|

市场调查报告书

商品编码

1641917

云端 AI:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Cloud AI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

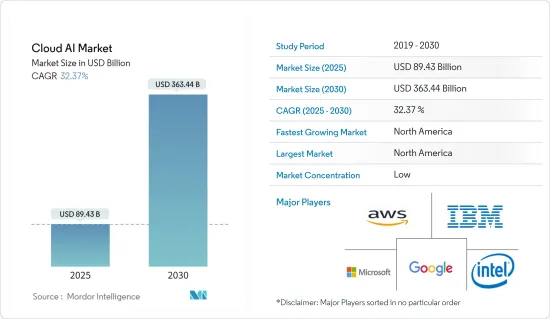

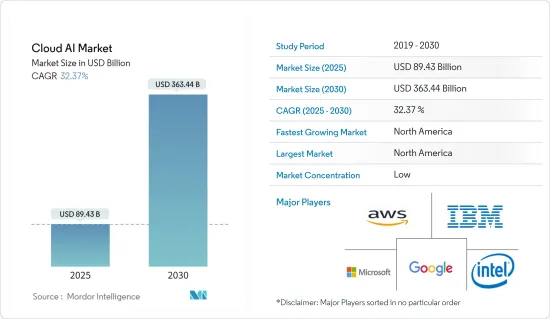

预计 2025 年云端 AI 市场规模为 894.3 亿美元,预计到 2030 年将达到 3,634.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 32.37%。

由于云端服务具有满足意外的服务需求高峰的弹性,COVID-19 疫情已促使许多组织加速向公共云端解决方案迁移。迁移到云端极大地帮助企业在 COVID-19 期间重塑了业务方式。随着对人工智慧服务的需求不断增长,许多云端供应商现在都提供这些服务。因此,去年云端市场在医疗保健领域实现了显着成长。云端AI技术正被广泛用于对抗新冠肺炎疫情。

主要亮点

- 随着企业数量的增加和企业之间竞争的加剧,企业正在努力将人工智慧 (AI) 技术融入其应用程式、分析、业务和服务中。此外,企业正在努力降低营运成本以提高利润率,这就是云端人工智慧变得越来越普遍的原因。

- 多重云端趋势和对云端基础的智慧服务日益增长的需求也在推动对人工智慧云端解决方案的需求。据 IBM 称,到今年年底,98% 的企业计划采用多重云端架构。只有 41% 的企业拥有多重云端管理策略,只有 38% 的企业拥有操作多重云端环境的程式或工具。这对云端AI服务而言是一个庞大的商机。

- 推动市场发展的因素包括巨量资料量的增加、对虚拟助理的需求的不断增长以及云端基础的服务和应用程式的日益普及。

- 根据Cisco,巨量资料量将从2016年的Exabyte成长至去年的Exabyte,成长率约7倍。由于企业倾向于采用云端 AI 解决方案来从此类资料中获取洞察力,从而增加预测期内驱动因素的影响力,因此预计这一数量将在预测期内逐步增加。

- 云端处理平台市场受益于这场疫情。随着经济逐渐復苏,云端技术的使用使得网路业务变得更加容易。云端正在加速全面部署AI,加速云端AI的采用和支出。

云端人工智慧 (AI) 市场趋势

越来越多地采用云端基础的服务和应用程序

- 政府采用云端 AI 的动力源自于该平台强大的能力,它使政府机构能够扩展包括资料探勘在内的大规模工作,并直接影响公共挑战。此外,由于资料隐私原因而导致的采用云端处理的初始阻碍因素正在被克服,并且预计将获得进一步的发展。

- 随着云端、人工智慧(AI)、物联网(IoT)、区块链等新技术的出现和逐渐被接受,云端AI部署近年来已日趋成熟。一些政府机构正在利用三家云端服务供应商(Microsoft Azure、Amazon Web Services 和 Google Cloud Platform)之间的竞争来配置大型伺服器丛集并运行 Hadoop 和资料应用程式。数百名资料科学家。

- 在企业的充分参与下,云端已经从一个储存资料的地方发展成为一套涵盖组织所有环境的功能,可以降低成本、提供创新和灵活性。

- IBM 等公司一直与各级政府机构密切合作,推动云端运算、人工智慧、区块链和其他新兴技术的应用。 IBM 也推出了政府云端虚拟高峰会,各政府领导人在会上大力宣传云端 AI 服务如何协助应对自然灾害并在网路安全漏洞发生后改善公共安全。

- 机器学习模型在 Google Cloud 和 AWS 等云端 AI 平台上进行训练、託管并用于进行预测和提供见解。云端处理与人工智慧结合后,可以自行做出智慧决策。谷歌云端平台(GCP)涵盖基础设施、资料、分析和其他服务,是 Alphabet 云端业务的主要收益来源。谷歌云端去年收益为190亿美元,占Google总收益的7.5%。

北美占主要份额

- 北美是云端 AI 技术的早期采用者之一,预计将主导全球云端 AI 市场。另一个因素是,市场上大多数主要参与者都位于美国。该地区最终用户的云端采用率也相当高。因此,所研究市场的投资也过高。该地区还在全球混合云端和 IaaS 市场占据主导地位。

- 在该地区营运的市场参与者主要投资于其产品的附加和独特功能创新,以获得竞争优势并扩大其客户目标。这也有望带来区域和全球市场的进步。这项因素进一步扩大了市场范围。

- 例如,美国的SoundHound Inc. 提供Houndify。 Houndify 是一个独立的人工智慧平台,它使开发人员和企业主能够在任何地方部署对话介面,实现差异化、创新并让他们的品牌和用户掌控一切。该公司最近在其 Houndify 语音 AI 平台中添加了 SoundHound 音乐辨识技术。我们也与本田技研工业工业结成了策略伙伴关係,以加速发展。

- 随着组织不断将其流程和应用程式迁移到云端,市场上的供应商需要提供更高层级的客户体验 (CX)、效能和生产力,以获得竞争优势。公司将利用融合了人工智慧、机器学习(ML)、扩增实境(AR)和巨量资料等技术的各种分析工具,将增强智能添加到可用资料中。

- 此外,加拿大政府还采用了「云端优先」策略,该策略将在启动任何资讯技术投资、计划、策略或计划时将云端服务确定和评估为主要交付选项。云端运算还有望使加拿大政府能够利用私人供应商的创新,并使其资讯技术更加灵活。

- 云端供应商透过提供一系列服务和工具进一步刺激对人工智慧的需求,这些服务和工具使得开发、测试、扩展和操作人工智慧系统变得更加容易,而无需大量的前期投资。这包括机器学习优化的硬体、用于自动化语音辨识和文字分析的 API、用于提高生产力的自动化机器学习建模系统以及 AI 开发工作流程平台。

云端人工智慧 (AI) 产业概览

市场整合不断加剧,导致知名参与者之间的竞争加剧,例如:微软、IBM、Google、亚马逊等。引领他们获得了可持续的竞争优势。

2022 年 10 月,在 Oracle CloudWorld 上,Nvidia 和Oracle宣布了一项扩大的多年期协议,以帮助客户加速采用人工智慧 (AI)。此次合作使 Nvidia 的整个加速运算堆迭(包括 GPU、系统和软体)可在 Oracle 云端基础架构 (OCI) 上使用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 技术简介

- 机器学习

- 自然语言处理 (NLP)

第五章 市场动态

- 市场驱动因素

- 巨量资料量不断增加

- 对虚拟助理的需求不断增加

- 越来越多地采用云端基础的服务和应用程序

- 市场挑战

- 熟练劳动力短缺和资料安全问题

- COVID-19 评估

第六章 市场细分

- 按类型

- 解决方案

- 服务

- 按行业

- BFSI

- 卫生保健

- 车

- 零售

- 政府

- 教育

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Infosys Limited

- Wipro Limited

- Cloudminds Technology

- AIBrain LLC

- Salesforce.com Inc.

- SoundHound Inc.

- Twilio, Inc.

- Visenze Pte Ltd

第八章投资分析

第九章:市场的未来

The Cloud AI Market size is estimated at USD 89.43 billion in 2025, and is expected to reach USD 363.44 billion by 2030, at a CAGR of 32.37% during the forecast period (2025-2030).

The COVID-19 pandemic caused several organizations to accelerate their migrations to public cloud solutions since cloud service elasticity could meet unexpected spikes in service demand. Migrations to the cloud considerably helped companies reinvent how they conduct their businesses during COVID-19. The requirement for AI services has grown, and many cloud providers offer AI services. As a result, the cloud market recorded more growth significantly in the healthcare segment last year. Cloud AI technology was being used considerably to fight COVID-19.

Key Highlights

- With the growing number of enterprises and competition among them, companies are rigorously trying to integrate artificial intelligence (AI) technology with their application, analytics, business, and services. Moreover, companies are engaged in reducing their operational costs to ascend profit margins, owing to which artificial over the cloud is becoming popular, which is, in turn, expected to fuel the market growth over the forecast period.

- The rising trend of multi-cloud functioning and the growing need for cloud-based intelligence services also increase the demand for AI cloud solutions. According to IBM, 98% of the organization's plan will adopt multi-cloud architectures by last year. Only 41% have a multi-cloud management strategy, and just 38% have procedures and tools to operate a multi-cloud environment. This is poised to create a massive opportunity for cloud AI services.

- The driving factors in the studied market include rising big data volume, increasing demand for virtual assistants, and growing adoption of cloud-based services and applications.

- According to Cisco Systems Inc, the volume of big data is poised to increase from 51 exabytes in 2016 to 403 exabytes in the last year, representing a growth rate of almost seven times. The volume is expected to increase gradually in the forecast period, increasing the impact of the driver in the forecast period as companies tend to adopt cloud AI solutions to arrive at insights from such data.

- The market for cloud computing platforms has benefited from the pandemic. Using cloud technologies has made it easier to do internet business as the economy slowly revives. The cloud is hastening the deployment of full-scale AI, which hastens the adoption of and spending on Cloud-AI.

