|

市场调查报告书

商品编码

1640539

亚太地区黏合剂和密封剂:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

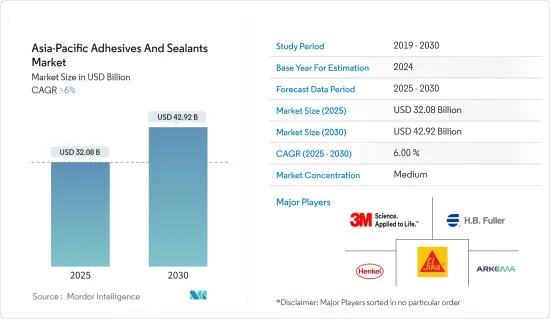

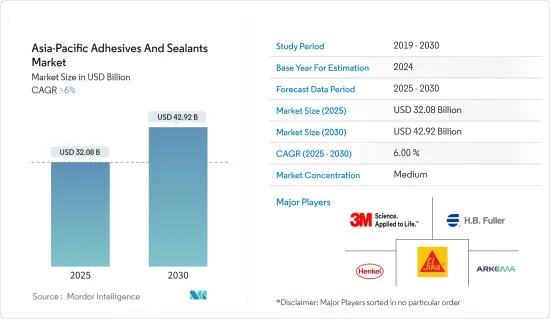

亚太地区黏合剂和密封剂市场规模预计在 2025 年为 320.8 亿美元,预计到 2030 年将达到 429.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 6%。达到。

该地区受到了新冠肺炎疫情的不利影响。该地区的黏合剂和密封剂市场也面临类似的情况。然而,目前它已达到疫情前的水平,预计市场将以显着的速度成长。

预计在预测期内,全球包装和建筑行业的不断扩张将推动对黏合剂和密封剂的需求。

然而,政府关于使用挥发性有机化合物的严格环境法规预计将阻碍市场扩张。

生物基黏合剂的创新和发展以及向复合材料黏合的转变可能会为黏合剂和密封剂市场提供机会。

中国将成为该地区最大的黏合剂和密封剂市场,其消费由汽车、建筑、电子和包装等终端用户产业推动。

亚太地区黏合剂和密封剂市场的趋势

包装领域占据市场主导地位

- 纸包装产品包括折迭纸盒、瓦楞纸箱、纸袋、液体纸板等。随着有组织零售业的大幅成长,由于超级市场和现代购物中心的激增,对纸质包装的需求预计会增加。

- 很大比例的工业产品都是经过包装出售的,这要么是因为储存和运输的稳定性要求,要么是出于美观的原因。当今使用的大多数包装材料都是透过将不同的材料黏合在一起而製成的,需要使用黏合剂。

- 加速这一领域成长的一些关键因素是电子商务平台的扩张和大众收入水准提高导致的消费增加。

- 中国是亚太地区包装产业的主要贡献者。中国在2021-2025年五年规划中表示,将提高塑胶回收和焚烧能力,推广「绿色」塑胶产品,并打击包装和农业中的塑胶滥用。新的五年计画还呼吁鼓励商店和宅配业者减少「不合理」的塑胶包装,并计划到 2025 年将都市区垃圾焚烧率从去年的 58 万吨提高到每天 80 万吨左右。预计此类发展将增加国内对可回收软质塑胶包装的需求。预计预测期内阿里巴巴等电子商务巨头的崛起将推动包装市场的发展。例如,在阿里巴巴为期10天的购物活动「双11」期间,中国消费者收到了约19亿件货物。

- 在印度,塑胶包装每年以 20-25% 的速度成长,目前产量为 680 万吨,而纸包装的价值为 760 万吨。这些趋势对包装行业的黏合剂消费产生了积极影响。

- 2022 年 6 月,环境部下属联邦机构中央污染控制委员会 (CPCB) 宣布了一系列禁止某些一次性塑胶产品的措施。预计这些措施将促进该国对纸质包装的需求。

- 此外,印度等国家对网路食品订购的需求正在增加,从而推动了包装食品盒在食品包装市场的利用率。例如,2022 年 2 月,知名宅配公司 Zomato 报告称,过去五年来,Zomato 上宅配餐厅的平均每月活跃用户增长了 6 倍,而平均月交易客户增长了 13次。

- 随着网路科技和网路应用的兴起,网路零售购物一直在高速成长,这主要支持了包装产业的发展。

- 根据韩国英国商会介绍,韩国食品饮料产业以大卖场为主导,透过电商平台扩大销售。预计到 2024 年,韩国餐饮市场规模将达到 761 亿英镑(899.8 亿美元)。

- 此外,政府推行的永续包装措施也要求采用纸包装产品。例如,作为韩国2050年碳中和目标的一部分,韩国环境部宣布,从2022年6月10日起,连锁咖啡馆和速食店将要求对一次性杯子缴纳300韩元(0.25美元)的押金。此规定适用于分店超过 100分店、门市超过 38,000 家的连锁企业。

- 因此,由于黏合剂和密封剂在纸张、纸板和包装行业的广泛应用,以及由于包装材料需求的增加(主要是由于市场增长),预计预测期内该地区该行业的黏合剂和密封剂消费量将进一步成长。

