|

市场调查报告书

商品编码

1640589

印尼纸包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Indonesia Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

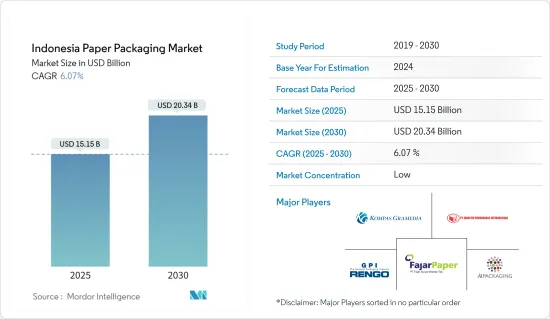

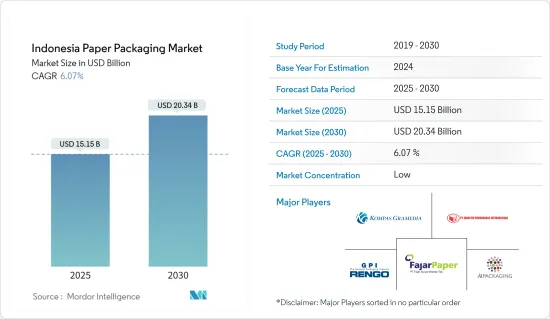

预计 2025 年印尼纸包装市场规模为 151.5 亿美元,预计到 2030 年将达到 203.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.07%。

主要亮点

- 印尼拥有众多造纸厂,提高了纸质包装材料的供应和可负担性,刺激了各行各业的需求。例如,根据Paper Desk 2023年11月的数据,印尼的纸浆和造纸业由112家公司组成,总生产量为纸浆1,145万吨、纸张2,065万吨,对该国经济做出重要贡献。

- 预计国内电子商务、食品宅配服务等产业将持续成长,纸浆和纸产品的消费量也可望增加。这将在全国范围内创造重要的市场进入和投资机会。

- 印尼纸包装行业的成长受到该国零售和电子商务行业的扩张以及对电子商务解决方案日益增长的需求的推动。据Trading Economics称,2024年2月,印尼的零售额年增6.4%,较上个月1.1%的增幅大幅恢復。

- 随着直接面向消费者的物流链变得越来越复杂,对经济实惠的瓦楞纸二次包装的需求也日益增长。电子商务货物在正常物流过程中预计要处理20次或更多。

- 随着线上零售商的销售额不断增长,他们自然需要更多的包装和运输用品。这是瓦楞包装市场当前和未来成长的原因之一。由于永续性的需求日益增长,瓦楞纸箱正成为线上交付管道的首选材料。

- 纸包装也广泛用于食品包装,因为它有永续环保并且方便消费者。折迭式纸盒、瓦楞纸箱等纸质包装产品是食品包装的理想选择,尤其是非油性产品。这些箱子以其坚固的结构而闻名,可以帮助企业可靠地运输食品。瓦楞纸箱将食物存放在干净、密封的容器中,最大限度地降低变质的风险。

印尼纸包装市场趋势

瓦楞纸箱有望大幅成长

- 城市人口不断增长、环保意识不断增强、公众对永续包装解决方案的需求不断增加、对便捷包装的需求不断增长以及电子商务活动日益增多等因素正在推动印尼瓦楞包装市场的增长。

- 由于对快速消费品和品牌耐用消费品的需求庞大,瓦楞纸包装的使用量正在增加。瓦楞纸板广泛应用于食品和饮料行业,包装麵包、零嘴零食、已调理食品(RTE)、肉品、水果、耐用消费品以及食品和饮料等加工食品。

- 例如,餐饮业使用瓦楞纸箱包装披萨。消费者生活方式的改变和对方便食品的需求不断增长,推动了对优质包装服务的需求,从而刺激了全国瓦楞纸行业的发展。

- 瓦楞包装在电子商务中发挥着至关重要的作用,它在运输过程中为产品提供强有力的保护,减少因包装篡改而导致的货物退货。根据国际贸易部2024年1月发布的报告,预计2023年印尼电子商务市场规模将达529.3亿美元,2028年将达到868.1亿美元。随着网路购物趋势的日益增长,预计未来几年对包装材料的需求也将同步增长。

食品和饮料行业预计将出现最高的市场成长

- 纸包装在食品领域有着广泛的应用。它既环保,又带给消费者方便。因此,食品和饮料行业在向消费者提供优质产品的公司之间面临激烈的竞争。我们拥有纸板、瓦楞纸箱等多种包装材料,可满足多种包装需求。

- 电子商务平台在印尼食品产业越来越受欢迎。因为他们提供各种食品并确保按时送达且包装完好。随着电子商务的扩张,食品包装的需求也预计将增加。创新的包装可以维持产品品质并延长保质期。

- 在国内,对软纸包装解决方案的需求主要由千禧世代的客户推动,他们更喜欢单份、便携的食品和饮料。挠性纸包装因其便携、耐用、重量轻的特点已成为包装这些产品的热门选择。国内食品饮料产业对软包装的需求可能主要集中在零嘴零食类,因为零食类是生鲜食品食品和包装食品中成长最快的。

- 人均收入的提高、都市化进程的加速和人口的年轻化预计将推动该国包装食品和食品饮料行业的崛起。这可能会刺激食品零售和餐饮业纸质包装的增加。人们对塑胶包装永续性的关注日益增加,纸包装将受益。

- 根据经济合作暨发展组织(OECD)的数据,到2031年,印尼的人均新鲜乳製品消费量将达到约5.01公斤。根据该机构的研究,儘管新鲜乳製品并不是日常饮食中的主要成分,但鲜牛奶、起司和优格等乳製品在中等收入的印尼人中很受欢迎。印尼乳製品消费量不断增长,加上消费者对永续包装解决方案的偏好,将推动纸质包装的采用,因为纸质包装具有新鲜度、保质期长和环保特性。

印尼纸包装产业概况

印尼的纸包装市场比较分散,少数几个主要的市场参与者占据了大部分市场份额。 SIG Group AG、PT Industri Pembungkus Internasional、PT Fajar Surya Wisesa Tbk、PT Metaform (Kompas Gramedia)、AR Packaging Group AB 和 Rengo 等市场参与者正在探索策略伙伴关係和联盟,以扩大市场占有率。

- 2024 年 1 月亚太资源国际有限公司 (APRIL Group) 的子公司 PT Riau Andalan Paperboard International 将开始试运行使用其新的价值 23 亿美元的纸板製造厂。这使得该工厂更接近今年稍后实现的全面商业化生产。新的板材厂彰显了亚太集团向下游多元化发展、进军高价值产品的策略,并实现永续业务成长。这项策略充分利用了我们作为一家提供全方位服务的纤维基消费品製造商的优势。

- 2024 年 5 月 - 国际展览主办单位 Krista Exhibitions 宣布,ALLPack Indonesia 2024 将与 AllPrint Indonesia Expo 2024 同期举办。活动定于10月在雅加达克马腰兰的雅加达国际博览中心(JIExpo)举行。第 23 届 ALLPack Indonesia 2024 将汇集各种加工和出口产品,满足各个行业的需求,包括食品、饮料、饼干、糖果零食、药品、传统草本饮料、化妆品、个人护理、美容、农业、电子产品和冷却器.专注于封装技术。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 对环保包装的需求不断增加

- 纸质容器在各行各业的应用日益广泛

- 市场挑战

- 原物料价格波动

第六章 当前贸易情势-进出口分析

- 瓦楞纸板原纸

- 废纸

第七章 印尼国家分析

- 主要宏观经济指标分析

- 监管和法律状况

- 经济成长主要贡献产业

- 外国公司进入印尼应关注的重要议题

第八章 印尼包装产业前景

第九章市场区隔

- 按类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他类型

- 按最终用户产业

- 饮食

- 卫生保健

- 个人护理

- 工业

- 其他最终用户产业

第十章 竞争格局

- 公司简介

- PT Industri Pembungkus Internasional

- PT Fajar Surya Wisesa TBK

- PT Metaform(Kompas Gramedia)

- AR Packaging Group AB

- Rengo Co. Ltd

- APP(Asia Pulp & Paper)

- PT Pabrik Kertas Indonesia(PT Pakerin)

- International Paper Company

- SIG Group AG

- Teguh Group

- PT Pura Barutama

第十一章 投资分析

第十二章 市场机会与未来趋势

The Indonesia Paper Packaging Market size is estimated at USD 15.15 billion in 2025, and is expected to reach USD 20.34 billion by 2030, at a CAGR of 6.07% during the forecast period (2025-2030).

Key Highlights

- The presence of numerous paper mills in Indonesia bolsters the availability and affordability of paper packaging materials, driving demand across diverse industries. For instance, as per Paper Desk in November 2023, Indonesia's pulp and paper industry consisted of 112 companies with a total capacity of 11.45 million tons of pulp and 20.65 million tons of paper, contributing significantly to the country's economy.

- Domestic industries like e-commerce and food delivery services, among others, will continue to grow over the coming years, and so will the consumption of pulp and paper products. This presents significant market entry and investment opportunities across the country.

- The increase in the paper packaging industry in Indonesia is driven by the expansion of the retail and e-commerce industries and the growing demand for eco-conscious packaging solutions in the country. According to Trading Economics, retail sales in Indonesia increased by 6.4% Y-o-Y in February 2024, sharply picking up from the 1.1% growth registered in the previous month.

- There is a growing need for affordable secondary corrugated board packaging since the logistics chain for direct-to-consumer delivery is getting more complicated. E-commerce shipments are anticipated to be handled up to 20 times or more during ordinary distribution.

- With online retailers' growing sales, they naturally need more packing and shipping supplies. This is one of the reasons for the current and future growth of the corrugated boxes market. Corrugated boxes are becoming the material of preference for online-based delivery channels due to the rising need for sustainability.

- Paper packaging also finds extensive application in food packaging as it is environmentally sustainable and convenient for consumers. Paper packaging products such as folding cartons and corrugated boxes are ideal for food packaging, specifically for non-greasy items. These boxes are known for their sturdy structures, allowing businesses to transport food products reliably. A corrugated box stores food in a clean and sealed container to minimize spoilage risk.

Indonesia Paper Packaging Market Trends

Corrugated Boxes Expected to Register Significant Adoption

- Factors such as rising urban populations, growing environmental consciousness, the nation's increasing demand for sustainable packaging solutions, the rise in demand for convenient packaging, and the expansion of e-commerce activities are accelerating the growth of the corrugated packaging market in Indonesia.

- The usage of corrugated boards for packaging is increasing due to the significant demand for fast-moving consumer goods (FMCG) and branded consumer durables. Corrugated boards are widely used in the food and beverage industry to package processed foods, including bread, snacks, ready-to-eat (RTE) meals, meat products, fruits, durable foods, and beverages.

- Foodservice establishments, for instance, use corrugated boxes to package pizza. The demand for high-quality packaging services has been driven by a shift in consumer lifestyles and the increased desire for convenience food, fueling the expansion of the corrugated board industry across the country.

- Corrugated packaging plays a crucial role in e-commerce by providing robust protection to products during transit, thus reducing shipment returns due to tampered packaging. According to the International Trade Administration's report published in January 2024, Indonesia's e-commerce market size was USD 52.93 billion in 2023 and is expected to reach USD 86.81 billion by 2028. With the rising trend of online shopping, a parallel increase in the demand for packaging materials is also expected over the coming years.

The Food and Beverage Industry is Expected to Exhibit the Highest Market Growth

- Paper packaging is being extensively used in the food segment. It is both environmentally beneficial and convenient for consumers. As a result, there is tremendous competition in the food and beverage industry among companies that provide high-quality products to consumers. Various packaging materials, such as cardboard and corrugated boxes, are available to satisfy multiple packaging needs.

- E-commerce platforms have gained much attention in the Indonesian food industry. This is because they offer various food products and ensure those are delivered on time and in proper packaging. With the expansion of e-commerce, the demand for food packaging is expected to rise. Innovative packaging preserves a product's quality and extends its shelf-life.

- Millennial customers in the country primarily drive the demand for flexible paper packaging solutions, as they favor single-serving and on-the-go food and beverage products. Flexible paper packaging is a common alternative for packing these products because it is meant to be portable, sturdy, and lightweight. The need for flexible packaging from the food and beverage industry in the country is likely to be governed by the fastest-growing categories of snack foods, both fresh and processed foods.

- The rising per capita income, increasing urbanization, and a high youth population are expected to boost the country's packaged food and beverage industry's rise. This will help fuel the increase in folding carton packaging in the food retail and restaurant industries. Paper packaging will benefit from growing concerns about the sustainability of plastic packaging.

- According to the Organization for Economic Co-operation and Development, the human consumption of fresh dairy products in Indonesia in 2031 will be around 5.01 kilograms per capita. The organization's study outlines that despite fresh dairy products not being a regular staple in the Indonesian daily diet, dairy products like fresh milk, cheese, and yogurt have gained traction among middle-income families. The rising consumption of dairy products in Indonesia intends to propel the adoption of paper packaging due to its freshness, preservation, and eco-friendly attributes, aligning with consumer preferences for sustainable packaging solutions.

Indonesia Paper Packaging Industry Overview

The Indonesian paper packaging market is fragmented due to several prominent market players holding the majority share. The market players, such as SIG Group AG, PT Industri Pembungkus Internasional, PT Fajar Surya Wisesa Tbk, PT Metaform (Kompas Gramedia), AR Packaging Group AB, and Rengo Co. Ltd, are considering strategic partnerships and collaborations to expand their market share.

- January 2024: PT Riau Andalan Paperboard International, a subsidiary of Asia Pacific Resources International Limited (APRIL Group), began commissioning its new USD 2.3 billion paperboard manufacturing plant. This move brings the facility closer to its anticipated full-scale commercial production, set for later this year. The new paperboard facility underscores APRIL Group's strategy of diversifying downstream into high-value-added products, aiming for sustainable business growth. This strategy capitalizes on the company's strength as a fully integrated producer of fiber-based consumer products.

- May 2024 - Krista Exhibitions, an international-scale exhibition organizer, announced that ALLPack Indonesia 2024 will take place alongside the AllPrint Indonesia Expo 2024. The event is scheduled for October at the Jakarta International Expo (JIExpo) center in Kemayoran, Jakarta. The 23rd edition of ALLPack Indonesia 2024 will highlight processing and packaging technologies catering to a diverse range of industries, including food, beverages, biscuits, confectionery, pharmaceuticals, traditional herbal drinks, cosmetics, personal care, beauty, agriculture, electronics, and coolers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Packaging

- 5.1.2 Increase in Adoption of Folding Carton by Different Industries

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Prices of Raw Materials

6 CURRENT TRADE SCENARIO - EXPORT/IMPORT ANALYSIS

- 6.1 Cartonboard

- 6.2 Recovered Paper

7 INDONESIA COUNTRY ANALYSIS

- 7.1 Analysis of Key Macroeconomic Indicators

- 7.2 Regulatory and Legal Landscape

- 7.3 Major Industries Contributing to Economic Growth

- 7.4 Key Imperatives for Foreign Companies to Establish a Presence in Indonesia

8 INDONESIA PACKAGING INDUSTRY OUTLOOK

9 MARKET SEGMENTATION

- 9.1 By Type

- 9.1.1 Folding Cartons

- 9.1.2 Corrugated Boxes

- 9.1.3 Other Types

- 9.2 By End-user Industry

- 9.2.1 Food and Beverage

- 9.2.2 Healthcare

- 9.2.3 Personal Care and Household Care

- 9.2.4 Industrial

- 9.2.5 Others End-user Industries

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 PT Industri Pembungkus Internasional

- 10.1.2 PT Fajar Surya Wisesa TBK

- 10.1.3 PT Metaform (Kompas Gramedia)

- 10.1.4 AR Packaging Group AB

- 10.1.5 Rengo Co. Ltd

- 10.1.6 APP (Asia Pulp & Paper)

- 10.1.7 PT Pabrik Kertas Indonesia (PT Pakerin)

- 10.1.8 International Paper Company

- 10.1.9 SIG Group AG

- 10.1.10 Teguh Group

- 10.1.11 PT Pura Barutama