|

市场调查报告书

商品编码

1640628

北美劳动力管理软体:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

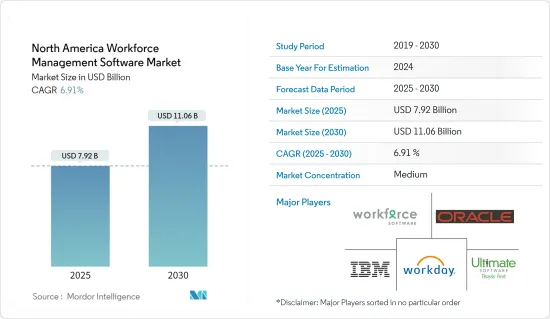

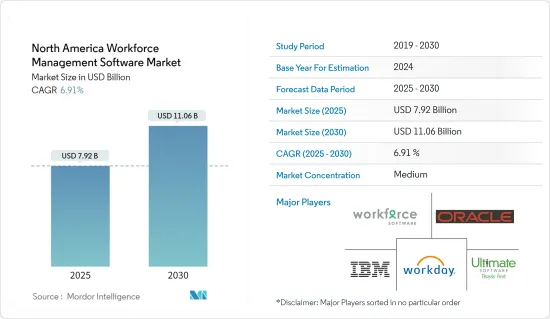

北美劳动力管理软体市场规模预计在 2025 年为 79.2 亿美元,预计到 2030 年将达到 110.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.91%。

过去几年,北美劳动力管理市场一直蓬勃发展。提高劳动效率和生产力是该地区最关注的问题。结果,该地区占据了相当大的市场占有率,交易量翻了一番,并超过了其他地区,成为零售创投市场的领先交易者。这一地位归功于美国和加拿大等国家。

主要亮点

- 劳动力管理软体透过有效管理工作计划、业务流程、人事费用和人才管理来优化组织绩效。

- 劳动力管理软体的主要目的是透过行动和桌面应用程式为业务指标提供可靠性。此外,这些解决方案透过简化业务运作和提高资料安全性为组织提供长期成本和资源效益。

- 此外,这些公司越来越多地采用解决方案来更好地管理员工和优化业务。像这样的应用程式就是为帮助您实现这一目标而设计的。製造业、旅游运输业和零售业正在迅速扩张,并在采用这些管理软体系统方面引领市场。

- 以前,资源管理都是手动使用电子表格进行的,这很耗时,而且容易出现资料不一致。将物联网查核点引入您的劳动力管理软体将增强您的技术能力并使您的工作更轻鬆。然而,将新的劳动力管理软体与现有的手动措施相结合并淘汰该系统仍然是大规模采用该系统并最终实现市场繁荣的重大障碍。

- 随着新冠疫情的爆发,该地区对劳动力管理的需求增加,促使企业利用管理软体提供的功能来管理远端功能。这也有助于提高劳动力管理软体在大众中的普及度,进而促进市场发展。

北美劳动力管理软体市场趋势

物联网 (IoT) 和云端基础的解决方案的日益普及预计将推动市场成长

- 劳动力管理软体的云端运算为客户带来了多种好处,包括灵活性、行动性和安全性。该软体使组织管理人员可以即时存取评估员工、生产力指标和设备所需的所有资讯。

- 此外,您可以根据管理员的位置进行修改并规划与劳动力相关的任务。这有助于远端工作,并在确定所需的技术规格和储存时为公司节省大量时间和金钱。

- 根据SWZD报告,今年,GigabitWi-Fi网路是北美组织已部署或计划在2023年部署的最受欢迎的资讯科技趋势,其次是IT自动化技术。

- 企业正在采用对其有利的服务和灵活的云端存取。Oracle公司将于 2022 年 4 月将Oracle Fusion Cloud Human Capital Management 引入其平台,以推动改善员工沟通、倾听、生产力和参与度,这就是我们为员工成功所做的努力。

- 私人公司透过私有云端提供这些软体解决方案,并提供多层次的实体和逻辑安全功能。对于流程透明度的日益增长的需求使行业受益,并且使其对软体的偏好超过了云端。

美国表现出惊人的成长率

- 提高生产力对于任何组织的成功至关重要。公司努力提高员工生产力、降低成本并提高业务流程的效率。

- 随着公司采用解决方案来管理员工和优化业务,这些应用程式旨在帮助他们实现这些目标。製造业、旅游运输业以及零售业正在迅速扩张。此外,在这些管理软体系统的采用率方面,我们在市场中处于领先地位。

