|

市场调查报告书

商品编码

1651053

北美行动卫星服务:市场占有率分析、产业趋势和成长预测(2025-2030 年)North America Mobile Satellite Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

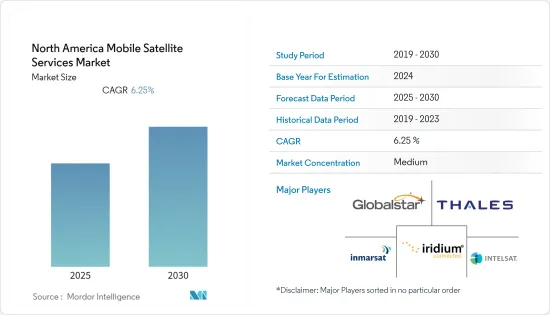

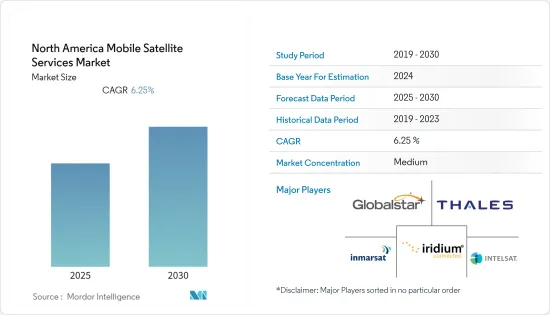

预测期内北美行动卫星服务市场预计复合年增长率为 6.25%

关键亮点

- 行动卫星服务的用途十分广泛,包括媒体广播、天气、通讯、军事情报、导航、太空探勘、5G通讯系统和监控应用。

- 此外,透过下一代卫星功能增强其 5G 行动网路将使行动卫星营运商在新兴的 5G 生态系统中发挥关键作用。

- 据卫星工业协会(SIA)称,GNSS市场和网路设备的扩张正在推动地面设备收益的大幅成长。相较之下,客户设备投资和资源保持稳定或略有下降,表明行动卫星通讯(MOST)将成为所研究市场的根本成长点。

- 终端用户产业越来越多地采用行动资料和语音卫星服务来满足其通讯需求,无论其业务位于何处。 Inmarsat 等公司透过其 Inmarsat Prepay 平台提供预付语音和资料卫星服务,并推出对源自美国及其领土的语音通话的支援。

- 然而,MSS 系统之间缺乏互通性以及对卫星技术使用日益严格的监管阻碍了预测期内的市场成长。

- 据卫星产业协会称,商业卫星产业在新冠疫情期间发挥了至关重要的作用。由于大量应用提供语音、资料和广播通讯解决方案以及导航、地球观测、遥感探测和其他对全国乃至全世界的企业、政府客户和消费者至关重要的独特服务,对卫星通讯的需求不断增加。包括美国太空总署在内的全球太空机构正在利用通讯来帮助描述由于 COVID-19 而导致的全球变化。

北美行动卫星服务市场趋势

增加政府投资

- 北美政府机构一直在努力引进新的卫星和导航系统,这将促进卫星通讯产业的发展。北美有大片沿海地区需要持续监测。该地区日益增长的商业活动和贸易推动了海上安全和监测的需求。

- 为了指挥和控制部队、监视敌方行动以及发现可能危及美国及其盟友的威胁,美国国防部 (DoD) 依靠卫星为几乎每项军事任务提供的优势。据忧思科学家联盟称,截至 2022 年 1 月 1 日,在绕地球运行的 4,852 颗卫星中,有 2,944 颗是美国的。

- 此外,各主要企业都在寻求进行策略性收购,以提供区域行动卫星相关服务。例如,2021 年 5 月,OneWeb 宣布加入卫星服务供应商TrustComm,一家低地球轨道 (LEO) 营运商。此次收购为 TrustComm 提供了服务美国政府和商业客户的管道。此外,此次收购将为国防部和其他政府客户提供一套新的服务,网路速度高达 195Mbps,延迟更低,多轨道用户终端更紧凑,并内建网路管理工具。

