|

市场调查报告书

商品编码

1640562

生物分解性塑胶包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Biodegradable Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

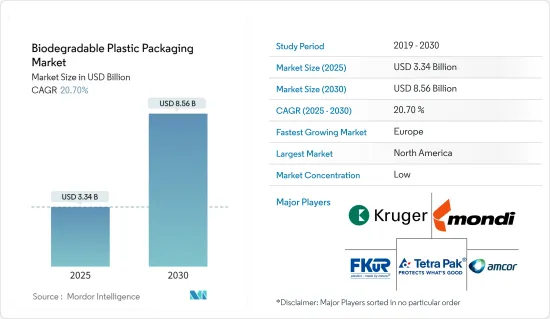

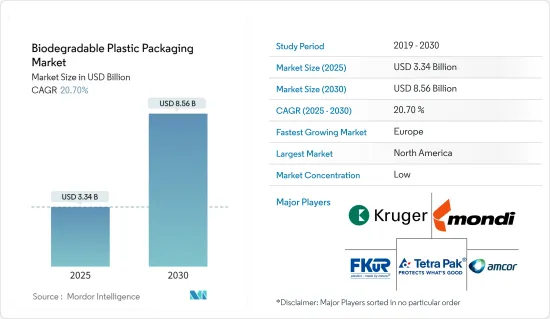

生物分解性塑胶包装市场规模预计在 2025 年为 33.4 亿美元,预计到 2030 年将达到 85.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.7%。

主要亮点

- 在日益增长的环境问题和对永续替代品的需求激增的推动下,生物分解性塑胶包装市场正在经历显着增长。随着人们越来越意识到塑胶废弃物对生态系统的影响,消费者正在要求改变。同时,世界各国政府正在加强法规以应对塑胶污染。这就是为什么食品和饮料、零售和电子商务等行业越来越多地采用生物分解性包装以满足消费者的期望和监管要求。

- 生物分解性塑胶常用于由玉米粉等可再生资源製成的包装,并且在食品包装中越来越普遍。这些生物分解性的材料是比传统塑胶更环保的替代品,传统塑胶需要几个世纪才能分解。

- 推动市场成长的因素有很多,最显着的是消费者转向永续产品以及企业向永续性的推动。企业正在投资生物分解性包装技术并建立伙伴关係,以提高材料性能并降低生产成本。随着电子商务的不断兴起,人们越来越关注生物分解性的包装,以减少对环境的影响,同时确保运输过程中产品的安全。

- 2023年8月,华盛顿大学的调查团队推出了一种由蓝藻螺旋藻製成的创新生质塑胶。与抗生物分解的传统塑胶或其他需要商业性加工的生质塑胶不同,这种新型生质塑胶可以自然、快速地分解。此外,螺旋藻固有的阻燃性能是其一大优势,使得以螺旋藻为基础的塑胶成为传统易燃塑胶无法满足的应用领域的理想选择。

- 监管压力、不断增长的消费者需求以及材料科学的突破正在推动生物分解性塑胶包装市场的成长。随着人们对环境问题的日益关注和全球向永续性的转变,未来几年市场将大幅扩张。

- 然而,生物分解性塑胶包装市场面临生产成本上升和某些应用中的性能问题等挑战。进一步复杂化的是缺乏生物分解性塑胶的回收基础设施,这可能会破坏这种材料的环境效益。

- 儘管存在这些障碍,北美和欧洲仍处于领先地位,而由于人们意识的增强和政府对永续包装的推动,亚太地区正成为一个有前景的地区。

生物分解性塑胶包装市场的趋势

食品领域占据主要市场占有率

- 随着人们对永续性和减少塑胶废弃物的关注度不断提高,将生物分解性塑胶引入食品包装的势头日益强劲。传统的塑胶包装是一个重大的环境问题,产生了大量一次性塑胶废弃物,尤其是在食品工业中。食品包装可以透过转向由玉米粉、甘蔗和藻类等可再生资源製成的生物分解性替代品来减少其生态足迹。这些材料能够在环境中更快地降解,比传统塑胶提供更永续的解决方案。

