|

市场调查报告书

商品编码

1640623

智慧家庭:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

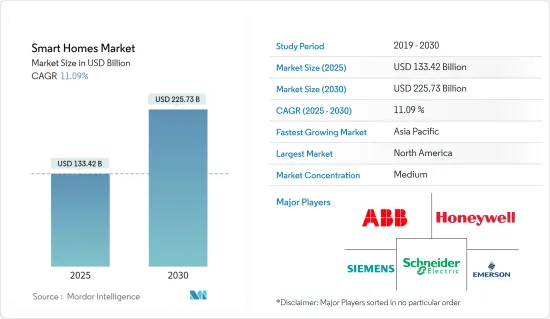

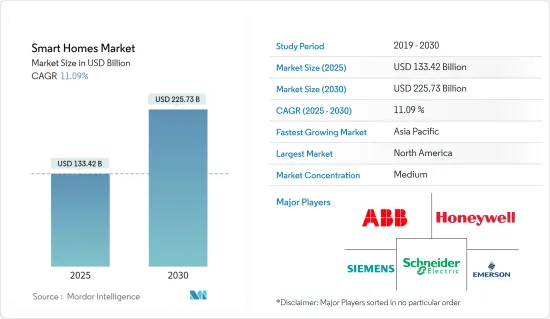

预计 2025 年智慧家庭市场规模为 1,334.2 亿美元,到 2030 年将达到 2,257.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.09%。

智慧家庭利用通讯网路连接各种家用电器。这些住宅配备了电子、照明和暖气系统,可透过智慧型手机或电脑进行远端控制、监控和存取。如今的智慧家庭还可以了解居住者的习惯并调整控制系统以简化日常业务。智慧型手机的快速普及、网路用户的增加以及人们对节能和低碳解决方案的认识的不断提高是推动该市场成长的一些主要趋势。

主要亮点

- 创新家居环境正在经历显着成长,连网灯泡、智慧扬声器和智慧锁等新一波智慧家居设备正在推动市场发展。近年来,智慧家庭和物联网设备领域的新兴企业数量激增,市场规模迅速扩大。由此产生的新兴企业涌入导致智慧家居设备价格显着下降,有助于推动其在各个地区的应用。

- 2023年1月,能源管理和自动化数位转型领导者Schneider Electric宣布推出Schneider家居。这种开创性的家庭电源管理解决方案满足了优先考虑节约、能源独立和舒适的住宅。施耐德家居包括用于能源储存的家用电池、电动车充电器、智慧电气面板、强大的太阳能逆变器以及连接的插座和电灯开关,所有这些都可以透过施耐德家居应用程式进行管理。这项综合解决方案旨在改变住宅与能源消耗互动和管理能源消耗的方式,促进更永续、更有效率的生活方式。

- 联网的能源管理设备增强了功能。在过去的两年里,智慧恆温器和智慧照明系统的需求激增。因此,这些进步预计将推动对安装服务的需求,从而促进市场成长。例如,ABB 于 2024 年 6 月推出 ReliaHome 智慧面板,标誌着其住宅能源管理软体平台在美国和加拿大的首次亮相。

- 5G技术的出现有望加速高效能、互联互通的智慧家庭生态系统的发展,为用户提供无缝、高速的连接。随着 5G 在许多地区的广泛部署以及 Wi-Fi 6 等连接技术的改进,智慧家庭设备将透过更快、更强大的网路连接在一起,从而实现云端处理和资料。。据爱立信称,预计2029年全球5G用户数将达到56亿人。

- 安全性是智慧家庭科技的重要趋势。一个安全通讯协定薄弱的智慧型设备可能会使整个生态系统面临风险。因此,安全已成为智慧家庭市场成长最快的领域之一。随着智慧锁、门铃和摄影机等连网安全设备的普及,这一趋势也随之出现。随着我们走向未来,越来越多的设备会不断追踪我们的活动,对这些设备采取先进安全措施的需求也日益增加。作为回应,这些互联繫统的设计人员和开发人员正在整合先进的身份验证方法。 Avira 的 SafeThings 路由器为您的家庭智慧系统提供支持,保护您免受网路攻击、间谍活动和其他潜在入侵。

- 儘管智慧家庭设备越来越受欢迎,但与之相关的高成本是一个重大挑战,并阻碍了市场的扩张。智慧家庭领域有许多製造商和产品,每个都可能使用不同的平台和通讯协定。这种碎片化,加上缺乏互通性,给消费者带来了很多麻烦。那些希望将来自不同製造商的设备整合到智慧家庭解决方案的人经常面临限制这些技术整体采用的挑战。

