|

市场调查报告书

商品编码

1641954

固定线路通讯-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Fixed-Line Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

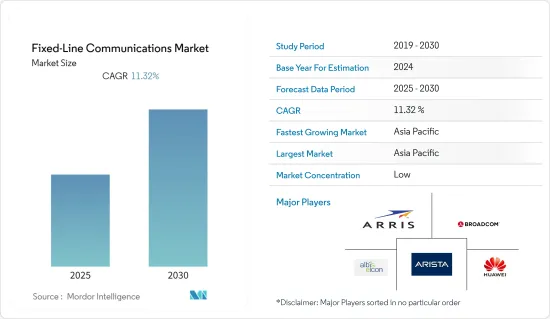

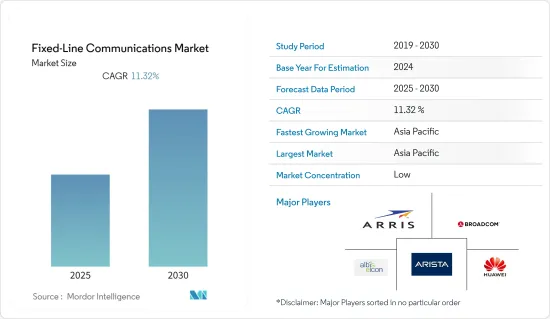

预测期内,固定通讯市场预计复合年增长率为 11.32%

关键亮点

- 数位化趋势也导致人们从有线电视转向机上盒(STB)的出现和购买,使客户能够以相对较低的成本享受更广泛的服务,并使提供者能够提供更高品质的服务。

- 提供固定宽频和电话服务的有线网路通常被称为固定线路通讯。这些通讯模式可以被视为与最终用户的有线连接,用户可以透过它连接到网路或拨打电话。固定资料,通常称为固定宽频,是指利用多种技术向家庭和企业进行高速资料传输。传输的范例包括缆线数据机互联网、数位用户线路(DSL) 互联网、光纤电缆和其他固定宽频技术连接。

- 对于更快互联网服务的需求正在推动市场的发展。市场扩张可能是受到网路和宽频存取日益普及以及对高清频道和点播视讯服务日益增长的偏好所推动。固定线路通讯广泛应用于中小型企业、私人住宅、教育机构和办公室。固定电话业者的资讯服务收入正在激增。各公司正在寻求为消费者提供结合宽频网路、视讯和 IP 语音网路的「三重播放」服务。

- 随着物联网、巨量资料分析和云端基础的服务的出现,对资料中心的需求不断增加是一种市场趋势。网路设备在资料中心运作中发挥着至关重要的作用。此外,政府机构、大型企业和通讯组织对资料中心的需求日益增加,推动了市场研究。

- 缺乏技术人员的培训和发展对所调查市场的成长构成了挑战。根据 Equinix 在今年的全球技术趋势调查显示,74% 的 IT 决策者认为缺乏具备必要技能的人才是其业务面临的主要威胁之一。

- 新冠肺炎疫情大大促进了互联互通。数位科技和服务使个人能够轻鬆存取互联网,使他们能够定期有效地使用互联网来改善生活,包括在家工作(WFH)、线上学习和线上商务。这有利于全世界人民。这一趋势在疫情结束后仍持续存在,资料使用量的增加、5G 的兴起以及工作模式的快速变化,使得企业在前所未有的情况下保持运作、社群保持联繫。这些进步正在推动对固定通讯设备的需求。

固定通讯市场趋势

光纤电缆的成长可望推动市场成长

- 光纤电缆和设备用于各种行业,包括电讯和社区连接电视(CATV),以及军事、航太、能源公共、市政、校园和其他分段网路。光纤网路旨在利用光讯号产生和传输资料,是全球高速通讯的主要技术方法。

- 基于光纤的固定宽频服务仍然是家庭和企业最常采用的网路服务。在主要市场,固网网路基本上已被光纤电缆取代,因为光纤的性能远优于双绞铜线网路。

- 互联网的广泛应用以及随后的视讯点播等服务的推出导致对频宽的需求增加,从而刺激了更强大的通讯介质的采用:光纤。光纤宽频服务的普及和引入需求、并将继续需要不仅来自营运商的投资,还需要政府的投资以及提供光纤批发的NBN的建立。

- 固定宽频的普及率逐年成长,光纤基础设施变得越来越重要。住宅领域是固网服务的最大消费者之一。透过住宅宽频网路连接到网路的用户数量正在不断增长。

- 根据通讯(ITU)的调查,全球固定宽频用户约有13亿,较去年的12亿略有成长,刺激了对光纤电缆的需求。

亚太地区可望主导固定通讯市场

- 亚太地区的资料中心建设正在兴起。该地区正在透过新技术进行数位转型,网路用户数量急剧增加,从而导致了资料中心的采用和对路由器产品的需求增加。儘管智慧型手机用户数量激增,固网网路连线仍然受到用户的欢迎。这也对固定通讯市场产生了正面影响。

- 由于宽频、行动互联网连接、基于网路的业务、竞争环境和基于云端的服务的采用的广泛应用,路由器的采用率的上升可能会对研究市场产生积极影响。此外,该地区采用机上盒和光纤电缆进行宽频服务的情况增加,以满足观看电影、直播、连续剧和社交媒体平台等媒体娱乐领域的需求。

- 预计,对高速网路服务的需求不断增长以及营运商提供价格具有竞争力的光纤宽频计画将推动该地区固定宽频服务的采用。无限制网路存取和存取主要基于订阅的视讯点播(SVoD)平台等好处可能会推动固定宽频服务的采用。

- 例如,在印度,BSNL 的 Superstar Premium 计划以每月 999 印度卢比(12 美元)的价格提供无限 150 Mbps 宽频连接,并可访问 Disney+Hot Star 等 OTT 平台。 Premium、SonyLIV Premium、Voot Select 和其他 OTT 平台均可使用。同样,Jio 和 Airtel 等通讯巨头也推出了无限流量计划,可以全面存取 OTT 平台和智慧城市中的 5G通讯。

- 近年来,根据电讯(ITU)的统计,中国是该地区宽频用户数量最多的国家,占10Mbps以上速度固定宽频用户的约80%。在中国和印度等国家,政府采取措施将常规频道转换为高清频道并专注于高清影像,推动了该地区机上盒市场的成长。

固网通讯业概况

固定通讯市场高度分散,预计仍将维持激烈的竞争态势,市场渗透率较高。由于较低的解约率和价格竞争,固网的表现优于行动业务。研究涉及的市场主要企业包括 Arris International PLC、Broadcom Inc.、Arista Networks Inc. 等。近期市场发展趋势如下:

2022 年 12 月,诺基亚与国家宽频网路 (NBN) 公司合作,部署诺基亚新一代宽频平台和 Altiplano 存取控制器,以实现更智慧、更快速、更环保的澳洲 NBN 网路。此次部署是 Lightspan MF-14 首次在南半球部署。

2022年10月,南非通讯巨头Telkom与华为合作推出5G高速网路网路服务,以在宽频需求不断成长的情况下支援其快速成长的行动资料和固定宽频业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 一般使用者对更快互联网服务的需求

- 资料中心对网路设备的需求增加

- 光纤电缆的成长可望推动市场成长

- 市场限制

- 缺乏工程师的培训

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 依产品类型

- 路由器

- 机上盒 (STB)

- 光纤电缆

- 按最终用户

- 住宅

- 商务用

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Arris International PLC

- Broadcom Inc.

- Arista Networks Inc.

- Avaya Inc.

- Albis Technologies AG

- Allied Telesis Inc.

- Peak Communications Inc.

- Aerohive Networks Inc.

- Raycap Inc.

- Huawei Technologies Co. Ltd

- Manx Telecom Trading Ltd

第七章投资分析

第八章 市场机会与未来趋势

The Fixed-Line Communications Market is expected to register a CAGR of 11.32% during the forecast period.

Key Highlights

- The trend for digitalization has also resulted in the emergence and shift toward purchasing set-top boxes (STBs) from cable television, allowing customers to enjoy a broader range of services at a relatively lower cost and enabling the providers to offer a better quality of services.

- The wired networks that provide fixed broadband and telephone services are generally referred to as fixed-line telecommunications. These modes of communication can be thought of as a cable connection to an end user, via which the user can connect to the Internet or make a phone call. Fixed data, often known as fixed broadband, refers to using a range of technologies for high-speed data transfer to a home or company. Examples of transmission methods are cable modem internet, digital subscriber line (DSL) internet, fiber optic cable, and other fixed broadband technology connections.

- The demand for faster Internet services is driving the market studied. Increasing Internet and broadband penetration and an increasing preference for high-definition (HD) channels and on-demand video services would likely boost market expansion. Fixed-line communications are highly relevant in small enterprises, homes, education institutes, and offices. Fixed-line telephone players are witnessing a boom in data service revenues. They are trying to provide 'triple play, a combination of play-broadband Internet, video, and voice, over an IP network, to consumers.

- Increasing demand for data centers is trending in the market with the advent of IoT, Big Data analytics, and cloud-based services. Network equipment plays a significant role in the operations of data centers. Additionally, there is an increasing demand for data centers from government agencies, large enterprises, and telecommunication organizations, driving the market studied.

- Nevertheless, the lack of training and development of technicians is a challenge for the growth of the market studied. According to Equinix, in this year's global tech trends survey, 74 percent of IT decision-makers view the shortage of personnel with the required skills as one of the main threats to the business.

- The COVID-19 pandemic provided a significant boost to connectivity. Digital technology and services enable individuals to have easy access to the Internet and use it regularly and effectively to better their lives in terms of work-from-home (WFH), online learning, online commerce, etc. This benefits people all over the world. This trend continues even post-pandemic owing to the increasing usage of data, an uptrend in 5G, and the rapid shift in working arrangements, helping businesses to stay in operation and communities connected in unprecedented conditions. These advancements drive the need for fixed-line communication equipment.

Fixed-line Communications Market Trends

Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth

- Fiber optic cables and devices are utilized in a variety of industries, including not only telecom and community access television (CATV) but also networks in the military and aerospace, energy utilities, municipal, campus, and other sectors. Fiber optic networks, designed to generate and transfer data using light signals, are the primary technical approach for high-speed communications around the globe.

- Fiber-based fixed broadband services remain the households and businesses' most adopted Internet services. In the leading markets, most of the fixed-line network has been replaced by fiber-optic cables to benefit from the optical fiber's far better performance than twisted-copper networks.

- The proliferation of the internet and the subsequent roll-out of services, such as video-on-demand, led to increased bandwidth demand, which fueled the adoption of fiber optics, a more enhanced communication medium. Governments' investments and the establishment of NBNs offering fiber on a wholesale basis, as well as investments by operators, have been and will be crucial for the widespread availability and adoption of fiber broadband services.

- Fixed-broadband deployment subscription continues to grow yearly, with growing importance on fiber infrastructure. The residential sector is one of the largest consumers of fixed-line services. A large and ever-increasing number of users connect to the internet via residential broadband networks.

- According to the International Telecommunication Union (ITU) survey, there were around 1.3 billion fixed broadband subscriptions worldwide, with a slight increase from 1.2 billion over the last year, which strives for the demand for fiber optic cable.q

Asia-Pacific is Expected to Dominate the Fixed-line Communications Market

- Asia-Pacific is witnessing an increase in the construction of data centers. The increasing adoption of data centers in the region is boosting the demand for router products because of digital transformation through new technologies, and the number of internet users has increased dramatically. Despite the rapid increase in smartphone users, fixed-line Internet connections remain popular among users. Thus, this has a positive impact on the fixed-line communications market.

- The adoption of the router is expanding due to the broadband penetrations, such as mobile-based internet access, network-based businesses, competitive business environments, and cloud-based service adoption, which may positively impact the market studied. Also, the adoption of STBs and optic cables for broadband services increased in the region owing to the need for demand of the Media and Entertainment segment to watch Movies, Live telecasts, Series, and social media platforms.

- Rising demand for high-speed internet services and competitively priced fiber broadband plans from operators would promote fixed broadband service adoption in the region. Benefits such as unlimited internet access and access to crucial subscription video-on-demand (SVoD) platforms would boost the adoption of fixed-line broadband service.

- In India, for example, BSNL's Superstar Premium Plans provide unlimited 150 Mbps broadband connection for INR 999 (US$12) per month and access to OTT platforms such as Disney + Hot Star. Premium, SonyLIV Premium, and Voot Select. Similarly, Telecom giants like Jio and Airtel have launched unlimited plans with all access to over-the-top (OTT) platforms and with a 5G capacity in smart cities.

- In recent years, according to the International Telecommunication Union (ITU), China accounts for the largest broadband subscriber base in the region and accounts for about 80% of all fixed-broadband subscriptions at speeds over 10 Mbps. In countries like China and India, the government has taken the initiative to focus on high-definition pictures by converting normal channels to HD channels which led to the growth of the set-top box market in the region.

Fixed-line Communications Industry Overview

The fixed-line communications market is highly fragmented, as the competition is expected to remain intense, with highly penetrated markets. Fixed-line outperforms mobile operations due to lower churn rate and price competition. Key players in the market studied are Arris International PLC, Broadcom Inc., Arista Networks Inc., etc. Recent developments in the market studied are -

In December 2022, Nokia, in partnership with National Broadband Network(NBN) Co, deployed Nokia's next-generation broadband platform and its Altiplano access controller to deliver a smarter, faster, and greener Australian NBN network. The deployment is the first for the Lightspan MF-14 in the Southern Hemisphere.

In October 2022, South African telecom giant Telkom launched 5G high-speed Internet network services in partnership with Huawei to boost its fast-growing mobile data and fixed-line broadband businesses amid increasing demand for broadband.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for Faster Internet Services by Public

- 4.2.2 Increasing Demand for Data Centers through Network Equipment

- 4.2.3 Growth of Fiber Optic Cable is Expected to Stimulate the Market Growth

- 4.3 Market Restraints

- 4.3.1 Lack of Training and Development of Technicians

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Routers

- 5.1.2 Set-top Box (STB)

- 5.1.3 Fiber-optic Cables

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commerical

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Arris International PLC

- 6.1.2 Broadcom Inc.

- 6.1.3 Arista Networks Inc.

- 6.1.4 Avaya Inc.

- 6.1.5 Albis Technologies AG

- 6.1.6 Allied Telesis Inc.

- 6.1.7 Peak Communications Inc.

- 6.1.8 Aerohive Networks Inc.

- 6.1.9 Raycap Inc.

- 6.1.10 Huawei Technologies Co. Ltd

- 6.1.11 Manx Telecom Trading Ltd