- 加拿大政府正在采取措施加强该地区的卫星连结性。例如,2021年5月,加拿大政府宣布提供频谱,以发展无线服务市场的竞争,改善农村连结性,并确保5G技术的有效部署。由于大量频谱保留用于偏远地区的卫星服务,可用于支援无线宽频服务的频谱数量已从 50 MHz 增加到 80 MHz。农村地区的公民也将受益于此措施。

- 此外,2022 年 4 月,西班牙通讯营运商 Hispasat 宣布将与网路服务供应商GlobalSat 合作,为墨西哥 500 个偏远城镇提供免费卫星连线热点。墨西哥联邦政府正在透过其 CFE TEIT(全民电信和互联网)计划推动这一伙伴关係。每个城市的居民将能够透过安装在公共区域的开放 Wi-Fi 热点为自己的设备存取免费的卫星连线。

预计美国将占很大份额

- 卫星服务可以服务远离地面的偏远地区。林业、采矿业、石油和天然气以及国防等偏远商业行业依靠行动卫星服务进行语音通讯、远端网路连线、位置资讯和自动监控。

- 此外,行动卫星设备通常在世界大部分地区运行,并且可以快速轻鬆地部署。商业卫星公司为美国政府客户提供各种行动卫星解决方案,例如美国国防部,从任务关键型卫星语音和资料到追踪和高速手机解决方案。

- 2021 年 6 月,美国授予铱星通信公司一份合同,用于建造可传输时间和位置信号等资料的有效载荷。该合约将用于价值高达3000万美元的研发活动。铱星公司将开发小型卫星有效载荷,并将其安置在一个未命名的低地球轨道卫星群中。

- 许多区域组织正在为行动卫星服务的发展做出贡献。例如,2022 年 6 月,Ligado Networks 宣布与索尼半导体以色列公司合作,为 Ligado 的物联网 (IoT) 5G 行动卫星网路开发晶片组。

- 同样,2022 年 4 月,卫星电信业者Kymeta 和安全商业卫星通讯应用解决方案供应商 OneWeb Technologies 宣布达成协议,为美国政府提供安全、可靠且经济高效的宽频连线服务。

北美行动卫星服务产业概况

随着许多参与企业的加入,竞争日益激烈,北美行动卫星服务市场似乎呈现分化趋势。北美行动卫星服务市场的主要企业正在透过收购和伙伴关係来扩大其对全球更多消费者的影响力。主要的行动卫星服务公司包括 Globalstar Inc、Thales Group 和 Inmarsat PLC。

- 2021年12月,全球行动卫星通讯领导者Inmarsat与三菱重工业株式会社(MHI)成立了Inmarsat PLC。首颗Inmarsat 6卫星(I-6 F1)将搭载H-IIA 45号火箭发射。 Inmarsat-6 F1通讯由空中巴士防务与航太公司设计建造,基于 Eurostar 3,000EOR卫星载具,将由 Inmarsat 的英国卫星通讯业者营运。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术趋势(5G技术主要发展趋势、3GPP Release-17、使用案例等)

- 监管状态

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 卫星和地面移动技术融合的需求日益增加

- 具有下一代卫星功能的 5G 行动网路可能会推动市场成长

- 市场问题

- MSS 系统之间缺乏互通性。

- 加强卫星技术使用的监管

第六章 市场细分

- 按卫星类型

- 低地球轨道(LEO)

- 中轨道(MEO)

- 地球静止轨道(GEO)

- 按服务

- 声音的

- 资料

- 按最终用户产业

- 海上

- 企业

- 航空

- 政府

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Globalstar Inc.

- Thales Group.

- Inmarsat PLC

- Iridium Communications Inc.

- Intelsat SA

- TerreStar Solutions Inc.