- 多种宏观经济因素正在影响市场成长。例如,COVID-19 疫情大大提高了人们对智慧家庭设备的认识。由于人们被限制在家中,他们可以更多地使用这些设备和技术。此外,新兴地区的经济成长也预计将推动市场发展。随着消费者消费能力的提高,他们对智慧家庭设备和智慧家庭概念的采用也会增加。

智慧家庭市场趋势

照明领域可望推动市场成长

- 随着对智慧家庭的需求不断增长,透过远端控制照明和线上通讯来实现住宅自动化正成为一种经济实惠的选择。不少公司正在创新智慧照明产品,并使其可供个人使用。先进的照明产品具有占用感应器、语音启动以及降低能耗和提高效率的功能。

- 随着全球经济努力解决能源浪费问题,人们明显转向采用智慧、节能的照明解决方案。世界各国政府主要透过执行能源效率标准的法规结构来推动 LED 的普及。例如,欧盟的能源标籤法规和生态设计指令为照明产品设定了严格的最低效率标准。这不仅确保在欧盟境内销售的产品符合高标准,而且还鼓励製造商进行创新,特别是在节能LED领域。此类监管措施并非欧盟独有,其他地区也制定了类似的法规,为研究领域的发展创造了有利的环境。

- 根据美国能源局的报告,照明约占典型家庭电力消耗的15%。这凸显了家庭透过简单升级节能照明就能节省大量开支。此外,美国能源局指出,家庭透过改用 LED 照明每年可节省约 225 美元。透过整合先进的照明控制系统等智慧组件,这些节省的成本将进一步增加,预计这将成为该领域成长的主要动力。

- 随着物联网 (IoT) 需求的激增,联网照明系统也将随之成长。照明市场主要企业飞利浦预测,未来5到10年,智慧照明将成为最具影响力的物联网设备。此外,物联网网路和高速资料连接的扩展将在未来几年推动对物联网照明解决方案的需求。

- 住宅设施越来越多地采用智慧照明,它可以即时调节氛围并智慧地回应居住者的活动。除此之外,智慧照明也被视为一种先锋应用,尤其是以人性化的照明。预计这些进步将在未来几年推动智慧家庭照明解决方案的采用。此外,市场扩张是由于此类智慧照明解决方案的接受度不断提高。根据消费科技协会 (CTA) 的数据,美国智慧灯泡和套件的销售额预计将在 2023 年达到 7.57 亿美元。

亚太地区市场将显着成长

- 预计预测期内亚太地区的智慧家庭应用将显着成长。这一趋势受到多种因素推动,包括生活水准的提高、可支配收入的增加以及智慧型手机和网路的广泛普及。此外,Siri 和 Alexa 等主导数位助理在日常业务中的应用越来越多,进一步推动了市场成长。

- 政府鼓励采用创新家庭技术的倡议极大地推动了市场成长。例如,东南亚国协近期看到中国加大对大型基础建设计划的投资。这些计划,如新克拉克城、新山森林城市、新马尼拉湾珍珠城、泰国东部经济走廊等,都融入了智慧城市元素,为市场拓展创造了有利环境,正在培育之中。

- 政府主导的智慧城市倡议也推动了智慧家庭需求的成长。例如,胡志明市正专注于先进技术,目标到 2025 年成为一座智慧城市。其他国家也出现了类似的趋势。例如,印度政府已经致力于智慧城市计画十多年。因此,这些趋势和发展也为研究市场的成长创造了有利的生态系统。

- 为了满足日益增长的需求,许多市场参与者正在推出针对住宅用户的解决方案以打入市场。此外,各本地公司也积极开发自己的产品,以在市场上站稳脚步。谷歌已推出智慧音箱,进入印度市场。这些扬声器不仅可以控制领先的家居产品,还可以与 Android 和 iOS 平台无缝整合。

- 同样,海信也在印度推出了最新空调系列。该公司推出了两个系列:IntelliPro 和 CoolingXpert。这些新空调具有 WIFI 语音控制和 5 合 1 转换专业等功能,让使用者可以轻鬆控制温度和模式。

智慧家庭产业概况

智慧家庭市场竞争适中,少数几家主要企业处于领先地位。儘管少数参与者占据了相当大的市场占有率,但整体格局仍然相当分散。关键岗位上的主要企业正在积极努力扩大他们的国际基本客群。透过建立策略联盟,我们的目标是增加市场占有率和盈利。其他主要企业包括 ABB 有限公司、施耐德电气有限公司、霍尼韦尔国际公司和西门子股份公司。

随着智慧家庭解决方案的需求不断飙升,新参与企业纷纷进入市场,各自试图凭藉自己的创新产品占有一席之地。现有参与者正在加强研发力度,以应对日益激烈的竞争。此外,该公司还利用其市场影响力和财务实力收购规模较小的公司,以进一步扩大其影响力。

管理智慧家庭市场的法律规范涉及隐私和资料保护、能源效率标准以及无线通讯协定合规性等关键领域。这些法规有多种目的,包括确保消费者安全、促进能源效率、保护个人资讯以及维护製造商之间的公平竞争。遵守这些法规将有助于企业增加消费者信任,为智慧家庭市场的创新和成长铺路。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

- 重点行业标准及政策

第五章 市场动态

- 市场驱动因素

- 对节能解决方案的需求不断增加

- 网路基础设施的扩展

- 新兴市场的经济成长

- 市场限制

- 安装和更换成本高

- 网路安全与资料外洩问题

第六章 市场细分

- 按组件

- 消费性电子产品

- 依产品类型

- 智慧音箱

- 智慧家庭剧院

- 智慧型净化器

- 其他家电

- 主要趋势分析

- 主要企业名单

- 门禁、安全与安保

- 按组件类型

- 硬体

- 软体

- 服务

- 依产品类型

- 智慧警报

- 智慧锁

- 智慧感测器

- 侦测器(包括烟雾侦测器)

- 智慧相机和监控系统

- 危险侦测/车库门操作器

- 其他产品类型

- 主要趋势分析

- 主要企业名单

- 照明

- 依产品类型

- 智慧照明

- 智慧灯具和智慧照明

- 环境照明

- 其他智慧家庭照明产品

- 主要趋势分析

- 主要企业名单

- 能源管理

- 依产品类型

- 智慧家庭照明能源管理

- 智慧家庭中央控制能源管理

- 智慧家庭 HVAC 能源管理控制

- 连结性别

- 无线通讯协定(Wi-Fi、ZigBee、Z-Wave、蓝牙等)

- 有线通讯协定

- 杂交种

- 主要趋势分析

- 主要企业名单

- 智慧家庭空调控制/HVAC 控制

- 依产品类型

- 扇子

- 散热器

- 恆温器

- 空调

- 主要趋势分析

- 主要企业名单

- 智慧家庭控制器/集线器

- 依产品类型

- DIY 轮毂/面板

- 商务用枢纽/面板

- 主要趋势分析

- 主要企业名单

- 智慧家庭医疗保健

- 依产品类型

- 医疗设备警报系统

- 智慧型血糖监测系统

- 智慧型心臟监护系统

- 按应用

- 跌倒预防和检测

- 医疗保健状况和监测

- 其他的

- 主要趋势分析

- 主要企业名单

- 智慧家庭厨房

- 依产品类型

- 智慧冰箱

- 智慧烹调器具和调理台

- 智慧洗碗机

- 智慧烤箱

- 其他的

- 主要趋势分析

- 主要企业名单

- 消费性电子产品

- 依住宅类型

- 单身的

- 多

- 按安装类型

- 新建筑

- 改装

- 按销售管道

- 在线的

- 离线

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- LG Electronics Inc.

- Cisco Systems Inc.

- Google Inc.

- Microsoft Corporation

- General Electric Company

- IBM Corporation

- Legrand SA

- Lutron Electronics Co. Inc.

- Samsung Electronics

- Control4 Corporation

- Assa Abloy

- Amazon.com. Inc.

- Apple Inc.

- Robert Bosch Smart Home GmbH

- Sony Corporation

- Faststream Technologies

- Simplisafe Inc.

- Ecobee

- 供应商排名分析

第八章:未来市场展望

The Smart Homes Market size is estimated at USD 133.42 billion in 2025, and is expected to reach USD 225.73 billion by 2030, at a CAGR of 11.09% during the forecast period (2025-2030).

Smart homes utilize a communication network to connect various appliances. These homes feature electronic devices, lighting, and heating systems that can be remotely controlled, monitored, and accessed via smartphones or computers. Today's smart homes can even learn residents' habits, adjusting control systems to simplify daily tasks. Key trends fueling the growth of this market include the swift adoption of smartphones, increasing internet user penetration, and heightened awareness of energy-saving and low-carbon emission solutions.

