|

市场调查报告书

商品编码

1639546

北美安全测试:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Security Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

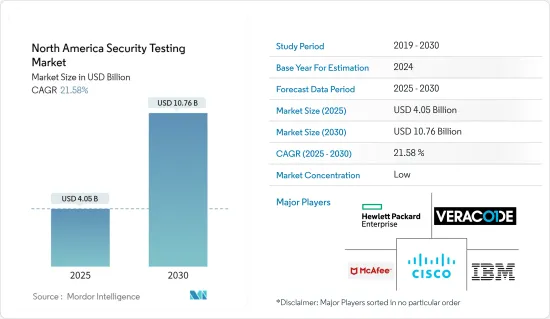

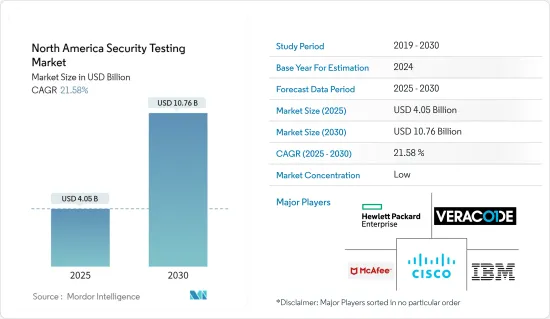

北美安全测试市场规模预计在 2025 年为 40.5 亿美元,预计到 2030 年将达到 107.6 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 21.58%。

北美是世界上监管最严格的地区之一,跨产业有许多法规和合规要求,包括联邦能源管理委员会 (FERC)、HIPAA、PCI DSS、SOX 等。北美公司在采用安全、渗透测试和漏洞管理解决方案方面明显更为先进,并且拥有最佳实践的日常业务流程,这推动了渗透测试解决方案的采用。

主要亮点

- 北美是一个技术中心。这就是为什么联邦政府对安全测试服务制定非常严格的规定。此外,BFSI 等行业必须遵守合规性测试。

- 对安全威胁的安全需求日益增长,推动了安全测试市场的成长。数位转型计画、云端运算、物联网和监管要求的结合,正在产生对全面安全测试服务的需求,以识别和解决组织系统、应用程式和数位基础设施中的漏洞。

- 政府法规在推动安全测试市场方面发挥着至关重要的作用。北美政府认识到网路安全的重要性,并实施了法规和标准,以确保敏感资料、关键基础设施和公民隐私的保护。

- 不了解安全测试的好处的组织可能不太可能采用这种做法。组织需要更加重视主动安全措施的重要性,并且可能仅依赖事件回应和復原等被动措施。有限采用此类安全测试可能会阻碍市场成长。

- 随着新冠肺炎疫情的蔓延,远距办公的采用率不断提高,确保安全地远端存取公司网路和资源成为首要任务。组织已投资安全测试来评估其远端存取基础设施的安全性,包括虚拟私人网路 (VPN)、远端桌面通讯协定和其他远端连线解决方案。安全测试有助于识别这些系统中的漏洞并确保远端存取得到适当的保护。

北美安全测试市场趋势

医疗保健终端用户产业预计将占据相当大的市场占有率

- 医疗保健最终用户系统的安全测试对于保护敏感的患者资料、维持法规遵循和防止潜在的安全漏洞至关重要。医疗保健最终使用者係统的安全测试对于保护病患资料、维持法规遵循、防止未授权存取、保护医疗设备和降低操作风险至关重要。透过优先进行安全测试,医疗保健组织可以确保其係统的机密性、完整性和可用性,为病患提供更安全、更有保障的医疗保健服务。

- 医疗保健系统处理大量敏感的患者信息,包括医疗记录、个人资讯和财务资料。安全测试有助于识别软体和基础设施中的漏洞和弱点,这些漏洞和弱点可能会使这些资料遭受未授权存取或外洩。透过主动测试和解决这些安全漏洞,医疗保健组织可以保护病患资料并保持机密性。

