|

市场调查报告书

商品编码

1640469

中东润滑油:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Middle-East Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

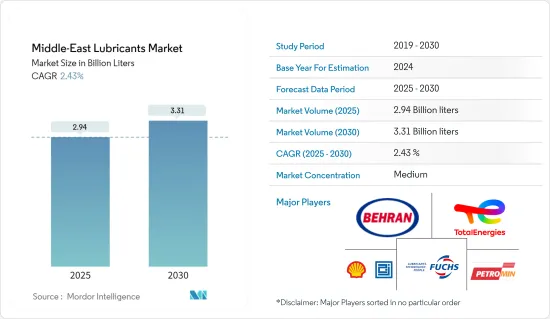

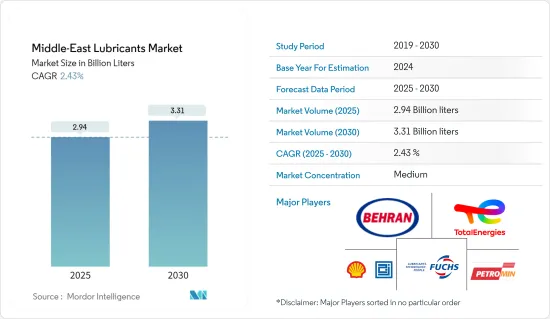

中东润滑油市场规模预估在2025年为29.4亿公升,预计2030年达到33.1亿公升,预测期间(2025-2030年)的复合年增长率为2.43%。

由于新冠疫情爆发,製造业受到严重影响,导致2020年润滑油使用量下降。然而,随着许多建筑计划和其他工业活动的回暖,市场在 2021 年出现復苏。预计未来几年这一趋势仍将保持积极态势。过去两年,汽车和工程产品销售的成长推动了市场復苏。

沙乌地阿拉伯、伊朗和阿拉伯联合大公国的工业成长以及高性能润滑油的使用增加是推动所调查市场成长的主要驱动力。

另一方面,高性能润滑油的高成本预计会阻碍市场的成长。

合成润滑油和生物基润滑油的发展预计将在未来提供市场机会。

预计沙乌地阿拉伯将成为最大的润滑油市场,并预计在预测期内实现最高的复合年增长率。

中东润滑油市场趋势

汽车产业占市场主导地位

- 润滑剂通常用于减少磨损、防止腐蚀并保持引擎内部平稳运转。

- 高燃油经济性机油因其具有防止漏油、防止油卡等特殊性能而需求很大。

- 大多数轻型和重型柴油和汽油引擎使用黏度等级为 10W40 和 15W40 的油,而 15W50 和 20W50 等多级油通常用于航空引擎。

- 汽车的平均车龄年限多年来一直在稳步增长,这为售后补油市场带来了机会。新兴经济体中乘用车平均使用年限的提高和城市人口的增加预计将推动运输润滑油市场的发展。

- 汽车工业对一个国家的社会经济发展至关重要。当地汽车行业专家表示,儘管全球电动车销量上升,但内燃机 (ICE) 汽车预计在未来 15 至 20 年内仍将主导沙乌地阿拉伯汽车市场。

- 主导沙乌地阿拉伯汽车产业的主要企业包括丰田(占有 30% 的市场份额)、现代和起亚(占有 26% 的市场份额)以及雷诺-日产-三菱(占有 9% 的市场份额)。通用汽车、福特和菲亚特克莱斯勒汽车公司占据剩余的份额。

- 沙乌地阿拉伯正在寻求汽车产业在地化并增加投资机会,以实现其国家汽车战略的目标,根据该国的「2030 愿景」目标发展本地製造能力。

- 过去几年,伊朗汽车市场呈现上涨趋势,国内生产的需求增加。例如,根据OICA预测,2022年伊朗汽车产量将成长19%,达到106.4万辆乘用车,而2021年约为89.4万辆。

