|

市场调查报告书

商品编码

1850105

欧洲安全检测:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Security Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

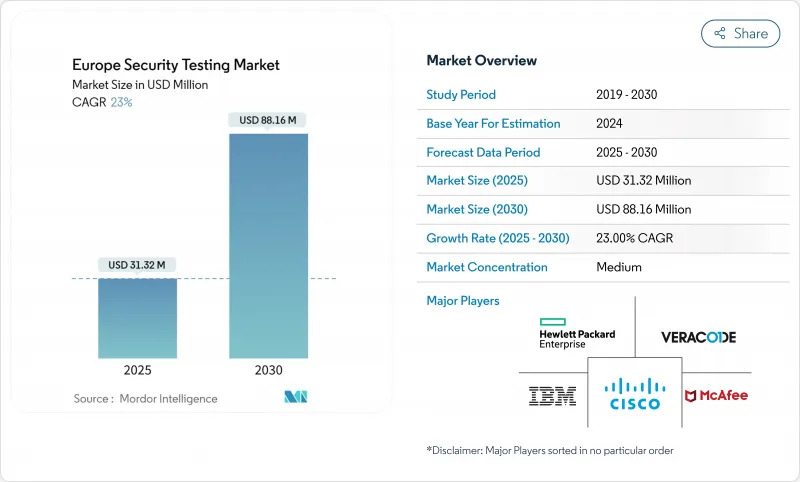

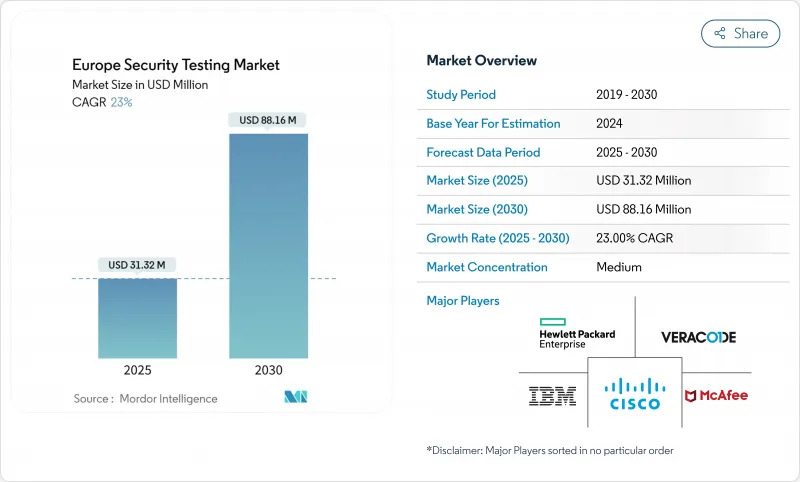

欧洲安全测试市场规模预计到 2025 年将达到 313.2 亿美元,预计到 2030 年将达到 881.6 亿美元,在预测期内将以 23% 的强劲复合年增长率增长。

这一近三倍的成长反映出欧洲日益严峻的数位威胁情势,随着数位转型步伐的加快,各组织机构面临日益复杂的网路威胁。该市场的成长轨迹远超历史水平,预示着欧洲安全重点的根本性转变。

市场格局正受到严格监管的重塑,尤其是《网路与资讯安全指令2》(NIS2)和《数位营运弹性法案》(DORA)的实施,这两项法规强制要求对关键产业进行全面的安全测试。 2024年,云端部署将占据主导地位,市占率达61%,其次是应用程式安全测试,市占率为39%。从地区来看,英国以23.11%的市占率领先,而法国的成长速度最快,到2030年复合年增长率将达到26.4%。

随着埃森哲和IBM等老牌企业面临欧洲专业安全测试供应商的压力,市场竞争日益激烈。这些供应商利用人工智慧主导的自动化技术提供更有效率的测试解决方案。为了减少误报并在开发週期的早期阶段整合安全措施,企业正寻求减少误报,市场也因此显着转向互动式应用安全测试(IAST),其复合年增长率高达27.8%。这一趋势在製造业尤为明显,该行业在终端用户中增长最快,复合年增长率达25.2%,这主要得益于工业IoT的日益普及以及IT和OT安全需求的融合。