- 根据国际劳工组织(ILO)的预测,2022年美国的就业与人口比率为59.70%。高就业率产生了对高效管理软体的需求。

- 美国占据了相当大的市场占有率,交易量翻了一番,超越了其他地区,确立了其在零售创投市场的领先地位。

- 这种全面的员工管理既避免了风险,也保证了公平,也提高了员工满意度。在零售市场,去年基础股票交易量大幅成长。

- 我们也注重提高劳动力的生产效率。劳动力管理软体有助于提高现有劳动力的效用,并提高几乎所有终端使用者产业的企业规模盈利。这巩固了其在该地区领先的市场占有率优势。

北美劳动力管理软体产业概况

北美劳动力管理软体市场半固体,主要企业包括 IBM Corporation、Workday, Inc.、WorkForce Software LLC、Oracle Corporation 和 Ultimate Software Group, Inc.市场参与者正在采用联盟、创新、併购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 10 月 - Workforce Software 利用 SAP Integration Suite,并在 SAP SuccessFactors 人力体验管理 (HXM) Suite 中推出了新的预建集成,该套件是 SAP 业务技术平台 (SAP BTP) 的一部分。

- 2022 年 11 月-IBM 与亚马逊网路服务 (AWS) 合作。今年早些时候,两家公司宣布 IBM 软体产品将作为软体即服务 (SaaS) 在 AWS Marketplace 上提供,使 IBM 解决方案更加容易存取。结果,客户报告了更好的业务成果。这种伙伴关係使客户更容易开展业务和获得利润。

- 2022 年 3 月 - ActiveOps 和 ReturnSafe 宣布建立策略伙伴关係,将 ReturnSafe 有效的疫苗接种、检测和个案管理功能与 ActiveOps 的混合劳动力智慧和规划解决方案相结合。此次伙伴关係将结合两家公司的技术和专业知识,以应对由疫情引起的不断变化的混合工作格局以及为保护人们免受病毒侵害而製定的各种通讯协定、规定和政策。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 物联网 (IoT) 和云端基础的解决方案的日益普及推动了市场扩张

- 中小企业越来越多地采用分析解决方案和 WFM 将推动市场成长

- 市场挑战

- 实施和整合问题阻碍市场

第六章 市场细分

- 按类型

- 劳动力调度和劳动力分析

- 考勤管理

- 绩效与目标管理

- 缺勤和休假管理

- 其他软体(疲劳管理、任务管理等)

- 依部署方式

- 本地

- 云

- 按最终用户产业

- BFSI

- 消费品和零售

- 车

- 能源与公共产业

- 卫生保健

- 製造业

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- IBM Corporation

- Workday, Inc.

- WorkForce Software LLC

- Oracle Corporation

- Ultimate Software Group, Inc.

- Kronos(US)Inc

- TimeClock Plus LLC

第八章投资分析

第九章:市场的未来

The North America Workforce Management Software Market size is estimated at USD 7.92 billion in 2025, and is expected to reach USD 11.06 billion by 2030, at a CAGR of 6.91% during the forecast period (2025-2030).

The North American workforce management market has thrived over the past few years. Increasing labor efficiency and productivity are this region's primary concerns. As a result, the region occupied a significant market share, with trade volumes increasing twice to move past other regions to establish itself as the leading trader in the retail venture market. This position can be attributed to countries like the United States and Canada.

Key Highlights

- Workforce management software optimizes organizational performance by effectively administering work schedules, business processes, labor costs, and talent management.

- The main goal of workforce management software is to lend credibility to business metrics through mobile and desktop applications. In addition, these solutions offer long-term cost and resource advantages to organizations by helping them streamline business activities and increase data security those benefits.

- Further, such enterprises are increasingly adopting solutions to manage their workforce better and optimize their operations; such applications are designed to help them achieve this goal. The manufacturing, travel and transport, and retail sectors are expanding rapidly, leading the market to adopt these management software systems.

- Previously, resource management was carried out manually or through spreadsheets, which could have been more time-consuming, leading to data discrepancies. Introducing IoT checkpoints to workforce management software eases the job by enhancing technological capabilities. However, integrating the new workforce management software with the existing manual measures and exiting the system still stands as a significant hurdle in the mass adoption of the system and hence, in the flourishment of the market.