- 生物分解性塑胶如 PLA(聚乳酸)和 PHA(聚羟基烷酯)越来越多地用于食品包装,因为它们保留了食品保存所需的特性。这些材料可以提供优异的防潮性、阻隔性以保护食品免受光和氧气的伤害,以及在运输和物料输送过程中的耐用性。因此,许多食品製造商正在转向生物分解性塑胶,以满足消费者对环保包装的需求,同时确保食品安全和品质。

- 政府法规和消费者偏好在食品包装中越来越多地采用生物分解性塑胶发挥关键作用。随着欧盟和北美等地对一次性塑胶的监管愈发严格,食品公司被迫寻找永续的替代品。同时,消费者的环保意识也越来越强,他们对环保包装产品的偏好推动企业投资生物分解性的解决方案。这一趋势与旨在减少塑胶污染的全球永续性相一致。

- 为了充分发挥生物分解性塑胶在食品包装中的潜力,投资改善废弃物管理系统至关重要。透过适当的堆肥和回收基础设施,生物分解性材料可以有效分解,不会成为掩埋的废弃物。随着消费者对永续包装的需求和监管压力不断增长,预计该行业将继续创新生物分解性塑胶技术,使其更容易被世界各地的食品製造商使用和推广。

- 2022年至2028年间,全球生质塑胶产能将激增,凸显全球迈向永续材料的转变。这种激增与包括食品包装在内的各个领域对生质塑胶的需求不断增长密切相关。 2022年,全球生质塑胶产量达86.4万吨。到 2023 年,这一数字将飙升至 113.6 万吨,凸显了人们对生物分解性材料(尤其是食品包装)的兴趣和投资的快速增长。欧洲生物塑胶协会预测,到 2024 年,这一数量将飙升至 157.5 万吨,到 2025 年将扩大至惊人的 259.8 万吨,到 2028 年将进一步扩大至 460.5 万吨。生产能力的激增与食品包装对生质塑胶的需求不断增长相吻合,而这得益于监管要求、消费者对永续性的偏好以及生物分解性塑胶技术的进步。

- 食品包装产业是塑胶的主要消费产业,由于其生物分解性且符合食品安全标准,将直接受到快速成长的生质塑胶产品的影响。随着生产能力的提高,生质塑胶将变得经济可行并可供食品製造商使用。预计 2028 年生产能力将达到 460 万吨,生质塑胶将成为食品包装的主流。随着全球监管压力不断增大以控制塑胶废弃物,这项变革尤其及时。随着品牌越来越多地转向永续包装,食品业将看到从食品饮料到生鲜食品的生质塑胶包装激增,以响应全球对抗塑胶污染的承诺。

预计亚太地区将出现显着成长

- 受消费者需求上升、环保意识增强和监管支持的推动,亚洲用于包装的生物分解性塑胶市场正在蓬勃发展。随着可支配收入的增加和都市化进程的加速,日本、韩国、印度和中国繁华城市中心等国家的消费者对塑胶废弃物对环境的影响越来越敏感。消费者态度的转变促进了生物分解性塑胶解决方案市场的快速成长,尤其是在食品和饮料、化妆品和消费品领域。

- 政府的倡议对于推动整个亚洲对生物分解性塑胶的需求至关重要。印度、中国和东南亚等国家正在采取措施遏制塑胶废弃物,包括禁止使用一次性塑胶和加强废弃物管理法规。政府的这些倡议正在引导产业走向生物分解性塑胶等更永续的选择。值得注意的是,继泰国和印尼之后,中国最近也收紧了塑胶监管规定,这促使企业转向符合监管标准和支持环境目标的创新包装。

