|

市场调查报告书

商品编码

1640708

包装薄膜:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

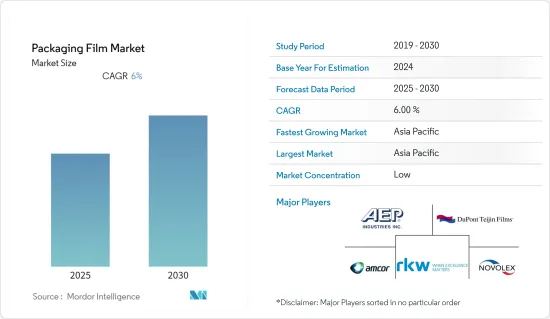

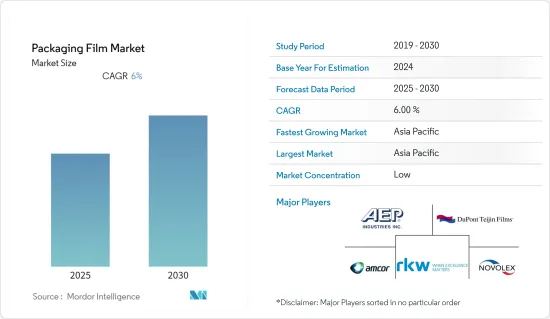

预测期内包装薄膜市场预计复合年增长率为 6%

关键亮点

- 电子商务市场的扩大以及消费品和保健食品需求的激增,推动了包装薄膜的需求。此外,由于保持卫生而导致的送餐宅配服务的增加以及疫情后对宅配领域的投资增加是支持市场成长的关键因素。

- 此外,零售业对延长包装产品保质期的需求不断增加,以及消费者对便利产品的需求,正在推动零售业包装薄膜的销售。

- 食品包装中薄膜用量的快速增加,对包装薄膜市场的成长做出了巨大的贡献。背后的原因是向下刨削的趋势,推动了从硬包装到软包装的转变。人们对延长产品保质期和减少包装浪费的浓厚兴趣,加上对水果、肉类、蔬菜和鱼贝类等包装生鲜食品的偏好日益增长,推动了对包装薄膜的需求。

- 然而,原材料价格波动、持续推动永续性(包括以生物分解性材料取代塑胶包装产品,以及使用PCR(消费后回收)塑胶来应对日益增长的环境问题)等都是导致永续发展的一些因素。

- 新冠疫情导致薄膜包装的需求大幅增加。网路购物、外带的兴起,带动包装薄膜使用量激增,市场需求大幅增加。同时,向电子商务的转变也在加速,导致产量长期处于停滞状态。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

包装薄膜市场趋势

电子商务激增推动包装需求

- COVID-19 加剧了人们对安全问题的担忧,并重新引起了人们对包装卫生的关注。此外,这段时期电子商务的兴起也增加了对永续、卫生、时尚和实用的包装薄膜的需求。

- 随着网路订单的大幅增加,这种包装膜比传统的透明收缩膜更厚,且具有高撕裂强度等隐蔽性,可在隐藏货件内容的同时确保耐用性和性能,在电子商务领域广受欢迎。

- 收缩膜因其保质期长、透氧性好等优点,广泛用于电子商务领域的食品包装。随着食品业对收缩膜的需求快速成长,製造商正致力于扩大生产能力以满足这一巨大需求。例如,2022年1月,IPG收购了位于北卡罗来纳州埃弗雷茨的一家新薄膜工厂,扩大了在北美的收缩膜生产。

- 由于生活方式的改变和可支配收入的增加,零售业正在经历强劲增长。随着线上宅配服务的出现,泰国等国家的人们正在将购物习惯从传统购物转向电子商务。超级市场、大卖场、便利商店等现代零售店也显着增加。近年来,泰国的零售额(包括网路购物和店内购物)大幅成长。

预测期内亚太地区和欧洲将贡献健康的成长率

- 预计中国将占据亚太地区包装薄膜市场的最大市场占有率,这主要得益于其庞大的中阶人口、不断增长的可支配收入以及对包装食品和药品的需求不断增长。该地区药品产量的不断增长极大地推动了该地区包装薄膜市场的成长。

