|

市场调查报告书

商品编码

1640695

高级认证-市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Advanced Authentication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

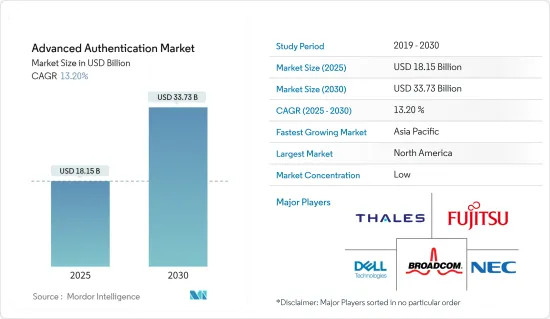

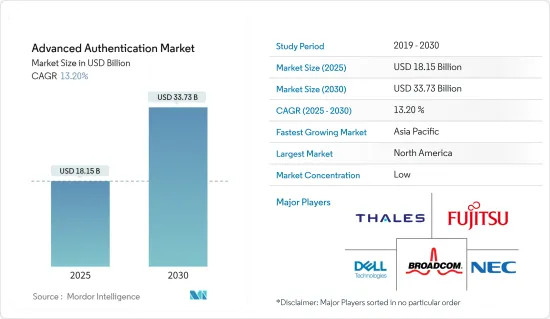

高级认证市场在 2025 年的价值预估为 181.5 亿美元,预计到 2030 年将达到 337.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.2%。

高阶身分验证市场受到行动性日益普及的推动,这意味着企业面临着向员工、合作伙伴和其他相关人员提供更敏感资讯存取权限的压力。安全威胁日益增加。骇客正在寻找窃取资料的新方法,并正在开发新的病毒来窃取企业和个人用户的机密资讯。由于现在大多数用户都喜欢线上交易,因此组织必须实施确保方便和安全存取的身份验证解决方案。

关键亮点

- 每个组织都需要一个可靠的安全系统来验证某件事的真实性或个人的身分。基本或传统密码可能会被破解、复製或共用,使资料面临被盗或被骇客攻击的风险。

- 行动性的不断提高也是推动高阶身分验证解决方案市场成长的因素。企业正感受到压力,需要让员工、合作伙伴和其他相关人员从任何地方、透过任何装置存取日益敏感的资讯。因此,先进的身份验证系统已成为公司组织策略的关键方面。

- 高级身份验证解决方案的供应商开发并改进了现有的身份验证方法。最常用的身份验证方法包括生物识别、智慧卡和令牌,从而降低了安全风险。

- 此外,公司也会自动为使用者启用双重认证,以增强安全性。例如,Google去年宣布了这项计划,并在新闻稿中指出,该计划已将因密码被盗而遭入侵的帐户数量减少了50%,并宣布将于2 月向超过1.5 亿用户推出这项服务2022.我已经为其启用了双重身份验证。该计划还呼吁为 200 万 YouTube 用户提供支援。

- 新冠肺炎疫情期间,网路犯罪者利用经济状况不确定性造成的焦虑和恐惧,迅速加强了攻击力度。国际刑警组织研究了新冠肺炎疫情对网路犯罪的影响,结果显示主要目标已从个人和小型企业转向大型企业、关键基础设施和政府。

POLITICO 分析发现,去年美国约有 5,000 万人的敏感健康资料遭到洩露,这一数字是过去三年的三倍。去年,除南达科他州外,每个州的医疗保健提供者和保险公司都报告了此类问题。这增加了未来几年对高级身份验证的需求。

高阶认证市场趋势

预测期内生物辨识技术将占据主要市场占有率

- 生物辨识技术根据指纹、视网膜、虹膜、手掌、声音或言语等人体特征对个人进行分析和验证。这种身份验证方法由于其主要优点而被广泛采用:它具有不可否认、不可转让和不可识别的特点,因此可以高度防范诈欺。

- 该技术已成功部署于各种终端用户,包括取证、政府、银行和金融机构以及企业身分管理。此外,指纹感应器在平价行动装置和政府国民身分证计画中的广泛应用也推动了人们对该技术的认识和采用。

- 2022 年 9 月,公路运输和公路部 (MoRTH) 发布通知,允许公民使用他们的 Aadhaar 数位身分证在线享受多项与交通相关的服务。以非接触式和无面对面的方式提供此类服务预计将大大节省时间,同时减轻公民的合规负担。

- 此外,2022年5月,万事达卡启动了一项制定生物识别标准的计划,让消费者只需微笑即可付款。该公司的生物辨识结帐计画是一个框架,为开发生物辨识付款认证服务的银行、商家和技术提供者制定技术安全和隐私标准。

- 此外,2022 年 6 月,国家资料库和註册局 (Nadra) 和首都发展局 (CDA) 签署了一项协议,以开发一套全面的生物识别系统,以确保伊斯兰堡的财产转移更加安全。该系统将有助于减少伊斯兰堡财产转移中的伪造行为,并消除非法手段和人员的欺骗行为。 CDA 每年发生约 20,000 笔房地产销售和转让交易。

