|

市场调查报告书

商品编码

1641846

住宅路由器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Residential Routers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

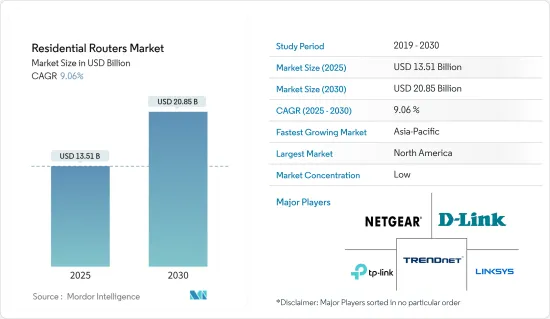

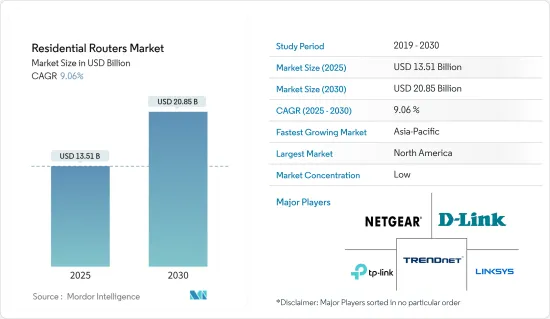

预计到 2025 年住宅路由器市场规模将达到 135.1 亿美元,到 2030 年将达到 208.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.06%。

关键亮点

- 物联网设备与家庭的整合在很大程度上依赖强大的互联网连接和网路。只有所有自动化设备在安装位置都具有适当的网路连接,智慧家庭才能无缝运作。这时路由器就派上用场了,它可以管理家里的网路连线。因此,路由器在确保网路顺畅、不间断运作方面发挥着至关重要的作用。

- 2022 年 3 月,Vodafone-Idea 推出了 Vi MiFi,这是一款袖珍型 4G 路由器,最多可连接 10 台支援 Wi-Fi 的装置。该路由器拥有 2,700mAh 的大容量电池,一次充电即可使用长达 5 小时。此外,2022 年 8 月,Reliance Jio 推出了 Jio Wi-Fi Mesh 路由器。这款路由器可扩展您家中的网路覆盖范围,一层楼的覆盖面积可达 1,000 平方英尺。

- COVID-19 疫情导致网路流量大幅增加,在最初几週内流量激增了 40%。随着疫情蔓延,流量模式从商业园区转向住宅,导致内容消费、游戏和OTT需求持续激增。这凸显了高效能家用路由器的需求。

- 值得注意的是,路由器和装置之间的距离会极大地影响您的 Wi-Fi 速度和连线强度。这就是为什么你的路由器必须设计为提供强大、广泛的讯号以覆盖你家的每个角落。为了在竞争激烈的市场中生存,路由器製造商必须不断创新和改进技术。

住宅路由器市场趋势

无线连线推动市场成长

- 多年来,网路变得越来越便宜和普及,尤其是在都市区,随着无线技术的普及,它也已经普及到半都市区和农村地区。由于无线连接不需要线缆,且比有线连接速度更快,不仅为人们的生活带来了便利,而且大大提高了人们的工作效率。因此,Wi-Fi 路由器已成为大多数家庭的常见装置。

- 2023年3月,高通与WeSchool、义大利电信(TIM)和宏碁合作启动5G智慧学校计划,为义大利学校提供下一代无线技术解决方案。该计划旨在提高初中和高中学生的数位技能,并为教师提供专业发展机会。

- 此外,考克斯私人网路也提供固定无线(FWA)测试,为农村地区提供高速网路。这项措施将有助于缩小数位鸿沟,并为偏远地区的人们提供网路存取。

- 2022年3月,美国政府拨款142亿美元用于「平价连接计画」(ACP),以协助降低农村地区的网路服务费用。在中频频率上,CBRS(公民波段无线电服务)为农村地区提供宽频。区域网路供应商 Broadband 推出了以农村为重点的基于 CBRS 的固定无线存取服务,进一步改善了偏远地区的网路存取。

- 总体而言,互联网可访问性和可用性的提高以及新无线技术的发展为人们的生活带来了许多好处,提高了教育、通讯和经济成长的机会。

预计北美将占据较大的市场占有率

- 根据 GSMA 的最新报告,5G 目前在北美蓬勃发展,预计到 2025 年将主导无线服务领域。美国预计将成为全球5G普及率第二高的国家,仅次于韩国。随着通讯业者加大中频段频谱部署力度,到 2025 年,5G 预计将占据几乎所有的行动资本支出。因此,5G收入预计将从2021年的2,940亿美元增加到2025年的3,330亿美元,彰显出该技术巨大的成长潜力。

- 此外,5G预计将涵盖加拿大92%的人口和美国100%的人口。美国主要电信业者正在寻求利用 5G 固定无线存取 (FWA) 技术从有线电视供应商手中抢占固定宽频领域的市场占有率。其中,T-Mobile截至2022年第一季拥有98万FWA用户,是最大的单一5G FWA服务供应商。

- 2022 年 10 月,交易网路服务 (TNS) 推出了全球无线存取的 SmartSIM 功能。 TNS 广泛的区域和国际无线覆盖意味着北美客户可以享受同样可靠、安全的无线连接以及全天候支持,无论他们的部署需要在哪里,同时提供广泛的解决方案来满足其客户的不同需求。提供漫游和全国连接选项。

- 总之,5G 在北美正在快速成长,预计到 2025 年将继续主导无线服务领域。美国将成为全球 5G 普及率最高的国家之一,其中 T-Mobile 在 5G FWA 服务方面处于领先地位。 TNS 的 Smart Sim 功能使北美各地的客户能够享受可靠、安全的无线连接,满足他们的业务需求,并提供全面的覆盖和支援。

住宅路由器产业概况

随着新的频宽使用和服务交付场景重塑网路基础设施,住宅路由器市场正在发生重大变化。设备製造商正在透过开发运营商级路由器来应对这一需求,这些路由器支援更广泛的服务和应用,并提供可扩展的容量和更高的资料传输。由于这一领域的参与企业众多,市场高度分散,而且随着製造商对其产品的创新硬体和软体功能进行投资,市场还有进一步增长的潜力。服务于该领域的主要企业包括 D-Link Corporation、Netgear Inc.、Linksys Group(富士康)和 Synology Inc.

2022 年 5 月,HFCL Limited 与 Wipro 合作宣布推出 5G 传输解决方案,使企业能够实现其 5G 愿景并加快优质 5G 解决方案的上市速度。 2022年10月,联发科与Invendis合作推出印度製造的5G路由器和Wi-Fi解决方案,为消费者和企业客户提供安全、强大、无缝的无线网路解决方案。此外,2023 年 2 月,Telecom26 和 Trasna Solutions 将合作开发用于行动电话路由器的eSIM 管理解决方案,为路由器製造商提供一种高效、用户友好的方式来管理现有基于SIM 卡的设备上eSIM 的方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 市场影响

- 市场驱动因素

- 连网型设备需求不断成长,智慧家庭市场不断扩大

- IP 流量增加

- 市场问题

- 安全漏洞威胁日益增加

第五章 市场区隔

- 连接类型

- 有线

- 无线的

- 标准

- 802.11b/g/n

- 802.11ac

- 802.11ax

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Netgear Inc.

- D-Link Corporation

- TP-Link Technologies Co. Ltd

- Linksys Group(Foxconn)

- TRENDnet Inc.

- Synology Inc.

- AsusTek Computer Inc.

- Google Inc.

- Nokia Networks

- Xiaomi Inc.

第七章投资分析

第 8 章:市场的未来

The Residential Routers Market size is estimated at USD 13.51 billion in 2025, and is expected to reach USD 20.85 billion by 2030, at a CAGR of 9.06% during the forecast period (2025-2030).

Key Highlights

- The integration of IoT devices into households is heavily reliant on robust internet connections and networks. A smart home can only function seamlessly if all automation devices are properly connected to the internet at the location where they are installed. This is where the router comes into play as it manages internet connectivity within the home. Thus, a router plays a crucial role in ensuring uninterrupted and smooth network functioning.

- In March 2022, Vodafone-Idea launched the Vi MiFi, a pocket-sized 4G router that enables users to connect up to 10 Wi-Fi-enabled devices. This router boasts a high battery capacity of 2700 mAh, which can last for up to 5 hours on a single charge. Additionally, in August 2022, Reliance Jio launched the Jio Wi-Fi Mesh router, which expands network coverage across homes, covering an area of up to 1000 sq ft across a single floor.

- The Covid-19 pandemic led to a significant increase in network traffic, with a 40% surge observed in the first few weeks. As the outbreak spread, traffic patterns shifted from business parks to residential areas, leading to a continued surge in content consumption, gaming, and OTT demand. This highlights the need for efficient home routers.

- It is worth noting that the distance between the router and the device can greatly impact Wi-Fi speed and connection strength. Therefore, it is essential that routers are designed to provide a strong and wide signal to reach all areas of the house. To withstand the competitive market, router manufacturers require constant innovation and technological advancements.

Residential Router Market Trends

Wireless Connectivity to Witness the Market Growth

- The Internet has become more affordable and accessible over the years, particularly in urban areas, and has even made its way to semi-urban and rural areas with the widespread adoption of wireless technology. This has not only brought convenience to people's lives but has also significantly improved productivity, as wireless connections do not require cables and are faster than wired connections. As a result, Wi-Fi routers have become a norm in most houses.