Key Highlights

- They are driven by a new wave of smart home devices-like connected light bulbs, smart speakers, and smart locks-and the innovative home landscape is witnessing significant growth. In recent years, a surge of emerging startups in the smart home and IoT gadget sectors has rapidly expanded the market. Consequently, this influx of startups has led to a notable drop in the prices of smart home devices, boosting their adoption across various regions.

- In January 2023, Schneider Electric, a leader in energy management and automation digital transformation, unveiled Schneider Home. This pioneering home power management solution caters to homeowners who prioritize savings, energy independence, and comfort. Schneider Home encompasses a home battery for clean energy storage, an electric vehicle charger, a smart electrical panel, a robust solar inverter, and connected electric sockets and light switches, all managed via the Schneider Home app. This comprehensive solution aims to revolutionize how homeowners interact with and manage their energy consumption, promoting a more sustainable and efficient lifestyle.

- Connected energy management devices offer enhanced functionality. Over the past two years, the demand for smart thermostats and smart lighting systems has surged, primarily due to their reputation for saving money and ease of use. Consequently, these advancements are anticipated to drive a demand for installation services, bolstering market growth. For example, in June 2024, ABB introduced the ReliaHome Smart Panel, marking its debut residential energy management software platform in the US and Canada.

- The emergence of 5G technology is expected to accelerate the development of interconnected and high-performance smart home ecosystems, providing users seamless and faster connectivity. Due to the significant rollout of 5G in various regions and improved connectivity technologies, such as Wi-Fi 6, smart home devices can be linked by more immediate, more powerful networks, meaning better credentials for processing and data resources in the cloud. According to Ericsson, global 5G subscription is anticipated to reach 5.6 billion by 2029.

- Security stands out as a pivotal trend in smart home technology. The vulnerability of even a single smart device, if equipped with weak security protocols, can jeopardize the entire ecosystem. Consequently, security emerges as one of the fastest-evolving sectors within the smart home market. This trend underscores the surge in popularity of connected security devices, such as smart locks, doorbells, and cameras. As we move towards a future where many devices are constantly tracking activities, there's an escalating demand for heightened security measures for these devices. In response, designers and developers of these interconnected systems are integrating sophisticated authentication methods. A case in point is Avira's SafeThings router, which fortifies a household's smart systems, safeguarding them from cyber-attacks, espionage, and other potential intrusions.

- Despite the growing popularity of smart home devices, their higher associated costs pose a significant challenge, hindering the market's expansion. Numerous manufacturers and products also populate the smart home landscape, each potentially utilizing distinct platforms and communication protocols. This fragmentation, coupled with a lack of interoperability, complicates consumer matters. Those aiming to integrate devices from various manufacturers into a cohesive smart home solution often encounter challenges, limiting the overall utilization of these technologies.

- Several macroeconomic factors influence the market's growth. For example, the COVID-19 pandemic significantly heightened awareness of smart home devices. As people were confined to their homes, their exposure to these devices and technologies increased. Additionally, the economic growth in emerging regions is expected to bolster the market. As consumers' spending capabilities rise, so will the adoption of smart home devices and the concept of smart homes.

Smart Homes Market Trends

Lighting Segment is Expected to Drive the Market Growth

- With the rise in demand for smart homes, it is affordable to automate homes by enabling remote controls for lights and online communications. Significant companies are innovating smart lighting products and making them available to individuals. Advanced lighting products are voice-activated with motion sensors and have features that reduce energy consumption and make them more efficient.

- As economies worldwide grapple with energy waste concerns, there's a notable shift towards adopting smart and energy-efficient lighting solutions. Governments are championing the cause of LED adoption, primarily through regulatory frameworks that enforce energy efficiency standards. For instance, the European Union's Energy Labelling Regulation and Eco-design Directive establish stringent minimum efficiency benchmarks for lighting products. This not only ensures that products sold within the EU meet high standards but also pushes manufacturers towards innovation, particularly in the realm of energy-efficient LEDs. Such regulatory measures aren't confined to the EU; other regions have instituted similar regulations, fostering a conducive environment for the growth of the studied segment.

- The US Department of Energy reported that lighting constitutes approximately 15% of a typical household's electricity consumption. This highlights the significant savings potential for families through a straightforward upgrade to energy-efficient lighting. Furthermore, the US Department of Energy notes that households can save around USD 225 annually by switching to LED lighting. These savings are further amplified with the integration of smart components, like advanced lighting control systems, poised to be a primary driver for the segment's growth.