- Swarm Technologies, Inc

- Viasat, Inc

- ORBCOMM Europe Holding BV

- Telesat

第八章投资分析

第九章 市场机会与未来趋势

The North America Mobile Satellite Services Market is expected to register a CAGR of 6.25% during the forecast period.

Key Highlights

- Mobile satellite services are used for several applications such as media broadcasting, weather, telecommunication, military intelligence, navigation, space exploration, 5G communications systems, and surveillance applications.

- Additionally, augmenting 5G mobile networks with next-generation satellite capabilities helps the mobile satellite operators play a vital role in the emerging 5G ecosystem.

- According to the Satellite Industry Association (SIA), ground equipment revenues have increased significantly due to the expansion of GNSS markets and network equipment. In contrast, customer equipment investments and resources have remained flat or slightly declining, indicating that mobile satellite communication (MOST) will become a fundamental growth point of the overall market studied.

- There is a growing trend among end-user industries to adopt data and voice mobile satellite services to satisfy their communication requirements, wherever their operations are located. Companies, such as Inmarsat, are offering pre-paid satellite services for voice and data via the Inmarsat pre-pay platform, with the introduction of support for voice calls originating in the United States and its territories.

- However, the lack of interoperability between MSS systems and increasing regulations on the use of satellite technology are restraining factors hindering the market's growth over the forecast period.

- According to the Satellite Industry Association, the commercial satellite industry played a pivotal role during the COVID-19 pandemic. The demand for satellite communication increased due to its vast applications in providing voice, data, and broadcast communications solutions along with navigation, earth observation, remote sensing, and other unique services vital for businesses, government customers, and consumers domestically and around the globe. Global space agencies, such as NASA, have leveraged communication satellites to illustrate the planet-wide changes resulting from COVID-19.

North America Mobile Satellite Services Market Trends

Increasing Government Investments

- The government agencies in North America have been making significant efforts to introduce new satellite and navigation systems that boosted the growth of the satellite communication industry. North America has a large coastal area that requires continuous monitoring. The increasing commercial activities and trade in the region are propelling the need for maritime safety and surveillance.

- To command and control forces, monitor opponent actions, and uncover threats that could jeopardize the United States and its allies, the U.S. Department of Defense (DoD) relies on the advantages afforded by satellites for nearly every military mission. As per the Union of Concerned Scientists, out of 4,852 active artificial satellites orbiting the Earth, 2,944 belongs to the United States as of January 1, 2022.

- Moreover, various key players look forward to strategic acquisitions to provide regional mobile satellite-related services. For instance, In May 2021, OneWeb announced the addition of TrustComm, a satellite service provider, the Low-Earth Orbit (LEO) operator. The acquisition is to provide channels to deliver services to TrustComm's U.S. government and enterprise clients. Further, this acquisition will provide DoD and other government clients with a new suite of services with network speeds up to 195 Mbps, lower latency, more compact multi-orbit user terminals, and built-in network management tools.

- The Canadian government is taking steps to enhance satellite-based connectivity in the region. For instance, In May 2021, the Canadian government announced the availability of the spectrum to develop competition in the wireless services market, improve rural connectivity and ensure the effective deployment of 5G technologies. With large amounts of spectrum maintained for satellite services in remote areas, the spectrum available to support wireless broadband services increased from 50 MHz to 80 MHz. The citizens in rural areas will also be benefited from this initiative.

- Moreover, In April 2022, Hispasat, Spanish telecommunications satellite operator, announced its collaboration with GlobalSat, an internet service provider, to provide free satellite connectivity hotspots in 500 remote towns in Mexico. The Mexican federal government promotes this partnership through the CFE TEIT (Telecommunications and internet for everyone) program. Residents of the cities will have free satellite connectivity on their devices through an open Wi-Fi hotspot in public areas.

