|

市场调查报告书

商品编码

1640533

亚太安全测试 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC Security Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

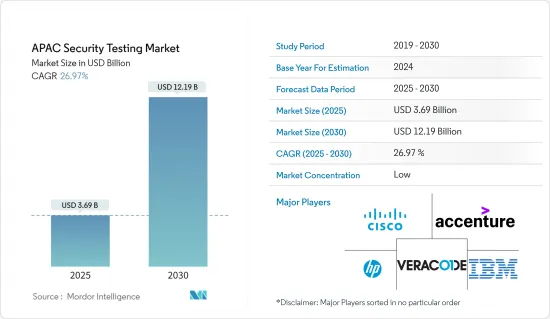

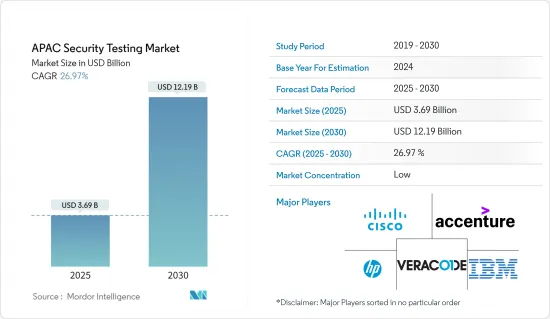

亚太地区安全测试市场规模预计在 2025 年为 36.9 亿美元,预计到 2030 年将达到 121.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 26.97%。

随着亚太地区各国每天遭遇的攻击次数不断增加,该地区对安全测试的需求也预计会增加。

关键亮点

- 私人公司和政府每天都要应对针对其网路的网路攻击。去年,新加坡遭到网路犯罪分子的攻击,他们窃取政府网站的资料并对其进行长达 229 天的钓鱼攻击。印度、菲律宾和韩国等国家都面临持续的网路攻击。

- 企业希望提供全面的可视性和高阶分层安全性,包括入侵防御、Web 过滤、威胁防御和应用程式控制,但他们在管理这些单点产品时缺乏整合和可视性。 。

- 2023 年 6 月,全球线上保护领域的领导者之一麦克菲公司 (McAfee Corp.) 宣布推出 McAfee Business Protection,这是与戴尔科技合作为中小型企业主提供的全新综合安全解决方案。 McAfee Business Protection 透过安全性、身分、暗网资料监控、VPN 和网路保护协助戴尔 SMB 客户防范网路威胁和漏洞,进行安全浏览。

- 安全测试可确保您网路上的系统和应用程式是安全的。动态应用程式安全测试超越后端 Web 应用程式安全测试的演变为安全测试市场开闢了新的途径。我们现在有能力测试次世代应用程式。一些测试提供者透过其实现静态和动态安全测试技术互动的能力来提供更详细的信息,这可以为 QA 测试中的开发人员提供更有意义的结果。

- 据估计,超过 99% 的攻击被称为通用漏洞和暴露 (CVE)。传统防御措施包括使用手动或自动漏洞扫描技术来侦测系统。然而,这会产生大量冗余和不相关的信息,并且无法揭示骇客是否可以利用漏洞来获取关键资产。目前唯一的解决方案是人工渗透测试,但不频繁的测试週期无法反映网路的动态特性,尤其是在当今的虚拟和云端基础的环境中。

- 这些解决方案透过在应用程式开发生命週期中实施加密和各种安全测试程序来保护基于 Web 和行动的应用程式免受漏洞和威胁。商业应用程式保存着关键的组织资料,并且是网路犯罪分子的目标。

- HTML5 的出现需要更高的成熟度和采用率,这将推动 DAST 的创新。云端运算的出现,以及它提供测试即服务 (TaaS) 的能力,以及在本地测试敏感应用程式和外包其他应用程式的灵活性,加速了 BFSI、政府和公共组织的成长。公司,包括工业、医疗保健和零售业,将测试纳入其业务。

