|

市场调查报告书

商品编码

1641997

专业服务自动化:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Professional Services Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

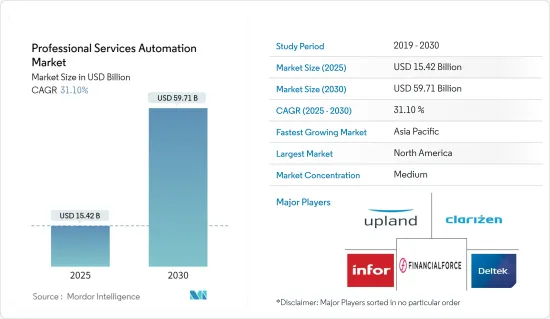

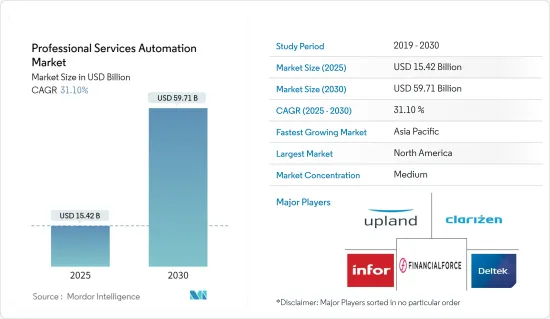

专业服务自动化市场规模在 2025 年预计为 154.2 亿美元,预计到 2030 年将达到 597.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 31.1%。

对于寻求快速有效处理的收件人来说,手动、实体、纸本发票带来了许多挑战。

主要亮点

- 市场正在见证多种解决方案创新,这些创新正在帮助推动市场成长。例如,VOGSY 是唯一基于 Google G Suite 建构的 PSA 解决方案,为专业服务组织的整体流程提供业务流程支援和整合。它建立在单一、可访问的平台上,为所有部门的员工提供支援。 VOGSY 最重要的差异化因素是我们建立了简单而又复杂的 PSA 解决方案,使用户能够做更多的事情。

- 由于前所未有的部署灵活性、扩充性、增强的协作、成本效益优势和全球可用性,预计在预测期内云端基础的部署类型将在应收帐款自动化市场中显着成长。市场上有多家供应商透过公共云端和私有云端提供付款收集解决方案,这些解决方案透过各种订阅和计量收费模式提供。

- 新冠肺炎疫情影响全球,对新创阶段的企业和政府造成了严重的负面影响。它对审核、会计和其他财务流程产生了严重影响。自那时起,由于当时市场需要的技术创新和进步,该行业和供应商经历了显着的成长。专业服务自动化市场预计将继续保持良好的成长动能。

专业服务自动化 (PSA) 市场趋势

BFSI 主导专业服务自动化市场

- 银行业的自动化透过自动执行重复且耗时的后端业务,帮助金融机构简化业务、降低业务成本并优化债务催收流程。它也有助于推动产业发展,消除冗余流程,提高金融机构的信任。此外,金融机构可以将宝贵的资源重新分配到各种其他重要的增值计划和不可避免的人力参与的任务上。

- 服务自动化正在被 BFSI 领域广泛采用,以大规模自动化发票处理、资料输入、彙报、现金收款、债务追收、供应商付款等交易业务。近日,中国工商银行正式为不列颠哥伦比亚省客户推出个人ICBC保险单线上续保服务。

- 此外,根据纽约联邦储备银行预测,截至2022年第二季度,美国消费者债务将超过16兆美元。其中大部分是房屋抵押贷款,约10.4兆美元,其次是学生贷款,约1.59兆美元。

北美主导专业服务自动化市场

- 北美占据着大部分的市场份额。北美区域市场涵盖了该行业大部分的技术领导者。这些领导者积极致力于推动现有技术并增加创新市场产品。由于劳动力快速老化,该地区的需求不断增加,自动化将促进顺利管理和有效分配可用资源。

- 北美区域成长的动力来自于服务业加速扩张和技术不断发展。此外,该地区的组织正在采用无机成长策略来扩大其全球影响力。

- 此外,该地区两大经济体美国和加拿大正在投资新兴技术并开发IT基础设施设施。由于 Autotask Corporation 和 FinancialForce.com 等主要市场参与者提供专业服务自动化软体和服务,美国是该地区的重要股东。

- 此外,北美是摩根大通、Visa、万事达卡和美国银行等主要 BFSI 公司的所在地,这些公司是专业服务自动化市场的主要贡献者和推动者。

专业服务自动化 (PSA) 产业概览

专业服务自动化市场是半静态的。当今的专业服务公司面临的挑战包括缺乏知识渊博和经验丰富的人才、强劲的市场环境、併购衍生以及日益成熟的客户。同时,决策者和高阶主管们对PSA解决方案的优势及其在提高公司竞争力和盈利方面的作用有了更深入的了解。市场的一些关键发展包括:

- 2022 年 10 月-Infor 宣布将在海德拉巴 Hitec City 开设新的开发中心 (DC),扩大其印度业务。该公司还宣布,将在一块占地 35 万平方英尺的土地上建造一座新的多层、最先进的开发中心,可容纳 3,500 名员工。此外,这项投资将使 Infor 能够开拓数位技术,包括云端、行动性、资料分析、人工智慧和物联网,以提供新的产业特定功能。

- 2022 年 5 月-Mavenlink 和 Kimble Applications 宣布推出Kantata,这是两家公司成功合併和整合后成立的。两家公司表示,Kantata 将加速开发和交付最全面的垂直 SaaS 解决方案,旨在帮助专业服务机构优化和提高业务绩效,打造蓬勃发展的业务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况(新冠疫情对市场的影响)

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 自动化和降低成本的趋势日益增强

- 中小企业需求旺盛

- 市场挑战

- 市场缺乏产品讯息

第六章 市场细分

- 依部署类型

- 本地

- 云

- 按类型

- 解决方案

- 发票

- 计划管理

- 费用管理

- 其他解决方案

- 服务

- 解决方案

- 按最终用户产业

- BFSI

- 建筑、工程和建设

- 法律服务

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Autotask Corporation(Datto Inc.)

- Mavenlink, Inc.

- Clarizen Inc.

- Deltek Inc.

- Financialforce Inc.

- Infor Inc.

- NetSuite Inc.(Oracle Corporation)

- Upland Software Ltd.

- Projector PSA Inc.

- Replicon Inc.

- Unanet Technologies

- Workfront, Inc

第八章投资分析

第九章 市场机会与未来趋势

The Professional Services Automation Market size is estimated at USD 15.42 billion in 2025, and is expected to reach USD 59.71 billion by 2030, at a CAGR of 31.1% during the forecast period (2025-2030).

Paper-based invoices that are manual & physical pose several challenges for recipients looking to quickly and effectively process them.

Key Highlights

- The market has witnessed several solution innovations, aiding in the market growth. For instance, VOGSY, the only PSA solution built on Google's G Suite, offers business process support and integration across the core processes of professional services organizations. It is built on a single, accessible platform and supports employees across all departments. VOGSY's most significant differentiator is that it created a simple yet sophisticated PSA solution that engages users to do more.

- Cloud-based deployment types are expected to have significant growth in the accounts receivable automation market during the forecast period due to their unprecedented deployment flexibility, scalability, enhanced collaboration, cost-efficiency benefits, and global availability. Several vendors in the market are providing payment collection solutions through the public and private cloud, and solutions are available in various subscriptions and pay-per-use models.

- COVID-19 had a global impact and, in turn, severely influenced businesses and governments in a deeply negative way at the starting phase. The implications for auditing, accounting, and other financial processes were severely affected. Later the industry and its vendors saw a significant boost due to their innovations and advancement, which were the market's needs at the time. And excellent growth is expected in the future of the market of Professional Services Automation.

Professional Services Automation (PSA) Market Trends

BFSI Holds a Dominant Position in Professional Services Automation Market

- Automation in the banking industry helps financial institutions simplify their operations, minimizing the operation costs and optimizing their credit collection process by automating the repetitive and time-taking backend tasks. It also helps the industry evolve, eliminate redundant processes, and improve the credibility of financial institutions. It further allows the institutions to deploy their valuable resources to various other critical value-added projects and tasks where the involvement of humans is inevitable.

- Services automation is widely adopted in the BFSI sector as it automates transactional tasks at scale, such as processing invoices, data entry, reporting, cash collection, credit collection, payment to vendors, and many more. Recently, ICBC launched the convenience of renewing personal ICBC insurance policies online for its customer in British Columbia, which will enable them to have the option to renew their policy using their computer, tablet, or mobile device.

- Moreover, according to New York Fed, Consumers in the United States had over USD 16 trillion in debt as of the second quarter of 2022. In addition, they stated that most of that debt was home mortgages, at approximately USD 10.4 trillion and Student loan debt was the second largest component, totaling approximately USD 1.59 trillion.

North American Holds a Dominant Share of Professional Services Automation Market

- North America occupies a significant share of the market. North America's regional market includes the majority of industry technology leaders. These leaders are actively operating towards the progress of existing technologies and the growth of innovative market offerings. Greater demand is experienced owing to the quickly aging workforce in the region, and automation facilitates smooth management and effective allocation of available resources.

- North America's regional growth can further be attributed to the accelerated sprawl in the service industry and advancing technological developments. The regional organizations have also embraced inorganic growth strategies to encourage global presence.

- Furthermore, the region's two advanced economies, the US and Canada, are investing in emerging technologies and have developed IT infrastructure facilities. The US is a significant shareholder in this region, owing to the presence of leading market players giving professional service automation software and services, such as Autotask Corporation, and FinancialForce.com, among others.

- Moreover, North America is a hub for major BFSI companies like JP Morgan Chase, Visa, Mastercard, and Bank of America, which contribute a lot towards the market of Professional Services Automation and drive the market.

Professional Services Automation (PSA) Industry Overview

The professional services automation market is semi-consolidated. Professional services firms are currently confronted with challenges such as a shortage of knowledgeable and experienced resources, robust market environments, spin-offs from mergers and acquisitions, and increasingly refined and sophisticated clients. At the same time, decision-makers and best executives are becoming more informed of PSA solutions' benefits and their role in making firms more competitive and profitable. Some of the key developments in the market are:

- October 2022 - Infor announced the expansion of its India operations by opening a new development center (DC) in Hitech City, Hyderabad. In addition, the company stated that the new multi-story state-of-the-art development center is spread over 350,000 square feet with a capacity for 3,500 employees. Moreover, this investment will allow Infor to pioneer digital technologies such as cloud, mobility, data analytics, artificial intelligence, and IoT to deliver new industry-specific features and functions specialized for industries.

- May 2022 - Mavenlink and Kimble Applications announced the launch of Kantata, formed through the successful merger and integration of the two companies. The companies stated that Kantata was created to accelerate the development and delivery of the most comprehensive range of vertical SaaS solutions purpose-built that helps professional services organizations to optimize and elevate operational performance for building thriving businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (followed by impact of COVID-19 on the market)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Automation and Reduction in the Overall Cost

- 5.1.2 High Demand from Small and Medium Enterprise

- 5.2 Market Challenges

- 5.2.1 Lack of Product Information in the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Solutions

- 6.2.1.1 Billing & Invoice

- 6.2.1.2 Project Management

- 6.2.1.3 Expense Management

- 6.2.1.4 Others Solutions

- 6.2.2 Services

- 6.2.1 Solutions

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Architecture, Engineering, and Construction

- 6.3.3 Legal Services

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autotask Corporation (Datto Inc.)

- 7.1.2 Mavenlink, Inc.

- 7.1.3 Clarizen Inc.

- 7.1.4 Deltek Inc.

- 7.1.5 Financialforce Inc.

- 7.1.6 Infor Inc.

- 7.1.7 NetSuite Inc. (Oracle Corporation)

- 7.1.8 Upland Software Ltd.

- 7.1.9 Projector PSA Inc.

- 7.1.10 Replicon Inc.

- 7.1.11 Unanet Technologies

- 7.1.12 Workfront, Inc