Cloud Artificial Intelligence (AI) Market Trends

Growing Adoption of Cloud-based Service and Application

- The adoption of cloud AI in government agencies is driven by the enormous capabilities of the platform, which allows government bodies to scale massive jobs, including data mining, and can directly impact public challenges. Furthermore, the initial inhibitions for data privacy reasons to adopt cloud computing are being overcome and are expected to gain further traction.

- The deployment of cloud AI has matured in recent years with the emergence and steady acceptance of the cloud, artificial intelligence (AI), the Internet of Things (IoT), blockchain, and other new technologies. Several government agencies have leveraged the competition between three cloud service providers, Microsoft Azure, Amazon Web Services, and Google Cloud Platform, to provision large clusters of servers, implement Hadoop and data lakes and employ hundreds of data scientists.

- The exhaustive participation of companies has increased the awareness amongst governments across the world regarding the development of the cloud from being a location to store data to a set of capabilities in all of an organization's environments that can reduce costs and deliver innovation and flexibility.

- Companies like IBM have worked closely with agencies at various levels of government to advance the application of cloud, AI, blockchain, and other new technologies. IBM also introduced the Government Cloud Virtual Summit, where various government leaders addressed how cloud AI services can help respond to natural disasters and improve public safety after a cybersecurity breach.

- Machine learning models are trained, hosted, and used to make predictions and provide insights on cloud AI platforms like Google Cloud and AWS. Cloud computing can make wise decisions on its own if AI is implemented in it. The Google Cloud Platform (GCP), which encompasses infrastructure, data and analytics, and other services, is the main revenue source for Alphabet's Cloud business. Last year, Google Cloud had USD 19 billion as income which represents 7.5% of Google's overall earnings.

North America Holds Major Share

- North America is expected to dominate the global cloud AI market, owing to its status as one of the early adopters of the technology. The other factor is that most of the major players in the market are US-based. Cloud adoption among the regional end-user is also quite high. Hence, the investment in the studied market is too high. The region is also a key region dominating the global hybrid cloud and IaaS market.

- Market players operating in the region are investing in innovating additional and unique features to their offerings, mainly to gain a competitive advantage and expand their customer target base. This is also expected to bring advancement in the regional and global markets. This factor expands the market scope further.

- For instance, US-based SoundHound Inc. offers Houndify, an independent AI platform that enables developers and business owners to deploy a conversational interface anywhere to retain control of their brand and users while differentiating and innovating. The company recently added SoundHound music recognition technology to its Houndify voice AI platform. It also strategically partnered with Honda Motor Co. Ltd to accelerate development.

- As regional organizations increasingly migrate their processes and applications to the cloud, vendors operating in the market may have to offer next-level customer experience (CX), performance, and productivity to gain a competitive edge. Companies add intelligence to the available data by using a broadened set of analytics tools that incorporate technologies such as AI, machine learning (ML), augmented reality (AR), and big data.

- Also, the Government of Canada has a "cloud-first" strategy, whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud is also expected to allow the Government of Canada to harness private-sector providers' innovation to make its information technology more agile.

- Cloud vendors are further strengthening the demand for AI by offering a number of services and tools that make it easier to develop, test, enhance, and operate AI systems without big upfront investments. These include hardware optimized for machine learning, APIs that automate speech recognition and text analysis, productivity-boosting automated machine learning modeling systems, and AI development workflow platforms.

Cloud Artificial Intelligence (AI) Industry Overview

The high market consolidation has increased the competition among prominent players such as Microsoft, IBM, Google, Amazon, etc. The other players are actively expanding their product portfolio and geographical presence to capture a significant market share. The players operating in this market are investing hugely in artificial intelligence-related technologies and innovating their products, leading them to gain a sustainable competitive advantage. Due to this, there is always high competition between players to innovate and introduce new products.

In October 2022, at Oracle CloudWorld, Nvidia and Oracle announced an expanded, multiyear agreement to support clients' accelerated adoption of artificial intelligence (AI). Through the partnership, Nvidia's entire accelerated computing stack will be made available to Oracle Cloud Infrastructure (OCI), including GPUs, systems, and software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - 'Porter's Five Forces Analysis'

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.4.1 Machine Learning

- 4.4.2 Natural Language Processing (NLP)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Big Data Volume

- 5.1.2 Increasing Demand for Virtual Assistants

- 5.1.3 Growing Adoption of Cloud-based Service and Application

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Workforce and Data Security Concerns

- 5.3 Assessment of COVID-19

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solution

- 6.1.2 Service

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Automotive

- 6.2.4 Retail

- 6.2.5 Government

- 6.2.6 Education

- 6.2.7 Other End-user Vertical

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Google LLC

- 7.1.4 IBM Corporation

- 7.1.5 Infosys Limited

- 7.1.6 Wipro Limited

- 7.1.7 Cloudminds Technology

- 7.1.8 AIBrain LLC

- 7.1.9 Salesforce.com Inc.

- 7.1.10 SoundHound Inc.

- 7.1.11 Twilio, Inc.

- 7.1.12 Visenze Pte Ltd