United States is Expected to Hold a Major Share

- Satellite services can serve remote areas far from the ground. Remote commercial industries such as forestry, mining, oil, gas, and defense use mobile satellite services for voice communications, remote connections to the internet, location information, and automated surveillance.

- In addition, mobile satellite equipment often operates in significant parts of the globe and can be deployed quickly and easily. Commercial satellite companies offer U.S. government customers such as the Department of Defense a variety of mobile satellite solutions, from essential satellite voice and data to tracking and high-speed handset solutions.

- In June 2021, the United States Army awarded Iridium Communications a contract to build a payload that may transmit data such as timing or position signals. The contract is used for research and development activities valued at up to USD 30 million. Iridium will develop a tiny satellite payload housed by an unnamed low-Earth-orbit constellation.

- Many regional organizations are contributing to the development of mobile satellite services. For instance, In June 2022, Ligado Networks announced a partnership with Sony Semiconductor Israel to develop chipsets for Ligado's 5G mobile satellite network for the Internet of Things (IoT), marking a major milestone for deploying enhanced connectivity and serving the growing market for 5G mobile satellite connectivity anywhere in the U.S. and across North America.

- Similarly, In April 2022, Kymeta, a satellite communications company, and OneWeb Technologies, a provider of secure commercial satellite communications application solutions, announced an agreement to distribute secure, reliable, and cost-effective broadband connectivity services to the U.S. government.

North America Mobile Satellite Services Industry Overview

North America Mobile Satellite Services market appears to be fragmented owing to the availability of the large number of players intensifying the competition. Major players in the North America Mobile Satellite Services market are adopting acquisitions and partnerships to expand their reach to more consumers worldwide. Some major mobile satellite servicing companies are Globalstar Inc, Thales Group, and Inmarsat PLC, among others.

- In December 2021, Inmarsat, the global leader in mobile satellite communications, and Mitsubishi Heavy Industries, Ltd. (MHI) launched the Inmarsat-6 fleet's first satellite (I-6 F1) using MHI's H-IIA Launch Vehicle No. 45. The Inmarsat-6 F1 communications satellite, designed and produced by Airbus Defense and Space and based on the Eurostar 3000EOR satellite bus, will be operated by Inmarsat's British satellite operator.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power Of Suppliers

- 4.3.2 Bargaining Power Of Buyers

- 4.3.3 Threat Of New Entrants

- 4.3.4 Threat Of Substitutes

- 4.3.5 Intensity Of Competitive Rivalry

- 4.4 Technology Insights (Key trends related to developments in 5G technology, Release-17 of 3GPP, use cases)

- 4.5 Regulatory Landscape

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Integration Demands for Satellite and Terrestrial Mobile Technology

- 5.1.2 5G mobile networks with next-generation satellite capabilities is likely to propel the market growth

- 5.2 Market Challenges

- 5.2.1 Lack of Interoperability between MSS Systems.

- 5.2.2 Increasing Regulations on the Use of Satellite Technology

6 MARKET SEGMENTATION

- 6.1 By Satellite Type

- 6.1.1 Low Earth Orbit (LEO)

- 6.1.2 Medium Earth Orbit (MEO)

- 6.1.3 Geostationary Earth Orbit (GEO)

- 6.2 By Service

- 6.2.1 Voice

- 6.2.2 Data

- 6.3 By End-user Industry

- 6.3.1 Maritime

- 6.3.2 Enterprise

- 6.3.3 Aviation

- 6.3.4 Government

- 6.4 By Country

- 6.4.1 U.S.

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Globalstar Inc.

- 7.1.2 Thales Group.

- 7.1.3 Inmarsat PLC

- 7.1.4 Iridium Communications Inc.

- 7.1.5 Intelsat S.A

- 7.1.6 TerreStar Solutions Inc.

- 7.1.7 Swarm Technologies, Inc

- 7.1.8 Viasat, Inc

- 7.1.9 ORBCOMM Europe Holding BV

- 7.1.10 Telesat