|

市场调查报告书

商品编码

1640552

苯乙烯-丁二烯橡胶(SBR):市场占有率分析、行业趋势和成长预测(2025-2030 年)Styrene Butadiene Rubber (SBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

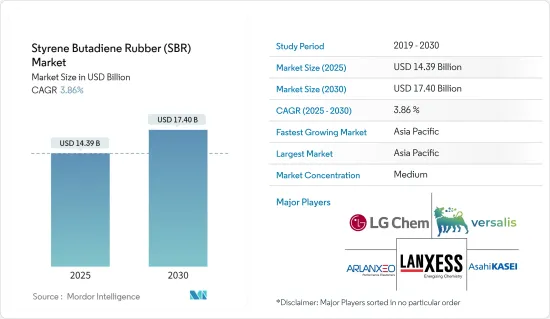

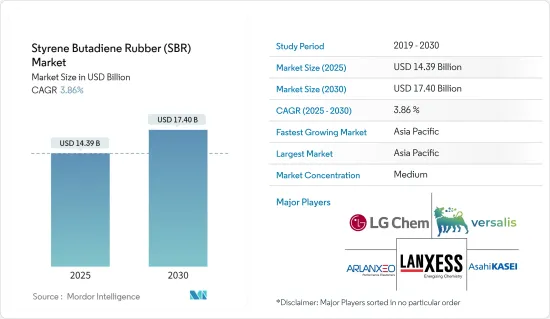

预计 2025 年苯乙烯-丁二烯橡胶市场规模为 143.9 亿美元,到 2030 年将达到 174 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.86%。

COVID-19对苯乙烯-丁二烯橡胶市场产生了负面影响。封锁措施、工厂关闭和运输限制阻碍了货物流通,影响了 SBR 及其原材料的供应。随着封锁措施的解除,对商品和服务的需求增加,从而导致对用于多种用途的 SBR 的需求復苏。

关键亮点

- 天然橡胶和 SBR 交叉产品销售的增加以及黏合剂和密封剂行业对 SBR 的需求不断增长是预计推动苯乙烯-丁二烯橡胶市场发展的主要因素。

- 另一方面,原材料的波动和可持续材料的替代品预计会阻碍市场的成长。

- 性能添加剂和基础设施开发计划的技术创新带来的需求不断增加,预计将为苯乙烯-丁二烯橡胶市场提供机会。

- 亚太地区在苯乙烯丁二烯市场占据主导地位,预计在预测期内仍将保持主导地位。

苯乙烯-丁二烯橡胶(SBR)市场趋势

黏合剂领域占据市场主导地位

- SBR 具有均衡的性能,包括良好的附着力、耐久性和柔韧性,适合配製各种用途的黏合剂。 SBR 基黏合剂用途广泛,可应用于许多行业,因为它们可以黏合多种基材,包括金属、塑胶、木材、纸张和纺织品。

- SBR 黏合剂对各种表面具有出色的黏合性,可在包装、建筑、汽车、鞋类和木工等应用中形成牢固持久的黏合。 SBR 形成内聚力和黏合力的能力使其在黏合剂领域中占据主导地位。

- 苯乙烯-丁二烯橡胶用于改善轮胎的性能。它可以降低滚动阻力并提高燃油效率。它还提高了轮胎的湿抓地力和煞车性能。它还可以保护您的轮胎免受磨损,有助于延长其使用寿命。

- 根据美国轮胎工业协会发布的估计,2022年将有约630万条原厂卡车轮胎和2,310万条替换轮胎运往美国。

- 此外,美国劳工统计局估计, 年终年底美国乘用车充气轮胎生产者物价指数为 180.2 指数点。

- 建筑和包装行业是 SBR 基黏合剂的重要消费者,用于黏合地毯、瓷砖、层压板、胶带、标籤和包装材料。随着这些行业在全球范围内持续成长,对 SBR 基黏合剂的需求预计将增加,从而增强黏合剂领域在该市场的主导地位。