- As the demand for the Internet of Things (IoT) surges, so does the growth of connected lighting systems. Philips, a major player in the lighting market, predicts that intelligent lights will emerge as the most influential IoT devices in the next five to ten years. Additionally, the expanding IoT networks and high-speed data connectivity are set to boost the demand for IoT-enabled lighting solutions in the coming years.

- Residential facilities increasingly adopt smart lighting to adjust ambiance in real-time, responding adeptly to occupant activities. Beyond this, smart lighting is evaluated for pioneering applications, notably human-centric lighting. Such advancements are poised to bolster the adoption of smart home lighting solutions in the coming years. Additionally, the market's expansion is fueled by a rising acceptance of these smart lighting solutions. As per the Consumer Technology Association (CTA), revenue from smart light bulbs and kits in the US was projected to hit USD 757 million in 2023.

Asia-Pacific to Experience Significant Market Growth

- During the forecast period, the Asia-Pacific region is set to experience significant growth in smart home adoption. This trend is bolstered by several factors: an enhanced standard of living, rising disposable incomes, and widespread access to smartphones and the Internet. Additionally, the increasing use of AI-driven digital assistants like Siri and Alexa for everyday tasks further fuels the growth of the market.

- Governments' initiatives promoting the adoption of innovative home technologies are significantly driving the market's growth. For example, ASEAN countries have recently witnessed increased Chinese investments in major infrastructure projects. These projects, such as New Clark City, Forest City Johor Bahru, New Manila Bay City of Pearl, and Thailand's Eastern Economic Corridor, incorporate smart city elements, fostering a conducive market expansion environment.

- Government-led smart city initiatives are also augmenting the boost in smart home demand. For instance, Ho Chi Minh City focuses on advanced technologies to become a smart city by 2025. A similar trend has been observed across other countries. For example, the Indian government has worked on its smart city initiative for over a decade. Hence, such trends and developments also create a favorable ecosystem for the growth of the market studied.

- In response to rising demand, numerous market players are introducing solutions tailored for residential users, aiming to bolster their market penetration. Additionally, various regional firms actively develop products to solidify their market foothold. Google made its foray into the Indian market with the launch of its smart speakers. These speakers not only control advanced home products but also seamlessly integrate with both Android and iOS platforms.

- Similarly, Hisense unveiled its latest air conditioner lineup in India. The company introduced two series: IntelliPro and CoolingXpert. These new air conditioners boast features like WIFI Voice Control and a 5-in-1 Convertible Pro, allowing users effortless control over temperature and modes.

Smart Homes Industry Overview

The smart homes market features a moderate level of competition, with several key players at the forefront. While a handful of these players command a significant market share, the overall landscape remains moderately fragmented. These leading companies, holding a central position, are actively working to expand their customer base internationally. They aim to bolster their market share and profitability by engaging in strategic collaborations. Notable players in this arena include ABB Ltd, Schneider Electric SE, Honeywell International, and Siemens AG, among others.

As demand for smart home solutions surges, the market sees an influx of newcomers, each aiming to carve out a niche with innovative offerings. Established players are ramping up their R&D efforts in response to this intensifying competition. Moreover, they're leveraging their market influence and financial strength to acquire smaller firms, further solidifying their presence.

The regulatory framework governing the smart home market addresses key areas such as privacy and data protection, energy efficiency standards, and adherence to wireless communication protocols. These regulations serve multiple purposes: ensuring consumer safety, promoting energy efficiency, safeguarding personal information, and maintaining fair competition among manufacturers. By aligning with these regulations, companies enhance consumer trust and pave the way for innovation and growth in the smart home market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

- 4.5 Key Industry Standards and Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy-efficient Solutions

- 5.1.2 Expanding Internet Infrastructure

- 5.1.3 Economic Growth of Emerging Markets

- 5.2 Market Restraints

- 5.2.1 High Installation and Replacement Costs

- 5.2.2 Issues Related to Cybersecurity and Data Breach

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Consumer Electronics

- 6.1.1.1 By Product Type

- 6.1.1.1.1 Smart Speaker

- 6.1.1.1.2 Smart Home Theater

- 6.1.1.1.3 Smart Purifier

- 6.1.1.1.4 Other Appliances

- 6.1.1.2 Key Trend Analysis

- 6.1.1.3 List of Key Players

- 6.1.2 Access Control, Safety, and Security

- 6.1.2.1 By Component Type

- 6.1.2.1.1 Hardware

- 6.1.2.1.2 Software

- 6.1.2.1.3 Services

- 6.1.2.2 By Product Type

- 6.1.2.2.1 Smart Alarm

- 6.1.2.2.2 Smart Locks

- 6.1.2.2.3 Smart Sensors

- 6.1.2.2.4 Detectors (Include smoke detectors)

- 6.1.2.2.5 Smart Cameras and Monitoring Systems

- 6.1.2.2.6 Hazard Detection/Garage Door Operators

- 6.1.2.2.7 Other Product Types

- 6.1.2.3 Key Trend Analysis

- 6.1.2.4 List of Key Players

- 6.1.3 Lighting

- 6.1.3.1 By Product Type

- 6.1.3.1.1 Smart Lighting

- 6.1.3.1.2 Smart Lamps & Smart Lumineries

- 6.1.3.1.3 Ambient Lighting

- 6.1.3.1.4 Other Smart Home Lighting Products

- 6.1.3.2 Key Trend Analysis

- 6.1.3.3 List of Key Players

- 6.1.4 Energy Management

- 6.1.4.1 By Product Type

- 6.1.4.1.1 Smart Home Lighting Energy Management

- 6.1.4.1.2 Smart Home Central Control Energy Management

- 6.1.4.1.3 Smart Home HVAC Energy Management Controls

- 6.1.4.2 By Connectivity

- 6.1.4.2.1 Wireless Protocols (Wi-Fi, ZigBee, Z-Wave, Bluetooth, Others)

- 6.1.4.2.2 Wired Protocol

- 6.1.4.2.3 Hybrid

- 6.1.4.3 Key Trend Analysis

- 6.1.4.4 List of Key Players

- 6.1.5 Smart Home Climate Control/HVAC Control

- 6.1.5.1 By Product Type

- 6.1.5.1.1 Fans

- 6.1.5.1.2 Radiator

- 6.1.5.1.3 Thermostats

- 6.1.5.1.4 Air Conditioner

- 6.1.5.2 Key Trend Analysis

- 6.1.5.3 List of Key Players

- 6.1.6 Smart Home Controllers/Hubs

- 6.1.6.1 By Product Type

- 6.1.6.1.1 DIY Hubs/Panels

- 6.1.6.1.2 Professional Hubs/Panels

- 6.1.6.2 Key Trend Analysis

- 6.1.6.3 List of Key Players

- 6.1.7 Smart Home Healthcare

- 6.1.7.1 By Product Type

- 6.1.7.1.1 Medical Device Alert Systems

- 6.1.7.1.2 Smart Glucose Monitoring System

- 6.1.7.1.3 Smart Cardiac Monitoring Systems

- 6.1.7.2 By Application

- 6.1.7.2.1 Fall Prevention and Detection

- 6.1.7.2.2 Healthcare Status and Monitoring

- 6.1.7.2.3 Others

- 6.1.7.3 Key Trend Analysis

- 6.1.7.4 List of Key Players

- 6.1.8 Smart Home Kitchen

- 6.1.8.1 By Product Type

- 6.1.8.1.1 Smart Refrigerators

- 6.1.8.1.2 Smart Cookware and Cooktops

- 6.1.8.1.3 Smart Dishwahers

- 6.1.8.1.4 Smart Ovens

- 6.1.8.1.5 Others

- 6.1.8.2 Key Trend Analysis

- 6.1.8.3 List of Key Players

- 6.1.1 Consumer Electronics

- 6.2 By Housing Type

- 6.2.1 Single

- 6.2.2 Multi

- 6.3 By Installation Type

- 6.3.1 New Construction

- 6.3.2 Retrofit

- 6.4 By Sales Channel

- 6.4.1 Online

- 6.4.2 Offline

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Argentina

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Schneider Electric SE

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 Siemens AG

- 7.1.6 LG Electronics Inc.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Google Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 General Electric Company

- 7.1.11 IBM Corporation

- 7.1.12 Legrand SA

- 7.1.13 Lutron Electronics Co. Inc.

- 7.1.14 Samsung Electronics

- 7.1.15 Control4 Corporation

- 7.1.16 Assa Abloy

- 7.1.17 Amazon.com. Inc.

- 7.1.18 Apple Inc.

- 7.1.19 Robert Bosch Smart Home GmbH

- 7.1.20 Sony Corporation

- 7.1.21 Faststream Technologies

- 7.1.22 Simplisafe Inc.

- 7.1.23 Ecobee

- 7.2 Vendor Ranking Analysis