|

市场调查报告书

商品编码

1640705

HPC 软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)HPC Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

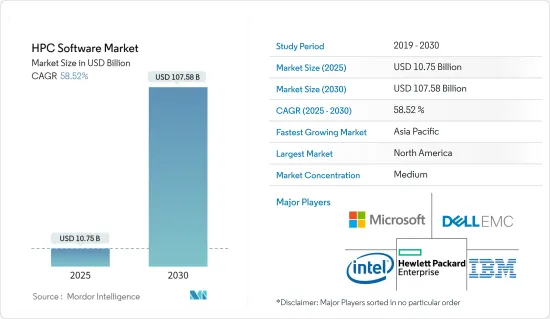

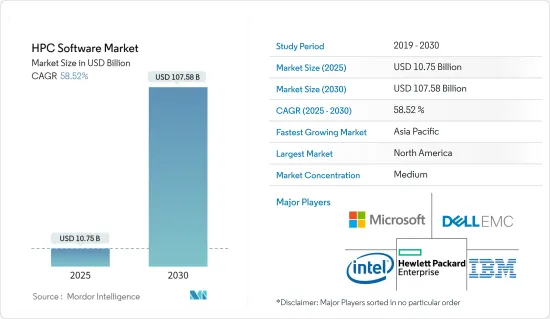

预计 2025 年 HPC 软体市场规模为 107.5 亿美元,预计到 2030 年将达到 1,075.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 58.52%。

在预测期内,人工智慧 (AI)、物联网 (IIoT) 的投资增加以及电子设计自动化 (EDA) 的工程需求等因素正在推动市场的发展。

主要亮点

- 对于更短的产品开发週期 (PLC) 的需求和保持恆定品质的需求快速成长,如果没有合适的工具和先进的技术,几乎不可能即时跟上。

- 包括美国、英国、英国、日本和中国在内的世界各国都认识到这些技术作为经济成长关键驱动力的重要性,并正在寻求开发 HPC 解决方案来支持这些努力,同时保持成本和性能效率。代表了该软体的潜在市场。

- 汽车、离散製造和医疗机器人等各行各业越来越多地采用高效能运算 (HPC) 系统和电脑辅助工程 (CAE) 软体进行高保真建模和模拟。

- 此外,云端基础的HPC 解决方案因其经济高效的计量收费模式而越来越受欢迎。政府机构、研究机构和大学是云端基础的HPC 解决方案的主要受益者。

HPC 软体市场趋势

云端基础的高效能运算软体推动成长

- 该地区的各家公司都开始转向云端租用 HPC 应用程式来解决复杂的数学建模问题。因此,云端高效能运算(HPC)近年来经历了快速成长。

- 云端 HPC 提供了一种可扩展、经济高效的方式来处理大量资料和运行复杂的应用程式。云端处理供应商投资研发来推出新软体来满足企业的需求。

- 例如,2023 年 2 月,亚马逊网路服务 (AWS) 的调查团队宣布了一个新的软体框架,用于在量子计算硬体上执行电磁模拟。它的开发是为了利用 AWS 提供的云端基础的高效能运算 (HPC) 产品和服务。

- 云端 HPC 供应商透过保持成本竞争力、快速创新和扩展其产品组合实现了丰厚的回报。

- 例如,2023 年 5 月,全球技术和 HPC 供应商 CGG 宣布已与爱尔兰製药软体公司 Pharma 签署了一份谅解备忘录 (MOU),该公司利用人工智慧 (AI) 大幅提高速度、成本、新颖性和开发新药的成功率。

- 2022 年 11 月,洛克希德马丁公司和微软宣布扩大战略关係,以帮助国防部 (DOD) 推动技术发展。该协议预计将重点关注云端创新、数位转型和其他前沿技术进步。这些主要供应商之间以云端为中心的伙伴关係关係预计将推动对云端 HPC 的需求。

亚太地区是一个快速成长的地区

- 亚太地区拥有包括中国、日本和印度在内的大型新兴经济体。这些经济体正在大力投资 HPC,以加速其经济发展。此外,製造业和医疗保健等各行业对模拟的应用日益广泛,也推动了对 HPC 的需求。

- 由于该地区製造业蓬勃发展,且对推动 HPC 发展的技术(如物联网和人工智慧)投入强劲,该地区很可能成为云端 HPC 供应商的利润丰厚的市场。

- 供应商正在进行大规模投资,以满足亚太地区强劲的製造业需求。为了降低製造成本并在全球市场保持竞争力,我们正在增加对模拟和云端运算的依赖来提高业务效率。

- 中国、日本、韩国、印度和澳洲在未来几年将为 HPC 软体带来巨大潜力。中国政府已承诺向半导体产业投资 470 亿美元,以减少製造和设计中的非国产设备,最终将在预测期内提升该国在高效能运算技术方面的潜在空间。

- 2022年4月,富士通将推出名为「富士通运算即服务(CaaS)」的全新服务组合,透过云端向商业提供对尖端运算技术的访问,以加速数位转型(DX)。该公司计划于 2022 年 10 月开始向日本市场提供这些新服务。

HPC 软体产业概况

一些地区和全球参与者凭藉其在高效能运算软体解决方案方面的技术专长主导了市场。预计全球高效能运算软体市场将呈现整合趋势。亚马逊网路服务公司(Amazon Web Services Inc.)、ANSYS 公司、达梭系统公司、戴尔EMC、Google公司、惠普企业发展有限公司(Hewlett Packard Enterprise Development LP)、IBM 公司、英特尔公司、微软公司和甲骨文公司是当今市场的一些主要参与者。所有这些参与者都参与部署联盟、新产品创新和市场扩张等竞争策略,以在全球高效能运算软体市场中占据主导地位。

2023 年 5 月,IBM 宣布 Cadence Design Systems, Inc. 将利用 IBM Cloud HPC 上的高效能运算 (HPC) 来协助加速晶片和系统设计软体的开发。 Cadence 在 HPC 混合云解决方案中整合了 IBM Spectrum LSF 部署,可灵活管理本地和云端的运算密集型工作负载。

2023 年 5 月,Quantum Machines 宣布与 ParTec 合作,共同开发将量子电脑紧密整合到高效能运算 (HPC) 环境中的通用软体解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 云端基础的高效能运算软体推动成长

- 虚拟创新

- IT产业的扩张与多样化

- 市场限制

- 高可用性云端模型中的资料安全问题

- 产业价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依部署类型

- 本地

- 云

- 按行业

- 航太和国防

- 能源与公共产业

- BFSI

- 媒体与娱乐

- 製造业

- 生命科学与医疗保健

- 设计与工程

- 其他工业应用

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- ANSYS, Inc.

- Dassault Systemes

- Dell EMC

- Google Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

第七章投资分析

第八章 市场机会与未来趋势

The HPC Software Market size is estimated at USD 10.75 billion in 2025, and is expected to reach USD 107.58 billion by 2030, at a CAGR of 58.52% during the forecast period (2025-2030).

Factors such as rising investments in the Artificial Intelligence (AI), the Industrial Internet of Things (IIoT), and engineering demand for Electronic Design Automation (EDA) are driving the market over the forecast period.

Key Highlights

- The surging demand for short product development cycles (PLCs) and a need to maintain persistent quality becomes nearly impossible to address in real time without using the right tools and advanced technologies.

- Countries across the globe, including Germany, the United States, the United Kingdom, Japan, and China, among others, have recognized the importance of such technologies as a significant driver of economic growth and are potential markets for HPC software, which support these initiatives while maintaining cost and performance efficiencies.

- The adoption of high-performance computing (HPC) systems with computer-aided engineering (CAE) software for high-fidelity modeling simulation is rising among various industries, such as automotive, discrete manufacturing, and healthcare robotics.

- Moreover, cloud-based HPC solutions are gaining traction due to their cost-effective pay-as-you-go pricing model. Predominantly, government agencies, research institutions, and universities are likely to benefit from cloud-based HPC solutions.

HPC Software Market Trends

Cloud Based High-Performance Computing Software is Driving the Growth

- Enterprises across regions are deciding to rent HPC applications via the cloud to solve complex mathematical modeling problems, as they see benefits beyond costs. As a result, cloud high-performance computing (HPC) has seen an uptick in the past few years.