中国在亚太地区占主导地位

- 亚太地区的黏合剂和密封剂消费以中国为主。建设活动的成长、包装产业消费的增加以及电子产品生产支持国际市场的需求是推动该国黏合剂和密封剂市场消费的一些主要因素。

- 中国的成长主要得益于住宅和商业建筑业的快速扩张以及国家经济的扩张。中国正在推动并持续推动都市化进程,预计2030年都市化率将达70%。因此,中国等国家建筑活动的活性化预计将刺激该地区黏合剂产业的发展。所有这些因素都倾向于增加全部区域黏合剂的需求。

- 根据中国国家统计局的数据,预计2022年建筑业产值将达到31.2兆元(4.5兆美元),高于2021年的29.31兆元(4.2兆美元)。此外,根据住宅及城乡建设部的预测,到2025年,中国建筑业预计仍将占GDP的6%。

- 中国乘用电动车(EV)市场持续大幅成长,预计 2022 年电动车销量将年与前一年同期比较87%。比亚迪、五菱、奇瑞、长安、广汽是占据电动车市场主导的中国品牌,本土品牌占81%。此外,2022年比亚迪的市场占有率将年增11%与前一年同期比较,中国市场前10款电动车款中,将有6款是比亚迪品牌。

- 此外,中国政府预测2025年电动车普及率将达20%。预计这将导致汽车电池的生产和消费增加,从而增加对黏合剂和密封剂的需求。

- 此外,中国是世界上最大的电子製造基地之一,为韩国、新加坡和台湾等现有的上游製造商带来了激烈的竞争。智慧型手机、OLED 电视和平板电脑等电子产品在市场消费性电子领域的需求成长最快。

- 在中国,由于进口自中国的电子产品的国家对电子产品的需求不断增加,以及中阶的可支配收入不断提高,电子产品产量预计将实现成长。

- 因此,预计预测期内终端用户行业的所有这些趋势都将推动该国黏合剂和密封剂市场的成长。

亚太地区胶黏剂和密封剂产业概况

亚太地区的黏合剂和密封剂市场本质上是部分合併的。主要企业(不分先后顺序)包括 3M、阿科玛、西卡、富乐公司和汉高公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 东南亚国家包装产业的成长

- 建筑业需求不断成长

- 其他驱动因素

- 限制因素

- 有关 VOC排放的严格环境法规

- 原物料价格上涨

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 通过粘合树脂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 氰基丙烯酸酯

- 乙烯-醋酸乙烯共聚物・

- 其他树脂(聚酯、橡胶等)

- 按黏合技术

- 溶剂型

- 反应性

- 热熔胶

- 紫外线固化胶合剂

- 水性

- 通过密封树脂

- 硅胶

- 聚氨酯

- 丙烯酸纤维

- 环氧树脂

- 其他树脂(沥青、聚硫化物紫外线固化等)

- 按最终用户产业

- 航太

- 车

- 建筑和施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他终端用户产业(电子、消费品/DIY 等)

- 按地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- DuPont

- Dymax Corporation

- Franklin International

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- Tesa SE(A Beiersdorf Company)

- Pidilite Industries Ltd.

- Sika AG

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 生物基胶黏剂的创新与发展

- 向复合黏合的转变

The Asia-Pacific Adhesives And Sealants Market size is estimated at USD 32.08 billion in 2025, and is expected to reach USD 42.92 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The region was negatively affected by the COVID-19 pandemic. The adhesives and sealants market in the region also faced a similar situation. However, the market has now reached pre-pandemic levels, and it is expected to grow at a significant pace.

Expanding packaging and building and construction industries around the globe are likely to drive demand for adhesives and sealants during the forecast period.

However, strict environmental regulations set by the government on the use of volatile organic compounds are anticipated to hamper market expansion.

The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to offer opportunities for the adhesives and sealants market.

China stands to be the largest market for adhesives and sealants in the region, where the consumption is driven by the end-user industries, such as automotive, construction, electronics, and packaging.

APAC Sealants & Adhesives Market Trends

Packaging Segment to Dominate the Market

- Packaging products in paper packaging comprises folding cartons, corrugated boxes, paper bags, and liquid paperboard. With the considerable increase in organized retail, the demand for paper packaging is anticipated to increase due to the rapid increase in supermarkets and modern shopping centers.

- An extremely high proportion of industrial products are sold in packages, either due to stability requirements for storage and transport or aesthetic reasons. Most packaging materials presently used are different materials laminated together, which require the use of adhesives.

- One of the critical factors that have been accelerating the growth of the segment includes a growing e-commerce platform and increasing consumption with the rise in income levels of the masses.

