|

市场调查报告书

商品编码

1939584

自动导引运输车(AGV):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

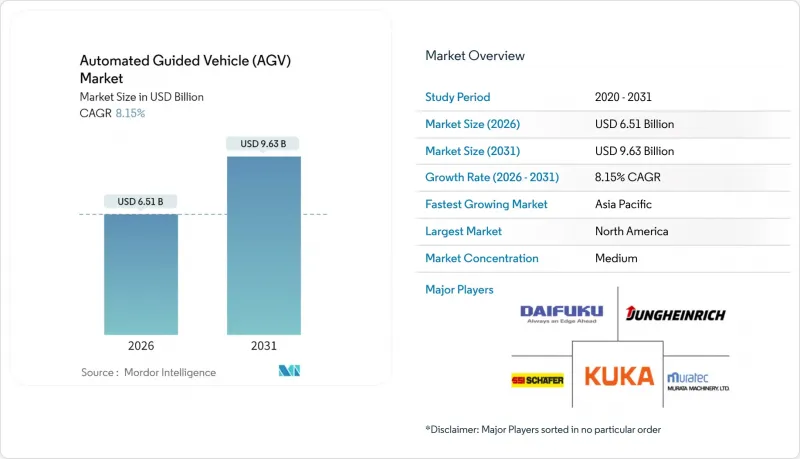

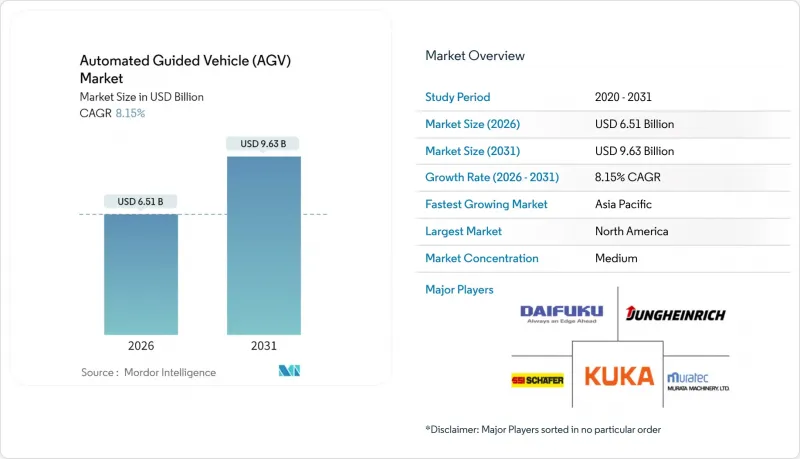

自动导引运输车(AGV) 市场预计将从 2025 年的 60.2 亿美元成长到 2026 年的 65.1 亿美元,预计到 2031 年将达到 96.3 亿美元,2026 年至 2031 年的复合年增长率为 8.15%。

这一成长趋势的驱动力来自电商订单的激增、持续的劳动力短缺以及对全天候无误物料搬运的需求。旺季订单量可成长300%至400%,远超传统的人工处理能力,促使业者转向自动驾驶车辆(AGV)。专用5G网路为AGV提供所需的确定性连接,与早期部署的Wi-Fi相比,可提高20%的生产效率并降低15%的资本支出。人工智慧驱动的导航,特别是视觉SLAM技术,可将部署时间缩短20%,并实现无需人工引导的布局重新配置。对网路安全的日益关注以及对稀土元素供应限制的担忧抑制了人们的热情,但迄今为止,这些风险都没有减缓采购步伐。

全球自动导引运输车(AGV)市场趋势与洞察

电子商务物流自动化快速成长

随着全通路零售的蓬勃发展,AGV市场正从提升效率扩展到业务永续营运领域。由于拣货作业约占仓库成本的55%,克罗格(Kroger)和奥卡多(Ocado)等大型零售商正将其机器人货物运输车队规模扩大四倍,以确保当日送达。 AGV与仓库管理软体的即时整合已将物料搬运成本降低了70%。得益于能够在狭窄通道中灵活穿梭的紧凑型AGV的出现,面积不足平方公尺的城市微型仓配中心如今已成为现实。模组化采购模式使小规模企业能够根据订单量的增长灵活增加车辆,从而避免前期投资。

人事费用上升和劳动短缺

仓储业的离职率持续超过75%,预计2030年全球整体劳动力缺口将达到8,500万人。在日本,由于劳动力供应链崩坏,售价1,500万日圆的自动堆高机(AGV)仍比人工堆高机更具竞争力。案例研究证实,AGV的投资回收期最短可达8个月,凸显了其卓越的内部报酬率(IRR)。全天候不间断的运作能够创造更多附加价值,而人机混合的劳动力模式则能提高吞吐量和员工满意度。劳动力短缺促使许多物流中心将AGV的应用从可选项转变为必选方案,推动了AGV市场的整体成长。

中小企业初始资本投资负担

初始实施成本从 5 万美元到 50 万美元不等,对于利润微薄的公司来说可能是一笔不小的负担,尤其是在藉贷成本高昂的情况下。然而,如果将 AGV 与物联网库存管理系统结合使用,在劳动密集型应用情境下,8 到 18 个月即可达到损益两平。机器人即服务 (RaaS) 模式显着降低了资本支出,并包含持续的技术支援。像 Agility Robotics 这样的供应商正凭藉其全方位服务合约主导。在北美和欧盟,高达 10% 的研发税额扣抵以及基于清洁行业准则的加速折旧计画进一步减轻了资本负担。儘管短期内存在一些摩擦,但资金筹措创新正使中小企业能够比以往任何週期更早进入自动驾驶汽车市场。

细分市场分析

到2025年,单元货载平台将占总收入的31.48%,凭藉其在多功能设施内移动托盘、货柜和周转箱的能力,将推动自动导引车(AGV)市场的发展。目前规模较小的自动堆高机预计将以8.54%的复合年增长率成长,这反映了市场对垂直运输能力以及与现有货架系统相容性的需求。牵引式堆高机在需要依序运输重型车架零件的汽车工厂中广受欢迎,而组装车辆在需要无尘操作的电子无尘室中也越来越受欢迎。

在寸土寸金的都市区,多层仓库正在兴起,而双模式(手动/自动)操作降低了变更管理的门槛,使得堆高机式车辆的需求日益增长。托盘搬运车式自动导引车是零售商入库货物处理自动化的第一步,而手推车和轻载型设计则非常适合高频次的电商拣货。此外,防爆型和医药级自动导引车也拥有持续的细分市场。这些趋势共同推动了自动导引车市场在所有产品线中的持续成长。

汽车製造商预计到2025年,AGV(自动导引车)将占其总收入的34.63%,他们正利用AGV实现准时组装并减少在製品库存。然而,随着当日送达成为消费者的一项基本需求,零售和电商配销中心预计将以8.18%的复合年增长率超越其他行业。食品饮料业者正在扩大AGV在冷藏区域的部署,以避免低温环境下的人手不足。同时,电子产品製造商正在使用AGV将精密子组件定位到毫米级精度,从而推动了自动导引车市场的广泛应用。

为回应药品良好分销规范 (GDP) 的要求,医药物流领域越来越多地采用自动导引车 (AGV)。第三方物流公司报告称,部署机器人车队后,人工工时减少了 42%。在航太领域,对飞机零件的公差控制要求极高,因此需要设计能够搬运超重型货物的 AGV。这些跨行业的变革表明基本客群正在扩大,从而增强了 AGV 市场,同时又不会增加对单一行业的依赖。

区域分析

预计到2025年,北美将维持AGV市场37.07%的收入份额,这主要得益于仓库工人超过25美元的时薪以及根深蒂固的电子商务网路对高速履约的需求。亚马逊和沃尔玛等主要客户已展现出大规模采用机器人技术的趋势,这正在重塑下游供应商生态系统。在美国,财政奖励、研发税额扣抵和特殊折旧计划确保了即使在利率上升时期也能持续的资本流入。同时,加拿大在冷链仓储和资源物流领域也看到了AGV应用的日益普及。

亚太地区预计将以8.36%的复合年增长率(CAGR)实现最快成长,直至2031年。这主要得益于中国「暗工厂」的推广以及日本人口结构变化导致的严重劳动力短缺。该地区拥有全球955个私有5G网路中的大部分,为对延迟敏感的AGV控制提供了连接优势。印度的生产关联激励计画和东协多元化的供应链正在创造更多适合自动化待开发区的全新项目。

欧洲预计将保持稳定成长,并专注永续性。欧盟委员会的《清洁工业转型指南》正在加速机器人设备的折旧免税额,并鼓励以更有效率的方式取代高能耗的人工作业。德国的汽车和机械产业正在采用以自动导引车(AGV)为核心的全面工业4.0架构,而英国则优先发展主要都会区週边的物流枢纽。中东、非洲和南美洲是新兴但极具吸引力的市场,采矿、港口和石化产业的安全效益足以支撑投资,从而推动全球自动导引运输车(AGV)市场的扩张。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务履约自动化快速成长