亚太安全测试市场趋势

转向线上付款有望推动市场成长

- 在亚太地区,政府和企业(尤其是银行、通讯和专业服务业)的支出增加,推动了对安全测试、端点安全、VPN 和防火墙等安全导向产品的投资增加。澳洲和印度是安全支出排名第二的两个最大国家,因为这两个国家拥有许多同时拥有国内和国际客户的公司。

- 随着付款方式数位化,提高安全性和防止网路诈骗的压力也越来越大。据Worldpay称,到2025年,数位和行动钱包预计将占亚太地区网路购物付款的72%。这比 2021 年有所增长,当时亚太地区 69% 的电子商务付款是使用数位钱包进行的。

- 过去五年来,数位钱包在亚太地区(中国除外)电子商务交易价值的份额增长了近四倍,预计未来三年这一数字将逐步增长。同样,数位钱包在付款量的份额在过去五年中增加了六倍。预计未来数位钱包的崛起将会加速。

- 受行动付款成长和二维码普及的推动,预计 2021 年至 2026 年间,亚太地区的现金使用量将从销售点交易额的 16% 减半至 8%。到 2026 年,预计现金将占香港、韩国、纽西兰、中国和澳洲等几个成熟消费经济体 POS 交易量的 10% 以下。

- 虽然用户数量少,但是人口多,现金流充足。在疫情爆发之前,中国就已经是亚太地区行动付款的领先者,并且一直保持着稳定的用户数量。中国最突出的付款管道包括支付宝和微信支付,这两大支付管道因疫情而获得了进一步的发展。用户数量的增加也反映出恶意行为者正在寻找基础设施的漏洞。对可能采取的打击行动的担忧促使各国政府开始对金融恶意软体进行管控。

印度可望占据主要市场占有率

- 印度正在采用先进的技术,网路事件数量的增加、连网机器数量的增加等都是有利于印度安全测试市场的主要因素。该国的政府措施数位化可能会创造多种成长前景。近年来,企业数位化转型步伐显着加快。

- 此外,根据国际数据公司的DNS 威胁报告,印度的攻击成本下降了6.08%,至5,970 万印度卢比(72 万美元),但每个组织都遭受了12.13 次攻击,这是近年来的最高水准。记录了最多的域名系统(DNS)攻击。

- 此外,印度的科技领域正在快速发展,本土公司正向全球扩张,跨国企业集团也迅速投资印度市场。预计此类组织努力和网路攻击的增加将推动该地区对安全测试的需求。

- 此次合作的结果,三星智慧型手机(包括新款 Galaxy S23 Ultra、Galaxy S23+、Galaxy S23 和 Galaxy Book 3 系列)现在将预先安装麦克菲公司的病毒防护软体。除了智慧型手机之外,此次合作还将提高三星平板电脑和电脑的安全性。

- 根据 IBM Security X-Force 威胁情报指数 2023,亚太地区仍是 2022 年遭受攻击最严重的地区,占总攻击次数的 31%。这一数字比 X-Force 在 2021 年应对的该地区袭击总数增加了 5 个百分点。

亚太安全测试产业概况

亚太地区安全测试市场呈现细分化,主要参与企业均在该地区开展业务。这些参与企业不断采用各种策略,如併购、产品开发、伙伴关係和联盟,以扩大其市场占有率并获得更多客户。

2023 年 2 月,UNICC 宣布与 Gartner 应用安全服务魔力像限领导者 Veracode 建立策略伙伴关係。 Veracode 提供统一的 AppSec 测试平台,包括静态分析、软体配置分析和动态分析解决方案、AppSec 交付成果的咨询支援和最佳实践以及开发人员的安全编码数位学习。

2022 年 8 月,着名技术服务和咨询公司 Wipro Limited 荣获亚马逊网路服务 (AWS) 1 级资安管理服务提供者 (MSSP) 现代运算安全和託管应用程式安全测试专业化能力认证。 。 AWS 1 级 MSSP 能力现在可以让客户更快、更简单地选择最佳的 MSSP,以帮助他们实现业务风险和云端策略可靠性目标。由于 Wipro 获得了进一步的专业头衔并成为 AWS 1 级 MSSP 能力的启动合作伙伴,客户从中受益。

