|

市场调查报告书

商品编码

1640696

图形处理器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Graphic Processors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

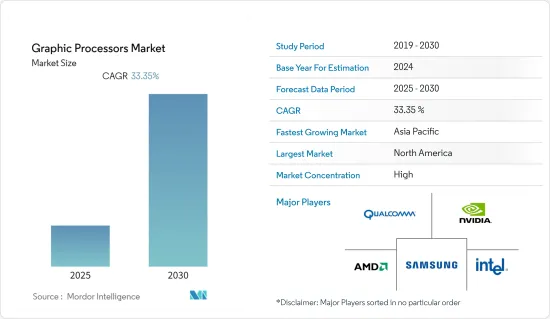

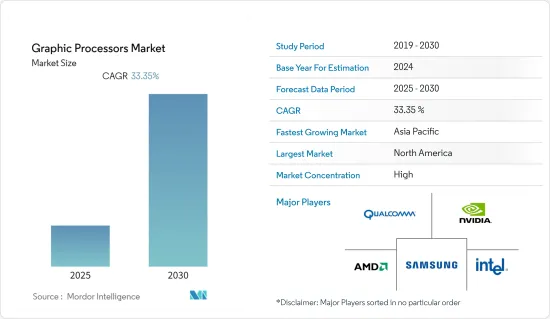

预计预测期内图形处理器市场将以 33.35% 的复合年增长率成长。

主要亮点

- 消费者在平板电脑、智慧型手机和笔记型电脑上的支出不断增加,正在扩大游戏应用市场,推动对能够提供高品质视觉效果和快速游戏应用的图形处理器的需求。

- 图形处理器市场的成长是由製造业、汽车业、房地产和医疗保健等各个行业对支援图形应用和 3D 内容的处理器的使用日益增加所推动的。例如,在汽车领域,CAD 和模拟软体使用 GPU 创建逼真的图像和动画来支援製造和设计应用。

- 地理资讯系统(GIS)和身临其境型多媒体的兴起也推动了图形处理市场的发展。智慧型手机、平板电脑和其他行动运算装置的普及,导致了诸如 GIS 之类提供即时空间和资料的应用程式的使用增加。 GIS 允许使用者产生查询、分析空间资讯、地图资料并提供输出。然而,为了提供即时讯息,行动运算设备正在采用大规模图形处理器。

- 元宇宙提供了增强的体验。人们在现实世界中可以进行的许多活动也可以在这个现实世界的虚拟表示中实现。为了使生态系统正常运转,平台、应用程式和服务之间的互通性至关重要,需要软体的进步来支援这一点。虽然软体是不同现实融合的关键支柱,但硬体对于人们与这种新的线上环境互动至关重要。

- 由于全身触觉和虚拟实境设备仍然可用,AR 和 VR 技术很可能成为人们在这段过渡时期体验元宇宙的主要方式。这为电子产业,尤其是 GPU 提供了巨大的潜力,可以引领一系列创新,帮助用户沉浸其中,同时利用并行性解决资料问题。

- 此外,无法在系统性能、效率和功耗之间取得适当的平衡也对市场成长构成了挑战。此外,预测期内工作站销量的下降可能会阻碍图形处理器市场的成长。

图形处理器市场趋势

游戏产业推动市场成长

- 游戏硬体市场规模庞大,涵盖所有平台,从手持设备到平板电脑、行动电话、个人电脑、主机、基于位置的游乐场和游戏厅。游戏机已经从在游戏厅、餐厅和酒吧中常见的功能强大的基于位置的机器发展成为专用游戏机、微型计算机,然后是个人电脑形式的家用机器。

- 游戏机使用两种类型的 CPU 处理器:ARM 和基于 x86 的机器。这些机器分为五个以上的平台,包括主机、笔记型电脑、桌上型电脑、行动装置以及在游乐场、餐厅、酒吧、游乐园、赌场和网咖/网咖中发现的各种类型的基于位置的设备。例如,AMD 已将 GPU 整合到其 x86 处理器中,并称为加速处理器单元 (APU)。

- 高效能游戏是游戏笔记型电脑的代名词。游戏笔记型电脑速度快、效率高,可以快速执行指令并快速执行。例如,就相对速度和整体效能而言,Nvidia GeForce RTX 3090(一款 Titan 级显示卡)提供了非常出色的效能。此外,它还很好地支援射线追踪和 DLSS,而无需降低游戏笔记型电脑上的图形设定。

- 但 Nvidia 也在技术方面投入巨资,为游戏玩家提供可自订的解决方案。该公司推出了一款名为「Titan RTX」的强大 GPU,它采用 Nvidia 的 Turing 架构,可提供 130 兆次浮点运算的深度学习效能和 11 GB 的射线追踪效能。 GPU 上的新 DisplayPort 专为下一代VR头戴装置而设计,只需一条线即可连接到 PC。

- 此外,硬体格局也在不断变化。例如,价格分布在 500 美元到 1500 美元之间的最新显示卡已经彻底改造,AMD 和 Nvidia 对其产品线进行了改进,以满足不断增长的 1440p 游戏市场的需求。 Nvidia 的新旗舰RTX 4090 在光栅密集型游戏中的速度比其前代旗舰RTX 3090 Ti 快2 倍,在完全光线追踪游戏中的速度比其前代旗舰RTX 3090 Ti 快4 倍,而RTX 4080 的速度则比其前代旗舰RTX 3090 Ti 快3 倍。

- 随着虚拟实境的復兴和扩增实境(AR)在游戏中的引入,游戏环境正在进一步扩大。例如,Niantic Labs 的《Pokemon Go》等 AR 游戏是基于位置的游戏,它使用谷歌地图来扩展充满 Pokemon 角色的神话世界。用户将在手机萤幕上探索新的小巷并寻找隐藏的人物,但最终要在现实世界中行走数公里。

亚太地区是一个快速成长的市场

- 预计中国、日本、新加坡和印度等新兴亚太国家将会出现较高的需求。这可以归因于行动运算设备日益普及以及该地区对游戏应用程式的高需求。

- 日本是全球第三大游戏市场,这得益于该国几家手机游戏公司的持续成功。日本玩家的花费比其他国家的玩家都多。日本玩家的平均支出约为西欧的2.5倍、北美的1.5倍。

- 中国透过引进璧人科技的BR系列,开发了自己的GPU运算引擎。中国现在将能够获得专用于图形和运算的本地 GPU,从而加剧激烈的 GPU 市场竞争。

- 总部位于上海的晶片製造商慕熙即将推出的专注于游戏的 GPU 预计将使中国走向全球并促进亚洲的成长。据称,该公司正在开发中国自己的 GPU,以满足中国不断扩大的高阶 PC 游戏产业的需求。专为游戏设计的 GPU 目前正在开发中,预计 2025 年发布。

- 物联网设备的日益普及,可以收集大量需要监控和分析的资料,这有效地增加了亚太汽车产业对高阶运算系统的需求。

- 此外,中国、印度、日本和新加坡等国家正经历技术增强的模式转移。因此,该地区的智慧型装置销量最高,包括智慧型手机、平板电脑、PlayStation 和游戏电脑。此属性解释了对图形处理器日益增长的需求。

图形处理器产业概况

随着主要市场参与者采用新策略来改进其製造技术并扩大产品系列以获得相对于其他市场参与者的竞争优势,图形处理器市场正在整合。市场的主要参与者有三星电子、高通、NVIDIA 公司、超威半导体公司、英特尔公司、台湾半导体製造有限公司、富士通有限公司、IBM 公司、Sony Corporation、苹果公司等。市场参与者所采取的发展策略包括:

- 2022 年 9 月,NVIDIA 将推出新的 GeForce RTX GPU 和技术。 NVIDIA 的 GeForce RTX 40 系列显示卡速度极快,为游戏玩家和创作者提供突破性的效能、AI 驱动的图形、更身临其境的游戏体验以及最快的内容创作工作流程。最新游戏的游戏效能提升 2 倍。透过利用 DLSS 3 和其他 Ada 开发成果,开发人员可以为完全光线追踪的游戏实现高达 4 倍的效能提升。 GeForce RTX 40 系列显示卡可为创新应用程式提供高达 2 倍的 3D 渲染、影片汇出速度和 AI 功能效能。

- 2022 年 11 月 AMD Radeon RX AMD 宣布推出 7900 XT 和 Radeon RX 7900 XT 显示卡。它们基于最新的高性能、节能的 AMD RDNA 3 架构。这款新显示卡是全球第一款采用革命性 AMD 晶片组设计的游戏显示卡,继广受欢迎的基于 AMD「Zen」的 AMD Ryzen 晶片组处理器之后。它具有出色的性能和能源效率,可为 4K 及以上的最苛刻的游戏提供高影格速率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果和市场假设

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 对图形应用程式的需求不断增加

- 地理资讯系统 (GIS) 和身临其境型多媒体的兴起

- 市场限制

- 工作站销量下滑

- 产业价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 独立显示卡

- 整合图形解决方案

- 混合解决方案

- 按部署

- 本地

- 云

- 按应用

- 智慧型手机

- 平板电脑和笔记型电脑

- 工作站

- 游戏电脑

- 媒体与娱乐

- 车

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- Qualcomm Incorporated

- NVIDIA Corporation

- Advanced Micro Devices Inc.

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company Ltd

- Fujitsu Ltd

- IBM Corporation

- Sony Corporation

- Apple Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Graphic Processors Market is expected to register a CAGR of 33.35% during the forecast period.

Key Highlights

- The market for gaming applications is rising due to increased consumer spending on tablets, smartphones, and notebooks, driving the demand for graphics processors to provide high-quality visual effects and high-speed gaming applications.

- The factor fueling the graphic processor market's growth is the increasing usage of processors to support graphics applications and 3D content in various industry verticals such as manufacturing, automotive, real estate, and healthcare. For instance, to support manufacturing and design applications in the automotive sector, CAD and simulation software leverages GPUs to create photorealistic images or animations.

- The rise of geographic information systems (GIS) and immersive multimedia are also driving the graphics processing market. Increasing usage of applications such as GIS that provide real-time spatial and geographical data is rising owing to the penetration of smartphones, tablets, and other mobile computing devices. A GIS allows users to generate a query, analyze spatial information, map data, and provide output. However, to provide real-time information, mobile computing devices incorporate graphic processors on a large scale.

- The metaverse offers an enhanced experience. Many activities people can perform in the real world are also possible in this virtual representation of the real world. The software will need to advance to support this because interoperability between platforms, applications, and services will be essential for a working ecosystem. Hardware will be essential to allow people to interact with this new online environment, despite software being an important pillar in the convergence of different realities.

- With full-body haptics and virtual reality equipment still available, AR and VR technologies will likely be the primary ways of experiencing the metaverse during the transition. This offers enormous potential for the electronics sector, particularly from the perspective of GPUs, to spearhead widespread innovation that will aid in immersing users while utilizing parallelism to address data issues.

- Moreover, the inability to properly balance system performance, efficiency, and power consumption poses a challenge to market growth. Further, declining workstation sales may hamper the graphic processors' market growth over the forecast period.

Graphic Processors Market Trends

Gaming Industry to Augment Market Growth

- The gaming hardware market is huge, spreading across all platforms, from handheld devices to tablets, phones, PCs, consoles, location-based arcades, and gaming parlors. Gaming machines evolved from powerful location-based machines found in arcades, restaurants, and bars to in-home machines in the form of dedicated gaming consoles, microcomputers, and then PCs.

- Gaming machines use two types of CPU processors: ARM and x86-based machines. Those machines fall into five or more platforms, including consoles, notebooks, desktops, mobile devices, and various types of location-based devices found in arcades, restaurants, bars, amusement parks, casinos, and iCafe/net cafes. For instance, AMD integrates a GPU into an x86 processor and calls it an accelerated processor unit APU.

- High-performance gaming is synonymous with gaming laptops. They enable quicker command execution and swift running since they are quick and effective. When it comes to relative speeds and overall performances, for instance, the Nvidia GeForce RTX 3090, a Titan class card, offers highly demanding performance. Additionally, it supports Ray Tracing and DLSS exceptionally well without reducing the graphics settings on the gaming laptop.

- However, Nvidia is also investing significantly in technology and offering gamers customizable solutions. The company announced its powerful GPU, titled Titan RTX, which uses Nvidia's Turing architecture and delivers 130 teraflops of deep learning performance and 11 gigarays of ray-tracing performance. The new display port on the GPU is designed for next-generation VR headsets, which will only need one wire to connect to PCs.

- Moreover, the hardware landscape is constantly in flux. For instance, the latest graphics cards in the USD 500-USD 1500 price range completely changed, with AMD and Nvidia overhauling their lineups for the growing 1440p gaming market. Compared to the previous flagship RTX 3090 Ti, Nvidia's new flagship RTX 4090 can perform up to two times better in raster-heavy games and up to four times quicker in fully ray-traced games, while the RTX 4080 will be up to three times faster.

- The gaming environment has been further expanded with the resurrection of virtual reality and the introduction of augmented reality for gaming. For instance, AR games like Niantic Lab's Pokemon Go are location-based games and use Google Maps to augment a mythical world filled with characters from the Pokemon. Users are encouraged to explore new alleys or hunt for hidden characters on their mobile screens; in the real world, they walk several miles.

Asia-Pacific to be Fastest-Growing Market

- Developing countries in the Asia Pacific, such as China, Japan, Singapore, and India, are expected to witness high demand. This may be attributed to the increasing adoption of mobile computing devices and the region's high demand for gaming applications.

- The Japanese gaming market is the third-largest in the world due to the continued success of several mobile gaming companies in the country. Japanese gamers spend more than players in any other country. The average spending per Japanese player is approximately 2.5 times higher than that in western Europe and nearly 1.5 times higher than in North America.

- China developed its own GPU compute engines by introducing the BR series of products from Biren Technology. China now has access to a dedicated local GPU for graphics and computing, which will intensify the fierce GPU market competition.

- With its upcoming game-focused GPUs, Shanghai-based chipmaker Muxi is anticipated to put China on the global map and promote Asia's growth. In order to meet the needs of the expanding high-end PC gaming sector in the nation, the company is reportedly creating China's in-house GPU. The GPU explicitly designed for gaming is currently under development and is anticipated to be available in 2025.

- With the growing adoption of IoT devices that gather huge amounts of data that needs to be monitored and analyzed, the demand for high-end computing systems has effectively increased in the automotive sector in the Asia-Pacific Region.

- Moreover, countries such as China, India, Japan, and Singapore are shifting the paradigm toward technological enhancement. Therefore, the region has the highest smart device sales, from smartphones and tablets to PlayStation and gaming PCs. This attribute explains the increasing demand for graphics processors.

Graphic Processors Industry Overview

The graphic processors market is consolidated due to major market players adopting novel strategies to improve manufacturing techniques and widen their product portfolios to gain a competitive edge over other market players. The major players in the market are Samsung Electronics Co. Ltd, Qualcomm Incorporated, NVIDIA Corporation, Advanced Micro Devices Inc., Intel Corporation, Taiwan Semiconductor Manufacturing Company Ltd, Fujitsu Ltd, IBM Corporation, Sony Corporation, and Apple Inc., among others. Some developmental strategies adopted by market players are:

- In September 2022, new GeForce RTX GPUs and technologies were launched by NVIDIA. The GeForce RTX 40 Series graphics cards from NVIDIA are so fast that they provide gamers and creators with a quantum leap in performance, AI-powered graphics, more immersive gameplay, and the quickest content creation workflows. The newest games have a 2X increase in gaming performance. By utilizing DLSS 3 and other Ada developments, developers can increase performance in fully ray-traced games by up to a 4X increase. The GeForce RTX 40 Series graphics cards offer up to two times as much performance in 3D rendering, video export speed, and AI features for creative apps.

- In November 2022, The AMD Radeon RX AMD introduced 7900 XT and Radeon RX 7900 XT graphics cards. They are based on the newest, high-performance, energy-efficient AMD RDNA 3 architecture. The new graphics cards are the first gaming graphics cards in the world to include an innovative AMD chipset design, following the hugely popular AMD "Zen"-based AMD Ryzen chipset processors. They provide exceptional performance and superb energy efficiency to enable high-framerate 4K and greater resolution gaming in the most demanding titles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Graphic Applications

- 4.3.2 Rise of Geographic Information Systems (GIS) and Immersive Multimedia

- 4.4 Market Restraints

- 4.4.1 Declining Workstation Sales

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Dedicated Graphics Card

- 5.1.2 Integrated Graphics Solutions

- 5.1.3 Hybrid Solutions

- 5.2 By Deployement

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Applications

- 5.3.1 Smartphones

- 5.3.2 Tablets and Notebooks

- 5.3.3 Workstations

- 5.3.4 Gaming PC

- 5.3.5 Media and Entertainment

- 5.3.6 Automotives

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd

- 6.1.2 Qualcomm Incorporated

- 6.1.3 NVIDIA Corporation

- 6.1.4 Advanced Micro Devices Inc.

- 6.1.5 Intel Corporation

- 6.1.6 Taiwan Semiconductor Manufacturing Company Ltd

- 6.1.7 Fujitsu Ltd

- 6.1.8 IBM Corporation

- 6.1.9 Sony Corporation

- 6.1.10 Apple Inc.