- In March 2023, Qualcomm, in partnership with WeSchool, Telecom Italia (TIM), and Acer, launched the 5G Smart Schools program to provide next-generation wireless technology solutions to schools in Italy. The program aims to develop digital skills among secondary school students and provide professional development opportunities for teachers.

- Moreover, Cox Private Networks is running Fixed Wireless (FWA) trials to deliver high-speed internet in rural areas. This initiative will help bridge the digital divide and provide access to the internet to people living in remote areas.

- In March 2022, the US Government raised 14.2 billion USD for the Affordable Connectivity Program (ACP) to help rural communities pay for their internet service. With mid-band frequencies, Citizens Band Radio Service (CBRS) will offer broadband in rural communities. Broadband, a regional internet provider, debuted CBRS-based Fixed Wireless Access services focused on rural areas, further improving access to the internet in remote locations.

- Overall, the increasing accessibility and affordability of the Internet, along with the development of new wireless technologies, are bringing numerous benefits to people's lives and improving opportunities for education, communication, and economic growth.

North America Is Expected to Hold Significant Market Share

- Based on the latest report from GSMA, 5G is currently booming in North America and is projected to dominate the wireless services sector by 2025. The United States is expected to have the world's second-highest 5G adoption rate, with only South Korea surpassing it. By 2025, 5G is forecasted to account for almost all mobile capex as operators increase mid-band spectrum deployments. As a result, 5G revenues are expected to increase from 294 billion USD in 2021 to 333 billion USD in 2025, showing the immense growth potential for this technology.

- Moreover, 5G is expected to cover 92% of the Canadian population and 100% of the US population. Major telcos in the US are leveraging 5G Fixed Wireless Access (FWA) technology to gain market share from cable providers in the fixed broadband sector. Among them, T-Mobile, with 0.98 million FWA subscribers as of Q1 2022, is the largest single provider of 5G FWA services.

- In October 2022, Transaction Network Services (TNS) launched its Smart Sim capability for Global Wireless Access, which benefits processors, ISOs, and merchants across the US. TNS's extensive local and international wireless coverage allows North American customers to take advantage of the same dependable and secure wireless connectivity, with round-the-clock assistance, wherever they need to deploy, providing access to roaming and domestic connectivity choices in various geographies.

- In summary, 5G is experiencing rapid growth in North America and is expected to continue to dominate the wireless services sector by 2025. The US is poised to have one of the highest 5G adoption rates globally, with T-Mobile leading the charge in 5G FWA services. With TNS's Smart Sim capability, North American customers can benefit from reliable and secure wireless connectivity for their business needs, backed by comprehensive coverage and support.

Residential Router Industry Overview

The residential router market is experiencing significant changes as new bandwidth usage and service delivery scenarios are reshaping network infrastructures. Equipment manufacturers are responding by developing carrier-class routers that support a broader range of services and applications and offer capacity scalability and higher data rates. With many players involved in this sector, the market is highly fragmented and has the potential to grow further as manufacturers invest in innovative hardware and software features in their products. Some significant players offering their services in this sector include D-Link Corporation, Netgear Inc., Linksys Group (Foxconn), Synology Inc., and more.

In May 2022, HFCL Limited collaborated with Wipro to introduce 5G transport solutions that enable enterprises to realize their 5G-enabled vision and increase the speed with which they can bring high-quality 5G solutions to the market. In October 2022, MediaTek partnered with Invendis to launch Made in India 5G Routers and Wi-fi solutions, providing consumers and enterprise customers with secure, strong, and seamless wireless networking solutions. And in February 2023, Telecom26 and Trasna Solutions partnered to develop eSIM management solutions for cellular routers, offering router manufacturers an efficient and user-friendly way to manage eSIMs on their existing SIM-based devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increasing Demand of Connected Devices and Proliferating Smart Homes Market

- 4.4.2 Growth in IP Traffic

- 4.5 Market Challenges

- 4.5.1 Increasing Threat of Security Breaches

5 MARKET SEGMENTATION

- 5.1 Connectivity Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 Standard

- 5.2.1 802.11b/g/n

- 5.2.2 802.11ac

- 5.2.3 802.11ax

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Netgear Inc.

- 6.1.2 D-Link Corporation

- 6.1.3 TP-Link Technologies Co. Ltd

- 6.1.4 Linksys Group (Foxconn)

- 6.1.5 TRENDnet Inc.

- 6.1.6 Synology Inc.

- 6.1.7 AsusTek Computer Inc.

- 6.1.8 Google Inc.

- 6.1.9 Nokia Networks

- 6.1.10 Xiaomi Inc.