|

市场调查报告书

商品编码

1685854

北美自动导引运输车(AGV) 市场:市场占有率分析、产业趋势、成长预测(2025-2030 年)North America Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

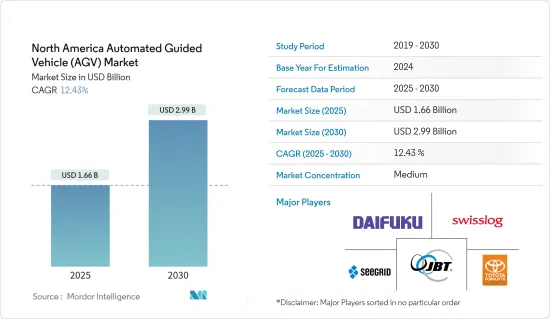

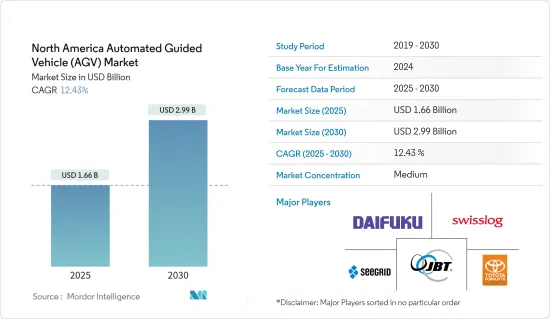

北美自动导引运输车市场规模预计在 2025 年为 16.6 亿美元,预计到 2030 年将达到 29.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.43%。

现代製造设施依靠最新的技术和创新来更快、更低成本地生产更高品质的产品。该地区正面临人才短缺的问题,因此采用更智慧的软体和硬体是当前竞争环境中生存的唯一途径。

主要亮点

- 自动导引车技术为製造商提供了许多关键且可衡量的优势,包括降低营业成本和提高材料吞吐量,但它还可以进一步发展。透过物料输送自动化优化第一英里可提高仓库盈利和客户满意度。

- 例如,XPO、UPS 和 DHL 等大型物流公司正在逐步实现履约中心的自动化,并且与依赖标准方法的公司相比,收益有所增加。

- 市场趋势表明,更多成熟且规模较小的公司正在转向涉及自动导引车 (AGV) 的解决方案。透过设计新型车辆并在人工智慧等领域取得技术突破,我们正在使 AGV 解决方案更加智能,并扩大 AGV 的功能范围。快速发展的电子商务领域和汽车产业的模式转移是其他关键驱动因素。

- 工业环境中的无线通讯系统还确保资讯在特定时限内发送和接收。然而,无线通道和介质存取控制(MAC)的特性引入了随机通讯延迟。这些延迟可能会导致自动导引车网路控制系统出现严重的效能问题。

- 此外,COVID-19 已经感染了美国许多重要工作人员,导致第一线组织实施新的安全流程。疫情过后,类似的措施也在陆续实施,各行各业对AGV的使用也正在推动AGV市场的成长,预计未来这种趋势将持续。

北美自动导引运输车(AGV)市场趋势

零售占据主要市场占有率

- 由于全球化、线上化、量贩店以及工厂和仓库的采用不断增加,零售业对自动导引运输车(AGV) 的需求正在成长。在电子商务市场中,服务品质和消费者满意度是主要的竞争因素。

- 每家公司都提供一日送达服务,但需额外收费。随着已开发经济体和新兴经济体可支配收入的增加,此类计画的商业性可行性正在显着提高。电商仓库正藉助AGV进行一日配送流程。

- 零售业引入 AGV 可使公司实现分类、拣选和码垛等物流任务的自动化,从而提高效率。随着行业现有企业寻求部署可靠的储存流程并提高效率,电子商务行业对 AGV 的使用正在显着增加。

- 例如,Movexx AGV1000 可以自动连接和断开带有两个旋转脚轮和固定脚轮的手推车,并且可以移动 1000 公斤的负载。它也是一款低维护机器,配备 36Ah 锂电池的快速更换电池系统,可快速轻鬆地充电。

- 亚马逊和沃尔玛等零售商正在仓库和零售店中使用行动机器人进行库存处理、扫描和清洁。自动导引车 (AGV) 需要与目前零售系统不可分割且相容的作业系统、资料收集和资料分析工具。

- 此外,根据加拿大统计局 (StatsCan) 的数据,加拿大电子商务零售额预计将在 2022 年 7 月达到 31.5 亿加元(23.6 亿美元),并在预测期内进一步增长,推动该地区市场的发展。

美国占很大份额

- 美国是全球最大、最发达的自动化解决方案市场之一。蓬勃发展的经济、港口运输量的大幅增长、电子商务的活性化以及推动製造业显着增长的关键製造业指标正在推动该国物流行业对自动化解决方案的需求。