- 国际汽车工业组织(OICA)将伊朗2022年汽车产量增幅排在全球第六位。

- 欧洲汽车工业协会(ACEA)也将伊朗评为2022年全球第11大汽车製造国。

- 由于生产和销售需求增加,阿联酋汽车市场车辆註册量正在增加。

- 据业内人士透露,2023年1至9月,全国汽车註册量为193,698辆,较去年同期成长20.2%。

- 此外,预计2022年全国汽车市场新车销量将超过40万辆,与前一年同期比较增长10%。在该国人口成长和收入提高的推动下,预计这种成长将持续下去。

- 因此,预计上述因素将在预测期内促进该地区所研究市场的成长。

沙乌地阿拉伯预计将实现快速成长

- 沙乌地阿拉伯是中东最大的经济体。沙乌地阿拉伯的经济主要依赖石油工业。

- 沙乌地阿拉伯是海湾合作委员会最大的汽车市场之一。乘用车约占该地区汽车市场的80%。

- 沙乌地阿拉伯正在加强其电力部门(发电、输电、配电和智慧电网)的能力,以有效满足国内和商业消费者日益增长的电力需求,并支持该国能源结构的多样化。 。

- 据能源部称,到2030年,沙乌地阿拉伯在电力和可再生能源计划上的支出预计将达到2,930亿美元。此外,2021 年 12 月,沙乌地阿拉伯能源部长宣布计画在 2030 年在能源发行上投入 380 亿美元。

- 沙乌地阿拉伯已成为快速成长的能源消费国。随着国家对电力的需求不断增加,发电基础设施也不断增加。据估计,到 2040 年,该国需要将发电能力提高到 160GW,才能满足不断增长的需求。为实现这一目标,政府计划每年在发电方面投资约 50 亿美元,在配电和输电 (D&T) 方面投资 40 亿美元。该国的可再生能源发电计画旨在2023年将可再生能源发电量提高到950万千瓦。

- 持续润滑对于轴承、齿轮和链条的寿命至关重要。与其他机械系统一样,食品和饮料工厂中的运动部件需要适当的润滑才能发挥最佳功能。污染、湿气、高温和潮湿都会对轴承、链条和齿轮的寿命构成威胁。沙乌地阿拉伯正在大力投资金属产业。根据世界钢铁协会预测,2023年沙乌地阿拉伯粗钢产量将比2022年成长约0.8%,产量约990万吨。

- 2023年12月,沙国政府宣布将投资约120亿美元用于钢铁计划,增加钢铁产量,满足国内需求的大幅成长。预计计划总产能约620万吨。

- 雀巢计划于 2025 年建立一座製造厂,初期投资为 3.75 亿沙特里亚尔(9,972 万美元),随后建立一个拥有研发项目的区域中心,以及首个面向中小型和小型新兴企业的中心。和新创培养箱。

- 石油和天然气探勘使用大量润滑剂。预计这些因素将在预测期内温和推动阿联酋市场的发展。

中东润滑油产业概况

中东润滑油市场呈现细分化。主要企业(不分先后顺序)包括 TotalEnergies、Petromin、Aljomaih、壳牌润滑油公司 (JOSLOC)、Behran Oil Co. 和 FUCHS。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 沙乌地阿拉伯、伊朗和阿拉伯联合大公国的产业成长

- 扩大高性能润滑剂的使用

- 其他驱动因素

- 限制因素

- 高性能润滑油成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监理政策分析

第五章 市场区隔(市场规模(基于数量))

- 团体

- 第一组

- 第二组

- 第三组

- 第四组 (PAO)

- 环烷

- 基料

- 生物性润滑剂

- 矿物油润滑剂

- 合成润滑油

- 半合成润滑油

- 产品类型

- 机油

- 传动液和液压油

- 金属加工油

- 通用工业用油

- 齿轮油

- 润滑脂

- 加工油

- 其他产品类型(涡轮机油、冷冻机油、航空油、船舶油、变压器油)

- 最终用户产业

- 发电

- 汽车及其他运输设备

- 重型机械

- 饮食

- 冶金与金属加工

- 化学製造

- 其他终端用户产业(海洋、纺织、製造、石油和天然气)

- 地区

- 沙乌地阿拉伯

- 伊朗

- 伊拉克

- 阿拉伯聯合大公国

- 科威特

- 其他中东地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aljomaih And Shell Lubricating Oil Company Limited

- AMSOIL INC.

- Behran Oil Co.

- Emarat

- Exxon Mobil Corporation

- FUCHS

- GP Global MAG LLC

- GULF OIL Middle East Limited(Gulf Oil International Ltd.)

- Idemitsu Kosan Co., Ltd.

- IRANOL(LLP)

- Lubrex FZC

- Pars Oil Company

- Petromin

- Saudi Arabian Oil Co.

- Sepahan Oil Company

- TotalEnergies

第七章 市场机会与未来趋势

- 合成润滑油和生物基润滑剂的开发

- 其他机会

The Middle-East Lubricants Market size is estimated at 2.94 billion liters in 2025, and is expected to reach 3.31 billion liters by 2030, at a CAGR of 2.43% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, the manufacturing industry was severely affected, and this resulted in a decrease in the use of lubricants in 2020. However, with the recovery of many construction projects and other industrial activities, the market saw a recovery phase in the year 2021. It is expected to see a positive trend in the forecasted years. An increase in automotive sales and engineering goods has been leading the market recovery over the last two years.

The industrial growth in Saudi Arabia, Iran, and the United Arab Emirates and the growing usage of high-performance lubricants are the major driving factors augmenting the growth of the market studied.

On the flip side, costlier high-performance lubricants are expected to hinder the growth of the market.

Developments in synthetic and bio-based lubricants are projected to act as an opportunity for the market in the future.

Saudi Arabia emerged as the largest market for lubricants and is expected to register the highest CAGR during the forecast period.

Middle East Lubricants Market Trends

Automotive Sector to Dominate the Market

- Lubricants are typically used for applications such as wear reduction, corrosion protection, and ensuring smooth operation of the engine internals.

- High-mileage engine oils are experiencing great demand owing to specific properties, such as oil leak prevention and reduction in oil burn-off.

- Most light and heavy vehicle diesel and gasoline engines use 10W40 and 15W40 viscosity grade oils, while multi-grade oils, such as 15W50 and 20W50, are commonly used for aircraft engines.

- The average vehicle age has been increasing at a constant rate over the years, which is an opportunity in terms of the aftermarket refill market. The increasing average age of passenger cars and the growing urban population in developing countries is expected to drive the market for lubricants in transportation.

- The automotive industry is essential to the country's socio-economic development. According to some local automotive industry experts, despite the growing electric vehicle sales worldwide, Saudi Arabia expects internal combustible engines (ICE) vehicles to make up the majority of cars driven in for the next 15-20 years.

- Some of the major players controlling the automotive industry in the country include Toyota, with a 30% share, followed by Hyundai and KIA, with 26%, and Renault-Nissan-Mitsubishi, with 9%. General Motors, Ford, and Fiat Chrysler Automobiles comprise the remaining share.

- Saudi Arabia aims to localize the automotive sector and increase investment opportunities to achieve the national strategy's objectives for the industry in developing local manufacturing capabilities in line with the goals of the Kingdom's Vision 2030.

- The Iran automotive market has witnessed a rise over the historic period, with demand for production increasing in the country. For instance, according to the OICA, car manufacturing in Iran increased by 19% in 2022, as the country manufactured 1.064 million vehicles in 2022, while the passenger vehicles produced were around 894,000 units in 2021.

- The International Organization of Motor Vehicle Manufacturers (known as OICA) ranked Iran sixth in the world in terms of car manufacturing growth in 2022.

- Also, as per the European Automobile Manufacturers' Association (ACEA), the organization ranked Iran as the world's 11th largest automaker in 2022.

- The United Arab Emirates automotive market has been experiencing a rise in vehicle registrations over the current period, with demand in production and sales increasing in the country.

- As per industry sources, the country's automotive vehicle registration in the period January to September 2023 stood at 193,698, up 20.2% in comparison to the same period in the previous year.

- Moreover, in 2022, the country's car market sold over 400,000 new cars, representing a 10% increase over the previous year. This growth is expected to continue in the coming years, driven by the country's growing population and rising incomes.

- Thus, the factors above are expected to augment the growth of the market studied in the region during the forecast period.

Saudi Arabia is Expected to Experience a Surge in Growth

- Saudi Arabia is the largest economy in the Middle East region. Saudi Arabia's economy is mainly dependent on the oil industry.

- Saudi Arabia is one of the largest automotive markets in the GCC. Passenger cars account for approximately 80% of the region's automotive market.

- Saudi Arabia is enhancing the capacity of its power sector (electricity generation, transmission, distribution, and smart grid) to meet increasing demand efficiently from residential and commercial consumers for electricity and to support the diversification of its domestic energy mix.