- Cloud HPC offers scalable and cost-effective ways to process a large amount of data and run complex applications. Cloud computing providers are investing in research and development to introduce new software to meet the needs of businesses.

- For instance, in February 2023, Researchers at Amazon Web Services (AWS) launched a new software framework that can be used to create electromagnetic simulations on quantum computing hardware. It was developed to leverage the cloud-based high-performance computing (HPC) products and services available on AWS.

- Cloud HPC providers gain significant returns by maintaining competitive costs, rapid innovation, and portfolio expansions.

- For instance, in May 2023, CGG, a global technology, and HPC provider, announced that it signed a contract to be the exclusive HPC cloud partner of Biosimulytics, an Irish pharma software company that uses artificial intelligence (AI) to dramatically improve the speed, cost, novelty, and success rate in new drug development.

- In November 2022, Lockheed Martin and Microsoft announced the expansion of their strategic relationship to support the advancement of technology for the Department of Defense (DOD). The agreement was expected to focus on Classified Cloud innovations, Digital Transformation, and other advanced technological innovations. Such cloud-focused partnerships by the major vendors are expected to boost the demand for cloud HPC.

Asia-Pacific is the Fastest Growing Region

- The region is home to several large and emerging economies, including China, Japan, and India. These economies are heavily investing in HPC to accelerate their economic development. Moreover, the growing use of simulation in various industries, including manufacturing, healthcare, and others, drives the demand for HPC.

- The region's strong manufacturing industry and investments in technologies driving HPC, such as IoT and AI, will likely make it a lucrative market for cloud HPC vendors.

- Vendors have made significant investments to cater to Asia-Pacific's robust manufacturing sector, which increasingly relies on simulation and cloud computing to lower production costs and improve operational effectiveness to maintain their competitiveness in the global market.

- Specifically, China, Japan, South Korea, India, and Australia are creating huge potential for HPC software in the coming years. The Chinese government has declared to invest USD 47 billion in its semiconductor industry to cut out non-indigenous devices in manufacturing and design, which will eventually create potential space for high-performance computing technology in the country for the forecast period.

- In April 2022, Fujitsu announced the launch of its new service portfolio, "Fujitsu Computing as a Service (CaaS)," to accelerate digital transformation (DX) by offering access to the most advanced computing technologies via the cloud for commercial use. The company was expected to begin delivery of these new services to the Japanese market in October 2022.

HPC Software Industry Overview

Some regional and global players dominate the market with their technological expertise in high-performance computing software solutions. The global market for high-performance computing software is expected to be consolidated in nature. Amazon Web Services Inc., ANSYS, Inc., Dassault Systemes, Dell EMC, Google Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, and Oracle Corporation are some of the major players in the current market. All these players are involved in competitive strategic developments such as partnerships, new product innovation, and market expansion to gain leadership positions in the global high-performance computing software market.

In May 2023, IBM announced Cadence Design Systems, Inc. is leveraging high-performance computing (HPC) with IBM Cloud HPC to help develop its chip and system design software faster. Cadence can flexibly manage its compute-intensive workloads on-premises and in the cloud with the integrated IBM Spectrum LSF deployed in a hybrid cloud solution for HPC.

In May 2023, Quantum Machines announced its partnership with ParTec to launch a co-developed universal software solution for tightly integrating quantum computers into high-performance computing (HPC) environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Cloud Based High-Performance Computing Software is Driving the Growth

- 4.3.2 Innovation in Virtualization Technology

- 4.3.3 Expansion and Diversification of IT Industry

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns in High Availability Cloud Model

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Industrial Application

- 5.2.1 Aerospace & Defense

- 5.2.2 Energy & Utilities

- 5.2.3 BFSI

- 5.2.4 Media & Entertainment

- 5.2.5 Manufacturing

- 5.2.6 Life-science & Healthcare

- 5.2.7 Design & Engineering

- 5.2.8 Other Industrial Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 ANSYS, Inc.

- 6.1.3 Dassault Systemes

- 6.1.4 Dell EMC

- 6.1.5 Google Inc.

- 6.1.6 Hewlett Packard Enterprise Development LP

- 6.1.7 IBM Corporation

- 6.1.8 Intel Corporation

- 6.1.9 Microsoft Corporation

- 6.1.10 Oracle Corporation