北美占据主要市场占有率

- 美国各地的组织越来越依赖电脑网路和电子资料来进行日常业务,个人和财务资讯越来越多地在网路上传输和储存。人们越来越多地使用线上服务来进行日常交易。这就是为什么高级身份验证服务变得越来越重要。

- 此外,参与该国有组织犯罪的专业身分窃贼的手段日益精湛,加拿大企业有必要采取行动。此外,BYOD趋势越来越盛行,智慧卡、实体代币和关键绩效指标(KPI)等高级身份验证方法越来越多地被用于存取敏感资讯和登入客户端伺服器。

- 为了使身份验证更加安全,该地区的许多终端用户行业(包括银行、零售和医疗保健)正在为其线上和云端服务以及配备微晶片的信用卡和签帐金融卡添加双向身份验证系统。 。

- 2022 年 10 月,身分验证软体製造商 Mitek Systems 宣布推出采用多模态生物识别的无密码身分验证平台。该平台允许用户透过自拍或对着行动电话说话来存取自己的数位帐户。这些新兴市场的发展正在推动北美市场的发展。

此外,BIO-Key International Inc.宣布将于2022年5月升级BIO-Key MobileAuth,因此无需多种身分验证解决方案。新的生物识别和推送权杖认证选项支援更广泛的用例并解决传统身份验证的不足。

高级认证行业概况

高级认证市场竞争激烈,由几家大公司组成。从市场占有率来看,目前有少数公司占据市场主导地位。这些占据了绝对市场份额的大公司正致力于扩大海外基本客群。这些公司正在利用战略合作计划来增加市场占有率和盈利。

2022 年 10 月,NEC Malaysia 宣布 IRIS Corporation Berhad(IRIS)的子公司 IRIS Information Technology Systems Sdn Bhd(IITS)将为马来西亚国家综合移民系统(NIISe)实施边境管制解决方案和生物识别系统。作为技术合作伙伴

2022 年 10 月,Experian 与 Prove Identity Inc. 宣布建立全球伙伴关係,透过先进的身份验证技术推广金融包容性。该合作伙伴关係将使企业能够使用加密认证等先进的身份验证技术来快速且安全地验证更多消费者。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 政府法规和政策

- 技术简介

- 技术概述

- 如何部署

- 不同的身份验证方法

- 高级身份验证应用程式

第五章 市场动态

- 市场驱动因素

- 云端用户和资料中心数量不断增加

- 安全漏洞数量和相关成本增加

- 市场限制

- 升级和更换成本高

第六章 市场细分

- 身份验证方法

- 智慧卡

- 生物识别

- 行动智慧凭证

- 令牌

- 基于用户的公开金钥基础建设

- 其他身份验证方法

- 最终用户产业

- BFSI

- 医疗

- 政府

- 防御

- 资讯科技和电信

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Fujitsu Ltd.

- Thales Group(Gemalto NV)

- NEC Corp.

- Broadcom Inc.(CA Technologies)

- Dell Technologies Inc.

- Safran Identity and Security SAS

- Lumidigm Inc.

- Validsoft

- Pistolstar

- Securenvoy

第八章投资分析

第九章 市场机会与未来趋势

The Advanced Authentication Market size is estimated at USD 18.15 billion in 2025, and is expected to reach USD 33.73 billion by 2030, at a CAGR of 13.2% during the forecast period (2025-2030).

Factors driving the Advanced Authentication Market include increased adoption of mobility, and enterprises are feeling pressure to enable employees, partners, and other stakeholders to access more sensitive information. Security threats have been increasing continuously. Hackers are finding new ways to steal data, while new viruses are being developed to steal sensitive information from enterprises and individual users. With most users now preferring to perform transactions online, it becomes imperative for the organization to deploy authentication solutions that help ensure convenient and secure access.

Key Highlights

- Every organization needs a reliable security system to confirm the truth of something or a person's identity. Too often, the basic or traditional password method is broken, copied, or shared, putting data at risk of being stolen or hacked.

- The increased adoption of mobility is the other factor contributing to the growth of the market for advanced authentication solutions. Enterprises are feeling pressure to enable employees, partners, and other stakeholders to access more sensitive information from anywhere and on any device. This makes advanced authentication systems a critical aspect of an enterprise's organizational strategy.

- Vendors of advanced authentication solutions are developing and improving their existing authentication methods. Some of the most commonly used authentication methods are biometrics, smartcards, tokens, and several others for mitigating security risks.

- Further, companies are auto-enabling two-step verification for users for enhanced security. For instance, in February 2022, Google enabled two-step verification for more than 150 million users after announcing the effort last year and noting in a press release that the action had caused the number of accounts hijacked by password theft to decrease by 50%. The initiative has also involved requiring two million YouTube users to enable it.

- Cybercriminals have boosted their attacks at a rapid pace amid COVID-19, thereby exploiting the uncertainty and fear caused by the unstable social and economic situation. Interpol looked at how COVID-19 affected cybercrime and found that the main targets had changed from individuals and small businesses to large corporations, critical infrastructure, and governments.