- 劳动成本上升和劳动短缺

- 人工智慧导航和感测器套件的进步

- 中小企业采用「暗仓」模式的趋势迅速成长

- 与专用 5G 网路整合以实现确定性控制

- 已开发市场中以ESG主导的自动化倡议

- 市场限制

- 中小企业初始资本投入高

- 多个领域的维修工程师短缺

- 车队管理软体中的网路安全责任

- 高扭力AGV马达稀土元素材料短缺

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济和疫情后因素的影响

第五章 市场规模与成长预测

- 依产品类型

- 自动堆高机AGV

- 牵引车/拖拉机/拖轮 AGV

- 单元货载AGV

- 组装AGV

- 托盘搬运车AGV

- 手推车和小载AGV

- 专用AGV

- 其他产品类型

- 按最终用户行业划分

- 车

- 食品/饮料

- 零售与电子商务

- 电子电器设备

- 製药和医疗保健

- 分销及第三方物流(3PL)

- 航太/国防

- 一般製造业

- 其他终端用户产业

- 按负载容量

- 低于500公斤

- 500~1,000 kg

- 1,000~2,000 kg

- 2000公斤或以上

- 透过使用

- 物料管理和运输

- 拣货和分类

- 拖车装卸

- 包装和托盘堆垛

- 组装工作

- 低温运输和冷藏保管

- 危险物品处理

- 按地区

- 北美洲

- 我们

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd.

- AutoStore AS

- BALYO SA

- Berkshire Grey, Inc.

- Clearpath Robotics Inc.

- Daifuku Co., Ltd.

- Dematic Corp.(KION Group)

- Elettric80 SpA

- FANUC Corporation

- Fetch Robotics, Inc.

- John Bean Technologies Corporation

- Jungheinrich AG

- KUKA AG

- Locus Robotics Corp.

- Mobile Industrial Robots A/S

- Murata Machinery, Ltd.

- Oceaneering International, Inc.

- Omron Adept Technologies, Inc.

- Scott Technology Limited

- Seegrid Corporation

- SSI SCHAFER Systems International DWC LLC

- Swisslog Holding AG

- System Logistics SpA

- Toyota Material Handling Co., Ltd.

第七章 市场机会与未来展望

The Automated Guided Vehicle market is expected to grow from USD 6.02 billion in 2025 to USD 6.51 billion in 2026 and is forecast to reach USD 9.63 billion by 2031 at 8.15% CAGR over 2026-2031.

Intensifying e-commerce order spikes, persistent labor shortages, and the need for round-the-clock, error-free material handling are underpinning this trajectory. Operators are turning to autonomous mobile fleets because peak-season order volumes can climb 300-400%, a level traditional manual processes cannot sustain. Private 5G networks now provide the deterministic connectivity AGVs require, delivering 20% productivity gains and 15% lower capex than Wi-Fi in early rollouts. AI-enabled navigation, most notably Visual SLAM, cuts commissioning time by 20% and allows layout re-configuration without physical guides. Heightened cybersecurity focus and looming rare-earth supply constraints temper enthusiasm, yet neither risk has slowed procurement to date.

Global Automated Guided Vehicle (AGV) Market Trends and Insights

Rapid Growth of E-commerce Fulfillment Automation

Omnichannel retail has pushed the automated guided vehicle market beyond efficiency gains and into business-continuity territory. Picking functions absorb roughly 55% of warehousing costs, prompting Kroger, Ocado and other large retailers to quadruple their fleets of goods-to-person robots to keep same-day-delivery promises. Real-time links between AGVs and warehouse-management software are trimming material-handling expenses by 70%. Urban micro-fulfillment sites, often below 1,000 m2, have become viable thanks to slimmer AGV form factors that maneuver in tight corridors. Modular procurement models allow smaller merchants to add vehicles as order volumes escalate, insulating them from large upfront bets. Collectively, these changes ensure the automated guided vehicle market continues scaling on the back of e-commerce growth.

Escalating Labor Costs and Workforce Scarcity

Warehousing attrition routinely exceeds 75%, and a global shortfall of 85 million workers is expected by 2030. In Japan, autonomous forklifts priced at 15 million yen still outcompete manual units because the labor pipeline is crumbling. Documented installations show payback in as little as eight months, strengthening the internal-rate-of-return case for AGVs. Round-the-clock operation without fatigue adds further value, while hybrid workforces pairing people with robots improve both throughput and job satisfaction. Labor scarcity therefore shifts AGV adoption from discretionary to mandatory in many distribution centers, powering growth across the automated guided vehicle market.

High Upfront Capital Expenditure for SMEs

Initial deployments range from USD 50,000 to USD 500,000 and can strain thin margins, especially where borrowing costs run high. Documented labor-intensive use cases, however, hit breakeven in 8-18 months when IoT inventory control accompanies the AGV rollout. Robots-as-a-Service models slash capex and embed ongoing technical support, with vendors such as Agility Robotics spearheading full-service contracts. R&D tax credits worth up to 10% and accelerated depreciation schedules under clean-industry guidelines further lighten cash burdens in North America and the EU. Despite near-term friction, financing innovations help SMEs enter the automated guided vehicle market sooner than in earlier cycles.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in AI-enabled Navigation and Sensor Suites

- Surge in "Dark Warehouse" Adoption Among SMEs

- Shortage of Multi-disciplinary Maintenance Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unit-Load platforms captured 31.48% of 2025 sales, anchoring the automated guided vehicle market with their ability to move pallets, containers and totes across multipurpose facilities. Automated Forklift models, though smaller at present, are projected for an 8.54% CAGR, reflecting demand for vertical-reach capability and compatibility with existing racking systems. Tow-tractor variants thrive in automotive plants where heavy framed components require sequential transfer, whereas assembly-line vehicles gain ground in electronics clean rooms that favor particle-free motion.

Demand is tilting toward forklift-style vehicles because multilevel warehouses proliferate in land-constrained cities and because dual-mode manual/autonomous operation eases change-management hurdles. Pallet-truck AGVs remain the first automation step for retailers handling inbound freight, while cart and small-load designs suit high-frequency e-commerce picks. Niche opportunities endure for explosion-proof and pharmaceutical-grade units. Collectively, these dynamics underpin sustained growth of the automated guided vehicle market across all product lines.

Automotive manufacturers owned 34.63% of 2025 turnover, using AGVs to feed just-in-time assembly and reduce work-in-process buffers. Yet retail and e-commerce distribution centers should outpace every other vertical at an 8.18% CAGR as same-day delivery becomes non-negotiable for consumers. Food-and-beverage operators extend AGV use into refrigerated zones to sidestep labor shortages in cold environments, while electronics producers exploit millimeter-level positioning for fragile sub-assemblies, reinforcing broader adoption in the automated guided vehicles market.

Pharmaceutical logistics increasingly turns to AGVs to comply with Good Distribution Practices, and third-party logistics firms report 42% labor-hour savings after installing robot fleets. Aerospace adopters demand tight tolerance handling for fuselage sections, spawning ultra-heavy-duty designs. These cross-industry shifts indicate a broadening customer base that strengthens the automated guided vehicle market without over-reliance on any single vertical.

The Automated Guided Vehicle (AGV) Market Report is Segmented by Product Type (Automated Forklift, Tow/Tractor/Tug, and More), End-User Industry (Automotive, Food and Beverage, and More), Payload Capacity (Less Than 500 Kg, 500-1, 000 Kg, 1, 000-2, 000 Kg, and More), Application (Material Handling and Transportation, Order Picking and Sortation, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.07% revenue share in 2025 in the AVG market due to hourly warehouse wages exceeding USD 25 and deeply entrenched e-commerce networks that demand high fulfillment velocity. Anchor customers such as Amazon and Walmart validate large-scale robotic deployments, which in turn create downstream supplier ecosystems. U.S. fiscal incentive, R&D credits and bonus depreciation schedules, ensure continued capital inflows even as interest rates rise, while Canada favors AGVs for cold-storage and resource-sector logistics.

Asia Pacific will log the fastest 8.36% CAGR through 2031, led by China's "dark factory" push and Japan's acute demographic-driven labor crunch. The region boasts the bulk of the world's 955 private 5G networks, a connectivity edge supporting latency-sensitive AGV controls. India's production-linked incentive schemes and ASEAN supply-chain diversification add new greenfield sites primed for automation.

