|

市场调查报告书

商品编码

1640586

北美酰胺纤维:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Aramid Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

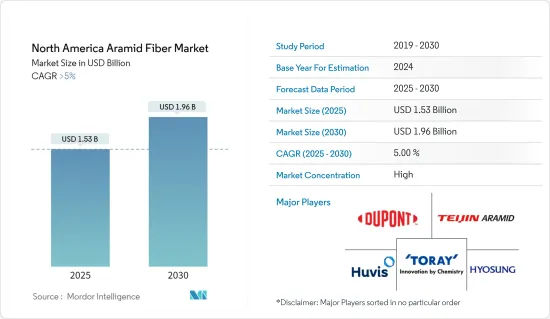

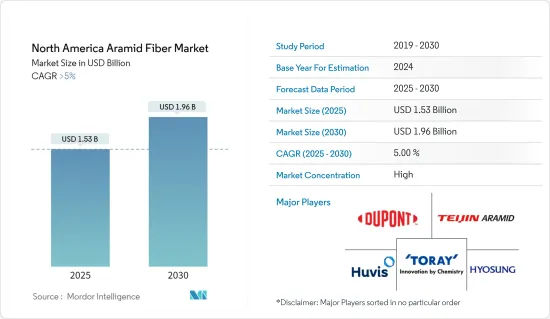

北美酰胺纤维市场价值预计在 2025 年将达到 15.3 亿美元,预计到 2030 年将达到 19.6 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

北美酰胺纤维市场受到了 COVID-19 疫情的不利影响。美国是受新冠疫情影响最严重的地区。新冠疫情导緻美国、加拿大和墨西哥等国停工,影响了汽车、电气电子、航太和国防终端用户产业,进而影响了酰胺纤维市场。然而,限制措施解除后,市场稳定回升。由于汽车、电气电子、航太和国防工业对酰胺纤维的消费量不断增加,市场出现了明显復苏。

关键亮点

- 短期内,预计市场将受到航太和国防工业轻量材料需求增加、汽车工业对轻量材料需求增加以及酰胺纤维作为钢铁材料潜在替代品使用量增加的推动。

- 酰胺纤维的非生物分解性质和原料价格的上涨阻碍了市场的成长。

- 预计芳香聚酰胺材料製造技术的进步将在预测期内为市场创造机会。

- 由于汽车、航太和国防以及电气和电子终端用户产业对酰胺纤维的需求不断增长,预计美国将占据市场主导地位。预计在预测期内,其复合年增长率也将达到最高。

北美酰胺纤维市场趋势

航太和国防终端用户产业占据市场主导地位

- 从热气球和滑翔机到战斗机、客机和太空梭,芳香聚酰胺被用于所有飞机和太空船的零件和结构应用中。酰胺纤维通常用于机翼组件、直升机叶轮、座椅螺旋桨以及仪器和内部组件的外壳。

- 在航太工业中,酰胺纤维在每一代新飞机的建造中都得到了越来越大的应用,以实现全天候运作并改善民航机的视觉系统。此外,温度稳定性和耐用性等特性可能会在未来几年进一步推动航太复合材料市场的成长。

- 美国是北美地区飞机OEM商最重要的市场之一。空中巴士和波音是全国最大的飞机製造商。例如,空中巴士将在2023年交付735架民航机,较2022年成长11%。总订单为 2,319 架飞机(净订单为 2,094 架),其中包括 1,835 架 A320 系列飞机和 300 架 A350 系列飞机。同样,波音公司已订单57 架波音 Max 8 的订单,预计交付为 2025 年。

- 根据美国运输统计局的资料,2022 年美国航空公司运送了 8.53 亿名乘客,比 2021 年的 6.74 亿名乘客增加 30%。因此,一些航空公司正在扩大持有并采购具有先进功能的飞机,以满足日益增长的航空旅行需求。

- 墨西哥是北美航太业的主要企业之一。墨西哥的航太产业目前生产从发动机、货舱门、机身、发动机部件、起落架组件到连接系统等飞机运行所必需的许多部件。

- 墨西哥的航空旅行正在增加。这导致该国对新民航机的需求增加。根据墨西哥航太工业联合会(FEMIA)预测,到2022年中期,墨西哥航太业将从2004年的100家製造公司和组织增加到368家。如今,这些公司主要包括民航机製造商以及维修、修理和大修设施(MRO)。

- 因此,航太和国防工业的成长预计将推动该地区酰胺纤维市场的发展。

美国主导市场

- 北美的酰胺纤维市场由美国主导。美国是成长最快的经济体之一,目前是世界上最大的生产国之一。该国的製造业对该国的经济贡献巨大。

- 美国是该地区酰胺纤维的重要市场之一。酰胺纤维用于各种终端用户产业,包括航太和国防。汽车、电器及电子设备、体育用品等。在美国,汽车和航太领域正在实现显着的市场成长,推动该国酰胺纤维市场的发展。

- 美国电子市场是世界上最大的市场,也是本次研究的主要潜在市场之一。美国製造工厂和开发中心的数量显着增加,主要专注于高端产品的开发。

- 在美国,电子产业技术进步和研发活动创新的快速步伐推动着对更新、更快的电子产品的需求。根据消费科技协会的数据,美国消费性电子产品/科技零售额预计将在 2022 年达到 5,050 亿美元,而 2021 年为 4,610 亿美元。销售额的成长是该国电子产业对酰胺纤维消费量增加的估计值。

- 美国汽车工业是仅次于中国的第二大汽车工业,是地区和全球汽车市场的主要贡献者。中国是主要汽车製造商的所在地,这些製造商生产并出口汽车到美洲、欧洲和亚太地区的其他经济体。

- 根据国际汽车製造商协会(OICA)预测,2022年该国汽车产量将达到1,006万辆,而2021年为90.6亿辆,成长率为10%。

- 总体而言,预计预测期内汽车和电子等行业的成长将推动该国酰胺纤维市场的发展。

北美酰胺纤维产业概况

北美酰胺纤维市场本质上是整合的。该市场的主要企业(不分先后顺序)包括杜邦、Huvis Corp、晓星、帝人芳纶和东丽工业公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 航太和国防工业对轻量材料的需求不断增加

- 汽车产业对轻量材料的需求不断增加

- 越来越多使用酰胺纤维作为钢材的替代品

- 限制因素

- 酰胺纤维非生物分解

- 原物料价格上涨

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 产品类型

- 对芳香聚酰胺

- 间芳香聚酰胺

- 最终用户产业

- 航太和国防

- 车

- 电气和电子

- 体育用品

- 其他终端用户产业(石油及天然气、通讯等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aramid Hpm, LLC.

- Bally Ribbon Mills

- Dupont

- Huvis Corp

- HYOSUNG

- KERMEL

- Shenma Industrial Co. Ltd.

- Teijin Aramid

- TORAY INDUSTRIES, INC.

- Yantai Tayho Advanced Materials Co.,Ltd.

第七章 市场机会与未来趋势

- 芳香聚酰胺材料製造技术的进展

- 其他机会

The North America Aramid Fiber Market size is estimated at USD 1.53 billion in 2025, and is expected to reach USD 1.96 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The North America Aramid Fibers Market had been negatively affected by the COVID-19 pandemic. The United States was worst hit by the COVID pandemic in the region. The COVID pandemic resulted in lockdowns in the United States, Canada, and Mexico, affecting the automotive, electrical and electronics, aerospace, and defense end-user industries, thereby affecting the market for aramid fibers. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of aramid fibers in automotive, electrical, and electronics end-user industries.

Key Highlights

- Over the short term, the increasing demand for lightweight materials in aerospace and defense industries, the increase in demand for lightweight materials in the automotive industry, and the rising usage of aramid fibers as a potential substitute for steel materials are excepted to drive the market.

- The non-biodegradable nature of aramid fibers and the increasing prices of raw materials are hindering market growth.

- The advancements in aramid materials manufacturing technology are expected to create opportunities for the market during the forecast period.

- The United States is expected to dominate the market due to the rising demand for aramid fibers from automotive, aerospace and defense, electrical, and electronics end-user industries. It is also expected to register the highest CAGR during the forecast period.

North America Aramid Fiber Market Trends

Aerospace and Defense End-User Industry to Dominated the Market

- Aramids are used for components and structural applications in all aircraft and spacecraft, ranging from hot air balloons and gliders to fighter planes, passenger airliners, and space shuttles. The aramid fibers are generally used in wing assemblies, helicopter rotor blades, seat propellers, and enclosures for instruments and internal parts.

- Every year, the aerospace industry uses a higher proportion of aramid fibers in constructing each new generation of aircraft due to the provision of an all-weather operation of commercial aircraft and enhanced vision systems. Moreover, characteristics such as temperature stability and durability will further fuel the growth of the aerospace composites market over the coming years.

- The United States is one of the significant markets for OEMs of airplanes in the North American region. Airbus and Boeing are the largest manufacturers of airplanes in the country. For instance, Airbus delivered 735 commercial aircraft in 2023, an 11% increase on 2022. 2,319 gross orders (2,094 net), including 1,835 A320 Family and 300 A350 Family aircraft. Similarly, Boeing Aeroplane OEM company received orders for 57 Boeing Max 8 jets, with delivery expected through 2025.

- According to data from the Bureau of Transportation Statistics, in 2022, airlines in the United States carried 853 million passengers at a growth rate of 30% compared to 674 million passengers in 2021. Thus, several airline companies are expanding their fleet and procuring aircraft with advanced capabilities to cater to the increasing air passenger demand.

- Mexico is one of the prominent players in the North American Aerospace Industry. Aerospace manufacturing in Mexico now produces everything from engines, cargo doors, fuselages, engine parts, landing gear assemblies, connection systems, and many other components essential for an aircraft to function.

- The number of passengers traveling by airplane is increasing in Mexico. Thus, the demand for new civil aircraft is increasing in the country. According to Mexican Aerospace Industry Federation, A.C. (FEMIA), Mexico's aerospace sector grew from 100 manufacturing firms and organizations in 2004 to 368 by mid-2022. Today these firms primarily include manufacturers and maintenance-repair-overhaul facilities (MROs) for civil aircraft.

- Thus, the aerospace and defense industry growth is expected to drive the region's aramid fibers market.

United States to Dominate the Market

- The United States dominated the aramid fiber market in the North American region. The United States is one of the fastest emerging economies and has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the significant contributors to the country's economy.

- The United States is one of the region's significant markets for Aramid Fibers. These are sued in various end-user industries such as aerospace and defense: Automotive, electric and electronics, and sporting goods. In the United States, the automotive and aerospace sectors registered significant market growth, thereby driving the market for aramid fibers in the country.

- The United States electronics market is the largest in the world, acting as one of the leading potential zones for the market studied. There is a significant increase in the number of manufacturing plants and development centers in the United States, primarily due to the focus on developing high-end products.

- In the United States, the rapid pace of innovation in terms of the advancement of technologies and R&D activities in the electronics industry is driving the demand for newer and faster electronic products. According to the Consumer Technology Association, the retail revenue from consumer electronics/technology sales in the United States was estimated at USD 505 billion in 2022, compared to USD 461 billion in 2021. the growth in sales is an estimation of enhanced consumption of aramid fibers from the electronics segment of the country.

- The automobile industry in the United States is the second-largest after China, contributing significantly to the regional and global automobile markets. The country houses major automakers producing and exporting vehicles to other economies in the Americas, Europe, and the Asia Pacific.

- According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), vehicle production in the country reached a total of 10.06 million units in 2022, compared to 9006 million units manufactured in 2021, at a growth rate of 10%.

- Overall, the growth of industries such as automotive and electronics will likely drive the market for aramid fibers in the country during the forecast period.

North America Aramid Fiber Industry Overview

The North America aramid fiber market is consolidated in nature. Some of the key players in the market (not in any particular order) include Dupont, Huvis Corp, HYOSUNG, Teijin Aramid, and TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Light Weight Materials in Aerospace and Defense Industries

- 4.1.2 The Increase in Demand for Light Weight Materials in Automotive Industry

- 4.1.3 The Rising Usage of Aramid Fibers as a Potential Substitute for Steel Materials

- 4.2 Restraints

- 4.2.1 Non-Biodegradable Nature of Aramid Fibers

- 4.2.2 The Increasing Prices of Rawmaterials

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Para-aramid

- 5.1.2 Meta-aramid

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Sporting Goods

- 5.2.5 Other End-user Industries (Oil & Gas, Telecommunication, etc.)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aramid Hpm, LLC.

- 6.4.2 Bally Ribbon Mills

- 6.4.3 Dupont

- 6.4.4 Huvis Corp

- 6.4.5 HYOSUNG

- 6.4.6 KERMEL

- 6.4.7 Shenma Industrial Co. Ltd.

- 6.4.8 Teijin Aramid

- 6.4.9 TORAY INDUSTRIES, INC.

- 6.4.10 Yantai Tayho Advanced Materials Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Aramid Materials Manufacturing Technology

- 7.2 Other Opportunities