2022 年9 月,以开发人员为中心的应用程式安全测试(AST) 解决方案的全球先驱Checkmarx 将推出其Checkmarx One 平台,帮助该地区的开发人员快速测试、修復和保护其应用程式程式码。面向东协地区推出。对于内部部署、云端和混合开发环境,Checkmarx One 专为云端原生应用程式安全而建置。它也是透过云传送的。在整个软体开发生命週期中,从开发人员提交的第一段程式码到软体投入生产,发现并改善安全漏洞的修復。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 现有恶意软体的传播不断攻击设备

- 连网设备数量不断增加

- 转向线上付款

- 市场限制

- 不愿采用数位化技术

- 技术简介

第六章 市场细分

- 部署模型

- 本地

- 云

- 服务类型

- 应用程式安全测试

- 介绍

- 行动应用程式安全测试

- Web应用程式安全性测试

- 云端应用程式安全测试

- 企业应用安全测试

- 我们如何测试

- SAST

- DAST

- IAST

- RASP

- 网路安全测试

- 介绍

- 防火墙测试

- 入侵侦测/预防测试

- VPN 测试

- URL 过滤

- 应用程式安全测试

- 测试工具

- 渗透测试工具

- 软体测试工具

- Web 测试工具

- 程式码审查工具

- 其他测试工具

- 最终用户产业

- 政府

- 医疗

- BFSI

- 製造业

- 零售

- 资讯科技/通讯

- 其他的

- 国家

- 中国

- 印度

- 日本

- 其他亚太地区

第 7 章 供应商市场占有率

第八章 竞争格局

- 公司简介

- HP

- IBM

- Veracode

- McAfee

- Cisco Systems Inc

- Core Security Technologies

- Cigital Inc

- Offensive Security

- Applause App Quality Inc.

- Accenture PLC

- ControlCase LLC

- Paladion Networks

- Maveric Systems

- Netcraft

- Synerzip

第九章投资分析

第十章 市场机会与未来趋势

The APAC Security Testing Market size is estimated at USD 3.69 billion in 2025, and is expected to reach USD 12.19 billion by 2030, at a CAGR of 26.97% during the forecast period (2025-2030).

The demand for security testing in APAC region is expected to increase with the escalation in the number of attacks that countries in the region are battling every day.

Key Highlights

- Both private companies and governments are battling cyber-attacks on their networks every day. Singapore was under siege from cyber-criminals last year, and for 229 days, cyber-criminals plundered and phished data out from government sites. Countries like India, the Philippines, and South Korea face constant cyber-attacks.

- As enterprises consider providing comprehensive visibility and advanced layer security, including intrusion prevention, web filtering, threat protection, and application control, they face a major challenge managing these point products without integration and lack of visibility.

- In June 2023, McAfee Corp., one of the global leaders in online protection, announced McAfee Business Protection, a new comprehensive security solution for small business owners that collaborated with Dell Technologies. McAfee Business Protection assists Dell small business customers prevent cyber threats and vulnerabilities with security, identity and dark web data monitoring, VPN, web protection for safe browsing, and more.

- Security Testing will ensure that the systems and applications on a network are secure. The evolution of Dynamic application security testing beyond the security testing of back-end web applications has opened up new avenues for the security testing market. They now have the capabilities to test next-generation applications. The ability of some of the testing providers to enable interaction between their static and dynamic security testing techniques provides more detailed information, which is quite useful in QA testing to provide more meaningful results to developers.

- It has been estimated that over 99% of attacks are known as Common Vulnerabilities and Exposures (CVEs). A traditional defense probes the system using manual or automatic vulnerability scanning techniques. However, this produces a lot of redundant and irrelevant information that sheds no light on whether a hacker can use the vulnerability to reach a critical asset. The only solution today is human penetration testing, but infrequent Testingperiodic does not reflect the network's dynamic nature, especially in today's virtual and cloud-based environments.