- 亚太地区拥有较高的生质塑胶生产能力,进一步增加了该市场的潜力。亚洲是世界上最大的生质塑胶生产国之一,其中以中国和印度为首。随着生产成本下降和效率提高,生物分解性塑胶正在成为更可行、更具成本效益的包装选择。这种能力建设对于食品包装等正在日益向永续解决方案转变的行业尤其重要。

- 亚太地区庞大的人口和蓬勃发展的中产阶级支撑了该地区对永续包装的强烈需求,尤其是食品包装。随着越来越多的消费者和品牌支持环保选择,生物分解性塑胶在食品包装领域占有一席之地,尤其是外带和宅配。它在食品、化妆品和药品领域的不断增长表明它可能会成为主流。随着对永续包装的需求日益增加,亚洲将在全球生质塑胶市场中发挥关键作用。

- 受可支配收入增加、生活方式改变和都市化推动,印度包装食品市场预计将从 2022 年的 513 亿美元增长至 2025 年的 675 亿美元和 2026 年的 702 亿美元。生物分解性塑胶。网路食品宅配服务的兴起进一步增加了对环保包装的需求,使得印度成为包装食品领域生物分解性塑胶的主要市场。

生物分解性塑胶包装产业概况

随着全球参与者转向利用现成的自然资源来开发创新的塑胶包装解决方案,生物分解性塑胶包装市场变得分散。大量投资于研发加剧了竞争,并推动企业推出新产品。知名产业参与者包括 Tetra Pak International SA、Kruger Inc.、Amcor Group、Mondi PLC 和 FKuR Kunststoff GmbH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 对塑胶污染的环境担忧日益加剧

- 各政府和联邦机构的严格监管

- 市场限制

- 与普通塑胶相比製造成本较高

第六章 市场细分

- 按类型

- 淀粉基塑料

- 纤维素基塑料

- 聚乳酸(PLA)

- 聚羟基烷酯(PHA)

- 其他塑胶类型

- 按应用

- 食物

- 饮料

- 药品

- 个人及居家护理

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Tetra Pak International SA

- Kruger Inc.

- Amcor Group

- Mondi PLC

- International Paper Company

- FKuR Kunststoff GmbH

- DS Smith PLC

- Klabin SA

- Rengo Co. Ltd

- Stavian Chemical

第八章投资分析

第九章 市场机会与未来趋势

The Biodegradable Plastic Packaging Market size is estimated at USD 3.34 billion in 2025, and is expected to reach USD 8.56 billion by 2030, at a CAGR of 20.7% during the forecast period (2025-2030).

Key Highlights

- Driven by mounting environmental concerns and a surge in demand for sustainable alternatives, the biodegradable plastic packaging market is witnessing significant growth. With heightened awareness of plastic waste's ecological toll, consumers are pushing for change. Concurrently, governments globally are tightening regulations to combat plastic pollution. This has led industries, notably in food and beverage, retail, and e-commerce, to increasingly embrace biodegradable packaging, aligning with consumer expectations and regulatory mandates.

- Biodegradable plastics, commonly utilized in packaging derived from renewable sources like cornstarch, dominate food packaging, while PHA is carving a niche in the medical and agricultural sectors. These biodegradable materials present a greener alternative to traditional plastics, which can take centuries to decompose.

- Several factors fuel the market's growth, notably a pronounced consumer shift towards sustainable products and corporate pushes for sustainability. Companies invest in biodegradable packaging technologies and forge partnerships to enhance material performance and curtail production costs. With the relentless rise of e-commerce, there's an intensified focus on biodegradable packaging to lessen environmental footprints while ensuring product safety during transit.

- In August 2023, researchers at the University of Washington introduced an innovative bioplastic sourced from the blue-green cyanobacteria spirulina. Unlike traditional plastics, which resist biodegradation, or other bioplastics that require commercial processing, these new bioplastics decompose naturally and rapidly. Additionally, their inherent fire-resistant properties provide a significant edge, positioning spirulina-based plastics as ideal candidates for applications where conventional, flammable plastics are inadequate.

- Regulatory pressures, rising consumer demand, and breakthroughs in material science are propelling the growth of the biodegradable plastic packaging market. With mounting environmental concerns and a worldwide shift towards sustainability, the market is poised for significant expansion in the years ahead.

- Yet, the biodegradable plastic packaging market has challenges, including elevated production costs and performance issues in specific applications. The nascent recycling infrastructure for biodegradable plastics further complicates matters, potentially undermining the material's environmental benefits.

- Despite these hurdles, the market's trajectory remains upward, with North America and Europe at the forefront and Asia Pacific emerging as a region of growing promise, bolstered by rising awareness and governmental backing for sustainable packaging.

Biodegradable Plastic Packaging Market Trends

Food Segment to Hold Significant Market Share

- Implementing biodegradable plastics in food packaging is gaining momentum due to the growing emphasis on sustainability and reducing plastic waste. Traditional plastic packaging has become a significant environmental issue, particularly in the food industry, which generates substantial amounts of single-use plastic waste. Food packaging can reduce the ecological footprint by transitioning to biodegradable alternatives from renewable resources like cornstarch, sugarcane, and algae. These materials are designed to break down more rapidly in the environment, offering a more sustainable solution than conventional plastics.

- Biodegradable plastics such as PLA (polylactic acid) and PHA (polyhydroxyalkanoates) are increasingly used in food packaging because they maintain the essential properties required for food preservation. These materials can offer excellent moisture resistance, barrier properties to protect food from light and oxygen, and durability during transportation and handling. As a result, many food manufacturers are adopting biodegradable plastics to meet consumer demand for eco-friendly packaging while ensuring food safety and quality.

- Government regulations and consumer preferences have played a crucial role in the growing adoption of biodegradable plastics in food packaging. As rules on single-use plastics become more stringent in regions such as the European Union and North America, food companies are increasingly compelled to find sustainable alternatives. At the same time, consumers are becoming more environmentally conscious, and their preference for products with eco-friendly packaging has driven companies to invest in biodegradable solutions. This trend aligns with global sustainability efforts aimed at reducing plastic pollution.

- Investing in improved waste management systems is essential to fully realizing the potential of biodegradable plastics in food packaging. Proper composting or recycling infrastructure ensures that biodegradable materials can break down effectively and not contribute to landfill waste. As consumer demand and regulatory pressure for sustainable packaging increase, the industry is expected to continue innovating in biodegradable plastic technologies, making them more accessible and scalable for food manufacturers worldwide.

- From 2022 to 2028, global bioplastic production capacity is steeply rising, underscoring a worldwide pivot towards sustainable materials. This surge is closely tied to the mounting demand for bioplastics across various sectors, notably food packaging. In 2022, global bioplastic production stood at 864,000 metric tons. By 2023, this figure jumped to 1,136,000 metric tons, highlighting a burgeoning interest and investment in biodegradable materials, especially in food packaging. Projections indicate a leap to 1,575,000 metric tons in 2024, with further escalations to 2,598,000 metric tons by 2025 and a staggering 4,605,000 metric tons by 2028 as per European Bioplastics. This surge in production capacity is in tandem with the rising demand for bioplastics in food packaging, spurred by regulatory mandates, consumer preferences for sustainability, and advancements in biodegradable plastic technologies.

- The food packaging sector, a major plastic consumer, will be directly influenced by burgeoning bioplastic products due to their biodegradable nature and compliance with food safety standards. With increased production capacity, bioplastics will become more economically viable, enhancing their accessibility for food manufacturers. By 2028, with a projected capacity of 4.6 million metric tons, bioplastics are poised for mainstream adoption in food packaging. This shift is especially timely as global regulatory pressures mount to curb plastic waste. As brands increasingly pivot to sustainable packaging, the food sector will witness a surge in bioplastic packaging, from beverages to fresh produce, echoing the global commitment to combat plastic pollution.

Asia-Pacific is Expected to Witness Significant Growth

- In Asia, the market for biodegradable plastics in packaging is gaining momentum, fueled by rising consumer demand, heightened environmental awareness, and supportive regulations. As disposable incomes grow and urbanization accelerates, consumers in nations like Japan and South Korea and bustling urban centers in India and China are increasingly attuned to the environmental repercussions of plastic waste. This evolving consumer mindset fosters a burgeoning market for biodegradable plastic solutions, particularly in food and beverage, cosmetics, and consumer goods.

- Government actions are pivotal in propelling the demand for biodegradable plastics across Asia. Nations, including India, China, and various Southeast Asian countries, have implemented initiatives to curb plastic waste, such as banning single-use plastics and tightening waste management regulations. These governmental moves are nudging industries towards sustainable choices, like biodegradable plastics. Notably, China's recent clampdown on plastics, mirrored by Thailand and Indonesia, is steering companies towards innovative packaging that meets regulatory standards and champions environmental objectives.

- Asia Pacific's robust industrial capacity for bioplastics further amplifies this market potential. With giants like China and India at the forefront, Asia boasts some of the world's largest bioplastics producers. As production costs dwindle and efficiency surges, biodegradable plastics are becoming a more viable and cost-effective choice for packaging. This bolstered production capability is especially crucial for sectors like food packaging, where the shift towards sustainable solutions is gaining traction.

- Asia Pacific's vast population and burgeoning middle class underscore the region's strong appetite for sustainable packaging, particularly in food. With increasing consumers and brands championing eco-friendly choices, biodegradable plastics are carving a niche in food packaging, especially for takeout and delivery. Their rising prominence in food, cosmetics, and pharmaceuticals signals a potential mainstream acceptance. As the clamor for sustainable packaging intensifies, Asia is poised to play a pivotal role in global bioplastics.

- India's packaged food market is projected to grow from USD 51.3 billion in 2022 to USD 67.5 billion by 2025 and USD 70.2 billion by 2026, as per Retailers Association of India, driven by rising disposable incomes, changing lifestyles, and urbanization. This growth fuels demand for biodegradable plastics in food packaging, as businesses and consumers increasingly prioritize sustainable solutions to address environmental concerns and align with government regulations phasing out single-use plastics. The rise of online food delivery services further amplifies the need for eco-friendly packaging, positioning India as a key market for biodegradable plastics in the packaged food sector, supported by the government's push for a circular economy and enhanced waste management systems.

Biodegradable Plastic Packaging Industry Overview

The biodegradable plastic packaging market is fragmented as global players pivot towards harnessing readily available natural resources for innovative plastic packaging solutions. Significant investments in research and development heighten competition, driving players to introduce new products. Notable industry players include Tetra Pak International S.A. and Kruger Inc., Amcor Group, Mondi PLC, and FKuR Kunststoff GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Concerns Regarding Plastic Pollution

- 5.1.2 Stringent Regulations by Various Government and Federal Agencies

- 5.2 Market Restraint

- 5.2.1 High Costs regarding Production Compared to Normal Plastic

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Starch Based plastic

- 6.1.2 Cellulose Based Plastics

- 6.1.3 Polylactic Acid (PLA)

- 6.1.4 Polyhydroxyalkanoates (PHA)

- 6.1.5 Other Plastic Types

- 6.2 By Application

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Personal and Homecare

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International S.A.

- 7.1.2 Kruger Inc.

- 7.1.3 Amcor Group

- 7.1.4 Mondi PLC

- 7.1.5 International Paper Company

- 7.1.6 FKuR Kunststoff GmbH

- 7.1.7 DS Smith PLC

- 7.1.8 Klabin SA

- 7.1.9 Rengo Co. Ltd

- 7.1.10 Stavian Chemical