- 零售、汽车、食品饮料和製药等行业是该国自动驾驶汽车的最大需求来源。食品和饮料是最大的产业,占美国每年包装运输量的35%以上。

- 这一因素导致对自动堆高机、单元货载自动导引车、标籤自动导引车、组装和广泛安装在食品和饮料製造设施中的专用产品等自动导引车设备的需求量很大。此外,严格的食品安全法规和对生产过程中低人为干预的偏好预计将在预测期内推动食品和饮料行业的成长。

- 在日本,製造业和生产业等中等技能的工作正在减少,而管理职缺和护理人员等高技能和低技能的工作正在增加。这种趋势现在通常被称为“工作两极化”,它正在推动许多重复性、手动性和低技能任务的自动化。

- 此外,低空置率和不断上涨的仓库租金正促使公司选择较小的地点出租作为仓储。为了优化这些密闭空间的生产力,预计公司很快就会采用更多自动化解决方案。

- 此外,根据美国商务部的数据,2022年第四季度,电子商务将占美国零售额的14.7%,高于上一季。 2022年10月至12月,美国零售电商销售额达到近2,620亿美元,创下有纪录以来的最高季度销售额。

北美自动导引运输车(AGV)产业概况

北美自动导引运输车市场竞争激烈,由多家大型公司组成。这些领先公司拥有强大的市场占有率,专注于併购、伙伴关係和扩大海外基本客群。我们也利用策略合作计划来提高盈利。

2023年3月,三菱Logisnext Americas集团宣布推出新型永恆力EKX 516ka/516a(AGV)自动高层架堆高机。它为高密度储存和窄巷道操作提供了强大且多功能的解决方案。它还拥有全自动全托盘储存和检索系统以及全天候运作,以最大限度地提高效率和生产力。

2023年1月,供应链效率、准确性和连接性的领导者Barcoding, Inc.宣布收购自动导引车(AGV)公司FRED Automation, Inc.,标誌着Barcoding, Inc.在工业自动化领域的持续扩张和扩大投资。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 电子商务蓬勃发展,自动化程度不断提高

- 海上应用需要自动化来提高终端效率

- 市场限制

- 由于通讯延迟导致的即时无线控制的限制

第六章市场区隔

- 依产品类型

- 自动堆高机

- 汽车牵引车/拖拉机/拖曳船

- 单元货载

- 组装

- 特殊用途

- 按最终用户产业

- 食品和饮料

- 车

- 零售

- 电子电器设备

- 一般製造业

- 製药

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章竞争格局

- 公司简介

- Amerden Inc.

- Swisslog Holding AG(KUKA AG)

- SSI Schaefer AG

- Daifuku Co. Ltd

- Jungheinrich AG

- Murata Machinery Ltd

- Dematic Group(Kion Group AG)

- Toyota Material Handling

- Transbotics Corporation

- John Bean Technologies(JBT)Corporation

- System Logistics SPA

- Seegrid Corporation

第八章投资分析

第九章:未来趋势

The North America Automated Guided Vehicle Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 2.99 billion by 2030, at a CAGR of 12.43% during the forecast period (2025-2030).

Modern manufacturing buildings rely on the latest technologies and innovations to create higher-quality products quickly and at a lower expense. Executing more intelligent software & hardware is the only way to stay in the present competitive scenario, as the region suffers from a human resources shortage.

Key Highlights

- Automated guided vehicle technology gives manufacturers many major and measurable benefits, like reduced operating costs and improved throughput of materials, but they can develop further. Optimizing the first mile utilizing material handling automation enhances a company's warehouse profitability and customer satisfaction.

- For instance, leading logistics companies, like XPO, UPS, & DHL, which have a large degree of automation in their fulfillment centers, are undergoing more increased revenues than companies relying on standard practices.

- The market trend indicates that more prominent and small companies are shifting to solutions involving automated guided vehicles (AGVs). Designing new vehicle types & technology breakthroughs in fields such as AI directs more intelligence in AGV solutions and extends the scope of what an AGV can do. The fastly developing e-commerce sector and the paradigm shift in the automotive industry are other significant driving factors.

- Wireless communication systems in industrial environments also ensure the information is sent & received within specific time bounds. However, the character of the radio channels and the medium access control (MAC) causes random communication delays. These delays can generate severe performance issues for networked control systems in automated guided vehicles.

- Moreover, COVID-19 infected many essential workers in the United States, resulting in organizations on the front lines enforcing new safety processes. Post-COVID-19, similar actions are being taken into action, in which using AGV across various industries is also of part helping the AGV market grow and is anticipated to grow.

North America Automated Guided Vehicle (AGV) Market Trends

Retail to Hold Major Market Share

- Globalization and online and bulk retail advancement have raised the need for automated guided vehicles (AGVs) in the retail industry owing to their growing installment in factories and warehouses. Service quality and consumer happiness are the primary competitive factors in the e-commerce market.

- Companies are delivering a single-day delivery option with certain extra charges. With increasing disposable revenue in advanced and emerging economies, the commercial viability of such schemes is rising significantly. E-commerce warehouses carry out the single-day delivery process with the help of AGVs.

- Installing AGVs in the retail industry has allowed companies to automate intralogistics tasks, such as sorting, selection, and palletizing, thus improving efficiency. The usage of AGVs by the e-commerce industry is growing substantially as industry incumbents try to roll out a reliable storage process and enhance efficiency.

- For instance, Movexx AGV1000 can automatically connect & disconnect trolleys with two swivels & fixed castors, capable of moving freight of 1000 kg. It is a low-maintenance machine with a fast-change battery system for 36 Ah lithium batteries, creating charging fast and easy.

- Retailers like Amazon and Walmart use mobile robots in their warehouses & retail stores for inventory handling, scanning, and cleaning. Automated guided vehicles (AGVs) require operating systems, data collection, and data-analysis tools that are vital and compatible with the current retail systems.

- Also, according to Statistics Canada (StatsCan), in July 2022, the e-commerce retail sales in Canada amounted to CDN 3.15 billion (USD 2.36 billion) and are anticipated to grow further during the forecasted period and drive the market in the region.

The United States to Hold Major Share

- The US is one of the biggest and most developed markets for automated solutions globally. The robust economy, with substantial port traffic, grown e-commerce activity, and critical manufacturing indices, all resulting in notable growth in manufacturing, drive the need for automated solutions around the logistics sector in the country.

- Sectors like retail, automotive, food and beverage, and pharmaceutical are the country's largest sources of demand for automated guided vehicles. Food and beverage is the largest industry, representing over 35% of US packaging shipments annually.

- This factor forms a substantial need for AGV equipment, like automated forklifts, unit load AGVs, tug AGVs, assembly lines, and special purpose products, broadly installed in food & beverage manufacturing establishments. Moreover, the strict food safety regulations & preference for lower human intervention in the production process are anticipated to grow the need for the food & beverage industry during the forecast period.

- The country is noticing a fall in middle-skill occupations, like manufacturing & production jobs, and growth in high & low-skill works, like managerial jobs on one end and jobs that aid or care for others. This trend is now popularly called job polarization, driving the adoption of automation of different repetitive, manual, and low-skill tasks.

- Additionally, due to low vacancies and a rise in the rental expenses of warehouses, enterprises are opting for smaller places to rent out for warehouse purposes. To optimize the productivity of these limited spaces, they are anticipated to install more automated solutions soon.

- Moreover, according to the US Department of Commerce, in the Q4 of 2022, the share of e-commerce in US retail sales stood at 14.7 percent, up from the last quarter. From October to December 2022, e-commerce sales of retail in the US hit almost USD 262 billion, the highest quarterly revenue in history.

North America Automated Guided Vehicle (AGV) Industry Overview

The North American automated guided vehicle market is competitive and consists of several major players. These major players with a prominent market share focus on mergers and acquisitions, partnerships, and expanding customer base across foreign countries. They are also leveraging strategic collaborative initiatives to increase their profitability.

In March 2023, Mitsubishi Logisnext Americas group announced the launch of its new Jungheinrich EKX 516ka / 516a (AGV) Automated High-Rack Stacker. It provides a powerful & versatile solution for high-density storage and narrow aisle operations. It also boasts a fully automated, full-pallet storage and retrieval system and 24/7 operation, maximizing efficiency and productivity.

In January 2023, Barcoding, Inc., a leader in supply chain efficiency, accuracy, and connectivity, announced its acquisition of FRED Automation, Inc., an automated guided vehicle (AGV) company, representing continued expansion and expansion investment in industrial automation for Barcoding, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth of E-commerce in Automation for Efficiency

- 5.1.2 Need for Automation in Maritime Applications for Improvement in Terminal Efficiency

- 5.2 Market Restraints

- 5.2.1 Limitation of Real-time Wireless Control Due to Communication Delays

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Automated Forklift

- 6.1.2 Automated Tow/Tractor/Tugs

- 6.1.3 Unit Load

- 6.1.4 Assembly Line

- 6.1.5 Special Purpose

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Automotive

- 6.2.3 Retail

- 6.2.4 Electronics and Electricals

- 6.2.5 General Manufacturing

- 6.2.6 Pharmaceuticals

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amerden Inc.

- 7.1.2 Swisslog Holding AG (KUKA AG)

- 7.1.3 SSI Schaefer AG

- 7.1.4 Daifuku Co. Ltd

- 7.1.5 Jungheinrich AG

- 7.1.6 Murata Machinery Ltd

- 7.1.7 Dematic Group (Kion Group AG)

- 7.1.8 Toyota Material Handling

- 7.1.9 Transbotics Corporation

- 7.1.10 John Bean Technologies (JBT) Corporation

- 7.1.11 System Logistics SPA

- 7.1.12 Seegrid Corporation