Europe presents a steady, sustainability-oriented profile. The European Commission's Clean Industrial Transition guidelines extend accelerated depreciation to robotics, accelerating replacement of energy-intensive manual processes. Germany's automotive and machinery sectors adopt holistic Industry 4.0 architectures with AGVs at the core, while the United Kingdom prioritizes logistics hubs ringing major metropolitan areas. The Middle East, Africa and South America remain nascent but attractive for applications in mining, ports and petrochemicals where safety benefits justify investment, expanding the global automated guided vehicle market footprint.

- ABB Ltd.

- AutoStore AS

- BALYO SA

- Berkshire Grey, Inc.

- Clearpath Robotics Inc.

- Daifuku Co., Ltd.

- Dematic Corp. (KION Group)

- Elettric80 S.p.A.

- FANUC Corporation

- Fetch Robotics, Inc.

- John Bean Technologies Corporation

- Jungheinrich AG

- KUKA AG

- Locus Robotics Corp.

- Mobile Industrial Robots A/S

- Murata Machinery, Ltd.

- Oceaneering International, Inc.

- Omron Adept Technologies, Inc.

- Scott Technology Limited

- Seegrid Corporation

- SSI SCHAFER Systems International DWC LLC

- Swisslog Holding AG

- System Logistics S.p.A.

- Toyota Material Handling Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of e-commerce fulfillment automation

- 4.2.2 Escalating labor costs and workforce scarcity

- 4.2.3 Advancements in AI-enabled navigation and sensor suites

- 4.2.4 Surge in "dark warehouse" adoption among SMEs

- 4.2.5 Integration with private 5G networks for deterministic control

- 4.2.6 ESG-driven automation incentives in developed markets

- 4.3 Market Restraints

- 4.3.1 High upfront capital expenditure for SMEs

- 4.3.2 Shortage of multi-disciplinary maintenance technicians

- 4.3.3 Cyber-security liabilities in fleet management software

- 4.3.4 Scarcity of rare-earth materials for high-torque AGV motors

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Macroeconomic and Post-Pandemic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Automated Forklift AGVs

- 5.1.2 Tow / Tractor / Tug AGVs

- 5.1.3 Unit-Load AGVs

- 5.1.4 Assembly-Line AGVs

- 5.1.5 Pallet Truck AGVs

- 5.1.6 Cart and Small Load AGVs

- 5.1.7 Special-Purpose AGVs

- 5.1.8 Other Product Types

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Food and Beverage

- 5.2.3 Retail and E-Commerce

- 5.2.4 Electronics and Electrical

- 5.2.5 Pharmaceutical and Healthcare

- 5.2.6 Logistics and 3PL

- 5.2.7 Aerospace and Defense

- 5.2.8 General Manufacturing

- 5.2.9 Other End-User Industries

- 5.3 By Payload Capacity

- 5.3.1 Less than 500 kg

- 5.3.2 500 - 1,000 kg

- 5.3.3 1,000 - 2,000 kg

- 5.3.4 above 2,000 kg

- 5.4 By Application

- 5.4.1 Material Handling and Transportation

- 5.4.2 Order Picking and Sortation

- 5.4.3 Trailer Loading / Unloading

- 5.4.4 Packaging and Palletizing

- 5.4.5 Assembly Operations

- 5.4.6 Cold-Chain and Refrigerated Storage

- 5.4.7 Hazardous Materials Handling

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 AutoStore AS

- 6.4.3 BALYO SA

- 6.4.4 Berkshire Grey, Inc.

- 6.4.5 Clearpath Robotics Inc.

- 6.4.6 Daifuku Co., Ltd.

- 6.4.7 Dematic Corp. (KION Group)

- 6.4.8 Elettric80 S.p.A.

- 6.4.9 FANUC Corporation

- 6.4.10 Fetch Robotics, Inc.

- 6.4.11 John Bean Technologies Corporation

- 6.4.12 Jungheinrich AG

- 6.4.13 KUKA AG

- 6.4.14 Locus Robotics Corp.

- 6.4.15 Mobile Industrial Robots A/S

- 6.4.16 Murata Machinery, Ltd.

- 6.4.17 Oceaneering International, Inc.

- 6.4.18 Omron Adept Technologies, Inc.

- 6.4.19 Scott Technology Limited

- 6.4.20 Seegrid Corporation

- 6.4.21 SSI SCHAFER Systems International DWC LLC

- 6.4.22 Swisslog Holding AG

- 6.4.23 System Logistics S.p.A.

- 6.4.24 Toyota Material Handling Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment