|

市场调查报告书

商品编码

1640687

欧洲电缆管理:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Cable Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

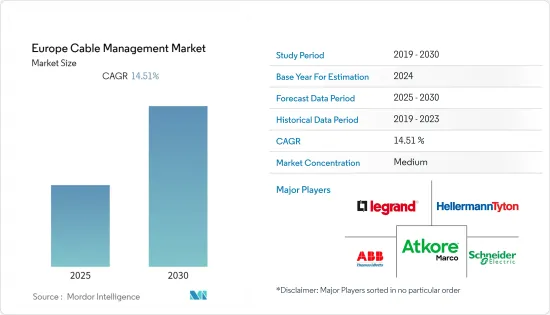

预测期内,欧洲电缆管理市场预计复合年增长率为 14.51%

关键亮点

- 可再生能源产量的增加、智慧电网技术蕴藏量的不断增长以及世界各国政府为升级配电系统和输电系统所做的努力正在推动所研究市场的发展。例如,2022年4月,西门子能源赢得了价值约19.5亿美元的NeuConnect计划合同,将在英国和德国之间铺设海底电力电缆。

- 此外,晶圆被纳入生产过程的主要原因是其平整表面的品质较高。预计对晶圆强化的投资将为欧洲电缆管理市场创造强劲的成长机会。

- 各地区的各公司都在加强自己的IT策略。例如,英国营运商BT集团最近开设了一个机器人研究设施,开发电讯和土木工程的自动化解决方案,以加速光纤部署。预计此类案例将在预测期内推动市场成长。

- 欧洲电缆管理市场的成长不仅受到元件小型化需求的推动,还受到其他因素的推动,例如对节能积体电路的需求不断增加、半导体技术的发展以及射频识别标籤的使用不断增加。

- 此外,高昂的维护成本也限制了薄晶圆加工及切割设备市场的发展。此类设备的演进对精度有很高的要求,因此其产量需要不断提高。

- 后疫情时代危机加速 许多国家对科技的需求不断增加,以创造更有效、更有效率的社会。此外,大容量网路的推出导致各个垂直领域的电缆安装变得复杂。因此,欧洲电缆管理市场受到日益增长的电缆控制需求的推动。

欧洲电缆管理市场趋势

IT 和电讯业正在推动市场

- 通讯电缆在使用光脉衝将资料从一个地方传输到另一个地方的过程中发挥着重要作用。这些电缆通常称为光纤电缆,由塑胶(玻璃)或纤维(线)製成。铜线用于透过塑胶或玻璃技术快速有效地传输资料。

- 此外,欧盟已采取多项重要倡议,加强多个领域的连结性。它取消了漫游费,允许消费者在全部区域使用行动电话订阅服务。 WiFi4EU倡议为当地社区提供了很大的帮助,使得安装 WiFi 热点成为可能。此外,欧盟还提案资助制定改善网路覆盖范围和在欧洲推出 5G 的技术指南,并为政府和企业提供专业知识。

- 此外,2023 年 3 月,法罗电信和爱立信进行了 5G 毫米波 (mmWave)频谱速度测试,在即时网路上实现了高达 6Gbps 的峰值下载速度。这是有史以来在欧洲即时网路上测得的最快速度。全国所有 18 个自治岛屿都将实用化这种多Gigabit毫米波技术,不仅提供多Gigabit速度,还提供都市区最高容量的行动宽频服务。

- 此外,5G网路应用正在迅速发展,其中IT连接器系统发挥关键作用。不断增加的讯号频率、资料速率、封装密度和讯号完整性要求推动了对高性能、高品质基板对基板互连解决方案的需求。此外,英国最大的通讯和宽频供应商之一 BT Group 采用了 Oracle Communications 的 CloudNative 融合策略管理,以优化整体网路资源并加速推出新的 5G 功能。该解决方案将使英国电信能够在 EE 的行动网路上测试并同时推出 5G 服务,包括 5G 直播和零距离内容。

德国占有较大的市场占有率

- 德国是欧洲非常重要的国家。在欧盟政策加强、能源消费量增加、生产线增加和建设活动活性化的背景下,对电缆管理系统的需求很可能会增加。根据联合国欧洲经济委员会的报告,过去十年,德国建筑业预计在2022年占GDP的6%,年增率达5.8%。

- 根据德国联邦统计局统计,去年德国共发放了约129,000套住宅和约29,000份已公布的建筑许可证。每种建筑类型发放的许可证数量都比往年增加。随着建设活动的增加,对电缆管理的需求也预计将增加。

- 随着电力供应地下电缆计划需求的不断增长,越来越多的公司签订了长期电缆供应合约。值得注意的是,2022 年 5 月,NKT 完成了德国 Suedlink 和 Suedostlink计划电力连接系统安装的准备工作。该供应商已与当地三家分包商签署协议,以支持即将实施的525kV高压直流电力电缆计划的实施。预计该电缆走廊将有助于将更多的可再生能源纳入电网。

- 此外,根据柏林meanstalten 的调查,67% 的家庭至少在一台设备上透过有线电视观看电视,而施莱德施吕塞尔施泰因、荷尔斯泰因、汉堡和梅克伦堡-前波美拉尼亚州这一比例为53%。随着越来越多的观众透过有线连接观看电视,预计未来几年市场将迎来巨大的成长机会。据德国媒体统计局报告称,2022年德国将有1,684万户家庭接入有线电视。

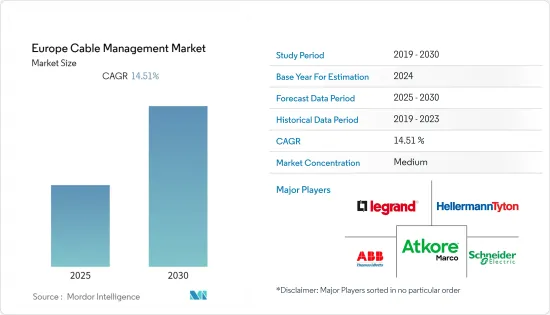

欧洲电缆管理产业概况

欧洲电缆管理市场竞争激烈,细分化程度适中。着名的市场参与企业包括 Thomas & Betts Corporation(ABB 集团公司)、施耐德电机 SE、Legrand SA、HellermannTyton 和 Marco Cable Management。这些大型製造商已经发现了尚未开发国家的潜在市场,并开始进入这些地区。

- 2022 年 7 月 - HellermannTyton 是紧固、识别、固定和保护电缆及其连接零件产品的领先供应商之一,现已扩大其 FCT 波纹管系列。最新的 FCT UV 用于布线和保护电气连接,旨在承受更高水平的紫外线照射。

- 2022 年 5 月 - 耗资 10 亿美元的凯尔特互连线计划将透过海底电缆将电力输送到爱尔兰海到法国,该计画已获得 AN BORD Pleanla 的规划许可。这条电缆将在法国北部布列塔尼海岸和科克海岸之间铺设,全长 575 公里。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 电缆管理市场的创新与发展

- 升级并更新新兴经济体的现有网络

- 市场限制

- 市场需求波动与客製化问题

第六章 市场细分

- 依产品类型

- 电缆配线架

- 电缆电气管槽

- 电缆导管

- 连接器和接地

- 电缆托架

- 电缆接头

- 接线盒/分配盒

- 其他产品类型(扎带、盖子、紧固件、夹子)

- 按最终用户产业

- 资讯科技/通讯

- 建造

- 能源公共产业

- 製造业

- 商业的

- 其他的

- 按应用

- 住宅

- 商业的

- 工业的

- 按材质

- 金属

- 非金属

- 氯乙烯

- PP

- PE

- 其他的

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他国家

第七章 竞争格局

- 公司简介

- Legrand SA

- Schneider Electric SE

- Thomas & Betts Corporation(ABB Ltd)

- Hellermann Tyton

- Eaton Corporation PLC

- Marco Cable Management

- Vantrunk International

- Panduit

- NIEDAX GROUP

- Leviton Manufacturing UK Limited

- TE Connectivity

- Hubbell

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 56990

The Europe Cable Management Market is expected to register a CAGR of 14.51% during the forecast period.

Key Highlights

- The growing renewable energy production, increasing reserves in smart grid technology, and government initiatives globally for upgrading distribution and transmission systems are driving the studied market. For instance, in April 2022, Siemens Energy was awarded a contract of approximately USD 1.95 billion for the NeuConnect project to lay undersea power cables between the United Kingdom and Germany that is likely to enable 1.4 gigawatts of electricity to pass in both directions between the U.K. and Germany.

- In addition, the primary reason for their increasing integration into the production process is the high quality of the flat surface of the wafers. The investment in the enhancement of wafers is expected to generate a strong growth opportunity within the European cable management market.

- Various companies in different regions have been bolstering their I.T. strategy. For instance, U.K. operator B.T. Group recently opened a robotic research facility that developed automated solutions for telecom and civil engineering to speed up fiber deployments. Such instances are anticipated to drive market growth over the forecast period.

- The growth of the cable management market in Europe, due to the requirement for miniaturisation of components, is also influenced by factors such as rising demand for highly energy efficient ICs, technological developments in semiconductors and increased use of radio frequency identification tags.

- In addition, high maintenance costs are restraining the development of the thin wafer processing and cutting equipment market. The evolution of such devices requires great precision, so their production could be improved.

- The Post COVID-19 crisis accelerated In a number of countries, demand for technology to create more effective and efficient society is increasing. In addition, complicated cable installations across a variety of vertical sectors have resulted from the deployment of high capacity networks. As a result, the market for cable management in Europe is being driven by an increased need to keep cables under control.

Europe Cable Management Market Trends

IT and Telecom Industry to drive the market

- The transmission of data from one location to another by means of light pulses has a significant role played by telecommunications cables. These cables, Widely known as optical fiber cables, are made of plastic (glass) or fibers (threads) .The modulated messages are sent over light waves from the package of glass threads. The copper wire is used for the quick and effective transmission of data by a plastic or glass technique.

- Moreover, several key steps have been taken by the EU to enhance connectivity in a number of areas. It abolished roaming charges and enabled consumers to make use of mobile subscription services throughout the region. Local communities were greatly helped by theWiFi4EU initiative, which enabled them to establish WiFI Hotspots. In addition, the European Union offers to finance and develop technical guidelines on improving network coverage and 5G deployment in Europe as well as providing expertise for governments and businesses.

- In addition, in March 2023, Faroese Telecom and Ericsson executed a speed test of a 5G millimeter wavemmWave spectrum to demonstrate the peak download speeds up to 6Gbps in live networks. In a live network across Europe, it is the fastest measured speed. In all eighteen selfgoverning islands of the nation, this multigigabit mmWave technology will be put into effect and provide mobile broadband services with maximum capacity as well as Multigigabit speeds in urban and rural areas.

- Moreover, 5G network applications are rapidly gaining momentum, and IT connector systems play a crucial role. Due to ever-higher signal frequencies, data rates, packing density, and signal integrity requirements, the need for high-performance and high-quality board-to-board connection solutions is also growing. In addition, Oracle Communications CloudNative Converged Policy Management has been preferred by BT Group, one of the UK's largest telecommunications and broadband providers to optimize overall network resources as well as accelerate deployment of new 5G capabilities. The solution will allow BT to test and launch 5G services on EE's Mobile Network, including live streaming and zeroed in content of 5G at the same time.

Germany to hold significant market share

- Germany is a very important country in Europe. It is likely that cable management systems will be required. grow in view of the strengthening of EU policies, rising energy consumption and a growing number of production lines along with additional construction activities. The UNECE report stated that, over the past decade, Germany's construction industry has grown to six percent of GDP in 2022, with a growth rate of 5.8% per year.