欧盟成员国之间资料主权规则的碎片化给实施云端基础的安全测试解决方案带来了挑战,但也推动了混合部署模式的创新,这些模式能够同时满足营运和合规要求。特别是金融服务机构和政府机构,已经开始进行早期试点项目,为应对后量子时代的安全威胁做好准备。

欧洲安全测试市场趋势与洞察

从2023年起,针对关键基础设施的网路攻击将急剧增加。

2024年针对欧洲电网和铁路系统的一系列复杂攻击迫使关键基础设施营运商重新思考其测试方案。据欧盟网路安全局(ENISA)称,安全事件数量增加了38%,其中OT入侵技术绕过了传统的边界控制。安全预算正转向能够绘製融合的IT和OT环境漏洞图的服务,尤其是在处理监控和资料撷取流量的电网中。能够结合红蓝测试的服务提供者如今正受益于跨多个国家的合约规模。强制性事件报告製度的扩展进一步推动了这一需求,因为即时测试的证据对于监管申报至关重要。

加速欧盟NIS2和DORA合规期限

随着NIS2将于2024年10月生效,DORA将于2025年1月运作,合规期限日益缩短,迫使企业将定期安全评估制度化。 DORA针对银行的三年週期性威胁主导渗透测试已促使企业与外部测试机构签订多年框架协议,而NIS2对供应链的关注也推动了对第三方程式码库的下游检验。跨国企业集团正在集中管理编配,以避免重复审核,这促使企业采用统一平台来安排、执行测试并记录证据,以满足多个监管机构的要求。

CREST认证安全测试人员短缺

欧洲人才短缺问题依然严峻,光是英国每年就需要新增7,000名专业人才。云端运算和营运技术(OT)领域的人才缺口尤为突出,导致大型转型计划的启动被延迟。虽然自动化可以减少日常工作,但它无法取代客户期望高级测试人员提供的上下文分析,从而限制了欧洲安全测试市场的整体交付能力。

细分市场分析

预计到2024年,云端基础的模式将占据欧洲安全测试市场61%的份额,并在2030年之前以26.01%的复合年增长率成长。到2030年,欧洲云端部署安全测试市场规模预计将达到540亿美元,反映出市场对能够在几分钟内模拟攻击者地理位置的弹性测试环境的需求日益增长。英国公司通常每週从云端原生平台发动外部攻击模拟,而德国公司则更倾向于采用混合配置,将加密金钥保存在本地。为了满足法国严格的资料在地化法规,服务提供者目前正在将主权云端控制措施(例如区域内金钥管理和专用安全营运人员编制配备)打包在一起。虽然本地部署仍然很重要,尤其是在处理敏感资讯的场所(例如国防部),但这些机构也在尝试安全的「运算输出,资料输入」模式,既可以限制原始资料的暴露,又可以将测试日誌异地储存。随着欧洲超大规模云端服务商承诺在区域市场投入数十亿欧元,混合编配正成为兼顾营运敏捷性和国家安全需求的可行桥樑。因此,欧洲安全测试市场正持续向整合部署方案转型,该方案能够在私人机架和受监管云端之间无缝迁移工作负载,同时保持审核追踪的完整性。

