):eSpin Technologies Inc.、帝人株式会社、东丽工业公司、Hollingsworth and Vose Company 和日本製纸工业公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 医疗和製药业的需求不断增长

- 新冠疫情对口罩和个人防护套件需求有正面影响

- 限制因素

- 碳奈米纤维的尺寸小且复杂,使其难以从实验室规模转变为工厂规模

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

- 专利分析

第 5 章 市场区隔(以金额为准的市场规模)

- 产品类型

- 碳奈米纤维

- 复合奈米纤维

- 金属和金属氧化物奈米纤维

- 聚合物奈米纤维

- 碳水化合物基奈米纤维

- 陶瓷奈米纤维

- 应用

- 水和空气过滤

- 汽车和运输

- 纤维

- 医疗

- 电子产品

- 能源储存

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 其他的

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Applied Sciences Inc.

- Argonide Corporation

- Chuetsu Pulp & Paper Co. Ltd

- Donaldson Company Inc.

- DuPont

- Esfil Tehno AS

- eSpin Technologies Inc.

- Hollingsworth & Vose Company

- IREMA-Filter GmbH

- Japan Vilene Company Ltd

- LIME

- Merck KgAA

- Nanofiber Solutions

- NanoLayr Limited

- Nanoval GmbH & Co. KG

- Nippon Paper Industries Co. Ltd

- Pardam SRO

- Sappi Ltd

- SNC Fibers

- Spur AS

- Teijin Limited

- Toray Industries Inc.

- US Global Nanospace Inc.

第七章 市场机会与未来趋势

- 加大对纤维素奈米纤维的研发,市场潜力大

The Nanofiber Market is expected to register a CAGR of greater than 15% during the forecast period.

The COVID-19 pandemic has created instability in the nanofiber market across the globe. However, the market is growing steadily post-pandemic owing to surging demand for HVAC systems.

Key Highlights

- Over the long term, the major factor expected to drive the growth of the market studied is the increasing demand from the medical and pharmaceutical industries.

- On the flip side, the difficulty in a shift of carbon nanofibers from lab scale to plant scale due to small size and complexity and the lack of sensitive instrumentation to calibrate properties of nanofibers is one of the major stumbling blocks in the growth of the market studied.

- The increasing R&D and high-potential market for cellulosic nanofibers are likely to provide opportunities for the market studied during the forecast period.

- Asia-Pacific dominates the market worldwide, and its demand for nanofibers is majorly driven by the increasing application and demand from industries such as electronics, energy, aerospace, healthcare, and defense.

Nanofiber Market Trends

Water and Filtration Segment to Dominate the Market Demand

- Electrospun nanofiber-based filter media possess a high ratio of surface/volume, low-pressure drop, good interconnectivity of voids, and controllable connectivity and morphology, rendering them desirable for excellent filtering. Owing to these factors, nanofibers are used in high-efficiency particulate air (HEPA) filters.

- HEPA filters are used in industrial applications for keeping a designated environment free of particulate contaminants, such as a clean room. In most countries, HEPA filters need to meet stringent requirements.

- The US Department of Energy (DOE) standards state that a HEPA filter needs to remove at least 99.97% of airborne particles, which are 0.3 µm in diameter, among other requirements.

- The European standard has different classes of HEPA with specific requirements. The electrospun filter membrane is known for its high filtration efficiency and performance, which makes it potentially suitable for HEPA filters.

- In the recent past, nanofibers synthesized from metal oxide semiconductors are being actively explored in numerous chemical and gas sensing applications, including in the detection of air quality, the inspection of toxic and inflammable gases, and the monitoring of the environment. These nanofibers are capable of detecting various reducing and oxidizing gases in a short period.

- While the typical N95 masks are made using polypropylene fibers, several startups have been making face masks using electrospun nanofibers post the COVID-19 pandemic. Masks made using nanofibers capture aerosol droplets better while providing additional breathability.

- Nanofibers are also used in the water treatment sector as the scaffold for TFC (thin-film composite) membranes in the pressure and osmotic membrane processes. Additionally, they are also used in the thermally-driven MD (membrane distillation) process for water treatment.

- The growing water treatment industry in many countries including China, the United States, Kuwait, and Saudi Arabia is likely to propel the demand for nanofibers. According to the General Authority of Statistics, Saudi Arabia deployed 133 wastewater treatment plants in 2021, up 14.66 percent year-on-year. Nearly 419 million cubic meters of treated water were reused in 2021, an increase of 23.60 percent compared to 2020.

- Additionally, in March 2022, Saudi Arabia announced over 60 water projects, worth SR 35 billion (USD 9.33 billion), that will secure the country's position as the world's largest water desalination market. Saudi Arabia has been increasing its investment in clean energy, power, and water.

- In Japan, the usage of treated wastewater is also increasing day-by-day, In 2021, approximately 92.6 percent of the Japanese population was served by wastewater treatment systems, up from 92.1 in 2020.

- Hence, all such market trends are expected to drive nanofibers' demand in water and filtration applications during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominates the global market share. The increasing demand from industries like healthcare, aerospace and defense, energy, and automotive has been driving the market's growth.

- The Chinese healthcare industry is the second-largest industry globally after the United States. China is expected to account for 25% of the global healthcare industry's revenue share by 2030. This is expected to increase the demand for nanofiber composites for drug delivery, tissue engineering, stem cell therapy, cancer therapy, and wound healing.

- Additionally, China has one of the largest wound dressing markets in the Asia-Pacific region, which is expected to register a CAGR of 6.7% over the next five years. China has many domestic and international wound management companies involved in wound dressings, such as Chinamed and Exciton Technologies. Most of them are located around the country's major cities, such as Shanghai and Guangzhou.

- The Chinese automotive industry is the largest in the world. According to the China Association of Automobile Manufacturers (CAAM), the automotive production stood at 2.59 million units in October 2022, up from 2.33 million units in October 2021.

- Healthcare has become one of India's largest industries. healthcare spending as a percentage of GDP is growing rapidly, owing to the government's focus on improving healthcare. India is also one of the most famous destinations for medical tourism due to its cheap and quality healthcare, and it has also been experiencing high growth.

- Additionally, the healthcare segment in India has also been growing and may boost the demand for the market studied in the country. The healthcare industry in the country is expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. Additionally, The Indian government is planning to introduce a credit incentive programme worth Rs. 500 billion (USD 6.8 billion) to boost the country's healthcare infrastructure.

- Owing to these prevailing market trends, the Asia-Pacific region is expected to dominate the global market.

Nanofiber Industry Overview

The nanofiber market is partially fragmented, with numerous players holding an insignificant share of the market and affecting market dynamics individually. Some of the notable players in the market include eSpin Technologies Inc., Teijin Limited, Toray Industries Inc., Hollingsworth and Vose Company, and Nippon Paper Industries Co. Ltd, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Medical and Pharmaceutical Industries

- 4.1.2 Positive Impact in Demand for Face Masks and PPE Kits due to COVID-19

- 4.2 Restraints

- 4.2.1 Difficulty in Shift of Carbon Nanofibers from Lab Scale to Plant Scale due to Small Size and Complexity

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technology Snapshot

- 4.6 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Carbon Nanofiber

- 5.1.2 Composite Nanofiber

- 5.1.3 Metal and Metal Oxide Nanofiber

- 5.1.4 Polymeric Nanofiber

- 5.1.5 Carbohydrate-based Nanofiber

- 5.1.6 Ceramic Nanofiber

- 5.2 Application

- 5.2.1 Water and Air Filtration

- 5.2.2 Automotive and Transportation

- 5.2.3 Textiles

- 5.2.4 Medical

- 5.2.5 Electronics

- 5.2.6 Energy Storage

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Applied Sciences Inc.

- 6.4.2 Argonide Corporation

- 6.4.3 Chuetsu Pulp & Paper Co. Ltd

- 6.4.4 Donaldson Company Inc.

- 6.4.5 DuPont

- 6.4.6 Esfil Tehno AS

- 6.4.7 eSpin Technologies Inc.

- 6.4.8 Hollingsworth & Vose Company

- 6.4.9 IREMA-Filter GmbH

- 6.4.10 Japan Vilene Company Ltd

- 6.4.11 LIME

- 6.4.12 Merck KgAA

- 6.4.13 Nanofiber Solutions

- 6.4.14 NanoLayr Limited

- 6.4.15 Nanoval GmbH & Co. KG

- 6.4.16 Nippon Paper Industries Co. Ltd

- 6.4.17 Pardam SRO

- 6.4.18 Sappi Ltd

- 6.4.19 SNC Fibers

- 6.4.20 Spur AS

- 6.4.21 Teijin Limited

- 6.4.22 Toray Industries Inc.

- 6.4.23 US Global Nanospace Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing R&D and High-potential Market for Cellulosic Nanofibers