|

市场调查报告书

商品编码

1641889

冷媒:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Refrigerants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

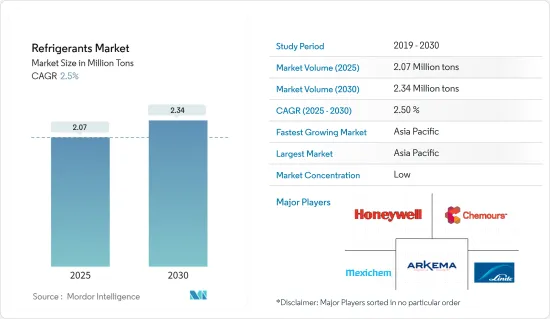

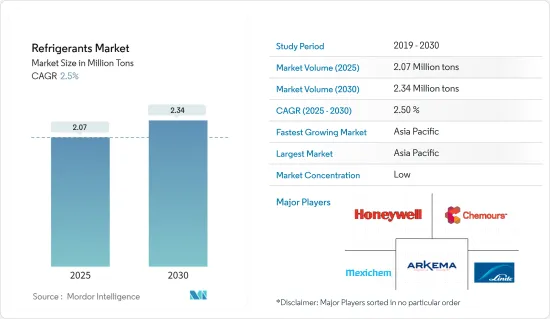

预计2025年冷媒市场规模为207万吨,至2030年预估达234万吨,预测期(2025-2030年)复合年增长率为2.5%。

COVID-19对市场产生了负面影响。疫情导致其他主要製造活动暂时停止,从而减少了冷冻、空调和其他应用中使用的冷媒的需求。然而,随着 2022 年各产业生产流程的恢復,市场保持了成长轨迹。

关键亮点

- 推动市场发展的关键因素是全球低温运输市场的扩张和对 HVAC 应用的需求的增加。

- 然而,针对氟碳冷媒的严格环境法规和《蒙特娄议定书》的持续修订可能会限制市场的发展。

- 人们对绿色和低 GWP 冷媒的认识和发展可能会为未来几年的市场成长提供机会。

- 由于印度、中国和东南亚国协等国家的需求快速增长,亚太地区在全球市场占据主导地位。

冷媒市场趋势

空调应用需求增加

- 冷媒是一种从周围环境吸收热量的化学物质,此特性用于冷却产品。冷媒是现代冷却系统的基本组成部分,包括空调、冰箱、冷冻库和冷冻。

- 此外,建筑业的扩张正在推动商务用空调市场的发展,这也对冷媒需求的成长产生了积极影响。办公大楼、机场、地铁等基础设施开发活动的增加也导致了商务用空调需求的增加。例如,2023年3月,美国政府资助11个主要地铁计划,价值44.5亿美元。

- 根据国际能源总署 (IEA) 的数据,全球建筑空调存量预计将从 2022 年的 16 亿台成长到 2050 年的 56 亿台,这意味着未来 30 年,全球每秒钟都会新增 10 台空调。将出售。

- 根据日本冷冻空调工业协会预测,2021年北美空调设备需求量预计将达到约1,650万台。

- 根据美国劳工统计局的数据,2021 年,美国房主在窗型冷气上的平均每单位支出为 4.81 美元。

- 此外,对环保冷却解决方案的需求正在推动冷冻和空调製造商的创新。例如,2022 年 2 月,总部位于华盛顿的饮料加工和工业市场冷冻设备製造商和供应商 Pro-Refrigeration, Inc. 宣布将开始使用二氧化碳冷冻,这是一种对全球暖化影响为零的天然製冷剂。

- 由于对永续产品的需求不断增加,各製造商都在致力于开发永续产品和解决方案。

- 在全球范围内,由于便利性、可支配收入的增加和繁忙的生活方式等多种因素,冷冻和加工食品的消费量正在增加,从而推动了市场对冷媒的需求。

- 资料中心会产生过多的热量,带来经济和环境挑战。这些高排放、对高效冷却的需求以及资料中心新兴市场的开放,正在推动资料中心 HVAC 系统中对高效冷冻的需求,从而促进市场的成长。

- 例如,Facebook母公司Meta将于2022年4月在密苏里州和德克萨斯州启用两个新的资料中心计划,使其在美国建造和营运资料中心的总投资达到约160亿美元。预计资料中心的兴起将显着推动冷媒市场的发展。