到2024年,应用安全测试(AST)将占据欧洲安全测试市场39%的收入份额,随着Web、行动和无伺服器工作负载的成长,应用安全测试将引领市场普及。在AST领域,以云端为中心的评估成长最快,复合年增长率(CAGR)高达31%,这主要得益于DORA条款要求金融机构审查传统代码和容器化代码。将动态扫描整合到提交管道中的持续整合工具进一步巩固了AST在欧洲安全测试市场的份额,从而能够在运作前进行风险分级。网路安全测试是零信任部署的核心,尤其是在併购后建置的扁平化网路中进行隔离时。在远端存取漏洞被公开披露后,VPN评估变得尤为重要,这些漏洞可以绕过多因素身份验证。防火墙测试先前专注于规则集的维护,现在则加入了规避性流量模拟,以衡量针对使用网域伪装的攻击者的侦测深度。随着云端、行动和API介面的融合,企业越来越需要整合式测试方案,这些方案能够交叉引用多种测试类型的洞察,并在不超出预算的情况下最大限度地提高覆盖范围。

欧洲安全测试市场按部署方式(本地部署、云端、混合部署)、类型(网路安全测试、应用安全测试等)、测试工具(Web应用测试工具、程式码审查工具等)、最终用户产业(政府机构、银行、金融服务和保险等)以及国家进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 从2023年起,针对关键基础设施(电力和铁路)的网路攻击将会增加。

- 加速欧盟NIS2和DORA合规期限

- 软体供应链中DevSecOps采用的左移

- 工业IoT在德国中型工厂的普及

- 欧洲公共部门竞标中的强制性渗透测试条款

- 抗量子密码过渡试点(低调)

- 市场限制

- CREST认证安全测试人员短缺

- 欧盟27国中小企业的预算将在2024年信贷紧缩后冻结。

- 资料主权规则的碎片化正在减缓云端基础的测试速度。

- 假阳性疲劳导致检测频率降低(不易察觉)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 杂交种

- 按类型

- 网路安全测试

- VPN测试

- 防火墙测试

- 其他服务类型

- 应用程式安全测试

- 按应用程式类型

- 行动应用安全测试

- Web应用程式安全性测试

- 云端应用安全测试

- 企业应用安全测试

- 网路安全测试

- 按测试类型

- SAST

- DAST

- IAST

- RASP

- 按最终用户行业划分

- 政府

- BFSI

- 卫生保健

- 製造业

- 资讯科技和通讯

- 零售

- 其他终端用户产业

- 透过测试工具

- Web应用程式测试工具

- 程式码审查工具

- 渗透测试工具

- 软体测试工具

- 其他测试工具

- 按国家/地区

- 英国

- 德国

- 法国

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture

- Atos

- Cisco Systems

- Core Security Technologies

- CrowdStrike

- Fortinet

- Hewlett Packard Enterprise

- IBM

- Kaspersky

- Micro Focus(CyberRes)

- McAfee

- Netcraft

- Offensive Security

- Orange Cyberdefense

- Paladion(Tech Mahindra)

- PwC

- Qualys

- Securonix

- Synopsys

- Veracode

第七章 市场机会与未来展望

The Europe Security Testing Market size is estimated at USD 31.32 billion in 2025 and is projected to reach USD 88.16 billion by 2030, growing at a robust CAGR of 23% during the forecast period.

This nearly threefold expansion reflects the intensifying digital threat landscape across Europe, where organizations face increasingly sophisticated cyber threats amid accelerated digital transformation initiatives. The market's growth trajectory is significantly steeper than historical patterns, indicating a fundamental shift in security priorities across the continent.

The market is being reshaped by stringent regulatory forces, particularly the implementation of the Network and Information Security Directive 2 (NIS2) and Digital Operational Resilience Act (DORA), which mandate comprehensive security testing for critical sectors. Cloud deployment dominates with 61% market share in 2024, while application security testing represents the largest type of segment at 39%. The United Kingdom leads geographically with 23.11% market share, though France exhibits the fastest growth at 26.4% CAGR through 2030, driven by substantial government investments in cybersecurity infrastructure.

Competitive intensity in the market is escalating as established players like Accenture and IBM face pressure from specialized European security testing providers leveraging AI-driven automation to deliver more efficient testing solutions. The market is witnessing a notable shift toward Interactive Application Security Testing (IAST), growing at 27.8% CAGR, as organizations seek to reduce false positives and integrate security earlier in development cycles. This trend is particularly pronounced in the manufacturing sector, which is experiencing the fastest growth among end-users at 25.2% CAGR due to increasing industrial IoT adoption and the convergence of IT and OT security requirements.