- These solutions protect web-based and mobile-based applications from vulnerabilities and threats by installing encryption applications and various security testing procedures during the application development life cycle. Business applications hold critical organizational data and are the target of cybercriminals.

- The emergence of HTML5, which requires higher maturity and adoption, drives innovation in DAST. The emergence of cloud computing, along with the ability to offer Testing as a Service (TaaS) with the flexibility to test sensitive applications on-premises and outsource others, has enabled firms across various sectors like BFSI, Government, and Public Sector, Healthcare, and Retail to include Testing in their operations.

APAC Security Testing Market Trends

Transition to Online Payment Methods is Expected to Drive the Market Growth

- Asia Pacific, investments in security oriented products such as security testing, endpoint security, VPN, and firewalls bumped up due to the increased spending by both governments and enterprises (particularly in the banking, telecom, and professional services industry. Australia and India are the next two largest countries in terms of security spending due to the presence of many businesses catering to domestic and international customers.

- As payment methods grow more digital, there is increased pressure for enhanced security and online fraud protection. According to Worldpay, digital or mobile wallets are expected to account for 72 percent of all online shopping payments in Asia Pacific area by 2025. This was an increase from 2021 when 69 percent of e-commerce payments in Asia Pacific area were made using digital wallets.

- In the previous five years, digital wallets in Asia Pacific (excluding China) have nearly quadrupled their proportion of e-commerce transaction value, and their numbers are expected to expand gradually over the next three years. Similarly, in the previous five years, digital wallets' percentage of payment transaction value at POS has increased sixfold. The rise of digital wallets is expected to accelerate in the future.

- Cash use in Asia Pacific is expected to reduce by half between 2021 and 2026, from 16% to 8% of POS transaction value, owing to the expansion of mobile payments and the adoption of QR codes. Cash is expected to decrease below 10% of POS transaction value in several mature consumer economies, including the nations of Hong Kong, South Korea, New Zealand, China, and Australia, by 2026.

- Despite the fewer users, its large population ensures sufficient cash flow. China has been a leader in mobile payments in APAC even before the pandemic, maintaining a steady flow of users. The country's most prominent payment channels include Alipay and WeChat Pay, boosted even further by the pandemic. The increase in users is also reflected by malicious actors looking for loopholes in the infrastructure. Concerns over any possible cracks have encouraged governments to control financial malware.

India is Expected to Hold Significant Market Share

- India is adopting advanced technologies, increased cyber incidents, and the growing number of interconnected machines in the country are some of the main factors that would benefit the market for security tests in India. Government initiatives and digitalization in the country will create several prospects for growth. The shift of businesses to digitalization has been enormous in recent years.

- India also witnessed the highest number of domain name system or DNS attacks in recent years, with 12.13 attacks per organization, even though the cost of attacks in the country decreased by 6.08% to INR 5.97 crores (USD 0.72 Million), according to International Data Corporation's DNS Threat Report.

- Further, India's technology atmosphere is rapidly growing; locally based businesses are expanding globally, while multinational conglomerates are rapidly investing in Indian markets. Such initiatives by the organizations and the increasing number of cyber-attacks are expected to drive the demand for security testing in the region.

- In April 2023, McAfee Corp announced the extension of its nine-year partnership with Samsung to protect customers' data and information from online threats; through this partnership, Samsung smartphones, including the new Galaxy S23 Ultra, Galaxy S23+, and Galaxy S23, as well as the Galaxy Book3 series, now come pre-installed with antivirus protection powered by McAfee. In addition to smartphones, the partnership gives rise to improved safety for Samsung tablets and computers.

- According to the IBM Security X-Force Threat Intelligence Index 2023, Asia-Pacific remained the most-attacked region in 2022, representing 31% of all incidents. This figure reflected a five percentage point increase from the overall number of attacks in the region to which X-Force reacted in 2021.

APAC Security Testing Industry Overview

The Asia Pacific security testing market is fragmented, with major players operating across the region. These players continuously adopt various strategies, such as mergers & acquisitions, product developments, partnerships, and collaborations, to increase their market presence and acquire more customers.

In February 2023, UNICC announced a strategic partnership with Veracode, one of the Gartner Magic Quadrant leaders in AppSec services. Veracode offers a consolidated platform for AppSec testing, including its Static Analysis, Software Composition Analysis and Dynamic Analysis solutions, and advisory support and best practices for AppSec deliverables and eLearning in secure coding for developers.

In August 2022, the renowned technology services and consulting firm Wipro Limited stated that it earned the distinctions of Modern Compute Security and Managed Application Security Testing Specialization in the Amazon Web Services (AWS) Level 1 Managed Security Service Provider (MSSP) Competency. The AWS Level 1 MSSP Competency made it quicker and simpler for clients to choose the best MSSP to assist them in achieving their goals for business risk and cloud strategy confidence. The clients benefited from Wipro's achievement of further specialist distinctions and its role as a launch partner for AWS Level 1 MSSP Competency.

In September 2022, Checkmarx, the global pioneer in developer-centric application security testing (AST) solutions, launched the Checkmarx One platform in Singapore for the ASEAN area to assist regional developers in quickly testing, rectifying, and protecting their application code. To serve on-premises, cloud, and hybrid development environments, Checkmarx One is built for cloud-native application security. It also delivered from the cloud. From the initial code commit made by a developer until the software was sent into production, it discovered security vulnerabilities and improved remediation across the software development life cycle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Existing Malware that is Continually Attacking Devices

- 5.1.2 Increasing Number of Connected Devices

- 5.1.3 Transition to online payment methods

- 5.2 Market Restraints

- 5.2.1 Hesitation to adopt the digitization techniques

- 5.3 Technology Snapshot

6 Market Segmentation

- 6.1 Deployment Model

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 Type of Service

- 6.2.1 Application Security Testing

- 6.2.1.1 Introduction

- 6.2.1.1.1 Mobile Application Security Testing

- 6.2.1.1.2 Web Application Security Testing

- 6.2.1.1.3 Cloud Application Security Testing

- 6.2.1.1.4 Enterprise Application Security Testing

- 6.2.1.2 Testing Method

- 6.2.1.2.1 SAST

- 6.2.1.2.2 DAST

- 6.2.1.2.3 IAST

- 6.2.1.2.4 RASP

- 6.2.2 Network Security Testing

- 6.2.2.1 Introduction

- 6.2.2.1.1 Firewall Testing

- 6.2.2.1.2 Intrusion Detection/Intrusion Prevention Testing

- 6.2.2.1.3 VPN Testing

- 6.2.2.1.4 URL Filtering

- 6.2.1 Application Security Testing

- 6.3 Testing Tools

- 6.3.1 Penetration Testing Tools

- 6.3.2 Software Testing Tools

- 6.3.3 Web Testing Tools

- 6.3.4 Code Review Tools

- 6.3.5 Other Testing Tools

- 6.4 End-User Industry

- 6.4.1 Government

- 6.4.2 Healthcare

- 6.4.3 BFSI

- 6.4.4 Manufacturing

- 6.4.5 Retail

- 6.4.6 IT and Telecommunications

- 6.4.7 Other End-User Industries

- 6.5 Country

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 Rest of Asia Pacific

7 Vendor Market Share

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 HP

- 8.1.2 IBM

- 8.1.3 Veracode

- 8.1.4 McAfee

- 8.1.5 Cisco Systems Inc

- 8.1.6 Core Security Technologies

- 8.1.7 Cigital Inc

- 8.1.8 Offensive Security

- 8.1.9 Applause App Quality Inc.

- 8.1.10 Accenture PLC

- 8.1.11 ControlCase LLC

- 8.1.12 Paladion Networks

- 8.1.13 Maveric Systems

- 8.1.14 Netcraft

- 8.1.15 Synerzip