- China is a major contributing country in the APAC region for the packaging industry. In a 2021-2025 "five-year plan," China announced it would improve its plastic recycling and incineration capacities, promote "green" plastic products, and combat the misuse of plastic in packaging and agriculture. The new five-year plan would push merchants and delivery companies to reduce "unreasonable" plastic wrapping and increase garbage incineration rates in cities to about 800,000 tons per day by 2025, up from 580,000 tons last year. Such developments are expected to increase the country's demand for recyclable flexible plastic packaging. Over the projection period, the rise of e-commerce giants like Alibaba is expected to fuel the packaging market. For example, Chinese shoppers received approximately 1.9 billion shipments during Alibaba's Double 11 shopping event, which lasted 10 days.

- In India, plastic packaging is growing at a significant rate of 20-25% annually and has reached 6.8 million tons, whereas paper packaging is valued at 7.6 million tons. These trends positively impacted the consumption of adhesives in the packaging sector.

- In June 2022, the Central Pollution Control Board (CPCB), a federal agency under the Ministry of the Environment, released a list of steps to outlaw specific single-use plastic products by June 2022. Such measures are anticipated to drive the demand for paper packaging in the country.

- Moreover, in a country such as India, the growing demand for online food ordering is increasing, pushing the usage of packaged food boxes in the food packaging market. For instance, in February 2022, Zomato, one of the prominent food delivery companies, said that the average monthly active food delivery restaurants have grown by 6x, and average monthly transacting customers have grown by 13x on Zomato over the past five years.

- Online retail shopping is increasing at a higher rate with the rising internet technologies and web applications, which have primarily supported the packaging industry's growth.

- According to the British Chamber of Commerce in Korea, South Korea's F&B business is defined by hypermarket dominance and expanding sales through e-commerce platforms. The F&B market in South Korea is expected to reach GBP 76.1 billion (USD 89.98 billion) by 2024.

- Furthermore, the government initiatives for sustainable packaging are mandating the adoption of paper packaging products. For instance, as part of South Korea's 2050 carbon neutrality goal, the South Korean Ministry of Environment has announced that disposable cups from chain cafes and fast-food restaurants will require a 300 KRW (USD 0.25) deposit starting on June 10, 2022. This regulation applies to chains with more than 100 branches and 38,000 stores.

- Therefore, with extensive application in the paper, board, and packaging industry and increased demand for packaging materials mainly due to the growing e-commerce industry, the consumption of adhesives and sealants in this segment is expected to increase further in the region over the forecast period.

China to Dominate in the Asia-Pacific Region

- China dominates the region's consumption of adhesives and sealants. Growing construction activities, increasing consumption in the packaging industry, and electronics production to support demand in the international market are some of the key factors driving the consumption of the adhesives and sealants market in the country.

- China's growth is fueled mainly by rapid expansion in the residential and commercial building sectors and the country's expanding economy. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. As a result, increased building activity in nations like China is projected to fuel the region's adhesive industry. All such factors tend to increase the demand for adhesives across the region.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- China's passenger electric vehicle (EV) market continues to grow at an impressive rate, with EV sales rising by 87% YoY in 2022. BYD, Wuling, Chery, Changan, and GAC are some of the top Chinese brands that dominate the EV market, with local brands commanding 81%. Additionally, in 2022, BYD increased its market share by over 11% Y-o-Y, with six out of the top 10 EV models in the Chinese market coming from the brand.

- Moreover, the Chinese government estimates a 20% penetration rate of electric vehicle production by 2025. Hence, this is anticipated to increase the production and consumption of vehicle batteries, thus increasing demand for adhesives and sealants in the market.

- Furthermore, China has one of the world's largest electronics production bases and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand.

- In China, electronics production is projected to grow with the rising demand for electronic products in countries importing electronic products from China and the increase in the disposable income of the middle-class population.

- Hence, all such trends in the end-user industries are expected to drive the growth of the adhesives and sealants market in the country over the forecast period.

APAC Sealants & Adhesives Industry Overview

The Asia-Pacific adhesives and sealants market is partially consolidated in nature. The major players (not in any particular order) include 3M, Arkema, Sika AG, H.B. Fuller Company, and Henkel AG & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Packaging Industry in South-East Asia Countries

- 4.1.2 Growing Demand in Construction Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 High Fluctuations in Raw Material Pricing

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins (Polyester, Rubber, etc.)

- 5.2 Adhesives Technology

- 5.2.1 Solvent-borne

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Sealants Resin

- 5.3.1 Silicone

- 5.3.2 Polyurethane

- 5.3.3 Acrylic

- 5.3.4 Epoxy

- 5.3.5 Other Resins (Bituminous, Polysulfide UV-Curable, etc.)

- 5.4 End-User Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking And Joinery

- 5.4.8 Other End-user Industries (Electronics, Consumer/DIY, etc.)

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Indonesia

- 5.5.6 Malaysia

- 5.5.7 Thailand

- 5.5.8 Vietnam

- 5.5.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Beardow Adams

- 6.4.6 Dow

- 6.4.7 DuPont

- 6.4.8 Dymax Corporation

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Huntsman International LLC

- 6.4.13 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.14 Jowat AG

- 6.4.15 Mapei Inc.

- 6.4.16 Tesa SE (A Beiersdorf Company)

- 6.4.17 Pidilite Industries Ltd.

- 6.4.18 Sika AG

- 6.4.19 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials