|

市场调查报告书

商品编码

1641964

行动卫星服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mobile Satellite Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

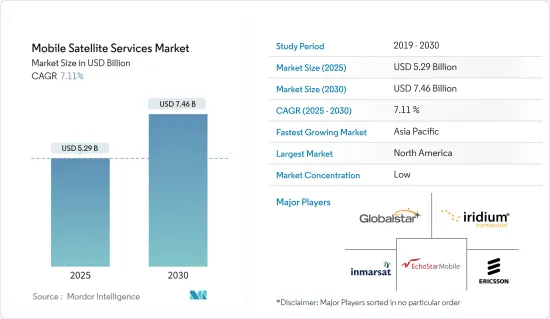

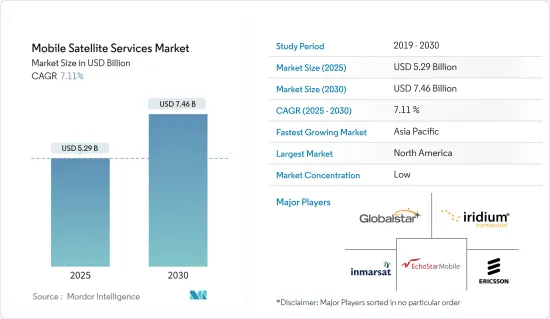

预计 2025 年行动卫星服务市场规模为 52.9 亿美元,到 2030 年将达到 74.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.11%。

新兴市场在物联网和防灾领域的卫星通讯服务使用量预计将在预测期内推动其发展。

主要亮点

- 行动卫星服务有广泛的应用范围,包括通讯、气象预报、导航、军事情报和太空探勘。此外,透过下一代卫星功能增强 5G 行动网路将使行动卫星营运商在新兴的 5G 生态系统中发挥关键作用。

- 直到最近,MSS频宽才与地面蜂巢使用的频宽分开,因为行动电话用户需要两个频宽或两部独立的行动电话。然而,在过去十年中,一些系统规划人员已提案使用 MSS频宽的部分内容用于地面蜂窝通讯和卫星通讯。

- 支援这种操作模式的地面蜂巢式网路称为辅助地面组件 (ATC)。儘管这会给现有的频率分配带来新的压力,并需要采取特殊预防措施来保护相邻频宽的 GPS 操作,但美国已经在使用与当前PCS/蜂窝设备类似的外形尺寸。概念已获得有条件核准采用标准设备的卫星地面网路将服务全球1000万人口。新兴无线和行动卫星服务正在融合。例如,ICO Global Communications(DSDB 最近被 Dish Network 收购)、TerreStar 和 LightSquared 在美国部署整合的 S 波段和L波段MSS 网路。

- 互通性是指各种资讯系统、设备和应用程式能够跨越组织内外部边界以同步方式连接,以便相关人员能够协作存取、交换和使用资料。资料交换架构和标准使得相关资料能够在所有适用环境中与相关相关人员(包括共用资讯的个人)有效、安全地共用。

- 最佳情况下,互通性促进了这些通讯系统之间的连接和集成,无论资料的来源或目的地如何,这样就可以立即获得资料并共用,而无需额外的最终用户干预。在行动卫星服务市场中,固定卫星服务与MSS或其他服务之间可以建立连线。这要求设备具有互通性,否则可能无法运作。

行动卫星服务 (MSS) 市场趋势

语音服务领域预计将大幅成长

- 该公司提供行动电话和固定电话服务,为世界各地偏远地区营运的企业提供必要的语音通话和通讯。这些语音服务可在陆地、海上和空中提供。利用先进的卫星通讯网络,我们提供清晰的语音品质和很少的掉线情况。

- 对于政府机构来说,语音移动卫星服务可以成为管理海岸警卫队和护林员的有效解决方案,并帮助边境和岛屿上的人们。在发生自然灾害时,这是必要的。

- 除政府机构外,企业也采用语音卫星服务,以确保渔业、采矿业、运输业、建筑业、旅游业等行业的工作人员能够持续、不间断地通讯。住宅客户也受益于语音卫星服务,特别是那些经常移动或在没有行动电话网路的地区工作的客户。

- 该公司透过提供语音卫星服务来支援极地探险者,使行动装置在地面网路无法覆盖的地方也能实现卫星连接。例如,极地探险家安东尼·津曼 (Anthony Zinman) 在南极洲之旅中使用了 Iridium GO。

- 企业也采用基于语音的行动卫星服务,以便员工与家人和亲密朋友保持联繫。例如,国际海事卫星组织提供了一项名为 ChatCard 的服务,这项服务让船员无论身在何处都可以自由地与家人和朋友保持联繫,从而帮助他们减少在海上的孤独感。

- 例如,美国电信业者Viasat 总部位于加州卡尔斯巴德,在国内和国际开展业务。 2022 年 Viasat 50% 以上的收益将来自卫星服务,其余则来自其产品线。 Viasat 为军事和商业市场提供安全的网路解决方案和高速卫星宽频服务。 2022财年,该公司预计将实现28亿美元收益。 Viasat 的收益自 2019 年以来稳步增长。

预计北美将出现强劲成长

- 北美是应用方面主导的创新者和先驱者之一,也是行动卫星服务最大的市场之一。政府、海事和航空等终端用户产业的需求不断增长,推动了该地区市场的成长。此外,该地区拥有发达的技术基础设施和完善的网路连接。

- 该地区的政府机构正在大力引进新的卫星和导航系统,这进一步支持了卫星通讯产业的发展。例如,2022 年 10 月,美国太空军发布了未来商业卫星通讯规范清单,以协助有兴趣的供应商为潜在的 2023 财年招标做准备。该部门指出,计划采购的 11 份合约预计将在未来 11 个月内持续。这份为期五年的合约预计价值在 6.2 亿美元至 6.3 亿美元之间。

- 另一项要求是重新竞争向国防部和其他联邦机构提供 Inmarsat 机载宽频和 World Express 服务的合约。一份价值 2.4 亿至 2.5 亿美元的后续五年合约可能会于 2023 年 2 月授予。

- 近日,SES GS宣布,美国总务管理局未来卫星通讯服务采购(FCSA)计画授予SES政府解决方案联合商业卫星通讯解决方案合约(CS3)席位。

- 这将为美国政府提供最具创新性的服务,包括使用多轨道卫星的高吞吐量连线。复杂的解决方案将包含固定和移动卫星服务、服务启用许可证、组件以及辅助设备(如终端、传送港和周边设备)的任意组合。

行动卫星服务 (MSS) 产业概览

行动卫星服务市场竞争激烈,由几家大公司组成。从市场占有率来看,目前市场主要被几家主要企业所占据。这些占据了绝对市场份额的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。此外,在这个市场运营的公司正在收购从事行动卫星服务技术的新兴企业,以增强其产品供应。

- 2023年5月,有报告指出,第八代Inmarsat太空船将由SWISSto12开发。三颗I-8卫星将提供额外的网路弹性,以确保Inmarsat全球L波段安全服务的长期连续性。

- 2023 年 3 月,Globalstar, Inc. 宣布,泰王国国家广播和通讯委员会 (NBTC) 秘书处已授予其必要的授权,在曼谷北部巴吞他尼府的 Thaicom 电信港中心运营一个新的地面站。该公司宣布已批准在泰国全境提供Globalstar 行动卫星服务。新地面站位于 Thaicom 电信中心,与分布在 17 个国家的其他 27 个地面站一起,为全球数亿人提供最佳的行动卫星服务,包括重要的紧急 SOS通讯。

- 2022 年 7 月-美国作战能力发展司令部授予领先的国家安全解决方案提供商 Kratos 国防与安全解决方案一份合同,以演示虚拟SATCOM 地面系统。该解决方案基于 Kratos 的 OpenSpace 平台,将透过简化多供应商网关和远端终端功能、降低生命週期成本以及支援自适应和动态空间操作,帮助加速 SATCOM 网路现代化工作。由陆军未来司令部创建的网路指挥、控制、通讯和情报跨职能团队 (N-CFT) 为该奖项提供了资金。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

第五章 市场动态

- 市场驱动因素

- 卫星和地面移动技术融合的需求日益增加

- 政府和军方的兴趣日益浓厚

- 市场限制

- MSS 系统之间缺乏互通性

- 加强卫星技术使用的监管

第六章 市场细分

- 按服务

- 声音的

- 资料

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

- 按最终用户产业

- 海上

- 企业

- 航空

- 政府

第七章 竞争格局

- 公司简介

- Globalstar Inc.

- Ericsson Inc.

- Inmarsat PLC

- EchoStar Mobile Limited

- Iridium Communications Inc.

- Intelsat SA

- Thuraya Telecommunications Company

- ViaSat UK Limited

- ORBCOMM Europe Holding BV

第八章 市场机会与未来趋势

- 投资分析

- 市场潜力

The Mobile Satellite Services Market size is estimated at USD 5.29 billion in 2025, and is expected to reach USD 7.46 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

The usage of satellite communication services for IoT, as well as in the disaster management areas in developed regions, is expected to boost the market studied over the forecast period.

Key Highlights

- Mobile satellite services can find space for a wide range of applications, including telecommunication, weather prediction, navigation, military intelligence, and space exploration. Additionally, augmenting 5G mobile networks with next-generation satellite capabilities helps mobile satellite operators play a vital role in the emerging 5G ecosystem.

- Until recently, the MSS frequency bands were separate from the bands used for terrestrial cellular because the mobile user either needed a dual frequency band handset or two separate handsets. However, in the past decade, several system planners have proposed that segments of the MSS frequency bands be used for both terrestrial cellular and satellite communications so that the handsets might be simplified and the user's service is always through the same service provider.

- The terrestrial cellular network to support this mode of operation is called the ancillary terrestrial component (ATC). Although this will put additional burdens on the existing frequency allocations and require special precautions to protect GPS operations in adjacent bands, conditional approvals for the concept have already been obtained in the United States for the deployment of new integrated satellite and terrestrial networks using standard devices with form factors similar to current PCS/Cellular devices. There is a convergence between emerging wireless and mobile satellite services. Examples include the deployment of S-Band and L-Band integrated MSS networks in the United States by ICO Global Communications (DSDB recently acquired by Dish Network), TerreStar, and LightSquared.

- Interoperability is described as the ability of diverse information systems, devices, and applications to connect, in a synchronized manner, inter and intra-organizational boundaries to access, exchange, and cooperatively use the data amongst stakeholders. Data exchange architectures and standards allow relevant data to be shared effectively and securely within all applicable settings and with relevant stakeholders (including with the person whose information is being shared).

- Optimally, interoperability facilitates the connections and integrations across these communication systems to occur regardless of the data's origin or destination and ensures the data are usable and readily available to share without additional intervention by the end user. In the mobile satellite services market, the connection can happen between fixed satellite services to MSS or others as well. It requires the facilities to have interoperability; otherwise, the function may fail.

Mobile Satellite Services (MSS) Market Trends

Voice Service Segment is expected to register a Significant Growth

- Companies are offering portable and fixed phone services that provide essential voice calls and messaging for businesses operating in remote regions across the world. These voice services can be used on land, at sea, and in the air. They utilize advanced satellite communications networks, offering clear voice quality and minimal call dropout.

- For government agencies, voice mobile satellite services are an effective solution to manage coast guards and forest rangers, allowing them to help people on the borders and the islands. This is necessary during natural disasters.

- Apart from government agencies, businesses adopt voice satellite services to ensure continuous, uninterrupted communications for their crews in the fishery, mining, transport, construction, and tourism industries. Individual customers also benefit from voice satellite services, especially those who are always on the move or working in areas without cellular networks.

- Companies support polar adventurers by providing them with voice satellite services, which enable satellite connectivity for mobile devices that terrestrial networks cannot reach. For instance, Polar adventurer Antony Jinman used Iridium GO on his Antarctica trip.

- Companies are also adopting voice-based mobile satellite services to keep their employees connected with their families and close friends. For instance, INMARSAT offers one of the services called ChatCard, which helps to reduce feelings of isolation at sea by giving crewmembers the freedom to stay in touch with family and friends anywhere.

- For instance, American communications firm Viasat Inc. is headquartered in Carlsbad, California, and has other operations both domestically and abroad. Over 50% of Viasat's revenue in 2022 came from satellite services, with the balance coming from its product line. Viasat is a provider of secure networking solutions and high-speed satellite broadband services for the military and commercial markets. In the fiscal year 2022, the corporation made 2.8 billion dollars in revenue. Viasat's revenue steadily increased since 2019.