- 泰国等东南亚国家的电子商务产业日益增长,为该地区的包装薄膜发展铺平了道路。此外,涉及工业粉末、颗粒化学品、润滑剂、农产品和其他材料的工业应用需要自订的包装膜和包装纸,从而促进市场成长。

- 公司正在进行各种扩张活动,以扩大其地理影响力和市场地位。例如,2021 年 12 月,PTL 在印尼推出了一条 BOPP 生产线,作为其东南亚扩张计画的一部分。随着新的10.6米BOPP薄膜生产线的推出,该公司旨在透过规模经济进一步加强其在印尼业务的成本效益,并提高其在该地区的工业定位。

- 在亚太地区,需要安全包装的已调理食品越来越受欢迎,食品和饮料行业也随之增长,推动了对聚氯乙烯(PVC) 保鲜膜等高品质、高性价比包装解决方案的需求。品质包装产生了巨大的需求。

包装薄膜产业概况

包装薄膜市场由许多参与企业细分,例如 AEP Industries Inc.、Novolex、Bemis Company Inc.、RKW SE、Dupont Teijin Films、Jindal Poly Films Ltd、Innovia Films 和 ProAmpac。大多数新参与企业都采取了合併、收购、新产品发布和市场开发等多项策略发展措施来获得竞争优势。

2022 年 5 月,Jindal Poly Films Limited (JFPL) 与 Brookfield Asset Management 达成协议,出售其一小部分包装膜业务。该公司及其机构投资者合作伙伴(统称「Brookfield」)承诺向该业务投资 200 亿印度卢比(2.6 亿美元)。

2022 年 3 月,SAES 涂层薄膜公司与 RKW 集团合作开发用于永续食品包装的高性能薄膜,旨在在产品的整个生命週期内提供高保护。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力模型

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 电子商务业务激增推动包装需求

- 食品和饮料包装的创新

- 市场限制

- 对包装材料化学成分有严格规定

第六章 市场细分

- 依材料类型

- 聚乙烯

- 聚丙烯

- 聚酯纤维

- 氯乙烯

- 其他的

- 按应用

- 食品和饮料包装

- 医药包装

- 消费品包装

- 工业包装

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- AEP Industries Inc.

- Novolex

- Amcor PLC(Bemis Company Inc.)

- RKW SE

- Dupont Teijin Films

- Jindal Poly Films Ltd

- Innovia Films

- ProAmpac

- Cosmo Films Ltd

- SRF Limited

- Graphic Packaging International LLC

- Sigma Plastics Group

- Sealed Air Corporation

第八章投资分析

第九章:未来市场展望

The Packaging Film Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- The growing e-commerce market and surge in demand for consumer goods and health products are driving demand for packaging films. Further, the rise in food delivery services due to maintaining hygiene and increasing investment in food delivery sectors post-pandemic are essential factors supporting the market's growth.

- Furthermore, the rising demand from the retail sector for the extended shelf life of packaged products and the consumers' demand for convenience products are augmenting the sales of packaging films in the retail industry.

- The rapidly growing usage of films in food packaging is significantly contributing to the growth of the packaging film market. This can be attributed to the increasing trend of down-gauging, which has supported the shift from rigid to flexible packaging. A strong focus on extending product shelf life and reducing packaging material waste, combined with a growing preference for packaged fresh foods such as fruits, meat, vegetables, and seafood, have increased demand for packaging films.

- However, the volatility of raw material prices, the ongoing drive for sustainability which includes replacing plastic-based packaging products with biodegradable materials, and mandates of using PCR (post-consumer recycled) plastics in response to growing environmental concerns are some of the major factors hampering the market growth.

- The COVID-19 pandemic has led to a significant increase in the demand for film packaging. The market experienced a marked increase in need through the rise in online shopping and food takeaway, which has led to an upsurge in the amount of packaging film usage. At the same time, the accelerated shift towards e-commerce resulted in a permanent plateau in production. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Packaging Film Market Trends

A Surge in E-commerce Business has Fueled Demand for Packaging

- Because of COVID-19, there has been a renewed interest in packaging hygiene due to increased safety concerns. Furthermore, the period saw an increase in e-commerce, which increased the demand for well-designed and functional packaging films that are both sustainable and hygienic.