- Last year, according to the statistics bureau of Bundesamt, almost 129,000 dwellings and nearly 29,000 notified building permits have been granted in Germany. For both of these structures, the number of permits has been higher than in previous years. The demand for cable management will increase as a result of this increase in construction activity.

- Companies are increasingly entering into long term contracts to supply cables as demand for underground cable projects for power supply increases. In particular, in May 2022, NKT completed preparations to install the power link systems of both SuedLink and SuedOstlink projects in Germany. The supplier has signed contracts with three local subcontractors that will support the upcoming execution of the 525 kV HVDC power cable projects. The cable corridors will help integrate more renewable energy into the grid.

- Furthermore, according to the meanstalten in Berlin, 67% of households are watching television through a cable connection at least one device; whereas for Schleiderswlstein, Holstein, Hamburg, Mecklenburg West Pomerania, 53% of households have been watching TV via a cable connection on multiple devices. Significant growth opportunities are expected on the studied market in the coming years, due to an increasing number of viewers watching television over a cable connection. In Germany, 16.84 million households were connected to cable TV in 2022, as per a report of die medienanstalten.

Europe Cable Management Industry Overview

The Europe cable management market is competitive and moderately fragmented. Some prominent market players are Thomas & Betts Corporation (ABB group), Schneider Electric SE, Legrand SA, HellermannTyton, Marco Cable Management etc. These leading manufacturers have identified potential markets in underdeveloped countries and have started entering those regions.

- July 2022 - HellermannTyton, one of the significant suppliers of products for fastening, identifying, fixing, and protecting cables and their connecting components, has expanded its FCT convoluted tubing range. Its latest FCT UV is Used to route and protect electrical connections, which are designed to withstand increased levels of UV exposure an improved UV-resistant conduit

- May 2022 - The USD 1 billion Celtic Interconnector project, which will allow electricity to be exchanged using a subsea cable across the Irish Sea with France, has been given planning permission by AN BORD Pleanla. The power cable will run across the undersea for 575km between the Brittany coast, northern France, and the Cork coast.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovation and Development in the Cable Management Market

- 5.1.2 Upgrade and Renewal of Existing Networks in the Developed Economies

- 5.2 Market Restraints

- 5.2.1 Fluctuating Market Demands and Customization Issues

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Cable Trays

- 6.1.2 Cable Raceways

- 6.1.3 Cable Conduits

- 6.1.4 Connectors and Glands

- 6.1.5 Cable Carriers

- 6.1.6 Cable Lugs

- 6.1.7 Junction/Distribution Boxes

- 6.1.8 Other Product Types (Ties, Covers, Fasteners, and Clips)

- 6.2 By End-User Industry

- 6.2.1 IT and Telecommunication

- 6.2.2 Construction

- 6.2.3 Energy and Utility

- 6.2.4 Manufacturing

- 6.2.5 Commercial

- 6.2.6 Other End-User Industries

- 6.3 By Application

- 6.3.1 Residential

- 6.3.2 Commercial

- 6.3.3 Industrial

- 6.4 By Material

- 6.4.1 Metallic

- 6.4.2 Non-metallic

- 6.4.2.1 PVC

- 6.4.2.2 PP

- 6.4.2.3 PE

- 6.4.2.4 Other Materials

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Italy

- 6.5.5 Spain

- 6.5.6 Russia

- 6.5.7 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Legrand SA

- 7.1.2 Schneider Electric SE

- 7.1.3 Thomas & Betts Corporation (ABB Ltd)

- 7.1.4 Hellermann Tyton

- 7.1.5 Eaton Corporation PLC

- 7.1.6 Marco Cable Management

- 7.1.7 Vantrunk International

- 7.1.8 Panduit

- 7.1.9 NIEDAX GROUP

- 7.1.10 Leviton Manufacturing UK Limited

- 7.1.11 TE Connectivity

- 7.1.12 Hubbell

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219