|

市场调查报告书

商品编码

1641925

嵌入式分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Embedded Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

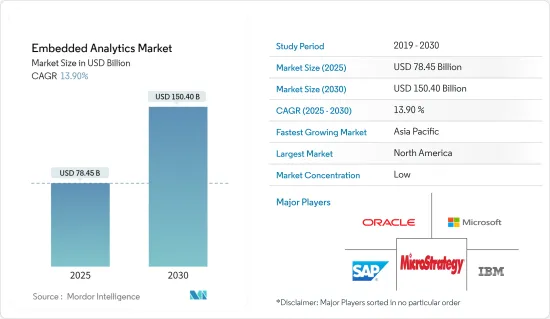

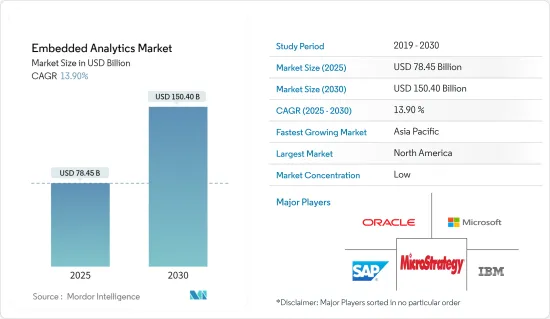

嵌入式分析市场规模预计在 2025 年为 784.5 亿美元,预计到 2030 年将达到 1504 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.9%。

嵌入式分析是整合到公司软体程式中的最终用户 BI 和分析解决方案。嵌入式分析不是独立于平台的服务,而是一种固有的应用程式元件。这项研究将使用户能够处理品质更好的资料并更快地产生报告。

主要亮点

- 推动嵌入式分析市场发展的关键因素是企业中巨量资料和物联网 (IoT) 的扩展、行动装置和云端技术的可靠性,以及对资料分析与业务应用程式整合的日益增长的需求。

- 此外,资料量和种类的增加,以及银行和其他金融机构对金融交易 IT 系统日益增长的需求也推动了嵌入式分析的需求。

- 巨量资料应用的兴起将大大促进嵌入式分析的广泛应用。因此,巨量资料和分析解决方案的收益近年来持续成长。

- 然而,高昂的替换成本以及旧有系统与新 API 的不相容性,增加了资料短缺的风险,预计将在预测期内阻碍市场收益的成长。

- 市场报告指出,COVID-19 疫情为市场创造了成长机会,因为网路购物、食品订购、数位化支付方式等为企业提供了大量资料。嵌入式分析工具透过产生的数位化资料企业提供了 COVID-19 期间的资料趋势和见解,从而促进了市场成长。

嵌入式分析市场趋势

行动装置和云端处理技术的使用增加将推动显着成长

- 云端技术和行动装置对于有效利用先进的商业应用程式至关重要。整合嵌入式分析软体的行动装置支援即时资料视觉化。

- 由于业务运营的改善和对客户行为的更深入了解,云端运算技术的日益普及预计将推动市场收益的成长。

- 此外,对嵌入式分析软体的需求增加可以提高生产力、节省营运费用并减少审查资料所需的时间。由于这些原因,预计预测期内对嵌入式分析软体的需求将会增加。

- 云端处理可以帮助企业整合和更好地了解资料。云端基础的资料仓储提供即时且安全的资讯存取。此外,整合可以透过资料分析实现即时预测模型。

- 许多企业正在采用云端业务分析,因为它提供了可扩展、有弹性且不需要不断维护内部基础设施的经济实惠的基础设施。随着云端运算越来越普及,企业需要开发一个能够为託管资料和资料带来益处的强大平台。

预计北美将占据主要份额

- 与其他地区相比,北美各终端用户行业的资料现代化技术采用率最高,这被认为是推动该地区采用嵌入式分析等各种分析解决方案的关键因素。该地区是苹果、Facebook、IBM 和谷歌等许多大公司的所在地,因此在 ICT 行业中保持领先地位。

- 此外,先进技术的采用、对适当技术基础设施的需求不断增长、对嵌入式分析工具的需求增长以及全部区域大量公司的存在正在推动嵌入式分析软体市场的成长。

- 医疗保健、BFSI 和製造业等终端用户产业大量采用了嵌入式分析等分析解决方案,在该地区占据主导地位。因此,预计预测期内该地区嵌入式分析解决方案的采用将大幅成长。

- 该地区在云端服务应用也占据主导地位。因此,该国的分析提供者正在透过云端领域的合作伙伴关係和协作进行创新。

嵌入式分析产业概览

嵌入式分析市场竞争激烈,有 IBM 公司、SAP SE 和微软等全球性公司参与。随着许多新兴国家的中小企业从传统经营模式转向数位化和资料主导的模式,企业正在寻求新兴市场以获得竞争优势。

- 2022 年 7 月 - TIBCO Software 宣布对 TIBCO Cloud Integration(TIBCO Cloud 推出的业界认可的 iPaaS)进行重大改进。这扩大了混合环境中应用程式、资料和设备整合的可能性,帮助客户应对动盪的环境,加速业务成果。 TIBCO Cloud Integration 大幅加速了整个企业的业务流程自动化和数位资产的整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 对高阶商业资料分析技术的需求不断增加

- 资料驱动型组织的崛起

- 行动商业智慧和巨量资料分析的采用日益增多

- 行动装置和云端运算技术的使用日益增多

- 市场限制

- 许可挑战和相关成本上升

第六章 市场细分

- 按解决方案

- 软体

- 服务

- 按组织规模

- 中小企业

- 大型企业

- 按部署

- 云

- 本地

- 按行业

- BFSI

- 资讯科技/通讯

- 卫生保健

- 零售

- 能源与公共产业

- 製造业

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- MicroStrategy Incorporated

- Oracle Corporation

- Tableau Software(Sales Force, Inc.)

- TIBCO Software, Inc.

- Birst, Inc.(Infor Inc.)

- Logi Analytics, Inc

- QlikTech International AB

- Sisense Inc.

- Information Builders, Inc.

- OpenText Corp.

- Yellowfin International Pty Ltd

- GoodData Corporation

- Izenda, Inc.

- Vertica Systems, Inc.(HPE)

- WNS Global Services SA(Pty)Ltd

- Exago, Inc.

第八章投资分析

第九章:市场的未来

The Embedded Analytics Market size is estimated at USD 78.45 billion in 2025, and is expected to reach USD 150.40 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

Embedded analytics is a BI and analytics solution aimed at end users that are integrated into company software programs. Embedded analytics is a component of the intrinsic application rather than a platform-independent service. This study enables users to work with higher-quality data and generate reports quickly.

Key Highlights

- The primary factors driving the embedded analytics market are big data and the Internet of Things (IoT) expansion in businesses, the dependability of mobile devices and cloud technologies, and the rising demand for data analytics integration with business applications.

- In addition, the increase in volume and variety of data and the growing demand for IT systems for financial transactions in banks and other financial institutes are also driving the need for embedded analytics.

- An increase in big data applications would significantly contribute to the acceptance of embedded analytics. Thus, there has been consistent growth in big data and analytics solutions' revenue in recent years.

- However, high replacement costs and legacy systems are incompatible with new APIs, which increases the risk of data insufficiency, which is expected to hamper the market revenue growth during the forecast period.

- The market report finds that the COVID-19 pandemic created growth opportunities for the market as Online shopping, food ordering, and digitized payment methods provided a data pool to businesses. Embedded analytic tools provided companies with data trends and insights during COVID-19 through the generated digitized data, which boosted market growth.

Embedded Analytics Market Trends

Increasing Use of Mobile Devices and Cloud Computing Technologies to Witness Significant Growth

- To effectively use advanced business applications, cloud technologies and mobile devices are crucial. Mobile devices integrated with embedded analytics software support real-time data visualization.

- Increased use of cloud computing technology improves business operations and provides better insight into customer behavior, which is anticipated to drive market revenue growth.

- Additionally, the growing requirement for embedded analytics software will boost productivity, save operating expenses, and save time when reviewing data. The demand for embedded analytics software is anticipated to increase due to these reasons over the forecast period.

- Businesses can combine data and improve the comprehension of their data with the help of cloud computing. Through a cloud-based data warehouse, information may be instantly and securely accessible. Additionally, consolidation makes real-time prediction models possible through data analysis.

- Numerous businesses employ cloud business analytics because it provides scalable, elastic, and affordable infrastructure that doesn't require ongoing maintenance of internal infrastructure. The rising popularity of cloud computing pushes enterprises to develop a solid platform that can benefit both hosted and on-premise data.

North America is Expected to Hold Major Share

- The adoption of data modernization technologies across various end-user industries in the North America region is the highest, compared to other regions; it is the major factor driving the adoption of various analytical solutions, like embedded analytics in the region. The region maintains its position in the ICT industry, as it is home to many large corporations, such as Apple, Facebook, IBM, and Google.

- Moreover, The implementation of advanced technology, Increasing demand for Adequate technology infrastructure, the subsequent growth in the demand for embedded analytics tools, and the presence of a large number of enterprises across the region drive the Embedded Analytics software market to grow.

- Several end-user industries, like healthcare, BFSI, and manufacturing, among others, with significant adoption of analytics solutions, such as embedded analytics, hold a dominant position in the region. Hence, the adoption of embedded analytics solutions, in the region, is expected to grow significantly during the forecast period.

- Also, the region is a dominant player in the cloud services applications. Therefore, the analytics providers in the country are innovating by entering partnerships and collaborations in the caloud space.

Embedded Analytics Industry Overview

The embedded analytics market is highly competitive because of the the presence of global corporations like IBM Corporation, SAP SE,Microsoft Corporation, Companies pursue emerging markets to obtain competitive advantages since many small and medium-sized businesses in developing countries switch from traditional business models to digital and data-driven ones.

- July 2022 - TIBCO software has announced significant enhancements to TIBCO cloud integration, its industry-recognized iPaaS offering by TIBCO cloud, which expands the potential for integration of applications, data, and devices across hybrid environments, assisting customers grappling in a volatile to accelerate business outcomes. TIBCO Cloud Integration delivers remarkably faster automation of business processes and integration of digital assets across the enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced Analytical Techniques for Business Data

- 5.1.2 Increasing number of Data Driven Organizations

- 5.1.3 Increasing Adoption of Mobile BI and Big Data Analytics

- 5.1.4 Increasing Use of Mobile Devices and Cloud Computing Technologies

- 5.2 Market Restraints

- 5.2.1 Licensing Challenges and Higher Associated Costs

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Size of Organisation

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunication

- 6.4.3 Healthcare

- 6.4.4 Retail

- 6.4.5 Energy and Utilities

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 SAP SE

- 7.1.4 SAS Institute Inc.

- 7.1.5 MicroStrategy Incorporated

- 7.1.6 Oracle Corporation

- 7.1.7 Tableau Software (Sales Force, Inc.)

- 7.1.8 TIBCO Software, Inc.

- 7.1.9 Birst, Inc. (Infor Inc.)

- 7.1.10 Logi Analytics, Inc

- 7.1.11 QlikTech International AB

- 7.1.12 Sisense Inc.

- 7.1.13 Information Builders, Inc.

- 7.1.14 OpenText Corp.

- 7.1.15 Yellowfin International Pty Ltd

- 7.1.16 GoodData Corporation

- 7.1.17 Izenda, Inc.

- 7.1.18 Vertica Systems, Inc. (HPE)

- 7.1.19 WNS Global Services SA (Pty) Ltd

- 7.1.20 Exago, Inc.