The fragmented data sovereignty rules across EU member states are creating implementation challenges for cloud-based security testing solutions, though this is simultaneously driving innovation in hybrid deployment models that can satisfy both operational and compliance requirements. The market's evolution is further characterized by the emergence of specialized testing methodologies for quantum-resistant cryptography, particularly in financial services and government sectors, where early pilots are already underway to prepare for post-quantum security threats.

Europe Security Testing Market Trends and Insights

Heightened Post-2023 Critical-Infrastructure Cyber-Attacks

A succession of sophisticated attacks on European power grids and rail systems in 2024 pushed critical-infrastructure operators to overhaul testing blueprints. ENISA logged a 38% rise in incidents, with OT infiltration techniques bypassing legacy perimeter controls. Security budgets have been redirected toward services capable of mapping vulnerabilities across converged IT-OT environments, especially in distribution networks handling supervisory control and data acquisition traffic. Providers responding with combined red- and blue-team engagements are benefiting from contract sizes that now extend across multi-country footprints. Expansion of mandatory incident reporting regimes further cements demand, as real-time testing evidence becomes essential for regulatory filings.

Accelerated EU NIS2 & DORA Compliance Deadlines

NIS2 enforcement in October 2024 and DORA's go-live in January 2025 compressed compliance windows and forced organizations to institutionalize recurring security assessments. DORA's three-year threat-led penetration-testing cycle for banks has already triggered multiyear framework agreements with external testers, while NIS2's supply-chain focus is driving downstream validation of third-party code repositories. Cross-border conglomerates are centralizing test orchestration to avoid audit duplication, spurring uptake of unified platforms that schedule, execute, and document evidence for multiple regulators.

Shortage of CREST-Certified Security Testers

Europe's talent deficit remains acute, with the United Kingdom alone needing 7,000 additional professionals every year. The gap is especially sharp in cloud and OT disciplines, delaying project kick-offs for large transformation programs. Automation mitigates routine tasks yet cannot replace the contextual analysis clients expect from senior testers, thereby constraining the absolute delivery capacity of the Europe security testing market.

Other drivers and restraints analyzed in the detailed report include:

- Shift-Left DevSecOps Adoption in the Software Supply Chain

- Industrial IoT Penetration in German Mittelst and Factories

- Budget Freeze Across EU-27 SMEs Amid 2024 Credit-Tightening

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-based models delivered 61% of the Europe security testing market in 2024 and are on track for a 26.01% CAGR through 2030. The Europe security testing market size for cloud deployment is projected to reach USD 54 billion by 2030, reflecting mounting demand for elastic test environments that replicate attacker geographies within minutes. United Kingdom enterprises typically launch weekly external attack simulations from cloud-native platforms, while German firms favour hybrid configurations that retain encryption keys on-premises. Providers now bundle sovereign-cloud controls such as in-region key management and dedicated SOC staffing to satisfy France's strict data-locality statutes. On-premises installations remain relevant where classified information is processed, notably in defense ministries, yet even these agencies pilot secure "compute-out, data-in" patterns that keep test logs offsite while restricting raw data exfiltration. As European hyperscalers pledge multibillion-euro investments in regional zones, hybrid orchestration has emerged as a pragmatic bridge for organizations balancing operational agility with national-security mandates. The Europe security testing market therefore continues to pivot toward integrated deployment portfolios that shift workloads seamlessly between private racks and regulated clouds without disrupting audit trails.

Application security testing (AST) generated 39% of the Europe security testing market revenue in 2024 and leads adoption curves as web, mobile, and serverless workloads multiply. Within AST, cloud-specific assessments post the steepest climb at 31% CAGR, propelled by DORA clauses obliging financial entities to review both legacy and containerized code. The Europe security testing market share for AST is bolstered by continuous integration tools that embed dynamic scans into commit pipelines, enabling risk triaging before production. Network security testing still anchors zero-trust rollouts, particularly for segmenting flat networks amassed through M&A activity. VPN assessments gained urgency following publicized remote-access exploits that bypassed multi-factor authentication. Firewall testing, formerly a ruleset hygiene exercise, now incorporates evasive-traffic emulation to gauge inspection depth against adversaries using domain fronting. As cloud, mobile, and API surfaces converge, enterprises increasingly commission unified engagements that cross-reference findings from multiple test types, maximizing coverage without inflating budgets.

Europe Security Testing Market Segmented by Deployment (On-Premises, Cloud and Hybrid), Type (Network Security Testing, Application Security Testing and More), Testing Tool (Web Application Testing Tool, Code Review Tool and More), End-User Industry (Government, BFSI and More) and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture

- Atos

- Cisco Systems

- Core Security Technologies

- CrowdStrike

- Fortinet

- Hewlett Packard Enterprise

- IBM

- Kaspersky

- Micro Focus (CyberRes)

- McAfee

- Netcraft

- Offensive Security

- Orange Cyberdefense

- Paladion (Tech Mahindra)

- PwC

- Qualys

- Securonix

- Synopsys

- Veracode

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened post-2023 critical-infrastructure cyber-attacks (Power and Rail)

- 4.2.2 Accelerated EU NIS2 and DORA compliance deadlines

- 4.2.3 Shift-left DevSecOps adoption in software supply-chain

- 4.2.4 Industrial IoT penetration in German Mittelstand factories

- 4.2.5 Mandatory penetration-testing clauses in European public-sector tenders

- 4.2.6 Quantum-resistant crypto migration pilots (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Shortage of CREST-certified security testers

- 4.3.2 Budget freeze across EU-27 SMEs amid 2024 credit-tightening

- 4.3.3 Fragmented data-sovereignty rules slowing cloud-based testing

- 4.3.4 False-positive fatigue reducing test frequency (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By Type

- 5.2.1 Network Security Testing

- 5.2.1.1 VPN Testing

- 5.2.1.2 Firewall Testing

- 5.2.1.3 Other Service Types

- 5.2.2 Application Security Testing

- 5.2.2.1 By Application Type

- 5.2.2.1.1 Mobile Application Security Testing

- 5.2.2.1.2 Web Application Security Testing

- 5.2.2.1.3 Cloud Application Security Testing

- 5.2.2.1.4 Enterprise Application Security Testing

- 5.2.2.2 By Testing Type

- 5.2.2.2.1 SAST

- 5.2.2.2.2 DAST

- 5.2.2.2.3 IAST

- 5.2.2.2.4 RASP

- 5.2.1 Network Security Testing

- 5.3 By End-User Industry

- 5.3.1 Government

- 5.3.2 BFSI

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 IT and Telecom

- 5.3.6 Retail

- 5.3.7 Other End-User Industries

- 5.4 By Testing Tool

- 5.4.1 Web Application Testing Tool

- 5.4.2 Code Review Tool

- 5.4.3 Penetration Testing Tool

- 5.4.4 Software Testing Tool

- 5.4.5 Other Testing Tools

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Accenture

- 6.4.2 Atos

- 6.4.3 Cisco Systems

- 6.4.4 Core Security Technologies

- 6.4.5 CrowdStrike

- 6.4.6 Fortinet

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 IBM

- 6.4.9 Kaspersky

- 6.4.10 Micro Focus (CyberRes)

- 6.4.11 McAfee

- 6.4.12 Netcraft

- 6.4.13 Offensive Security

- 6.4.14 Orange Cyberdefense

- 6.4.15 Paladion (Tech Mahindra)

- 6.4.16 PwC

- 6.4.17 Qualys

- 6.4.18 Securonix

- 6.4.19 Synopsys

- 6.4.20 Veracode

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis