|

市场调查报告书

商品编码

1640524

北美行销自动化软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Marketing Automation Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

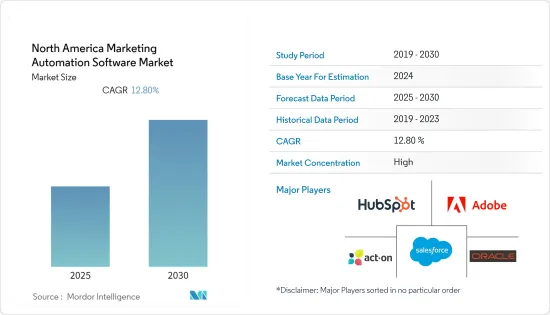

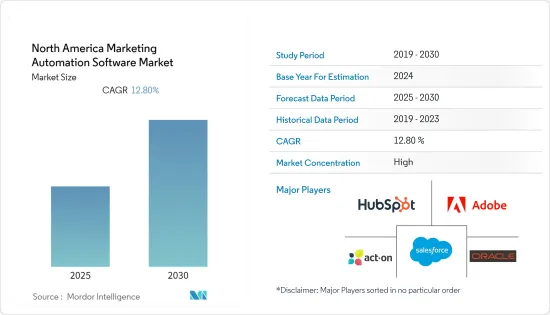

预计预测期内北美行销自动化软体市场复合年增长率将达到 12.8%。

主要亮点

- 行销自动化使得协调各个销售团队产生和追踪潜在客户变得更加容易。行销团队利用产生的大量资料来规划和完善宣传活动。 eBay 和亚马逊等电子商务网站使用此类产品根据过去的客户造访情况客製化页面。

- 此外,行销自动化软体为行销团队提供了一系列解决方案,使重复任务变得无缝。社群媒体的兴起和维持数位存在的重要性是市场成长的主要驱动力。该软体可用于电子邮件行销和线上广告宣传。越来越多地使用社群媒体平台来传播讯息、建立品牌形象和吸引粉丝,正在对市场产生影响。 SaaS 使用率的提高和云端运算的重大进步促进了市场的成长。行销自动化是 CRM 软体市场中快速成长的子集。

- 此外,将人工智慧和机器学习融入使用常用搜寻短语的搜寻引擎并对其进行优化以最大限度地覆盖市场,很可能成为大公司的一项新策略。预测分析可以帮助您回应不断变化的客户需求并相应地集中您的支出。设计适合使用者需求的宣传活动将会产生潜在客户,改善客户体验,并最终推动市场自动化软体市场的发展。

- 然而,资料隐私和安全是采用数位支援技术时的关键考虑因素。随着 SMAC 技术越来越广泛的应用,公司可能需要更强大的安全和隐私措施来防止违规行为。安全问题影响数位化的成功。随着客户资料的成长,安全和隐私问题也随之成长,使得端点、网关和智慧型手机很容易成为骇客的目标。资料安全和隐私是必须有效解决的瓶颈。

- 随着新冠疫情的爆发,许多 B2B 行销公司采取了“安全措施”,削减行销预算,等待经济形势好转,直到他们能够分析疫情对其业务的影响。根据 HubSpot 的一项调查,大约一半的企业将行销预算削减了 1% 至 25%。疫情期间,多数B2B行销公司报告预算削减了26%或更多,但部分预算此后已恢復,减少了因疫情造成的整体预算削减。除了传统的漏斗顶端需求产生之外,行销重点不断扩大,转向数位媒体,以及采用可用于跨区域行销职能的集中式工具,这些都推动了疫情后的市场成长。

北美行销自动化软体市场趋势

零售领域越来越多地采用自动化工具正在推动市场成长

- 北美零售市场正在经历重大转型,推动力来自智慧型手机、平板电脑和笔记型电脑等各种设备的网路存取。消费者的购物习惯正在根据他们在网路上看到的内容而改变。社群媒体正在影响产品销售和品牌形象。网路购物在该地区越来越受欢迎,越来越多的零售商透过网路销售商品。消费行为都会受到追踪,从而产生大量的资料。

- 零售商正在采用行销自动化软体来跟上快速变化的消费者偏好并提供更有效率的服务。自动化产品建议是行销自动化的关键收益驱动功能。零售行销自动化使负责人能够提供一致的客户体验并建立更牢固的客户关係。

- 交叉销售和提升销售产品可以提高您的平均交易价值。这是透过在所有通讯管道中支援自动建议的个人化而实现的。

- Satocan称,截至去年12月,加拿大共有7,342家便利商店。其中近 3,000 家商店位于加拿大人口最多的省份安大略省,还有一家位于育空特区。零售业的营销自动化使用户能够促进客户维繫、应用忠诚度行销策略并提高客户终身价值。

- 零售负责人可以自动发送回馈和评论请求,向高消费客户提供独特的宣传活动,并在用户流失时触发消费者参与和重新参与宣传活动。这些策略使行销人员能够加强与客户的信任并提高他们的终身价值。

预计美国将占据主要市场占有率

- 由于越来越多的人转向数位化和全通路行销来取代传统行销,该地区对行销自动化软体的采用正在增加。根据美国行销协会/杜克大学 CMO 调查 (n=356),去年美国B2B 产品负责人预测,他们在传统广告上的支出将在未来一年减少 0.61%,而数位行销支出预计将增加 14.32 .

- 该地区客户获取成本的上升也推动了对行销自动化软体的需求。根据 HubSpot 北美调查,超过 60% 的负责人表示,他们的客户获取成本在过去三年中有所增加。该地区约 53.85% 接受调查的行销人员表示他们会衡量客户获取成本。

- 分析在电子邮件行销等重复性任务中的应用,以及行销自动化软体等行销技术,帮助行销人员高效使用和分析在大量电子邮件宣传活动期间收集的资料,负责人。 SharpSpring 等供应商在其行销自动化平台内提供电子邮件追踪和分析功能。根据《广告时代》报道,去年数位收入占美国广告代理商总收入的 64.2%。

- 此外,个人化服务因其提供高投资收益而成为市场的主要驱动力。根据个人化登陆页面公司 Instapage 的调查,88% 的美国负责人表示个人化带来了可衡量的改进。

北美行销自动化软体产业概况

北美行销自动化软体市场正在整合,HubSpot、Adobe Inc.、Oracle Corporation、Salesforce 和 Act-on Software 等主要参与者占据了相当大的市场份额。该市场的主要企业正在利用策略合作措施来增加市场占有率。

- 2022 年11 月:HubSpot 是一个用于扩展业务的客户关係管理(CRM) 平台,ClickUp 是一个将工作集中到一处的工作效率平台,它们正在合作帮助客户开发更有效率的工作流程,我们宣布建立合作伙伴关係,以帮助团队更好地协作有效地。透过结合 ClickUp 和 HubSpot 的强大功能,整个客户生命週期的相关人员都可以从提高生产力中受益。当您的客户团队使用 HubSpot 和 ClickUp 时,他们需要的所有资讯都会自动汇总在一起。因此,相关人员可以看到客户体验的每个步骤,从交货到续约。

- 2022 年 10 月:Adobe 宣布在 Adobe Creative Cloud 和整个 Adobe产品系列中推出新的自动化和协作功能。 Adobe Creative Cloud 和 Adobe Document Cloud 也透过与 Mastercard、Etsy 和 Meta 达成的新协议提供给中小型企业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 越来越多地使用社群媒体平台来传播讯息、建立品牌形象并吸引粉丝

- 零售业越来越多采用自动化工具

- 零售和电子商务领域众多中小企业的崛起

- 市场限制

- 市场竞争加剧

- 安全性问题以及开放原始码和免费增值行销工具的存在

第六章 市场细分

- 按部署

- 本地

- 云

- 按应用

- 宣传活动管理

- 社群媒体行销

- 数位行销

- 电子邮件行销

- 行动行销

- 集客式行销

- 其他用途

- 按最终用户产业

- 政府

- 广告

- 媒体与娱乐

- 零售

- 製造业

- BFSI

- 卫生保健

- 其他最终用户产业

- 按地区

- 美国

- 加拿大

- 北美其他地区

第七章 竞争格局

- 公司简介

- HubSpot

- Adobe Inc.

- Oracle Corporation

- Salesforce

- Act-on Software

- IBM Corporation

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 54236

The North America Marketing Automation Software Market is expected to register a CAGR of 12.8% during the forecast period.

Key Highlights

- Marketing automation facilitates the coordination of various sales teams to generate and keep track of leads. The marketing team uses the massive amount of data generated to plan and refine their campaigns. E-commerce websites like eBay and Amazon use products like these to customize their pages based on previous customer visits.

- Additionally, marketing automation software provides marketing teams with various solutions for seamlessly performing repetitive tasks. The rise of social media and the importance of maintaining a digital presence significantly propel the market's growth. The software can be used in email marketing and online advertising campaigns. The increasing use of social media platforms for disseminating information, creating a brand image, and reaching out to followers impacts the market. Increased SaaS usage and significant cloud computing advancements contribute to the market's growth. Marketing automation is a briskly growing subset of the CRM software market.

- Further, incorporating artificial intelligence and machine learning in search engines by using frequently used search phrases and optimizing them for maximum market reach is likely to be a new strategy for large corporations. Predictive analytics can help them meet the changing needs of their customers and focus their spending accordingly. Campaigns can be designed to meet the user's needs to generate leads, improve the customer experience and, in turn, drive the market automation software market.

- However, data privacy and security are critical considerations when implementing digital enablement technologies. As SMAC technologies become more widely used, organizations will require more robust security and privacy safeguards to prevent breaches. The issue of security has an impact on digitalization's success. As the number of customer data sets grows, so will the number of security and privacy issues, and endpoints, gateway, and smartphones can become a likely target for hackers. Data security and privacy are a bottleneck that must be effectively addressed.

- With the onset of the COVID-19 pandemic, many B2B marketing companies adopted a "play it safe" approach through which they reduced their marketing budgets until they could analyze the impact on their businesses and had to wait for the economic scenario to improve. According to a survey by Hubspot, almost half of the businesses implemented a cut of 1%-25% of their marketing budgets. During the pandemic, most B2B marketing companies reported budget cuts of 26%+, but some of the budgets have been restored, resulting in lower overall budgetary cuts due to the pandemic. Expanding focus beyond the traditional top-of-funnel demand generation, migration to digital mediums, and adopting centralized tools that can be used across regional marketing functions are expanding market growth after the pandemic.

North America Marketing Automation Software Market Trends

Increased Adoption of Automation Tools in the Retail Segment to Drive the Market's Growth

- The retail market in North America is undergoing significant change with internet access on various devices such as smartphones, tablets, and laptops. Consumer shopping habits are changing as a result of what they see online. Social media has an impact on product sales and brand image. Online shopping is becoming more popular in the region, with more and more retailers selling their products on the internet. Consumer behavior online and in stores is being tracked to generate massive amounts of data.

- Retailers adopt marketing automation software to cope with the rapid shift in consumer preferences and provide efficient services. Automated product recommendations are one of the significant revenue-boosting features in the marketing automation arsenal. Marketers can provide a consistent customer experience and build stronger customer relationships with marketing automation for the retail industry.

- It Improves average transaction value by cross-selling and upselling products, which is made possible by endorsing personalization in automated recommendations across all communication channels.

- According to Satcan, there were 7,342 convenience stores in Canada as of December last year. Almost 3,000 of them were in Ontario, Canada's most populated province, with one in Yukon Territory. With marketing automation in retail, users can ease retention, apply loyalty marketing strategies, and increase their customer lifetime value.

- The retail marketer can automate requests for feedback and reviews, launch unique campaigns for high-spending customers, and trigger consumer engagement and re-engagement campaigns when subscribers become distant. These tactics strengthen the marketer's rapport with their customers and increase their lifetime value.

United States is Expected to Hold Major Market Share

- The adoption of marketing automation software has been increasing in the region as there has been a shift to digital omnichannel marketing compared to traditional marketing. According to the CMO Survey by American Marketing Association and Duke University (n=356), last year, B2B product marketers in the United States suggested that their spending on traditional advertising was expected to decline by 0.61% in the following year, while the digital marketing spending was projected to increase by 14.32%.

- The region's growth in customer acquisition costs also pushes the need for marketing automation software. According to HubSpot North American Survey, over 60% of the marketers surveyed suggested that their customer acquisition costs have increased over the past three years. About 53.85% of the marketers surveyed in the region said they measure customer acquisition costs.

- The use of analytics for repetitive tasks such as email marketing and marketing technologies such as marketing automation software that helps efficient use and analysis of data collected during bulk email campaigns has become imperative for marketers. Vendors like SharpSpring offer email tracking and analytics features with their marketing automation platform. According to advertising age, digital revenue accounted for 64.2% of total advertising agency revenue in the United States last year.

- Personalization services are also becoming a vital driver for the market as they offer a high probability of return on investment. According to Instapage, a provider of personalized landing pages, 88% of US marketers reported seeing measurable improvements due to personalization.

North America Marketing Automation Software Industry Overview

The North American marketing automation software market is consolidated, with major players like HubSpot, Adobe Inc., Oracle Corporation, Salesforce, and Act-on Software, among others, holding a significant market share. The key players in the market leverage strategic collaborative initiatives to increase their market share.

- November 2022: HubSpot, a customer relationship management (CRM) platform for expanding businesses, and ClickUp, a productivity platform that brings work together in one place, announced a partnership to help customers develop more efficient workflows and collaborate more effectively across teams. Stakeholders throughout the customer lifecycle benefit from enhanced productivity by combining the strong capabilities of ClickUp and HubSpot. Whenever client teams move work ahead using HubSpot and ClickUp, hand-offs are done automatically and with all the necessary information. As a result, stakeholders can keep track of each stage of the client experience, from delivery to renewal.

- October 2022: Adobe announced new automation and collaboration features throughout Adobe Creative Cloud and the Adobe product portfolio, assisting small and mid-sized enterprises in modernizing workflows while embracing new creative and productivity frontiers. Adobe Creative Cloud and Adobe Document Cloud will be available to SMBs through new agreements with Mastercard, Etsy, and Meta.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Social Media Platforms for Disseminating Information, Creating Brand Image, and Reaching Out to Followers

- 5.1.2 Increasing Adoption of Automation Tools in Retail Sector

- 5.1.3 Emergence of Large Numbers of Medium and Small Enterprises in Retail and E-commerce Sectors

- 5.2 Market Restraints

- 5.2.1 Intense Competition in the Market

- 5.2.2 Security Concerns and Presence of Open-Source and Freemium Marketing Tools

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Application

- 6.2.1 Campaign Management

- 6.2.2 Social Media Marketing

- 6.2.3 Digital Marketing

- 6.2.4 E-mail Marketing

- 6.2.5 Mobile Marketing

- 6.2.6 Inbound Marketing

- 6.2.7 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Government

- 6.3.2 Advertising

- 6.3.3 Media and Entertainment

- 6.3.4 Retail

- 6.3.5 Manufacturing

- 6.3.6 BFSI

- 6.3.7 Healthcare

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 Canada

- 6.4.3 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HubSpot

- 7.1.2 Adobe Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Salesforce

- 7.1.5 Act-on Software

- 7.1.6 IBM Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219