North America is expected to witness significant growth

- Among the lead innovators and pioneers in terms of adoption, North America is one of the largest markets for mobile satellite services. The growth in demand from end-user industries, such as government, maritime, and aviation, among others, is boosting the growth of the market in the region. Moreover, the region has advanced foothold technological infrastructure and improved network connectivity.

- The government agencies in the region have made significant efforts to introduce new satellite and navigation systems, which have further boosted the growth of the Satcom industry. For instance, in October 2022, in order to assist interested vendors in getting ready for potential solicitations in the fiscal year 2023, the U.S. Space Force released a list of future specifications for commercial satellite communications. The service mentioned that the 11 planned contracts for procurement are anticipated to last for the following 11 months. The estimated value of the five-year contract is between USD 620 million and USD 630 million.

- Another requirement listed is a recompete of a contract used to deliver Inmarsat's airborne broadband and Global Xpress services to the Department of Defense and other federal agencies. A potential five-year follow-on contract worth between USD 240 million and USD 250 million could be awarded in February 2023.

- Recently, SES GS announced that the U.S. General Services Administration's Future Satellite Communications Service Acquisition (FCSA) program had awarded SES Government Solutions the spot on the Complex Commercial Satellite Communications Solutions contract (CS3).

- This will likely allow the U.S. Government to take advantage of the most innovative offerings, including high throughput connectivity on a multi-orbit satellite fleet. Complex solutions will have any combination of fixed and mobile satellite services, service-enabling authorizations, components, and ancillary equipment, such as terminals, teleports, and peripherals.

Mobile Satellite Services (MSS) Industry Overview

The Mobile Satellite Services market is highly competitive and fragemented consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share of the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups working on Mobile Satellite Services technologies to strengthen their product capabilities.

- May 2023, it was reported that a new 8th generation of Inmarsat spacecraft will be developed by SWISSto12. The three I-8 satellites will provide further network resilience to ensure the continuation of Inmarsat's global L-band safety services for a long time.

- March 2023, Globalstar, Inc., announced that the Kingdom of Thailand's Office of The National Broadcasting and Telecommunications Commission (NBTC) has authorized the provision of Globalstar mobile satellite services throughout Thailand, including the authority to operate its new ground station at Thaicom's Teleport Center in Patumthani province north of Bangkok. Its new ground station at Thaicom's Teleport Center joins twenty-seven other stations in seventeen countries to provide the finest mobile satellite services, including critical Emergency SOS communications, to hundreds of millions of people globally.

- July 2022 - The Combat Capabilities Development Command of the U.S. Army awarded a contract to Kratos Defense & Security Solutions, Inc., a leading National Security Solutions provider, to showcase a virtualized SATCOM ground system. The solution, which is based on Kratos' OpenSpace Platform, will allow the government to deploy SATCOM networks in accordance with modernization objectives such as streamlining gateway and remote terminal capabilities supported by multiple vendors, lowering life-cycle costs, and assisting adaptive, dynamic space operations. The Network Command, Control, Communication, and Intelligence Cross-Functional Team (N-CFT), which was created by the Army's Future Command, provided funding for this award.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Integration Demands for Satellite and Terrestrial Mobile Technology

- 5.1.2 Growing Interest from Government and Military

- 5.2 Market Restraints

- 5.2.1 Lack of Interoperability between MSS Systems

- 5.2.2 Increasing Regulations on the Use of Satellite Technology

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Voice

- 6.1.2 Data

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.3 By End-User Industry

- 6.3.1 Maritime

- 6.3.2 Enterprise

- 6.3.3 Aviation

- 6.3.4 Government

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Globalstar Inc.

- 7.1.2 Ericsson Inc.

- 7.1.3 Inmarsat PLC

- 7.1.4 EchoStar Mobile Limited

- 7.1.5 Iridium Communications Inc.

- 7.1.6 Intelsat S.A

- 7.1.7 Thuraya Telecommunications Company

- 7.1.8 ViaSat UK Limited

- 7.1.9 ORBCOMM Europe Holding BV

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 Investment Analysis

- 8.2 Future of the Market