- According to the Ministry of Energy, Saudi Arabia's spending on power and renewable energy projects is expected to reach USD 293 billion by 2030. Additionally, in December 2021, Saudi Arabia's Energy Minister announced the country's plan to spend USD 38 billion on energy distribution by 2030.

- Saudi Arabia emerged as a rapidly growing energy consumer. With the increasing demand for electricity in the country, the power generation infrastructure has been growing. It is estimated that the country is required to increase its power generation capacity to 160 GW by 2040 to fulfill its increasing demand. To achieve this, the government is planning to make an annual investment of around USD 5 billion in generation and USD 4 billion in distribution (D&T). The National Renewable Energy Program in the country aims to increase the generation of renewable energy to 9.5 GW by 2023.

- Consistent lubrication is vital to the life of bearings, gears, and chains. Like any mechanical system, moving parts in a food and beverage plant need proper lubrication to function optimally. Contamination, moisture, high temperatures, and humidity are all threats to bearing, chain, and gear service life. Saudi Arabia is heavily investing in metal industries. According to the World Steel Association, Saudi Arabia's crude steel production in 2023 observed an increase of about 0.8% as compared to 2022 and produced approximately 9.9 million metric tons of steel.

- In December 2023, the Saudi Arabian government announced to investment of about USD 12 billion in steel projects to increase steel production and meet the significant growth in domestic demand. The project is planned to have a total production capacity of about 6.2 million tons.

- Nestle has announced an initial investment of SAR 375 million (USD 99.72 million) with the establishment of a manufacturing plant in 2025, followed by a regional center with a research and development program and its first business incubator for small and medium-sized companies and start-ups.

- A significant amount of lubricants are used in oil and gas exploration. These factors are expected to drive the market slowly over the forecast period in the United Arab Emirates.

Middle East Lubricants Industry Overview

The Middle-East lubricants market is fragmented. The major companies (in no particular order) include TotalEnergies, Petromin, Aljomaih, Shell Lubricating Oil Company (JOSLOC), Behran Oil Co., and FUCHS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Industrial Growth in Saudi Arabia, Iran, and the United Arab Emirates

- 4.1.2 Growing Usage of High-performance Lubricants

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Costlier High Performance Lubricants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Group

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV (PAO)

- 5.1.5 Naphthenics

- 5.2 Base Stock

- 5.2.1 Bio-based Lubricant

- 5.2.2 Mineral Oil Lubricant

- 5.2.3 Synthetic Lubricant

- 5.2.4 Semi-synthetic Lubricant

- 5.3 Product Type

- 5.3.1 Engine Oil

- 5.3.2 Transmission and Hydraulic Fluid

- 5.3.3 Metalworking Fluid

- 5.3.4 General Industrial Oil

- 5.3.5 Gear Oil

- 5.3.6 Greases

- 5.3.7 Process oils

- 5.3.8 Other Product Types (Turbine oils, Refrigeration oils, Aviation oils, Marine oils, and Transformer oils)

- 5.4 End-user Industry

- 5.4.1 Power Generation

- 5.4.2 Automotive and Other Transportation

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other End-user Industries (Marine, Textiles, Manufacturing, and Oil and gas)

- 5.5 Geography

- 5.5.1 Saudi Arabia

- 5.5.2 Iran

- 5.5.3 Iraq

- 5.5.4 United Arab Emirates

- 5.5.5 Kuwait

- 5.5.6 Rest of Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aljomaih And Shell Lubricating Oil Company Limited

- 6.4.2 AMSOIL INC.

- 6.4.3 Behran Oil Co.

- 6.4.4 Emarat

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 FUCHS

- 6.4.7 GP Global MAG LLC

- 6.4.8 GULF OIL Middle East Limited (Gulf Oil International Ltd.)

- 6.4.9 Idemitsu Kosan Co., Ltd.

- 6.4.10 IRANOL (LLP)

- 6.4.11 Lubrex FZC

- 6.4.12 Pars Oil Company

- 6.4.13 Petromin

- 6.4.14 Saudi Arabian Oil Co.

- 6.4.15 Sepahan Oil Company

- 6.4.16 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developments in Synthetic and Bio-based Lubricants

- 7.2 Other Opportunities