|

市场调查报告书

商品编码

1641963

劳动力分析 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Workforce Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

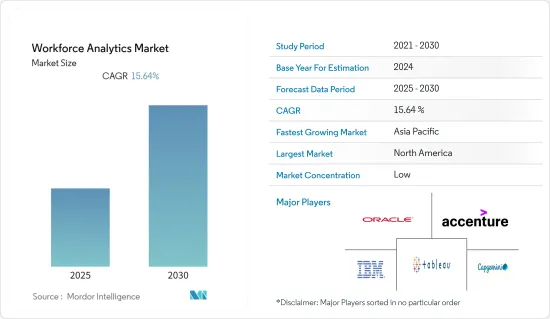

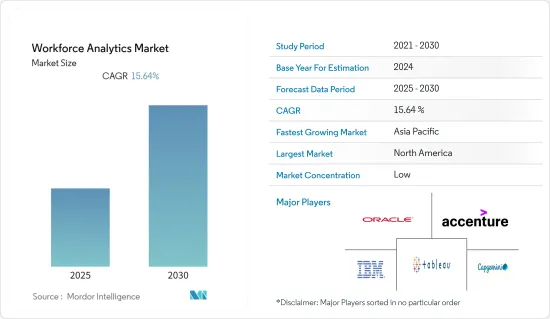

预测期内,劳动力分析市场预计将实现 15.64% 的复合年增长率

关键亮点

- 劳动力分析用于研究员工行为。这将有助于提高现有员工的生产力,而不是僱用额外的员工并改善选择标准。

- 预测劳动力分析是劳动力分析的重要子类型之一。预测是指使用历史资料进行劳动力分析并建立预测。机器学习和资料探勘是本次劳动力分析中采用的主要统计模型。许多企业正在使用预测性劳动力分析来改善员工体验并简化流程。这个过程通常涉及使用回归分析、模式匹配、多元统计和其他技术来帮助公司预测未来在风险和人才结果方面可能发生的情况。

- 在这个全球化的世界中,企业需要灵活性、速度、创新和人才来使自己从其他企业中脱颖而出。在 MindTree,我们让员工专注于支持我们业务成长和目标的人才策略和员工投资。例如,Mindtree 使用人力资源分析工具进行离职率建模、风险评估、管理分析和生产力指标。人力资源分析工具有助于预测未来 90 天的员工离职率,使招募团队能够从预测模型中使用的资料分析中获得可行的见解。

- 然而,缺乏产品资讯和高昂的实施成本正在抑制预测期内的市场成长。

劳动力分析市场趋势

绩效监控具有成长潜力

- 根据甲骨文去年发布的报告,全球 55% 的劳动力可能会留在使用人工智慧帮助他们提升职涯发展的组织。巨量资料分析和人工智慧的日益普及正在促进劳动力分析市场的成长。

- 作为人力资源分析的子集,劳动力分析透过追踪和衡量员工相关资料来帮助人力资源团队充分利用组织的人力资源。透过专注于每次招聘的投资回报,该部分远远超出了招聘和解僱的范围。它还突出显示了更详细的信息,可以帮助您识别职场的趋势,例如潜在的风险因素和对决策的满意度。

- 此外,快速变化的市场动态要求即时的人才决策。人力资本是任何组织最宝贵的资产,员工绩效对收益有重大影响。因此,监控员工绩效可以让您清楚了解哪些绩效领域需要改进以及哪些领域达到或超越预期。例如,主要企业塔塔咨询服务公司和印孚瑟斯公司已转向持续绩效系统。两家公司相信,透过这样做,他们将能够定期监控员工绩效并预测员工行为。

- 也可以监控绩效资料,以评估管理者与员工互动、设定期望、澄清疑虑、制定改善计画和解决绩效问题的效果。例如,Google使用人力资源分析进行人才管理活动。 计划 Oxygen 分析公司内部资料来量化主动管理者的行为。制定了「八项措施」结合的管理培训计划,管理品质得到提升。

- 因此,预计上述因素将在预测期内推动劳动力分析市场的发展。

亚太地区将经历最快成长

- 由于向以员工为中心的组织转变,预计亚太地区在预测期内将以最快的速度成长。公司优先考虑员工以在其地区获得竞争优势。这就是为什么公司纷纷转向劳动力分析来清楚了解其内部框架。

- 此外,印度创业计画等政府鼓励国内创业的措施也推动了市场的发展。劳动力分析可协助组织做出基于事实的人力资源决策。这将对市场产生正面影响。

- 数位科技正在金融、教育、广告和房地产等多个行业中扩张。儘管人力资源技术被视为工作方式转变的关键因素,但日本等公司正在将劳动力分析纳入劳动力技能管理的主流。例如,日立公司就已迅速采取行动来增强其能力。日立采用了这项技术,并认识到人员分析在招聘中的有效性,因此该公司还开发了员工安置和生产力调查的解决方案,以及使用人工智慧将调查资料与巨量资料相结合。