- The region witnessed the demand for workforce management with the outbreak of the COVID-19 pandemic, with companies leveraging the features offered by the management software to manage remote functioning. This also boosted the market, helping increase the popularity of workforce management software among the masses.

North America Workforce Management Software Market Trends

Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expected to Drive the Market Growth

- Cloud computing in workforce management software offers customers several advantages, including flexibility, mobility, and security. The software gives the organization's administrator access to all information needed to evaluate an employee, productivity metrics, or device at any moment.

- Furthermore, modifications may be made depending on the administrator's location, or any workforce-related task can be planned. This contributes to remote working, saving significant time and money as the company determines the necessary technical specifications and storage.

- According to SWZD, in the current year, the most popular information technology trend either implemented or planned to be implemented in North American organizations in 2023 is gigabit Wi-Fi networking, followed by IT automation technology.

- Businesses are introducing services and flexible cloud access to benefit their companies. Oracle Corporation introduced a platform with Oracle Fusion Cloud Human Capital Management in April 2022, aiming for employee success by facilitating increased communication, listening, productivity, and engagement on the employee front.

- Companies provide such software solutions through the private cloud to provide multi-level physical and logical security features; as a result, private cloud investment is expanding. The growing requirement for process transparency benefits the industry and software preference via the cloud.

United States to Witness Significant Growth Rate

- Good productivity is crucial for the success of any organization. Enterprises are striving hard to enhance the productivity of their employees, reduce costs, and improve business process efficiency.

- Enterprises are increasingly adopting solutions to manage their workforce and optimize their operations; such applications are designed to help them achieve this goal. The manufacturing, travel and transport, and retail sectors are expanding rapidly. Moreover, they lead the market regarding the adoption rate of these management software systems.

- According to International Labour Organization, the estimated employment-to-population ratio in 2022 accounted for 59.70% in the United States. The significant employment rates also demand efficient software backing the management of the same.

- The United States occupied a significant market share, with trade volumes increasing twice to move past other regions to establish itself as the leading trader in the retail venture market.

- This holistic employee management avoids risk, ensures fairness, and drives employee satisfaction. The retail markets experienced a high-volume growth of the original stock volume last year.

- Also, the focus has been increased on improving the labor force's productivity. Workforce management software has helped increase the usefulness of the present labor force, adding profitability on a large scale through businesses belonging to almost all end-user industries. This has bolstered the region's dominance of a major market share.

North America Workforce Management Software Industry Overview

The North America Workforce Management Software Market is semi-consolidated with the presence of major players like IBM Corporation, Workday, Inc., WorkForce Software LLC, Oracle Corporation, and Ultimate Software Group, Inc.Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Workforce Software has launched its new prebuilt integration to SAP SuccessFactors Human Experience Management (HXM) Suite, leveraging SAP Integration Suite and forming part of the SAP Business Technology Platform (SAP BTP), Where A human resources technology provider, WorkForce Software looks to deliver an integrated employee experience and workforce management solutions for large, complex employers across the world

- November 2022 - IBM collaborated with Amazon Web Services (AWS). Earlier this year, the companies announced the availability of IBM Software products as Software-as-a-Service (SaaS) on the AWS Marketplace, making IBM solutions more accessible. As a result, clients reported better business results. The partnership makes it easier for them to build their businesses and profits.

- March 2022 - ActiveOps and ReturnSafe announced a strategic partnership to combine the effective vaccination, testing, and case management capabilities of ReturnSafe with ActiveOps' hybrid workforce intelligence and planning solutions. The partnership combines the technology and expertise of both companies to handle the ever-changing landscape of hybrid working due to the COVID-19 pandemic and the various protocols, mandates, and policies implemented to protect people from the virus.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market

- 5.1.2 Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Workforce Scheduling and Workforce Analytics

- 6.1.2 Time and Attendance Management

- 6.1.3 Performance and Goal Management

- 6.1.4 Absence and Leave Management

- 6.1.5 Other Software (Fatigue Management, Task Management, etc.)

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Consumer Goods and Retail

- 6.3.3 Automotive

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Workday, Inc.

- 7.1.3 WorkForce Software LLC

- 7.1.4 Oracle Corporation

- 7.1.5 Ultimate Software Group, Inc.

- 7.1.6 Kronos (US) Inc

- 7.1.7 TimeClock Plus LLC