- With the massive growth in online ordering, packaging film has gained popularity in the e-commerce market due to its discreet characteristics, which include being thicker than traditional clear shrink films to ensure durability and performance while keeping the contents of shipment private and having higher tear strength.

- Shrink films are widely used for wrapping food packaging products in the e-commerce sector owing to their benefits, such as optimal shelf life and better oxygen transmission rates. With the demand for shrink film from the rapidly growing food industry, manufacturers are focusing on expanding their capacity to cater to this significant demand. For instance, In January 2022, IPG expanded its North American shrink film production by acquiring a new film plant in Everetts, NC, which allowed the company to expand its production capacity and product types.

- The retail sector has witnessed strong growth due to changing lifestyles and rising disposable income. The emergence of online delivery services has shifted people's shopping habits from traditional to e-commerce in the countries like Thailand. Modern retail stores such as supermarkets, hypermarkets, and convenience stores have also risen significantly. Thailand's retail sales, including online and in-store purchases, have increased dramatically in the past few years.

Asia-Pacific and Europe Contribute to Healthy Growth Rate over the Forecast Period

- China is expected to account for the largest market share in the packaging films market of the Asia Pacific region, majorly due to its large middle-class population, increasing disposable incomes, and high demand for packaged food and pharmaceutical products. The increasing pharmaceutical production in the region is significantly driving the growth of the packaging film market in the region.

- The e-commerce sector's growing presence in Southeast Asian nations such as Thailand is paving the way for packaging film in the region. Moreover, custom-made packaging films and wraps are required for industrial applications involving industrial powders, granular chemicals, lubricants, agricultural products, and other materials, which cater to market growth.

- There have been various expansion activities by companies in the market to enhance their geographical presence and position. For instance, in December 2021, PTL launched a BOPP line in Indonesia as a part of its Southeast Asia expansion plans. With the start-up of the new BOPP film line, a 10.6-meter line, the company aims to further strengthen the cost-effectiveness of the operations in Indonesia due to economies of scale and improve its industry positioning in the geography.

- The growing popularity of ready-to-eat meals that require safe packaging in the Asia Pacific and the growth of the food and beverage industries create a significant demand for high-quality and cost-effective packaging such as Cling films made of polyvinyl chloride (PVC) is a sustainable option for fresh food packing.

Packaging Film Industry Overview

The packaging film market is fragmented with many players, such as AEP Industries Inc., Novolex, Bemis Company Inc., RKW SE, Dupont Teijin Films, Jindal Poly Films Ltd, Innovia Films, ProAmpac, and many others. Most of these players are undergoing several strategic developments to gain a competitive edge, including mergers, acquisitions, new product launches, and market expansion.

In May 2022, Jindal Poly Films Limited (JFPL) signed a contract with Brookfield Asset Management to sell a small portion of its packaging film business. The company decided to spend INR 2,000 crores (USD 260 million) in the business with institutional partners (collectively referred to as "Brookfield").

In March 2022, SAES Coated Films and RKW Group partnered to develop premium performance films for sustainable food packaging that aimed to offer high protection throughout the product lifecycle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in E-commerce Business has Fueled Demand for Packaging

- 5.1.2 Innovations in Food and Beverage Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations for Chemical Composition of Packaging Materials

6 MARKET SEGMENTATION

- 6.1 By Type of Material

- 6.1.1 Polyethylene

- 6.1.2 Polypropylene

- 6.1.3 Polyester

- 6.1.4 PVC

- 6.1.5 Other Type of Materials

- 6.2 By Application

- 6.2.1 Food and Beverage Packaging

- 6.2.2 Medical and Pharmaceutical Packaging

- 6.2.3 Consumer Products Packaging

- 6.2.4 Industrial Packaging

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEP Industries Inc.

- 7.1.2 Novolex

- 7.1.3 Amcor PLC (Bemis Company Inc.)

- 7.1.4 RKW SE

- 7.1.5 Dupont Teijin Films

- 7.1.6 Jindal Poly Films Ltd

- 7.1.7 Innovia Films

- 7.1.8 ProAmpac

- 7.1.9 Cosmo Films Ltd

- 7.1.10 SRF Limited

- 7.1.11 Graphic Packaging International LLC

- 7.1.12 Sigma Plastics Group

- 7.1.13 Sealed Air Corporation