|

市场调查报告书

商品编码

1640576

美国无损检测设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)US NDT Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

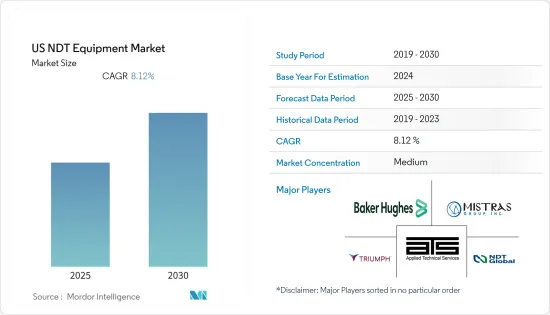

预测期内,美国无损检测设备市场预计将实现 8.12% 的复合年增长率

关键亮点

- 各行业优化维护活动以确保机器安全且高效运作是该地区无损检测设备市场成长的主要因素。

- 此外,汽车、基础设施、航太、发电、石化和机械产业是每个阶段都需要进行无损检测 (NDI) 的一些最终用户产业。通讯和医疗保健行业的技术进步主要推动了该市场的扩张。

- 技术进步促进了现代无损检测技术的发展,增强了故障隔离和安全性。此外,随着製造商对使用 NDT 的意识增强,预计未来几年 NDT 技术的采用将会有所改善。

- 然而,设备高成本、缺乏能够按照适当的参考标准进行测试并彻底解释结果的熟练技术人员,以及管道破坏的威胁日益增加,这些因素正在阻碍市场的成长。

- 自新冠疫情爆发以来,非破坏性检测设备市场成长放缓,预计这一趋势将持续下去。造成这种经济放缓的关键因素是世界各国广泛实施部分或全面封锁措施。

美国无损检测设备市场趋势

超音波检测推动成长

- 超音波检测是最常用的非破坏性检测技术之一。超音波检测机借助探头产生的高频声波对材料进行扫描。这些探头追踪从材料中返回的声波,然后设备显示观察以供检查。

- 检查混凝土材料品质和发现结构件损坏的有效无损检测技术是超音波脉衝速度(UPV)。近年来美国建筑业的扩张带动了设备销售额的增加。预计选举后的重点将放在建设新的基础设施和修復现有安全问题的现有资本资产。此外,预计官民合作关係(PPP)在关键基础设施计划中将会增加。

- 未来几年,佩科斯小径输油管计划、宾州酵母输油管计划、大西洋海岸输油管等管线建设计划将相继完工。未来几年,这些计划预计将大幅增加国内对超音波非破坏性检测设备的需求。

- 此外,与其他非破坏性检测设备相比,超音波检测设备的缺陷识别有效性和操作简便性是推动超音波检测在整个全部区域应用扩展的关键因素。

- 根据美国人口普查局的数据,2020 年新建商业建筑的价值已恢復到景气衰退前的水平,达到 799 亿美元。美国去年开工建筑金额估计为 1,350 亿美元。 2019年,私人办公室是全国使用最广泛的商业开发案。预计未来几年私人办公室、仓库和购物/零售中心将受到青睐。由于建筑业的不断增长,美国超音波非破坏性检测设备市场可能会成长。

电力和能源实现成长

- 这些已建成的工厂大多比较老旧,采用的材料、标准和零件都符合当时的工业规范,这增加了对非破坏性检测设备的需求。

- 确保压力容器、锅炉、热交换器、管道和管线等工厂设备的安全性、完整性和可靠性是电力产业无损检测应用的主要目标。由于这些材料通常在这些工厂设备的建造中发挥至关重要的作用,水泥建筑物的检查是工厂寿命评估的一个要素。

- 与核能发电厂不同,核电厂使用 NDT 技术来检查燃料棒、小型阀门、废弃物容器和废弃物管理基础设施,而电力产业则使用 NDT 技术来检查压力系统、蒸气涡轮和燃气燃气涡轮机。 。

- 此外,数位成像技术的使用和适应性的提高有望提高发电行业无损检测设备方法的成本效益。创新的 NDT 仪器方法还能够实现连续的资料收集、储存、线上检查以及增强的即时资料建模和资讯解释。这些策略正在为该行业创造更多机会。

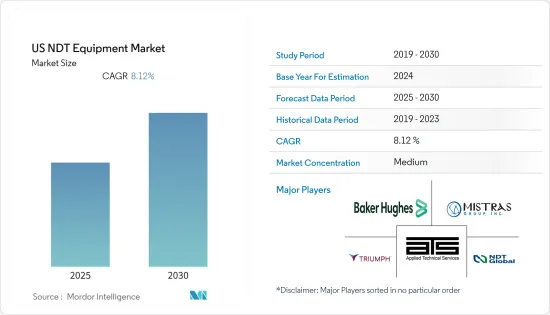

美国无损检测设备产业概况

美国无损检测设备市场处于中等整合状态,许多公司占有的市场占有率很小。推动市场区隔的关键因素是区域市场的成长和当地企业在外国直接投资的参与度不断提高。

- 2022 年 8 月-贝克休斯宣布已同意从 One Equity Partners 收购 BRUSH Group 的发电部门。 BRUSH 是一家成熟的设备製造商,专门从事工业能源领域的发电和管理。此次收购支持了贝克休斯的战略承诺,为天然气行业和历史上难以脱碳的领域提供脱碳解决方案。供应链,具体方式如下:扩大其在工业和能源领域客户计划的影响力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争强度

- 替代品的威胁

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 严格的法规要求安全

- 基础设施老化,维护需求增加

- 市场限制

- 缺乏熟练劳动力和培训设施

第六章 市场细分

- 依技术分类

- 射线检测设备

- 超音波检测设备

- 磁粉探伤机

- 液体液体渗透探伤设备

- 视觉检测设备

- 涡流检测设备

- 其他的

- 按最终用户产业

- 石油和天然气

- 电能

- 航太和国防

- 汽车与运输

- 建造

- 其他的

第七章 竞争格局

- 公司简介

- Baker Hughes

- Triumph Group

- Mistras Group Inc.

- NDT Global LLC

- Applied Technical Services

- TEAM Inc.

- NVI Nondestructive & Visual Inspection

- Innerspec Technologies Inc.

- TesTex Inc.

- National Inspection Services LLC

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 55139

The US NDT Equipment Market is expected to register a CAGR of 8.12% during the forecast period.

Key Highlights

- The aspect that has substantially contributed to the growth of the NDT equipment market throughout the region is the optimization of maintenance activities by various industries to maintain machine safety and effective performance.

- Moreover, The automotive, infrastructure, aerospace, power generation, petrochemical, and mechanical sectors are some of the end-user industries that demand non-destructive inspection (NDI) at each stage. Technological advancements in the telecommunications and medical industries are primarily driving the expansion of this market.

- Modern NDT techniques with enhanced fault identification and safety have been developed as a result of technological advancements. Furthermore, it is anticipated that improved adoption of NDT techniques in the upcoming years will result in manufacturers becoming more aware of the usage of NDT.

- However, the high cost of equipment and lack of skilled technicians who can conduct the test with the proper reference standards and thorough interpretation of the results, as well as an increase in pipeline sabotage threats, would hamper the market growth.

- The market for non-destructive testing equipment has experienced a slowdown in growth since the introduction of COVID-19, and this trend is anticipated to continue. The main cause of this slowdown is the widespread use of partial or total lockdowns in numerous nations worldwide.

USA NDT Equipment Market Trends

Ultrasonic Testing to Witness the Growth

- Ultrasonic testing is one of the NDT techniques that are most frequently utilized. With the help of probe-generated high-frequency sound waves, ultrasonic testing equipment scans the material. These probes track the return of sound waves from a substance, and instrumentation displays the findings for examination.

- An efficient nondestructive testing technique for checking the quality of concrete materials and spotting damage to structural elements is ultrasonic pulse velocity (UPV). Equipment sales have increased due to the expansion of the US construction industry in recent years. It was anticipated that there would be a focus on constructing new infrastructure and fixing current capital assets that create safety issues after the presidential election. Public-private partnerships (PPPs) are additionally anticipated to rise for significant infrastructure projects.

- Over the next few years, pipeline construction projects like the Pecos Trail Pipeline Project, Penn East Pipeline Project, and Atlantic Coast Pipeline are among those that will be finished. Over the following several years, it is anticipated that these projects will significantly increase demand in the nation for ultrasonic nondestructive testing equipment.

- Additionally, the effectiveness of defect identification and ease of operation of ultrasonic equipment, compared to other NDT equipment, are the primary factors driving the expanding use of the ultrasonic test method throughout the region.

- According to the US Census Bureau, with USD 79.9 billion reported in 2020, the value of new commercial buildings has returned to pre-recession levels. Construction starts in the United States are projected to be worth USD 135 billion in the last year. In 2019, private offices were the nation's most widely used commercial development. In the upcoming years, private offices, warehouses, and shopping/retail centers are anticipated to be preferred. The US ultrasonic NDT testing gear market may rise due to the expanding growth of the construction industry.

Power and Energy is to Witness the Growth

- Since most of these established plants are older and were built using materials, standards, and components that complied with industry norms at the time of construction, they exhibited an increased demand for non-destructive testing equipment.

- Assuring the safety, integrity, and dependability of plant equipment, such as pressure vessels, boilers, heat exchangers, pipework, and pipelines, is the primary goal of NDT applications in the power sector. As these materials frequently play a crucial role in constructing such plant equipment, inspecting concrete structures is a component of plant life evaluation.

- Unlike nuclear power plants, where NDT techniques are used to inspect rods, miniature valves, waste containers, and waste management infrastructure, the power industries use NDT techniques to check pressure systems, steam turbines, and gas turbines, which presents opportunities for market growth throughout the region.

- Additionally, it is anticipated that increased use and adaptability of digital imaging technology will improve the cost-effectiveness of NDT equipment approaches in the power generation sector. With innovative NDT equipment approaches, continuous data gathering, storage, online inspection, enhanced real-time data modeling, and information interpretation are also possible. More opportunities are being created in the industry thanks to these strategies.

USA NDT Equipment Industry Overview

The US NDT equipment market is moderately consolidated, with many businesses with a very small market share. The main elements fostering the market's fragmented nature are the growth of regional markets and the rising participation of local companies in foreign direct investments.

- August 2022 - Baker Hughes announced it has agreed to acquire the Power Generation division of BRUSH Group from One Equity Partners. BRUSH is an established equipment manufacturer specializing in electric power generation and management for the industrial and energy sectors. This acquisition supports Baker Hughes' strategic commitment to lead in providing decarbonization solutions for the natural gas industry, and historically hard-to-abate sectors with the company also plan to optimize its supply chain by leveraging BRUSH Power Generation's manufacturing base and expanding its scope on customer projects in both the industrial and energy sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Mandating Safety

- 5.1.2 Aging Infrastructure and Increasing Need for Maintenance

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Personnel and Training Facilities

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Radiography Testing Equipment

- 6.1.2 Ultrasonic Testing Equipment

- 6.1.3 Magnetic Particle Testing Equipment

- 6.1.4 Liquid Penetrant Testing Equipment

- 6.1.5 Visual Inspection Equipment

- 6.1.6 Eddy Current Equipment

- 6.1.7 Other Technologies

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power and Energy

- 6.2.3 Aerospace and Defence

- 6.2.4 Automotive and Transportation

- 6.2.5 Construction

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Baker Hughes

- 7.1.2 Triumph Group

- 7.1.3 Mistras Group Inc.

- 7.1.4 NDT Global LLC

- 7.1.5 Applied Technical Services

- 7.1.6 TEAM Inc.

- 7.1.7 NVI Nondestructive & Visual Inspection

- 7.1.8 Innerspec Technologies Inc.

- 7.1.9 TesTex Inc.

- 7.1.10 National Inspection Services LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219