|

市场调查报告书

商品编码

1640485

散装容器包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Bulk Container Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

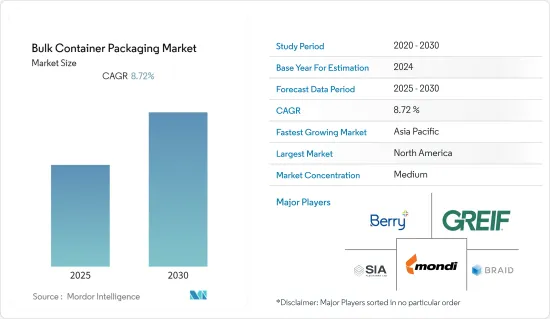

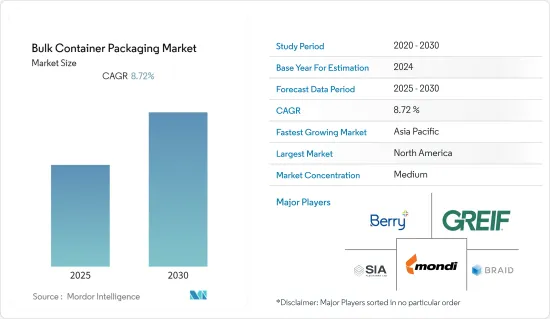

预计预测期内散装容器包装市场复合年增长率为 8.72%。

主要亮点

- 全球化透过将製造地来创造优势。运输成本被认为是总成本中最大的部分。因此,人们越来越需要更具创新性和成本效益的散装货柜包装解决方案来降低运输成本。散装容器包装市场仍由食品饮料和製药业主导。据估计,随着越来越多的公司和新兴企业进入食品业,散装容器包装市场将会成长。

- 此外,散装容器可运输和储存大量液体基质,包括溶剂和最有效的化合物。另一方面,高品质塑胶散装食品对于储存食品和饮料非常有用,因为它们可以确保消费品的最大新鲜度。预计在预测期内,工业化学品和食品饮料产业将共同占据全球市场的很大一部分。

- 公司也参与了策略性倡议,以利用散装容器包装市场日益增长的需求。例如,散装容器包装领域的公司Grief Inc.已宣布透过对桶装和IBC领域的多项投资,在德克萨斯州进行扩张。然而,减少对环境的影响正在影响整个包装市场。重复使用是包装的一个主要趋势,因为透过重复使用容器来延长有限资源的生命週期的压力越来越大。

- 2020年3月至2021年9月期间,受新冠疫情影响,全球散装货柜包装业务利润大幅下降。外出用餐限制和线上食品和饮料订购活动的暂停对食品和饮料业务的扩张产生了不利影响,扰乱了供应链流程。这对食品和饮料消费者对散装食品包装的需求产生了明显的影响。

- 后疫情时代,药品和化学品的国际贸易将会增加。製造商正在重视无菌散装容器包装,以确保药品和其他产品在运输过程中的安全,这可能会增加国际市场对散装容器包装的需求。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

散装容器包装市场趋势

对塑胶包装解决方案的需求预计将成为成长的主要动力

- 过去几年,工业散装容器包装行业对塑胶包装解决方案(如桶和圆桶)的需求激增,而对金属和玻璃等各种材料製成的解决方案的需求则有所下降。从生产角度来看,利用塑胶製品可以实现规模经济。

- 此外,使用塑胶作为原料可以使各种製造公司达到製造最高品质产品的标准,例如可靠性、耐用性和轻盈性。

- 危险物品包括易燃、易爆、有毒有害物质、放射性物质。从这个角度来看,这些物品的贩运增加了对工业塑胶桶的需求,并促进了桶市场的成长。

- 这些塑胶桶允许生产商从多种选择中选择自己最喜欢的颜色,从而让消费者满意。为了生产散装容器并确保长期市场永续性,製造业预计将转向生物分解性材料(塑胶)。

- 此外,消费者倾向于使用更轻的运输容器。因此,全球对塑胶散装容器的需求正在迅速增长。然而,一些监管机构已经制定了使用塑胶作为包装材料的指导方针。

北美占据很大市场份额

- 美国是世界上最大的散装货柜市场之一。由于新发现的页岩资源,化学工业的扩张预计将提振该地区对散装货柜的需求。此外,该国化学和製药业出口量庞大,对圆桶和桶等硬质散装容器的需求持续存在。

- 该国还拥有完善的再平衡基础设施,支援汇集网路。此外,北美政府鼓励在塑胶产品(包括容器和瓶子)的製造中使用再生塑胶。

- 然而,该产业正受到美国和中国贸易战的影响。近期,美国政府对中国化工产品进口增加关税,导致中国化工业进出口情况紧张,直接影响产业对散装货柜的需求。

- 化学工业广泛使用散装容器包装。美国生产大量页岩气,用作製造其他化学品的原料。由于全球拥有低成本原料,化学品业务吸引了许多投资者。散装容器包装满足了由此产生的独特包装和运输需求,有助于提升未来几年该市场的成长前景。

散装容器包装产业概况

主要企业包括 Greif Inc.、Bemis Company Inc.、TechnipFMC、Braid Logistics、National Bulk Equipment、Signode Industrial Group、Mondi Group 和 Bermis Company Inc.市场既不分散,也不统一。因此,市场集中度可能会处于中等水平。

2022 年 3 月,SIA Flexitanks 扩大了其在非洲的业务,以进一步巩固其在液体物流软槽领域的地位。 SIA Flexitanks 是全球最大的独立货柜液化罐公司,在开普敦和夸祖鲁纳塔尔省设有办事处,该公司已正式宣布成立 SIA Africa。 SIA Africa 将在南非市场占据强势地位。这项发展推动了新加坡航空继续其国际扩张,其货柜液袋已遍布全球 70 多个国家。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 区域终端用户产业中液袋的使用日益增多

- 散装货柜产品出口增加

- 市场挑战

- 人们对塑胶使用的环境问题的担忧日益加剧

- 产业价值链分析

- 产业吸引力-波特五力模型

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 鼓

- 桶装

- 物料输送容器

- 刚性中型散货箱

- 调色盘

- 垫材气囊

- 其他类型

- 按最终用户产业

- 化学品和製药

- 饮食

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Greif Inc.

- SIA Flexitanks Ltd.

- Trans Ocean Bulk Logistics Ltd.

- SCHUTZ GmbH & Co. KGaA

- Braid Logistics

- National Bulk Equipment, Inc.

- Signode Industrial Group

- Meyer Industries Limited

- Mondi Group

- Berry Global Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Bulk Container Packaging Market is expected to register a CAGR of 8.72% during the forecast period.

Key Highlights

- Globalization generates favorable circumstances by keeping manufacturing bases distant from the consumption regions. Transportation costs are considered the largest part of the total cost. Hence, there is a rising requirement for more innovative and cost-effective bulk container packaging solutions to reduce transportation costs. The markets for bulk container packaging have continued to be dominated by the food and beverage and pharmaceutical sectors. According to estimates, the market for bulk container packaging will grow as more businesses and startups enter the food sector.

- Additionally, bulk containers transport and store substantial quantities of liquid substrates, such as solvents and the most potent compounds. On the other hand, high-quality plastic-based bulk containers are very helpful for storing food and beverages because they guarantee the best possible freshness of consumable goods. It is anticipated that the industrial chemicals and food & beverage industries will jointly control a sizable portion of the global market during the projected period.

- Companies are also involved in strategic initiatives to leverage the growing demand for the bulk container packaging market. For instance, Grief Inc., one of the companies in the bulk packaging space, announced its expansion in Texas through various investments in the drums and the IBC segments. However, minimizing the impact on the environment is impacting the overall packaging market. Reuse is a major trend in packaging because of the increased pressure to prolong the lifecycle of finite resources by reusing containers.

- The gains from the worldwide bulk container packaging business declined dramatically between March 2020 and September 2021 due to the Covid-19 outbreak. The expansion of the food and beverage business has been negatively impacted by restrictions on dine-in restaurants and a halt in online food and beverage ordering activities, which has disrupted the supply chain process. Therefore, there is a noticeable impact on the demand for bulk container packaging among consumers of food and beverages.

- A rise in international trade in pharmaceuticals and chemicals is being seen in the post-Covid era. Manufacturers emphasize sterile bulk container packing to ensure the safety of medications and other products while in transportation, which will increase demand for bulk container packaging on the international market. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Bulk Container Packaging Market Trends

Demand for Plastic-based Packaging Solution is Expected to be a Significant Factor in Growth

- Over the years, a trend that has taken hold of the industrial bulk packaging industry is the soaring demand for plastic-based packaging solutions such as pails and drums over any other solution produced from various materials like metal and glass. Utilizing plastic items from a production perspective aids in reaching economies of scale.

- Additionally, using plastics as a raw material enables different manufacturing firms to achieve their standards for creating items with the best qualities, such as dependability, durability, and lightness.

- Along with combustible, explosive, toxic, and hazardous things, dangerous commodities include radioactive substances. In light of this, the trafficking of these items has increased the demand for plastic drums for industrial uses, which has aided in the growth of the drums market.

- The use of these plastic barrels aids producers in pleasing consumers by enabling them to select their most favored color from a wide range of choices, which in turn improves the marketing and advertisement alternatives for their goods. To produce bulk containers and ensure market sustainability over time, manufacturing businesses are anticipated to turn their attention toward biodegradable materials (plastics).

- Additionally, consumers are more likely to use lightweight transportation containers. As a result, the demand for bulk containers made of plastic is rapidly rising worldwide. Nevertheless, several regulatory organizations have established guidelines for using plastic as a packaging material.

North America to Account for a Significant Share in the Market

- The United States is one of the largest bulk container markets globally. The increasing expansion in the chemical industry, owing to the newfound shale resources, is expected to strengthen the demand for bulk containers in the region. Also, the country's immense exports from the chemical and pharmaceutical sector keep a constant demand for rigid bulk containers, such as drums and pails.

- The country also has a well-established reconditioning infrastructure, boosting pooling networks. Moreover, governments in North America encourage using recycled plastic for manufacturing plastic products, including containers and bottles.

- However, the industry is increasingly affected by the US-China trade wars. In recent times, increased tariff by the US government on Chinese chemical imports has escalated the import-export scenario of the country's chemical industry trade, directly impacting the demand for bulk containers from the industry.

- The chemical sector makes substantial use of bulk container packing. The United States produces a lot of shale gas, which is then utilized as a feedstock to make other chemicals. Many investors are drawn to the chemicals business by the availability of low-cost feedstock worldwide. The bulk container packaging will work best for the unique packaging and transportation needs resulting from this, driving this market's growth prospects over the following years.

Bulk Container Packaging Industry Overview

The major companies include Greif Inc., Bemis Company Inc., TechnipFMC, Braid Logistics, National Bulk Equipment, Signode Industrial Group, Mondi Group, and Bermis Company Inc., among others. The market is neither fragmented nor consolidated. Hence, the market concentration will be moderate.

In March 2022, to further solidify its position throughout the flexitank sector of liquid bulk logistics, SIA Flexitanks expanded its footprint in Africa. With offices in Cape Town and KwaZulu-Natal, SIA Flexitanks, the largest independent flexitank company in the world, formally announced the establishment of SIA Africa. SIA Africa will hold a strong position in the South African market. With this development, SIA is loading flexitanks in more than 70 nations worldwide, keeping with our international growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Use of Flexitank, among Regional End-user Industries

- 4.2.2 Growing Export of Bulk Container Packed Products

- 4.3 Market Challenges

- 4.3.1 Growing Environmental Concerns over the Use of Plastic

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Drums

- 5.1.2 Pails

- 5.1.3 Material Handling Containers

- 5.1.4 Rigid Intermediate Bulk Containers

- 5.1.5 Pallets

- 5.1.6 Dunnage Air Bags

- 5.1.7 Other Types

- 5.2 By End-user Industry

- 5.2.1 Chemicals and Pharmaceuticals

- 5.2.2 Food and Beverages

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Greif Inc.

- 6.1.2 SIA Flexitanks Ltd.

- 6.1.3 Trans Ocean Bulk Logistics Ltd.

- 6.1.4 SCHUTZ GmbH & Co. KGaA

- 6.1.5 Braid Logistics

- 6.1.6 National Bulk Equipment, Inc.

- 6.1.7 Signode Industrial Group

- 6.1.8 Meyer Industries Limited

- 6.1.9 Mondi Group

- 6.1.10 Berry Global Inc.