- 医疗保健产业受到各种监管要求的约束,包括美国的《健康保险互通性与课责法案》(HIPAA)。安全测试透过评估安全控制、加密措施、存取控制和其他相关安全实践来确保医疗保健系统符合这些法规。满足这些合规标准可以帮助医疗保健组织避免处罚和法律问题。

- 根据身分盗窃资源中心的数据,2023 年美国医疗保健领域将发生超过 809 起资料外洩事件。安全测试有助于识别医疗保健系统中的漏洞和弱点,攻击者可以利用这些漏洞和弱点进行未授权存取。这包括测试薄弱的身份验证机制、不足的存取控制和未加密的通讯管道等漏洞。透过解决这些漏洞,医疗保健组织可以防止未授权存取病患记录、医疗设备或关键系统。

- 医疗保健产业依赖各种医疗设备,包括物联网设备和连接系统。安全测试确保这些设备能够抵御可能威胁病患安全或洩漏敏感资讯的攻击和漏洞。透过测试医疗设备的安全性,组织可以识别薄弱环节并与製造商合作应用必要的修补程式和更新。

- 安全测试有助于识别可能影响医疗保健系统运作连续性的潜在风险和漏洞。透过识别薄弱环节,组织可以采取主动措施,降低系统停机、资料遗失和关键医疗服务中断的风险。

预计美国将占较大市场占有率

- 由于人们对网路安全威胁的认识不断增强以及各行业对强大安全措施的需求,美国安全测试市场正在快速成长。

- 美国有严格的法规和特定产业的合规要求,例如针对医疗保健的 HIPAA 和针对支付卡资料安全的 PCI DSS。由于各组织努力确保合规性并保护客户资料,这些法规正在推动对安全测试服务的需求。

- 2022年9月,美国标准与技术研究院(NIST)发布了针对美国物联网设备的安全建议提案。由于物联网经常因骇客攻击和资料外洩而带来网路安全风险,NIST 核心基准概述了製造商应在物联网设备中内建的安全功能,消费者在购物时应在设备包装盒或线上描述中留意这些功能。

- 根据美国管理与预算办公室于2022年预测,2023年美国网路安全总体支出将会增加,当年各部门网路安全预算提案总额约104.6亿美元。

- 数位转型计画、云端运算的采用和连网设备的增加日益增多,导致对安全测试服务的需求大幅增加。美国组织认识到主动安全措施的重要性,并愿意投资于全面的安全测试解决方案。

北美安全测试产业概况

北美安全测试市场高度分散,主要参与者包括惠普企业发展有限公司、IBM 公司、VERACODE、麦克菲有限责任公司和思科系统公司。市场参与者正在采取合作和收购等策略来增强其产品供应并获得永续的竞争优势。

2023 年 4 月,领先的 API 安全供应商之一 Noname Security 将与 IBM 合作,保护客户免受错误配置、漏洞和设计缺陷的侵害。客户可以使用 Noname Security 的 API 安全解决方案和 IBM DataPower 现有的企业安全功能,透过新的 Noname Advanced API Security for IBM 为 IBM API Connect 提供额外的保护层。透过 Noname API 安全平台,企业用户可受益于增强的 API 安全性,包括发现、态势管理、执行时间保护和安全测试。

2022年9月,主要企业(「Cybeats」或「公司」)宣布收购应用程式安全测试解决方案的全球领导者之一Cybeats。战略伙伴关係。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估新冠肺炎对产业的影响

第五章 市场洞察

- 市场驱动因素

- 安全威胁下的安全需求日益增加

- 政府法规推动安全需求

- 市场挑战

- 安全测试意识

第六章 市场细分

- 按部署

- 本地

- 云

- 杂交种

- 按类型

- 网路安全测试

- VPN 测试

- 防火墙测试

- 其他服务类型

- 应用程式安全测试

- 应用程式类型

- 行动应用程式安全测试

- Web应用程式安全性测试

- 云端应用程式安全测试

- 企业应用安全测试

- 测试类型

- SAST

- DAST

- IAST

- RASP

- 网路安全测试

- 透过测试工具

- Web 应用程式测试工具

- 程式码审查工具

- 穿透测试工具

- 软体测试工具

- 其他测试工具

- 按最终用户产业

- 政府

- BFSI

- 卫生保健

- 製造业

- 资讯科技/通讯

- 零售

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- VERACODE

- McAfee LLC

- Cisco Systems Inc.

- Core Security Technologies

- Offensive Security

- Accenture PLC

- Maveric Systems

- Synopsys Inc.

- Secureworks Inc.

第八章投资分析

第九章:市场的未来

The North America Security Testing Market size is estimated at USD 4.05 billion in 2025, and is expected to reach USD 10.76 billion by 2030, at a CAGR of 21.58% during the forecast period (2025-2030).

North America is a highly regulated region globally with numerous regulations and compliances, such as the Federal Energy Regulatory Commission (FERC), HIPAA, PCI DSS, and SOX, across verticals. North American companies are quite advanced at deploying security, penetration testing, and vulnerability management solutions and have best practices for everyday business processes, thereby driving the adoption of penetration testing solutions.

Key Highlights

- The North American region is a technology hub. Therefore, the federal government has made very stringent rules regarding security testing services. Moreover, it is compulsory for industries, such as BFSI, to adhere to compliance testing.

- The increasing need for safety from security threats is driving the growth of the security testing market. The combination of digital transformation initiatives, cloud computing, IoT, and regulatory requirements has created a demand for comprehensive security testing services to help organizations identify and address vulnerabilities in their systems, applications, and digital infrastructure.

- Government regulations play a significant role in driving the security testing market. Governments in North America have recognized the importance of cybersecurity and have introduced regulations and standards to ensure the protection of sensitive data, critical infrastructure, and citizen privacy.

- Organizations unaware of the benefits of security testing may be less likely to adopt such practices. They might need to pay more attention to the importance of proactive security measures and rely solely on reactive measures like incident response and recovery. This limited adoption of security testing can hinder the growth of the market.

- With the widespread COVID-19, the adoption of remote work, securing remote access to corporate networks and resources became a top priority. Organizations invested in security testing to assess the security of their remote access infrastructure, including virtual private networks (VPNs), remote desktop protocols, and other remote connectivity solutions. Security testing helped identify vulnerabilities in these systems and ensured that remote access was adequately protected.

North America Security Testing Market Trends

Healthcare End User Industry Segment is Expected to Hold Significant Market Share

- Security testing is crucial in healthcare end-user systems by protecting sensitive patient data, maintaining regulatory compliance, and preventing potential security breaches. Security testing in healthcare end-user systems is essential for protecting patient data, maintaining regulatory compliance, preventing unauthorized access, securing medical devices, and mitigating operational risks. By prioritizing security testing, healthcare organizations can ensure their systems' confidentiality, integrity, and availability and provide patients with safer and more secure healthcare services.

- Healthcare systems handle many sensitive patient information, including medical records, personal details, and financial data. Security testing helps identify vulnerabilities and weaknesses in the software and infrastructure that could expose this data to unauthorized access or breaches. By proactively testing and addressing these security gaps, healthcare organizations can safeguard patient data and maintain confidentiality.

- The healthcare industry is subject to various regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Security testing ensures that healthcare systems comply with these regulations by assessing their security controls, encryption measures, access controls, and other relevant security practices. Meeting these compliance standards helps healthcare organizations avoid penalties and legal issues.

- According to Identity Theft Resource Center, In 2023, there were more than 809 incidents of data compromises in the healthcare sector in the United States. Security testing helps identify vulnerabilities and weaknesses in healthcare systems that attackers could exploit to gain unauthorized access. This includes testing for vulnerabilities such as weak authentication mechanisms, inadequate access controls, or unencrypted communication channels. Healthcare organizations can prevent unauthorized access to patient records, medical devices, or critical systems by addressing these vulnerabilities.

- The healthcare industry relies on various medical devices, including IoT devices and connected systems. Security testing ensures these devices resist potential attacks and vulnerabilities that could compromise patient safety or expose sensitive information. By testing the security of medical devices, organizations can identify weaknesses and work with manufacturers to apply necessary patches or updates.