Also, according to a POLITICO analysis, nearly 50 million people in the United States had their sensitive health data breached last year, a threefold increase in the last three years. Last year, these kinds of problems were reported by healthcare providers and insurers in every state except South Dakota. This increased the need for advanced authentication over the next few years.

Advanced Authentication Market Trends

Biometrics to Hold Significant Market Share During the Forecast Period

- Biometrics analyzes and authenticates individuals based on human physical characteristics, such as fingerprint, retina, iris, palm, speech, and voice, among others. This authentication method has been widely adopted, owing to its key advantages, namely its non-repudiation, non-transferable, and non-identifiable nature, thus providing a high level of protection against fraud.

- The technology has found successful implementation across various end-users, such as forensics, governments, banking and financial institutions, and enterprise identity management, among others. Moreover, the widespread availability of fingerprint sensors in affordable mobile devices and the government's national ID programs have increased awareness and adoption of this technology.

- In September 2022, The Ministry of Road Transport and Highways (MoRTH) issued a notification allowing citizens to access several transport-related services online with their Aadhaar digital ID. Providing such services in a contactless and faceless manner will go a long way in saving time for citizens while easing their compliance burden.

- Also, in May 2022, Mastercard launched a program to set biometric authentication standards, allowing consumers to pay with a smile. The company's Biometric Checkout Program is a framework to set technology security and privacy standards for banks, merchants, and technology providers developing biometric payment authentication services.

- Furthermore, in June 2022, National Database and Registration Authority (Nadra) and Capital Development Authority (CDA) signed an agreement to develop a comprehensive biometric verification system for safer property transfers in Islamabad. The system will help reduce forgery and eliminate deceptive attempts by illegitimate means or persons regarding the transfer of properties in Islamabad. Approximately 20,000 transactions of sale, purchase, and transfer of properties take place annually in CDA.

North America to Hold a Significant Market Share

- Organizations across the United States are increasingly dependent on computer networks and electronic data to conduct their daily operations, and growing pools of personal and financial information are also transferred and stored online. People are more likely to use online services for day-to-day transactions. This has made it more important for the country to have advanced authentication services.

- Moreover, the sophistication level of professional identity thieves involved in organized crime in the country continues to grow, creating a need for countermeasures to be used by companies in the country. Also, the BYOD trend is getting bigger and bigger, which makes it easier for advanced authentication methods like smart cards, physical tokens, and key performance indicators (KPIs) to be used to access sensitive information or log in to client servers.

- To make authentication more secure, many end-user industries across the region, such as banking, retail, and healthcare, have added two-way authentication systems to their online or cloud services, as well as credit and debit cards with microchips.

- In October 2022, Mitek Systems, an ID verification software maker, launched a passwordless authentication platform with multimodal biometrics. The platform enables users to access digital accounts by taking a selfie and speaking a phrase with their phone. Such developments are boosting the North American market under consideration.

Furthermore, BIO-Key International Inc announced that its BIO-Key MobileAuth will be upgraded in May 2022, eliminating the need for multiple authentication solutions. New biometric and push token authentication options to support a wider range of use cases and address the insufficiencies of traditional authentication.

Advanced Authentication Industry Overview

The advanced authentication market is highly competitive and consists of several major players. In terms of market share, few players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In October 2022, NEC Malaysia was selected as a technology partner for the implementation of its border Control Solution and Automated Biometric Identification System for Malaysia's National Integrated Immigration System (NIISe), IRIS Information Technology Systems Sdn Bhd (IITS), a subsidiary of IRIS Corporation Berhad (IRIS).

In October 2022, Experian and Prove Identity Inc announced a global partnership to further financial inclusion through advanced identity verification technology. The partnership will give more access to companies for advanced identity technology, such as cryptographic authentication, that they can use to verify more consumers in a quick and secure manner.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Government Policies and Industry Regulations

- 4.5 TECHNOLOGY SNAPSHOT

- 4.5.1 Technology Overview

- 4.5.2 Deployment Methods

- 4.5.3 Different Authentication Methods

- 4.5.4 Advanced Authentication Applications

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Number of Cloud Users and Data Centers

- 5.1.2 Increasing Number of Security Breaches and Related Costs

- 5.2 Market Restraints

- 5.2.1 High Upgrade and Replacement Costs

6 MARKET SEGMENTATION

- 6.1 Authentication Methods

- 6.1.1 Smart Cards

- 6.1.2 Biometrics

- 6.1.3 Mobile Smart Credentials

- 6.1.4 Tokens

- 6.1.5 User-based Public Key Infrastructure

- 6.1.6 Other Authentication Methods

- 6.2 End-user Industry

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Government

- 6.2.4 Defense

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd.

- 7.1.2 Thales Group (Gemalto NV)

- 7.1.3 NEC Corp.

- 7.1.4 Broadcom Inc. (CA Technologies)

- 7.1.5 Dell Technologies Inc.

- 7.1.6 Safran Identity and Security SAS

- 7.1.7 Lumidigm Inc.

- 7.1.8 Validsoft

- 7.1.9 Pistolstar

- 7.1.10 Securenvoy