- 因此,预计上述因素将在未来几年对冷媒产生重大影响。

亚太地区占市场主导地位

- 亚太地区占据了最高的市场占有率,并可能在预测期内占据市场主导地位。

- 中国是世界上成长最快的经济体之一,人口、生活水准和人均收入的不断提高推动了几乎所有终端使用者产业的显着成长。

- 中国消费者越来越多地购买健康食品,包括豌豆和玉米等需要低温储存的有机食品。包装冷冻食品也越来越受欢迎,尤其是乳製品、婴儿食品和糖果零食。

- 根据中国冷链委员会及情报研究小组预测,未来中国低温运输产业规模仍将持续成长,预计可达约1,301.3亿美元。

- 在中国,随着已烹调包装食品的使用越来越多,许多消费者将冷冻设备视为家庭必需品,为进入设备市场铺平了道路。这一形势将进一步促进中国製冷市场的成长。

- 印度正处于现代经济蓬勃发展时期,生活水准和人均收入大幅提高,个人的选择和偏好也正在改变。这推动了印度经济所有主要领域的扩张,增强了该国的成长前景。

- 印度2022年4月空调销售量为175万台,较去年同期成长一倍。根据两家公司的报告,Voltas 销售了 120 万住宅空调,LG 电子销售了 100 多万住宅变频空调。

- 此外,该地区建设活动的活性化也支持了对冷媒的需求。中国计划在2022年兴建200座机场,预计年终年底完工。预测期内,该国建设活动投资的增加可能会推动对空调的需求,进而推动冷媒市场的需求。

- 因此,预计上述因素将在未来几年推动亚太地区对冷媒的需求。

冷媒产业概况

冷媒市场部分整合,五大主要企业占据相当大的份额。主要企业包括霍尼韦尔国际公司、科慕公司、Mexichem SAB de CV、阿科玛集团、林德公司等(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 全球低温运输市场的扩张

- 建筑业对暖通空调系统的需求不断增加

- 限制因素

- 氟碳冷媒的严格环境法规

- 正在进行的《蒙特娄议定书》修正案

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 类型

- 氟碳

- 氟烃塑胶(HCFC)

- 氢氟碳化物 (HFC)

- 无机

- 氨

- 二氧化碳

- 其他无机物质

- 碳氢化合物

- 异丁烷

- 丙烷

- 其他碳氢化合物

- 其他类型

- 氟碳

- 应用

- 冷冻

- 适合家庭使用

- 商务用

- 运输

- 工业的

- 空调

- 固定式

- 冷却器

- 移动的

- 其他的

- 冷冻

- 地区

- 亚太地区

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- A-Gas

- Arkema Group(Bostik SA)

- DAIKIN INDUSTRIES Ltd

- Dongyue Group

- Harp International Ltd

- Honeywell International Inc.

- Hudson Technologies

- Mexichem SAB de CV

- Navin Fluorine International Limited

- Sinochem Group

- SRF Limited

- The Chemours Company

- LINDE PLC

第七章 市场机会与未来趋势

- 绿色低GWP冷媒的认知与发展

- 其他机会

The Refrigerants Market size is estimated at 2.07 million tons in 2025, and is expected to reach 2.34 million tons by 2030, at a CAGR of 2.5% during the forecast period (2025-2030).

COVID-19 had a detrimental effect on the market. All the major manufacturing activities were on a temporary halt owing to the pandemic scenario, which minimized the demand for refrigerants used for refrigeration, air conditioners, and other applications. However, the market retained its growth trajectory in 2022 due to the resumed production processes in all industries.

Key Highlights

- The major factors driving the market are the expansion of the global cold chain market and increasing demand for HVAC applications.

- However, stringent environmental regulations against fluorocarbon refrigerants and the continuous amendments in the Montreal Protocol are likely to restrain the market.

- The awareness and development of green and low GWP refrigerants are likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the market across the world, owing to the rapidly growing demand from the countries like India, China and ASEAN Countries.

Refrigerants Market Trends

Increasing Demand from Air-conditioning Application

- Refrigerants are chemicals that absorb heat from their surroundings and are used in cooling products because of this characteristic. Refrigerant is a fundamental part of contemporary cooling systems, such as air conditioners, refrigerators, freezers, chillers, and other applications.

- Moreover, the expansion of the construction industry accounts for the propulsion of the commercial AC market, which in turn positively impacts the growth in demand for refrigerants. The growing infrastructure development activities, such as office complexes, airports, and metro rail systems, contribute to the increasing requirement for commercial AC after their completion. For instance, in March 2023, the United States government funded 11 major metro rail projects with an amount of USD 4.45 billion.

- According to the International Energy Agency, the global stock of air conditioners in buildings is anticipated to grow up to 5.6 billion by 2050, up from 1.6 billion in 2022, which amounts to 10 new ACs sold every second for the next 30 years.

- According to the Japan Refrigeration and Air Conditioning Industry, the demand for air conditioning devices in North America amounted to approximately 16.5 million units in 2021.

- According to the U.S. Bureau of Labor Statistics, in 2021, the mean household expenditure on window air conditioners by homeowners in the United States amounted to USD 4.81 per consumer unit.

- Additionally, the demand for environmentally friendly cooling solutions is driving chiller and air conditioner manufacturers to innovate. For instance, in February 2022, a Washington-based manufacturer and supplier of chillers for beverage processing and industrial markets, Pro-Refrigeration, Inc., developed the idea of a CO2 chiller, a natural refrigerant with zero impact on global warming.

- The increasing need for sustainable products is leading various manufacturers to develop sustainable products and solutions.

- Globally, there has been an increase in the consumption of frozen and processed food due to several factors, like convenience, an increase in disposable income, busy lifestyles, and many others, that have boosted the demand for refrigerants in the market.

- The data centers produce excessive heat, which presents an economic and environmental challenge. Such heavy emissions, the need for efficient cooling, and the increasing development of data centers have driven the demand for efficient chillers in HVAC systems in data centers and contributed to the market's growth.

- For instance, in April 2022, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in the United States data center construction and operations to almost USD 16 billion. The increasing number of data centers is expected to significantly drive the refrigerants market.

- Therefore, the aforementioned factors are expected to have a significant impact on refrigerants in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region accounted for the highest market share and is likely to dominate the market during the forecast period.

- China is one of the fastest-growing economies worldwide, and almost all the end-user industries have been experiencing significant growth owing to the rising population, living standards, and per capita income.

- Chinese consumers are increasingly purchasing health and wellness food products, including organic foods that require cold storage, including peas, corn, etc. Packaged frozen foods are also increasingly popular, especially dairy, baby food, and confectionery products.

- According to the China Cold Chain Committee and the Intelligence Research Group, the cold chain industry sector in China is expected to increase further to about USD 130.13 billion in the future.

- Many consumers in China are considering refrigeration appliances as household necessities owing to the increasing usage of ready-to-eat packaged food, which paves the way for appliances to penetrate the market. The scenario further strengthens the growth of the Chinese refrigeration market.

- India is a booming economy in modern times, due to significantly rising living standards and per capita income, which are changing the choices and preferences of an individual. These are resulting in the broadening of all major sectors of the Indian economy, leading to higher growth prospects in the country.

- India recorded a sale of 1.75 million units of air conditioners in April 2022, double as compared to the same period in the year prior. According to the companies' reports, Voltas sold 1.2 million units of residential ACs, while LG Electronic sold over one million units of residential inverter air conditioners.

- Moreover, rising construction activities in the region are also supporting the demand for refrigerants. China concentrated on constructing 200 airports in 2022, with completion anticipated for the end of 2035.The growing investments in construction activities in the country are driving the demand for ACs, which, in turn, may drive the refrigerants market over the forecast period.

- Therefore, the aforementioned factors are expected to boost the demand for refrigerants in the Asia-Pacific region in the coming years.

Refrigerants Industry Overview

The refrigerants market is partially consolidated, with the top five players accounting for a decent share of the market. The major companies include (not in any particular order) Honeywell International Inc., The Chemours Company, Mexichem SAB de CV, Arkema Group, and Linde PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion of the Global Cold Chain Market

- 4.1.2 Increasing Demand from Construction Sector for HVAC Systems

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations against Fluorocarbon Refrigerants

- 4.2.2 Continuous Amendments in the Montreal Protocol

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Fluorocarbons

- 5.1.1.1 Hydrochlorofluorocarbons (HCFC)

- 5.1.1.2 Hydrofluorocarbons (HFC)

- 5.1.2 Inorganics

- 5.1.2.1 Ammonia

- 5.1.2.2 Carbon Dioxide

- 5.1.2.3 Other Inorganics

- 5.1.3 Hydrocarbons

- 5.1.3.1 Isobutane

- 5.1.3.2 Propane

- 5.1.3.3 Other Hydrocarbons

- 5.1.4 Other Types

- 5.1.1 Fluorocarbons

- 5.2 Application

- 5.2.1 Refrigeration

- 5.2.1.1 Domestic

- 5.2.1.2 Commercial

- 5.2.1.3 Transportation

- 5.2.1.4 Industrial

- 5.2.2 Air-conditioning

- 5.2.2.1 Stationary

- 5.2.2.2 Chiller

- 5.2.2.3 Mobile

- 5.2.3 Other Applications

- 5.2.1 Refrigeration

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 India

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 ASEAN Countries

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa (MEA)

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A-Gas

- 6.4.2 Arkema Group (Bostik SA)

- 6.4.3 DAIKIN INDUSTRIES Ltd

- 6.4.4 Dongyue Group

- 6.4.5 Harp International Ltd

- 6.4.6 Honeywell International Inc.

- 6.4.7 Hudson Technologies

- 6.4.8 Mexichem SAB de CV

- 6.4.9 Navin Fluorine International Limited

- 6.4.10 Sinochem Group

- 6.4.11 SRF Limited

- 6.4.12 The Chemours Company

- 6.4.13 LINDE PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Awareness and Development of Green and Low GWP Refrigerants

- 7.2 Other Opportunities