- 中国在内部资源能力和外部竞争的双重作用下实现了惊人的成长。近期宏观经济放缓、投资资本报酬率下降以及人力资本成本上升,导致许多中国企业将注意力转向营运效率。这为劳动力分析创造了良好的环境。不仅如此,资料分析已成为中国IT企业经济模式的重要组成部分,资料已成为中国IT企业无法依赖的常态。所有上述因素预计将推动上述地区劳动力分析市场的发展。

劳动力分析行业概览

劳动力分析市场竞争激烈。 IBM 公司、甲骨文公司、埃森哲、凯捷公司等跨国公司是其中的主要企业。对更好的人才结构和招募职能日益增长的需求为中小企业和大型企业创造了巨大的机会。

- 2022年11月,为帮助企业更快做出资料主导的决策并应对意外情况,IBM 将推出新软体,帮助组织打破资料和分析孤岛。 IBM Business Analytics Enterprise商业智慧规划、预算、彙报、预测和仪表板功能让您全面观点整个企业的资料来源。为了打破孤岛并让合适的团队在适当的时间存取适当的资料,我们开发了 IBM Business Analytics Enterprise。例如,公司的销售、人力资源和业务团队可能需要使用来自各种商业智慧和规划工具的资料来满足他们的需求,例如最大化销售目标、创建员工人数预测以及估计业务能力和见解。

- 2022年10月,商业智慧和资料科学服务供应商Braincourt被凯捷收购。透过此次收购,Capgemini SA增强了在德国和北欧地区的需求资料和分析能力。 Braincourt 具体统筹财务、人力资源、生产和物流等关键业务领域,在商业智慧、资料科学和先进的计划管理服务方面建立了业界领先能力的声誉。 Braincoat 的客户包括大型汽车、建筑、能源和通讯公司,这与Capgemini SA的客户群完美契合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果和市场假设

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 做出更明智的劳动力决策的需求日益增长

- 人力资源部门薪资和招募资料增加

- 市场限制

- 缺乏劳动分析意识

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依组件类型

- 解决方案

- 人才招募与发展优化服务

- 薪资核算和监控

- 服务

- 专业服务

- 託管服务

- 解决方案

- 依实施类型

- 在云端

- 本地

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- 银行和金融服务保险(BFSI)

- 製造业

- 资讯科技/通讯

- 医疗

- 零售

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Automatic Data Processing Inc.

- IBM Corporation

- Oracle Corporation

- Accenture Plc

- Capgemini SE

- Cisco Systems Inc.

- SAP SE

- Visier Inc.

- Peoplestreme Pty Ltd(Ascender)

- SumTotal Systems LLC(Skillsoft Ltd)

- Cornerstone OnDemand Inc.

- Workday Inc.

第七章投资分析

第八章 市场机会与未来趋势

简介目录

Product Code: 63671

The Workforce Analytics Market is expected to register a CAGR of 15.64% during the forecast period.

Key Highlights

- Workforce analytics is used to study the behavior of employees and people data using analyzing people data to make better workforce decisions. This helps increase the productivity of the existing employees instead of hiring additional staff and improves the selection criteria.

- Predictive workforce analytics is one of the critical subtypes of workforce analytics. To forecast, utilizing past data refers to performing workforce analytics to create forecasts. Machine learning and data mining are the primary statistical models employed in this workforce analytics. Many firms use predictive workforce analytics to enhance the employee experience and streamline processes. Regression analysis, pattern matching, multivariate statistics, and other techniques are frequently used in this process to help businesses predict what is likely to occur in the future in terms of risks and talent outcomes.

- In this globalized world, the organization requires flexibility, speed, innovation, and talent to differentiate itself from other firms. It has let employees focus on workforce strategy and employee investment to support business growth and objectives. For instance, Mindtree used HR analytics tools in turnover modeling, risk assessment, management profiles, and productivity indexing. HR analytics tools have helped them predict employee turnover for the subsequent 90 days and enabled them to create usable insights from data analyses used in the forecasting model for the hiring teams.

- However, the lack of product information and the high cost of deployment are a few factors restraining the market from growing in the forecast period.

Workforce Analytics Market Trends

Performance Monitoring Offers Potential Growth

- According to a report by Oracle last year, 55% of the global workforce would be more likely to stay with an organization that uses AI to assist career progression. An increase in the implementation of big data analytics and artificial intelligence is contributing to the growth of the workforce analytics market.

- As a subset of HR analytics, workforce analytics assists HR teams in maximizing their organizations' human resources by tracking and measuring employee-related data. By focusing on the return on investment for each hire, the field goes far beyond hiring and dismissing. Furthermore, it highlights additional detailed information that aids in recognizing trends in the workplace, including potential risk factors, satisfaction with decisions, and more.

- Further, real-time talent decisions are the need of the hour, with market dynamics changing quickly. Human capital is the most valuable asset of any organization, and employee performance significantly impacts the bottom line. Thus, monitoring their employees' performance gives a clear picture of what parts of their performance need improvement and which sections are meeting or exceeding expectations. For example, India's leading IT services companies, Tata Consultancy Services, and Infosys, have shifted to a continuous performance system. By doing so, these two organizations believe they will be able to monitor employee performance at regular intervals and predict their behavior, which could affect their engagement levels.

- Monitoring performance data also helps evaluate how effectively managers engage with employees to set expectations, clarify doubts, plan improvement, and address performance anxieties. For example, Google utilizes HR analytics for its talent management activities. It is Project Oxygen analyzed its internal data to quantify what active managers do. It developed a management training program that consolidated eight behaviors, which led to better managerial quality.

- Therefore, the aforementioned factors are expected to boost workforce analytics market during the forecast period.

Asia-Pacific to Witness Fastest Growth

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period because of the shift toward more employee-centric organizations. The companies are focusing on their employees to gain regional competitive advantages. Therefore, they are implementing workforce analytics to get a clear picture of the internal framework.

- Moreover, the government's initiatives, such as Startup India, to encourage entrepreneurship within the country are also driving the market. Workforce analytics will help the organization make fact-based HR decisions. Therefore, creating a positive impact on the market.

- In several industries, including finance, education, advertising, and real estate, digital technology is expanding. Even though HR technology is thought to be a critical factor in the reform of working procedures, companies like Japan have used workforce analytics in the mainstream to manage workforce skills. For instance, Hitachi has moved quickly to build its capabilities. As a result of Hitachi's adoption of this technology and its recognition of the effectiveness of people analytics in recruitment, the company has also created surveys of employee placement and productivity, as well as solutions that use artificial intelligence to combine survey data with big data.

- China is witnessing tremendous growth due to a combination of internal resource-based capacity and foreign competitiveness. With the macroeconomic slowdown, reduced return on invested capital, and rising human capital costs in recent years, many Chinese businesses have turned their attention to managerial efficiency. This has made for a favorable environment for workforce analytics. In addition, data analytics has been a crucial component of the economic models of Chinese IT companies, which regard data as something of a norm they cannot survive. All the above factors are expected to drive the workforce analytics market in the mentioned region.

Workforce Analytics Industry Overview

The workforce analytics market is highly competitive. Many multinational companies, such as IBM Corporation, Oracle Corporation, Accenture, and Capgemini SE, are a few of the major players. The rising demand for better structures for talent and recruiting functions is creating immense opportunities among SMEs and large enterprises.

- In November 2022, to assist businesses in quickly making data-driven decisions and dealing with unforeseen disruptions, IBM unveiled new software to help organizations break down data and analytics silos. A comprehensive perspective of data sources from throughout the user's whole business is offered by the business intelligence planning, budgeting, reporting, forecasting, and dashboard capabilities of IBM Business Analytics Enterprise. To help eliminate silos and ensure that the appropriate teams have access to the appropriate data at the proper time, IBM Business Analytics Enterprise was created. For example, a company's sales, HR, and operations teams need access to data and insights from various business intelligence and planning tools for their individual needs, such as maximizing sales targets, creating workforce forecasts, or estimating operational capacity.

- In October 2022, Braincourt, a provider of business intelligence and data science services, was acquired by Capgemini. The acquisition will strengthen Capgemini's in-demand data and analytics capabilities in Germany and Northern Europe. In particular, throughout the governing domains of essential business operations like finance, HR, production, and logistics, Braincourt has established a reputation for having industry-leading capabilities in business intelligence, data science, and sophisticated project management services. Leading automotive, construction, energy, and telecommunications companies are among Braincourt's clients, which are an excellent match for Capgemini's clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Need to Make a Smarter a Decision About the Talent

- 4.3.2 Increasing Data in HR Departments related to Pay rolls, Recruitment

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness About Workforce Analytics

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component Type

- 5.1.1 Solutions

- 5.1.1.1 Talent Acquisition and Development Optimization Services

- 5.1.1.2 Pay Roll and Monitoring

- 5.1.2 Service

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Type

- 5.2.1 On-cloud

- 5.2.2 On-premises

- 5.3 By Organization Size

- 5.3.1 Small- and Medium-Sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Banking, Financial Services, and Insurance (BFSI)

- 5.4.2 Manufacturing

- 5.4.3 IT & Telecom

- 5.4.4 Healthcare

- 5.4.5 Retail

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Automatic Data Processing Inc.

- 6.1.2 IBM Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 Accenture Plc

- 6.1.5 Capgemini SE

- 6.1.6 Cisco Systems Inc.

- 6.1.7 SAP SE

- 6.1.8 Visier Inc.

- 6.1.9 Peoplestreme Pty Ltd ( Ascender)

- 6.1.10 SumTotal Systems LLC ( Skillsoft Ltd)

- 6.1.11 Cornerstone OnDemand Inc.

- 6.1.12 Workday Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219