- Security testing helps identify potential risks and vulnerabilities that could impact the operational continuity of healthcare systems. Organizations can proactively address weaknesses by identifying them and reducing the risk of system downtime, data loss, or disruption of critical healthcare services.

United States is Expected to Hold Significant Market Share

- The security testing market in the United States is rapidly growing due to the increasing awareness of cybersecurity threats and the need for robust security measures across industries.

- The United States has stringent regulations and industry-specific compliance requirements, such as HIPAA for healthcare and PCI DSS for payment card data security. These regulations drive the demand for security testing services as organizations strive to ensure compliance and protect customer data.

- In September 2022, The National Institute of Standards and Technology (NIST) issued Draft Security Recommendations for IoT Devices in the United States. Because IoT regularly posed a cybersecurity risk through hacks and data breaches, the NIST's Core Baseline highlighted recommended security features for manufacturers to incorporate into their IoT devices and guidelines for consumers to look for on a device's box or online description while shopping.

- According to the US Office of Management and Budget, In 2022, the overall cyber security spending in the United States was projected to increase in 2023, with the total proposed agency cyber security funding for the year approximately USD 10.46 billion.

- With the proliferation of digital transformation initiatives, cloud adoption, and an increasing number of connected devices, the demand for security testing services has grown significantly. Organizations in the United States realize the importance of proactive security measures and are willing to invest in comprehensive security testing solutions.

North America Security Testing Industry Overview

The North American Security Testing Market is highly fragmented with the presence of major players like Hewlett Packard Enterprise Development LP, IBM Corporation, VERACODE, McAfee LLC, and Cisco Systems Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In April 2023, Noname Security, one of the significant API security providers, partnered with IBM to protect clients against misconfigurations, vulnerabilities, and design defects. Customers can use Noname Security's API security solution and IBM DataPower's existing enterprise security capabilities to provide an extra layer of protection for IBM API Connect with the new Noname Advanced API Security for IBM. Enterprise users would benefit from enhanced API security, such as discovery, posture management, runtime protection, and security testing, with the Noname API Security Platform.

In September 2022, Cybeats Technologies Inc. ("Cybeats" or the "Company"), one of the leading providers of software supply chain risk and security technologies, announced a strategic partnership with Veracode, one of the global leaders in application security testing solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Safety from Security Threats

- 5.1.2 Government Regulations Driving Security Needs

- 5.2 Market Challenges

- 5.2.1 Awareness Regarding Security Testing

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Type

- 6.2.1 Network Security Testing

- 6.2.1.1 VPN Testing

- 6.2.1.2 Firewall Testing

- 6.2.1.3 Other Service Types

- 6.2.2 Application Security Testing

- 6.2.2.1 Application Type

- 6.2.2.1.1 Mobile Application Security Testing

- 6.2.2.1.2 Web Application Security Testing

- 6.2.2.1.3 Cloud Application Security Testing

- 6.2.2.1.4 Enterprise Application Security Testing

- 6.2.2.2 Testing Type

- 6.2.2.2.1 SAST

- 6.2.2.2.2 DAST

- 6.2.2.2.3 IAST

- 6.2.2.2.4 RASP

- 6.2.1 Network Security Testing

- 6.3 By Testing Tool

- 6.3.1 Web Application Testing Tool

- 6.3.2 Code Review Tool

- 6.3.3 Penetration Testing Tool

- 6.3.4 Software Testing Tool

- 6.3.5 Other Testing Tools

- 6.4 By End-user Industry

- 6.4.1 Government

- 6.4.2 BFSI

- 6.4.3 Healthcare

- 6.4.4 Manufacturing

- 6.4.5 IT and Telecom

- 6.4.6 Retail

- 6.4.7 Other End-user Industries

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hewlett Packard Enterprise Development LP

- 7.1.2 IBM Corporation

- 7.1.3 VERACODE

- 7.1.4 McAfee LLC

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Core Security Technologies

- 7.1.7 Offensive Security

- 7.1.8 Accenture PLC

- 7.1.9 Maveric Systems

- 7.1.10 Synopsys Inc.

- 7.1.11 Secureworks Inc.