|

市场调查报告书

商品编码

1640494

生物基黏合剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Bio-based Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

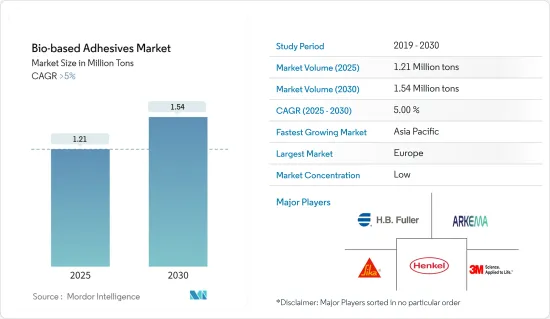

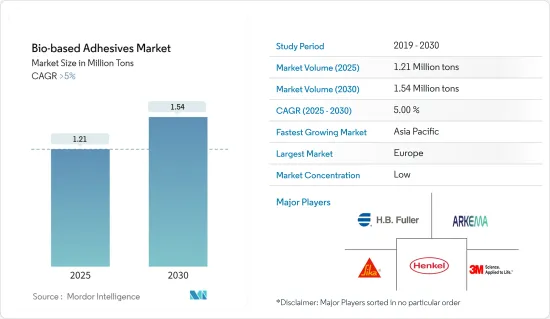

预计2025年生物基黏合剂市场规模为121万吨,预计到2030年将达到154万吨,预测期内(2025-2030年)的复合年增长率将超过5%。

关键亮点

- 包装产业的需求不断增长和美国对传统黏合剂的严格监管是推动市场成长的两个主要因素。

- 然而,与石油基添加剂相比,生物基添加剂的保质期较短和性能问题可能会阻碍市场成长。

- 扩大模组化建设活动可能会在短期内为市场创造成长机会。

- 欧洲在全球生物基黏合剂市场中占据主导地位,并可能在预测期内实现最高成长率。

生物基黏合剂市场趋势

包装产业可望主导市场

- 绝大多数工业产品都是以包装形式出售的,目的是为了储存或运输的稳定性,或是为了美观。现今使用的包装材料大部分都是利用黏合剂将不同的材料贴合加工的。

- 生物基黏合剂有利于永续包装、标籤、层压、延长保质期的食用涂层、乳製品和饮料加工中的组装、可堆肥包装、功能性应用并解决迁移问题。更环保的行业做出贡献,并且至关重要适用于食品和饮料行业。

- 根据包装和加工协会(PMMI)预测,2018年至2028年,北美饮料包装行业预计将实现4.5%的增长率,其中美国在饮料包装领域发展中发挥关键作用。

- 像 Amazon Fresh 这样的服务越来越受欢迎,让消费者足不出户就能买到新鲜的农产品。此外,大多数食品和饮料加工厂都专注于用于包装的生物基黏合剂。

- 全球对有机食品的需求不断增长,预计将推动食品包装消费。据有机贸易协会称,到 2025 年,美国有机包装食品的产值预计将达到 250.604 亿美元。

- 根据印度包装产业协会(PIAI)预测,印度包装产业预计在预测期内以22%的速度成长。预计2025年印度包装市场规模将达2,048.1亿美元。因此,该地区的生物基黏合剂市场预计将成长。

- 生活水准的提高和购买收入的增加,尤其是东欧和北美国家,推动了对各种产品的需求,而这些产品都需要包装。因此,包装需求正在推动生物基黏合剂消费量的增加。

- 因此,预计所有上述因素都将推动包装产业的发展,并在预测期内增加对生物基黏合剂的需求。

预计欧洲将主导市场

- 由于德国和英国等国家的需求量大,欧洲在生物基黏合剂市场占据主导地位。

- 德国是欧洲生物基黏合剂的主要消费国,也是许多大公司的所在地。德国是世界领先的天然橡胶和淀粉基黏合剂生产国之一。

- 德国生物琥珀酸产量的不断增加,支持了以生物琥珀酸为基础的生物基标籤黏合剂的生产。

- 生物基黏合剂在建筑业中发挥重要作用,用于木材黏合、面板和复合材料製造、隔热材料黏合、环保地板材料安装、建筑密封剂、预製建筑和黏合。安装、生物分解性的模板黏合剂以及整体永续的建筑实践,都有助于实现更绿色的建筑过程。

