|

市场调查报告书

商品编码

1640491

热喷涂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Thermal Spray - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

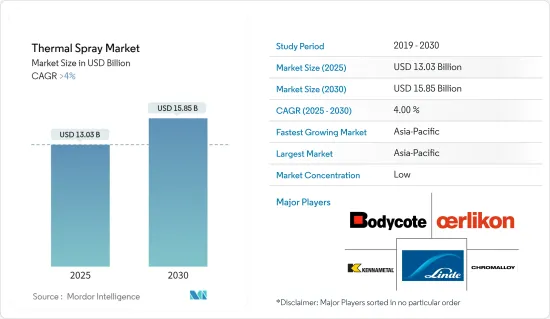

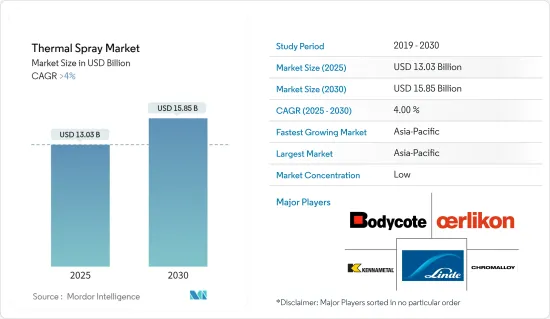

2025 年热喷涂市场规模预计为 130.3 亿美元,预计到 2030 年将达到 158.5 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

热喷涂市场受到了COVID-19疫情的负面影响。最初,停工和供应链中断减缓了製造活动,暂时减少了对热喷涂料的需求。然而,随着各行业采用新规范并更加重视卫生和保护,医疗保健、汽车和航太等产业对热喷涂涂层的需求不断增长。

主要亮点

- 热喷涂陶瓷涂层在医疗设备中的日益普及、热喷涂涂层在航太工业中的应用不断增加以及硬铬涂层的替代是推动热喷涂市场需求的一些因素。

- 然而,有关製程可靠性和一致性的问题,以及最近出现的硬质三价铬涂层,可能会阻碍市场成长。

- 石油和天然气行业对热喷涂的需求不断增加、热喷涂处理材料的回收利用以及热喷涂技术(冷喷涂製程)的进步预计将在未来几年为市场提供丰厚的成长机会。

- 预计预测期内亚太地区将主导热喷涂市场。

热喷涂市场趋势

航太业可望主导市场

- 航太零件经常暴露在恶劣的环境中,包括高温、腐蚀性化学物质和极端天气条件。热喷涂涂层可有效防止腐蚀,并延长涡轮叶片、引擎零件和机身等关键零件的使用寿命。

- 热喷涂涂层为航太零件提供轻量化解决方案,有助于提高燃油效率和整体飞机性能。具有客製化特性的涂层可以取代较重的材料,同时保持结构完整性。

- 航太业正在经历快速的技术进步和创新,从而带来飞机製造业的繁荣。根据波音《2023-2042 年商用飞机展望》,随着国际旅行復苏和国内旅行恢復到疫情前的水平,该公司预计到 2042 年全球对新型商用喷射机的需求将达到 48,575 架。

- 根据国际航空旅客协会的数据,2023年8月国内民航机客运量比疫情前增加了9.2%。空中交通量的增加可能会刺激对民航机的需求,这反过来可能会在预测期内推动对黏合剂的需求。

- 全球领先的飞机製造商空中巴士公司将于2023年交付735架民航机,与前一年同期比较成长11%。

- 预计上述因素将在预测期内推动航太工业对热喷涂的需求。

亚太地区占市场主导地位

- 亚太地区正经历快速工业化,尤其是中国、印度、日本和韩国等国家。该地区蓬勃发展的製造业,包括汽车、航太、电子和能源,正在推动对可提高零件性能和耐用性的热喷涂涂层的需求。

- 亚太地区各国政府正大力投资交通、能源和建筑等基础建设计划。热喷涂涂层可保护关键基础设施组件免受腐蚀、磨损和侵蚀,延长其使用寿命并降低维护成本。

- 中国是世界上最大的飞机製造国之一,根据中国民航局的数据,中国也是国内航空客运市场。此外,还有超过200家小型飞机零件製造商,零件及组装产业正在快速成长。

- 中国是全球最大的电子产品製造基地。智慧型手机、电视、有线电视、行动电脑、游戏机和其他家用电器等电子产品都在中国积极生产。根据CEIC统计,2023年12月中国电子产品出口额为216.3亿美元。

- 2023年,韩国累计获得外资将达188亿美元,与前一年同期比较成长3.4%。其中,电子业投资额占比最大,达30亿美元,成为头部小型产业。

- 中国是世界上最大的钢铁生产国之一。官方数据显示,2023年前11个月,原钢产量达9.5214亿吨,年增1.5%。

- 印度汽车工业在技术进步和宏观经济扩张中发挥着至关重要的作用。根据印度汽车工业协会(SIAM)统计,2023 年 4 月至 2024 年 3 月期间汽车销量达到 23,853,463 辆,较 23 财年同期的 21,204,846 辆成长 12.5%。

- 由于上述因素,预计该地区将在预测期内占据市场主导地位。

热喷涂产业概况

热喷涂市场比较分散。主要企业(不分先后顺序)包括 OC Oerlikon Management AG、Linde PLC(Praxair ST Technologies Inc.)、Chromalloy Gas Turbine LLC、Bodycote 和 Kennametal Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 热喷涂涂层在医疗设备的应用不断扩大

- 热喷涂陶瓷涂层越来越受欢迎

- 硬铬涂层的替代品

- 热喷涂涂料在航太工业的应用日益广泛

- 限制因素

- 硬质三价铬涂层的出现

- 流程可靠性和一致性问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 涂层材料

- 粉末

- 陶瓷

- 金属

- 聚合物和其他粉末

- 线材/棒材

- 其他涂装材料(辅助材料)

- 热喷涂设备

- 热喷涂系统

- 除尘器

- 喷枪和喷嘴

- 送料装置

- 备用零件

- 隔音罩

- 其他热喷涂设备

- 热喷涂涂层和表面处理

- 燃烧

- 电能

- 涂层材料

- 按最终用户产业

- 航太

- 工业用燃气涡轮机

- 车

- 电子产品

- 石油和天然气

- 医疗设备

- 能源和电力

- 钢

- 纤维

- 印刷和纸张

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Thermal Spray Material Companies

- Aimtek Inc.

- AISher APM LLC

- AMETEK Inc.

- C&M Technologies GmbH

- CASTOLIN EUTECTIC

- CenterLine(Windsor)Limited(Supersonic Spray Technologies Division)

- CRS Holdings LLC

- Fisher Barton

- Global Tungsten & Powders

- HC Starck Inc.

- HAI Inc

- Hoganas AB

- Hunter Chemical LLC

- Kennametal Inc.

- Linde PLC(Praxair ST Technologies Inc.)

- LSN Diffusion Limited

- Metallisation Limited

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Polymet

- Powder Alloy Corporation

- Saint-Gobain

- Sandvik AB

- Thermion

- Thermal Spray Coatings Companies

- APS Materials Inc.

- Bodycote

- Chromalloy Gas Turbine LLC

- Curtiss-Wright Corporation(FW Gartner)

- Fisher Barton

- FM Industries

- Hannecard Roller Coatings, Inc(ASB Industries Inc.)

- Lincotek Trento SpA

- Linde PLC(Praxair ST Technologies Inc.)

- OC Oerlikon Management AG

- Thermion

- TOCALO Co. Ltd

- Thermal Spray Equipment Companies

- Air Products and Chemicals Inc.

- Arzell Inc.

- ASB Industries Inc.(Hannecard Roller Coatings Inc.)

- Bay State Surface Technologies Inc.(Aimtek Inc.)

- Camfil Air Pollution Control(APC)

- CASTOLIN EUTECTIC

- Centerline(Windsor)Ltd(SUPERSONIC SPRAY TECHNOLOGIES)

- Donaldson Company Inc.

- Flame Spray Technologies BV

- GTV Verschleibschutz GmbH

- HAI Inc.

- Imperial Systems Inc.

- Kennametal Inc.

- Lincotek Equipment SpA

- Linde PLC(Praxair ST Technologies Inc.)

- Metallisation Limited

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Plasma Powders

- Powder Feed Dynamics Inc.

- Progressive Surface

- Saint-Gobain

- Thermion

- Thermal Spray Material Companies

第七章 市场机会与未来趋势

- 热喷涂技术(冷喷涂製程)的进展

- 热喷涂材料的回收利用

- 石油和天然气产业的需求不断成长

The Thermal Spray Market size is estimated at USD 13.03 billion in 2025, and is expected to reach USD 15.85 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The thermal spray market was negatively affected by the COVID-19 pandemic. Initially, there was a slowdown in manufacturing activities due to lockdowns and supply chain disruptions, leading to a temporary decrease in demand for thermal spray coatings. However, as industries adopted new norms and increased their emphasis on hygiene and protection, there was a growing demand for thermal spray coatings in industries such as healthcare, automotive, and aerospace.

Key Highlights

- The increasing popularity of thermal spray ceramic coatings due to their usage in medical devices, the rising use of thermal spray coatings in the aerospace industry, and the replacement of hard chrome coatings are some factors driving the demand for the thermal spray market.

- However, issues regarding process reliability and consistency and the emergence of hard trivalent chrome coatings in recent years are likely to hinder the market's growth.

- The increasing demand for thermal spray from the oil and gas industry, recycling of thermal spray processing materials, and advancements in spraying technology (cold spray process) are expected to provide lucrative growth opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the thermal spray market over the forecast period.

Thermal Spray Market Trends

The Aerospace Industry is Expected to Dominate the Market

- Aerospace components are often exposed to harsh environments, including high temperatures, corrosive chemicals, and extreme weather conditions. Thermal spray coatings provide an effective barrier against corrosion, extending the lifespan of critical components such as turbine blades, engine parts, and airframes.

- Thermal spray coatings offer lightweight solutions for aerospace components, contributing to fuel efficiency and overall aircraft performance. Coatings with tailored properties can replace heavier materials while maintaining structural integrity.

- The aerospace industry is undergoing rapid technological advancements and innovation, creating upswings for aircraft manufacturing. According to the Boeing Commercial Outlook 2023-2042, with a resurgence in international traffic and domestic air travel back to pre-pandemic levels, the company has projected global demand for 48,575 new commercial jets by 2042.

- According to the International Air Travel Association, domestic commercial aircraft passenger traffic increased by 9.2% over the pre-pandemic timeline in August 2023. Increased air traffic may raise the demand for commercial aircraft and propel the demand for adhesives during the forecast period.

- Airbus, a major aircraft manufacturer worldwide, delivered 735 commercial aircraft in 2023, an increase of 11% compared to the previous year.

- The factors mentioned above are expected to boost the demand for thermal spray in the aerospace industry during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is experiencing rapid industrialization, particularly in countries like China, India, Japan, and South Korea. The region's booming manufacturing sector, including the automotive, aerospace, electronics, and energy industries, is driving significant demand for thermal spray coatings to enhance component performance and durability.

- Governments in Asia-Pacific are investing heavily in infrastructure projects, including transportation, energy, and construction. Thermal spray coatings protect critical infrastructure components from corrosion, wear, and erosion, thereby extending their lifespan and reducing maintenance costs.

- China is one of the world's biggest aircraft manufacturers and a market for domestic air passengers, as stated by the Chinese Civil Aviation Administration. In addition, with more than 200 small aircraft component manufacturers, there has been rapid growth in the parts and assembly industry.

- China is the largest electronics manufacturing base in the world. Electronic products such as smartphones, televisions, cables, mobile computers, gaming systems, and other consumer electronic equipment are being produced in China on an active basis. According to the CEIC, in December 2023, the export value of Chinese electronics products was USD 21.63 billion.

- In 2023, South Korea received a total of USD 18.8 billion in investments from abroad, marking a 3.4% increase from the previous year. Specifically, the electronics industry saw the largest share of this investment, with USD 3 billion allocated, standing out as the top sub-industry.

- China is one of the largest producers of steel globally. According to official figures, the nation's primary steel production reached 952.14 million tons during the initial 11 months of 2023, marking a 1.5% increase compared to the same period in the previous year.

- The automotive industry in India plays a crucial role in technological advancements and macroeconomic expansion. According to the Society of Indian Automobile Manufacturers (SIAM), the number of vehicles sold from April 2023 to March 2024 reached 23,853,463, marking an increase of 12.5% from the 21,204,846 units sold in the same timeframe during FY 2023.

- Due to the above-mentioned factors, the region is projected to dominate the market during the forecast period.

Thermal Spray Industry Overview

The thermal spray market is fragmented in nature. The major players (not in any particular order) include OC Oerlikon Management AG, Linde PLC (Praxair ST Technologies Inc.), Chromalloy Gas Turbine LLC, Bodycote, and Kennametal Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Thermal Spray Coatings in Medical Devices

- 4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

- 4.1.3 Replacement of Hard Chrome Coating

- 4.1.4 Rising Use of Thermal Spray Coatings in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Emergence of Hard Trivalent Chrome Coatings

- 4.2.2 Issues Regarding Process Reliability and Consistency

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Coatings Materials

- 5.1.1.1 Powders

- 5.1.1.1.1 Ceramics

- 5.1.1.1.2 Metal

- 5.1.1.1.3 Polymers and Other Powders

- 5.1.1.2 Wires/Rods

- 5.1.1.3 Other Coating Materials (Auxiliary Material)

- 5.1.2 Thermal Spray Equipment

- 5.1.2.1 Thermal Spray Coating System

- 5.1.2.2 Dust Collection Equipment

- 5.1.2.3 Spray Gun and Nozzle

- 5.1.2.4 Feeder Equipment

- 5.1.2.5 Spare Parts

- 5.1.2.6 Noise-reducing Enclosures

- 5.1.2.7 Other Thermal Spray Equipment

- 5.1.1 Coatings Materials

- 5.2 Thermal Spray Coatings and Finishes

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Medical Devices

- 5.3.7 Energy and Power

- 5.3.8 Steel Making

- 5.3.9 Textile

- 5.3.10 Printing and Paper

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Thermal Spray Material Companies

- 6.4.1.1 Aimtek Inc.

- 6.4.1.2 AISher APM LLC

- 6.4.1.3 AMETEK Inc.

- 6.4.1.4 C&M Technologies GmbH

- 6.4.1.5 CASTOLIN EUTECTIC

- 6.4.1.6 CenterLine (Windsor) Limited (Supersonic Spray Technologies Division)

- 6.4.1.7 CRS Holdings LLC

- 6.4.1.8 Fisher Barton

- 6.4.1.9 Global Tungsten & Powders

- 6.4.1.10 H.C. Starck Inc.

- 6.4.1.11 HAI Inc

- 6.4.1.12 Hoganas AB

- 6.4.1.13 Hunter Chemical LLC

- 6.4.1.14 Kennametal Inc.

- 6.4.1.15 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.1.16 LSN Diffusion Limited

- 6.4.1.17 Metallisation Limited

- 6.4.1.18 Metallizing Equipment Co. Pvt. Ltd

- 6.4.1.19 OC Oerlikon Management AG

- 6.4.1.20 Polymet

- 6.4.1.21 Powder Alloy Corporation

- 6.4.1.22 Saint-Gobain

- 6.4.1.23 Sandvik AB

- 6.4.1.24 Thermion

- 6.4.2 Thermal Spray Coatings Companies

- 6.4.2.1 APS Materials Inc.

- 6.4.2.2 Bodycote

- 6.4.2.3 Chromalloy Gas Turbine LLC

- 6.4.2.4 Curtiss-Wright Corporation (FW Gartner)

- 6.4.2.5 Fisher Barton

- 6.4.2.6 FM Industries

- 6.4.2.7 Hannecard Roller Coatings, Inc (ASB Industries Inc.)

- 6.4.2.8 Lincotek Trento SpA

- 6.4.2.9 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.2.10 OC Oerlikon Management AG

- 6.4.2.11 Thermion

- 6.4.2.12 TOCALO Co. Ltd

- 6.4.3 Thermal Spray Equipment Companies

- 6.4.3.1 Air Products and Chemicals Inc.

- 6.4.3.2 Arzell Inc.

- 6.4.3.3 ASB Industries Inc. (Hannecard Roller Coatings Inc.)

- 6.4.3.4 Bay State Surface Technologies Inc. (Aimtek Inc.)

- 6.4.3.5 Camfil Air Pollution Control (APC)

- 6.4.3.6 CASTOLIN EUTECTIC

- 6.4.3.7 Centerline (Windsor) Ltd (SUPERSONIC SPRAY TECHNOLOGIES)

- 6.4.3.8 Donaldson Company Inc.

- 6.4.3.9 Flame Spray Technologies BV

- 6.4.3.10 GTV Verschleibschutz GmbH

- 6.4.3.11 HAI Inc.

- 6.4.3.12 Imperial Systems Inc.

- 6.4.3.13 Kennametal Inc.

- 6.4.3.14 Lincotek Equipment SpA

- 6.4.3.15 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.3.16 Metallisation Limited

- 6.4.3.17 Metallizing Equipment Co. Pvt. Ltd

- 6.4.3.18 OC Oerlikon Management AG

- 6.4.3.19 Plasma Powders

- 6.4.3.20 Powder Feed Dynamics Inc.

- 6.4.3.21 Progressive Surface

- 6.4.3.22 Saint-Gobain

- 6.4.3.23 Thermion

- 6.4.1 Thermal Spray Material Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Spraying Technology (Cold Spray Process)

- 7.2 Recycling of Thermal Spray Processing Materials

- 7.3 Increasing Demand From The Oil and Gas Industry