- 2022年,英国新建计划(以现价计算)成长15.8%至1,329.89亿英镑(1,680.601.9亿美元),创历史新高。这是由于私部门就业人数增加了 140.93 亿英镑(178.954 亿美元)以及公共部门就业人数增加了 40.68 亿英镑(5,118.055 亿美元)。

- 这些因素导致苯乙烯-丁二烯橡胶需求增加,并将在未来一段时间内推动市场成长。

亚太地区占市场主导地位

- 亚太地区有许多产业是 SBR 的重要消费者,包括汽车、建筑、鞋类、纺织品和包装。该地区快速的工业化、都市化和经济成长正推动轮胎、输送机、黏合剂、鞋底和沥青改质剂各种应用领域对 SBR 基产品的需求。

- 亚太地区,尤其是中国,是合成橡胶(包括 SBR)生产的主要製造地。该地区受益于丰富的原料供应、完善的石化基础设施和具有竞争力的生产成本,使其成为 SBR 生产的理想地点。尤其是中国,占了全球SBR产能的很大份额。

- 根据中国汽车工业协会(CAAM)发布的预测,2022年中国乘用车销量将达到约2,356万辆,商用车销量将达到约330万辆。

- 根据印度汽车工业协会发布的估计,2022年印度将成为世界上最大的两轮车生产国。此外,该领域在国内市场占据主导地位。 22财年,这个南亚国家国内两轮车销量超过1,580万辆。

- 亚太地区是鞋类和纺织品的重要生产国和消费国,其中SBR基材料被广泛使用。 SBR 因其耐用性、耐磨性和柔韧性而常用于鞋底、鞋跟和运动鞋。该地区不断增长的人口和不断上升的可支配收入正在推动对基于 SBR 的鞋类和纺织产品的需求。

- 印度是继中国之后的第二大鞋类生产国,2022财年将生产约2.19亿双鞋类。

- 因此,预计上述因素将推动苯乙烯-丁二烯橡胶,主要是在亚太地区。

苯乙烯-丁二烯橡胶(SBR)产业概况

苯乙烯-丁二烯橡胶(SBR)市场由主要企业主导。主要参与企业包括旭化成公司、阿朗新科、朗盛、Versalis SpA 和 LG 化学。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 增加天然橡胶/SBR 交叉产品的使用

- 对黏合剂和密封剂产业的需求增加

- 限制因素

- 原物料价格不稳定

- 永续材料替代

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 按类型

- 乳液SBR

- 溶液SBR

- 按应用

- 胎

- 胶水

- 鞋类

- 其他用途(建筑材料)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 越南

- 印尼

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation

- Dynasol Group

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA

第七章 市场机会与未来趋势

- 性能添加剂的创新

- 基础设施开发计划需求增加

The Styrene Butadiene Rubber Market size is estimated at USD 14.39 billion in 2025, and is expected to reach USD 17.40 billion by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

COVID-19 negatively impacted the styrene butadiene rubber market. Lockdown measures, factory closures, and restrictions on transportation hampered the movement of goods and affected the availability of SBR and its feedstock materials. As lockdowns were lifted, the increased demand for goods and services led to a rebounding demand for SBR used in various applications.

Key Highlights

- Increasing sales of natural rubber and SBR crossover products and the rise in demand for SBR from the adhesives and sealants industry are the significant drivers expected to drive the styrene butadiene rubber market.

- On the flip side, fluctuation in the volatile raw materials and the substitution by sustainable materials are expected to hinder the growth of the market.

- Innovation in performance additives and the increasing demand from infrastructure development projects are expected to provide opportunities to the styrene butadiene rubber market.

- The Asia-Pacific region dominated the styrene butadiene market and is projected to retain its dominance over the forecast period.

Styrene Butadiene Rubber (SBR) Market Trends

Adhesives Segment to Dominate the Market

- SBR offers a balance of properties, including good adhesion, durability, and flexibility, making it suitable for formulating a wide range of adhesives for diverse applications. SBR-based adhesives can bond to various substrates, including metals, plastics, wood, paper, and textiles, making them versatile and applicable in many industries.

- SBR-based adhesives offer excellent adhesion to various surfaces, providing strong and durable bonds in packaging, construction, automotive, footwear, and woodworking applications. SBR's ability to form cohesive and adhesive bonds contributes to its dominance in the adhesive segment.

- Styrene butadiene rubber has been applied to improve the properties of tires. It helps reduce rolling resistance and increases fuel efficiency. It also improves tire wet grip and braking performance. In addition, it protects the tire from wear and tear to prolong its life.

- According to the estimate released by the US Tire Manufacturers Association, about 6.3 million original equipment and 23.1 million replacement truck tires were shipped to the United States in 2022.

- Furthermore, according to the Bureau of Labor Statistics estimate, the US producer price index for passenger car pneumatic tires was 180.2 index points at the end of 2022.

- The construction and packaging industries are significant consumers of SBR-based adhesives for bonding carpets, tiles, laminates, tapes, labels, and packaging materials. The demand for SBR-based adhesives is projected to rise as these industries keep growing worldwide, strengthening the dominance of the adhesive segment in this market.

- In 2022, the value of new building projects in current prices increased by 15.8% to a record high of GBP 132,989 million (USD 168,060.19 million) in Great Britain. This is due to increased private and public sector employment of GBP 14,093 million (USD 17809.54 million) and GBP 4,068 million (USD 5118.05), respectively.

- This increase in demand for styrene butadiene rubber, which will help the market grow during the upcoming period, is a result of these factors.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to a wide range of industries that are significant consumers of SBR, including automotive, construction, footwear, textiles, and packaging. The region's rapid industrialization, urbanization, and economic growth drive demand for SBR-based products in various applications, such as tires, conveyor belts, adhesives, shoe soles, and asphalt modifiers.

- Asia-Pacific, particularly China, is a central manufacturing hub for synthetic rubber production, including SBR. The region benefits from abundant feedstock availability, well-established petrochemical infrastructure, and competitive manufacturing costs, making it attractive for SBR production. China, in particular, accounts for a significant share of global SBR production capacity.

- According to the estimate released by the China Automotive Association Manufacturers (CAAM), in China, about 23.56 million passenger cars and 3.3 million commercial vehicles were sold in 2022.

- According to the estimate released by the Society of Indian Automobile Manufacturers, in 2022, India became the world's biggest producer of two wheels. This segment has also dominated the country's market. More than 15.8 million units of two-wheelers were sold domestically in South Asian countries during the financial year 2022.

- Asia Pacific is a significant producer and consumer of footwear and textiles, extensively using SBR-based materials. SBR is commonly used in shoe soles, heels, and athletic footwear due to its durability, abrasion resistance, and flexibility. The region's growing population and increasing disposable incomes drive demand for SBR-based footwear and textiles.

- India is the second largest footwear producer after China, with around 219 million pairs of footwear produced during FY 2022.

- Thus, the abovementioned factors are expected to increase the demand for styrene butadiene rubber, majorly from the Asia-Pacific region.

Styrene Butadiene Rubber (SBR) Industry Overview

The styrene butadiene rubber (SBR) market is consolidated among the top players. The key players include Asahi Kasei Corporation, Arlanxeo, Lanxess, Versalis SpA, and LG Chem, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Natural Rubber and SBR Crossover Products

- 4.1.2 Increasing Demand from Adhesives and Sealants Industry

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Substitution by Sustainable Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Emulsion SBR

- 5.1.2 Solution SBR

- 5.2 By Application

- 5.2.1 Tyres

- 5.2.2 Adhesives

- 5.2.3 Footwear

- 5.2.4 Other Applications (Construction Materials)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 France

- 5.3.3.3 Germany

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARLANXEO

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 China Petrochemical Corporation

- 6.4.4 Dynasol Group

- 6.4.5 ENEOS Corporation

- 6.4.6 Kemipex

- 6.4.7 KUMHO PETROCHEMICAL

- 6.4.8 LANXESS

- 6.4.9 LG Chem

- 6.4.10 Sumitomo Chemical Asia Pte Ltd

- 6.4.11 Synthos

- 6.4.12 Trinseo

- 6.4.13 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Performance Additives

- 7.2 Increasing Demand from the Infrastructure Development Projects