- 根据欧盟委员会发布的资料,2023年12月与2022年12月相比,欧元区建筑业产量增加1.9%,欧盟成长2.4%。 2023年与2022年相比,建筑产量平均成长率为欧元区0.2%,欧盟0.1%。

- 在医疗产业,生物基黏合剂为各种医疗和製药领域的应用提供了生物相容性且安全的黏合剂解决方案,包括伤口护理、医疗设备组装和药物传输系统。

- 经济合作暨发展组织(OECD) 的最新报告称,到2023 年,德国将成为医疗保健支出占GDP 比重第二大的国家,达到12.7%,其次是法国,其医疗保健支出占GDP 比重约为12.1 %。

- 在个人护理行业中,生物基黏合剂用于化妆品和卫生用品的生产,有助于绷带、胶带和卫生棉的组装,为传统黏合剂提供永续且对皮肤友好的替代品。

- 根据英国国家统计局的数据,英国消费者在个人照护方面的支出将到 2023 年第一季达到 78.96 亿英镑,高于 2022 年第一季的 73.63 亿英镑。

- 在义大利,由于住宅建设活动和各种设施计划的增加,模组化建筑市场预计在预测期内将显着增长。据欧盟统计局(欧盟委员会总干事)称,到2025年,义大利的建筑收入将达到约576.8亿美元。

- 因此,欧洲很可能主导生物基黏合剂市场,并预计在预测期内将占据最大的市场占有率。

生物基产业概况

全球生物基黏合剂市场细分化,主要企业之间的竞争非常激烈。市场上一些主要的参与企业包括汉高股份公司、HB Fuller、阿科玛、西卡和 3M 公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装领域的需求不断增加

- 美国对传统黏合剂的监管更加严格

- 其他驱动因素

- 限制因素

- 与石油基黏合剂相比,保质期较短,性能较差

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 原料

- 松香

- 淀粉粉

- 木质素

- 大豆

- 其他成分

- 最终用户产业

- 建筑和施工

- 纸和纸板包装

- 医疗

- 个人护理

- 木製品和配件

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema(bostik)

- Artimelt AG

- Beardow Adams

- Dow

- Emsland Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Ingredion Incorporated

- Paramelt BV

- Sika AG

- Solenis

第七章 市场机会与未来趋势

- 扩大应用范围至工程木製品

- 其他机会

简介目录

Product Code: 53780

The Bio-based Adhesives Market size is estimated at 1.21 million tons in 2025, and is expected to reach 1.54 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- The increasing demand from the packaging sector and the stringent regulations for conventional adhesives in the United States are two main factors driving the market growth.

- However, the low shelf life and performance hindrance of bio-based additives compared to petroleum-based additives is likely to hinder market growth.

- Nevertheless, the growing modular construction activities are likely to provide growth opportunities for the market over the short term.

- Europe dominates the bio-based adhesives market across the world and is likely to witness the highest growth rate during the forecast period.

Bio-based Adhesives Market Trends

The Packaging Industry is Expected to Dominate the Market

- An extremely high proportion of all industrial products are sold in packaged form, either due to stability requirements for storage and transport or aesthetic reasons. Most of the packaging materials currently being used are made from a combination of different materials laminated together with the help of adhesives.

- Bio-based adhesives are integral to the food and beverage industry, facilitating sustainable packaging, labeling, laminates, edible coatings for extended shelf life, assembly in dairy and beverage processing, compostable packaging, functional applications, and addressing migration concerns, thereby contributing to a greener and more environment-friendly industry.

- As per PMMI (The Association for Packaging and Processing), the North American beverage packaging industry is expected to record a 4.5% growth from 2018 to 2028, with the United States taking a prominent role in advancing the beverage packaging sector.

- The prevalence of services like Amazon Fresh is on the rise, enabling consumers to acquire fresh produce from the comfort of their homes. Additionally, the majority of food and beverage processing plants are centered around bio-based adhesives for the packaging.

- The rising demand for organic food globally is expected to boost the consumption of food packaging. According to the Organic Trade Association, in the United States, organic packaged food is likely to reach a value of USD 25,060.4 million by 2025.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. The Indian packaging market is expected to reach USD 204.81 billion by 2025. Therefore, the bio-based adhesives market is expected to grow in the region.

- The improvement in living standards and higher purchasing incomes, especially in Eastern European and North American countries, has increased the demand for a broad range of products, all of which require packaging. Therefore, the demand for packaging has, in turn, increased the consumption of bio-based adhesives.

- Hence, all the aforementioned factors are expected to drive the packaging industry, enhancing the demand for bio-based adhesives during the forecast period.

Europe is Expected to Dominate the Market

- Europe dominated the bio-based adhesives market owing to the high demand from countries like Germany and the United Kingdom.

- Germany is the major consumer of bio-based adhesives in Europe, with many major companies having a presence in the country. It is a major producer of natural rubber- and starch-based adhesives in the global scenario.

- The increase in the production of bio-succinic acid in Germany has supported the production of bio-based label adhesives that are based on bio-succinic acid.

- Bio-based adhesives play a pivotal role in the construction industry, being utilized for wood bonding, panel and composite manufacturing, insulation material bonding, eco-friendly flooring installations, construction sealants, prefabricated construction, adhesive tapes, green roofing installations, biodegradable formwork adhesives, and overall sustainable construction practices, contributing to environmentally conscious building processes.

- As per the data released by the European Commission, growth in construction production in December 2023 compared to December 2022 was 1.9% across the euro area and 2.4% across the European Union. The year-on-year average increase in construction production in 2023 compared to 2022 was 0.2% for the euro area and 0.1% for the European Union.

- In the healthcare industry, bio-based adhesives find applications in various medical and pharmaceutical contexts, including wound care, medical device assembly, and drug delivery systems, providing biocompatible and safe bonding solutions.

- According to a new report by the Organisation for Economic Co-operation and Development (OECD), in 2023, Germany was the second-largest spender in healthcare, disbursing 12.7% of its GDP on healthcare, followed by France, which spent around 12.1% of its GDP.

- In the personal care industry, bio-based adhesives are employed in the production of cosmetic and hygiene products, contributing to the assembly of items such as bandages, adhesive tapes, and sanitary products, offering a sustainable and skin-friendly alternative to traditional adhesives.

- According to the Office for National Statistics (UK), consumer spending on personal care in the United Kingdom reached GBP 7,896 million in the first quarter of 2023, increasing from GBP 7,363 million in the first quarter of 2022.

- In Italy, the market for modular construction is expected to grow at a significant rate during the forecast period, with an increase in residential construction activities and various institutional projects. As per Eurostat (a directorate-general of the European Commission), the construction revenue in Italy will reach around USD 57.68 billion by 2025.

- Hence, Europe is likely to dominate the bio-based adhesives market and is expected to hold the largest market share during the forecast period.

Bio-based Industry Overview

The global bio-based adhesives market is fragmented, with high competition among the key players. Major players operating in the market include Henkel AG & Co. KGaA, H.B Fuller, Arkema, Sika, and 3M company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Packaging Sector

- 4.1.2 Stringent Regulations for Conventional Adhesives in the United States

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Low Shelf Life and Performance in Comparison to Petroleum-based Adhesives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Raw Materials

- 5.1.1 Rosin

- 5.1.2 Starch

- 5.1.3 Lignin

- 5.1.4 Soy

- 5.1.5 Other Raw Materials

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Paper and Board Packaging

- 5.2.3 Healthcare

- 5.2.4 Personal Care

- 5.2.5 Woodworking and Joinery

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema (bostik)

- 6.4.3 Artimelt AG

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 Emsland Group

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Ingredion Incorporated

- 6.4.10 Paramelt BV

- 6.4.11 Sika AG

- 6.4.12 Solenis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application In Engineered Wood Products

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219