|

市场调查报告书

商品编码

1851753

资料中心基础设施管理(DCIM):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Data Center Infrastructure Management (DCIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

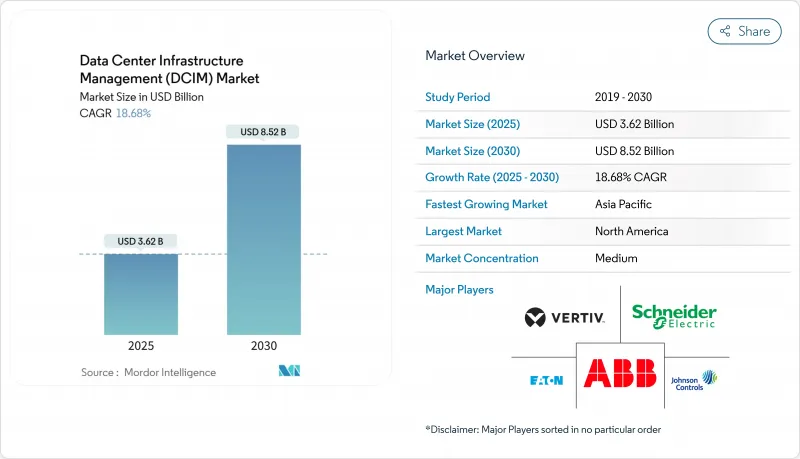

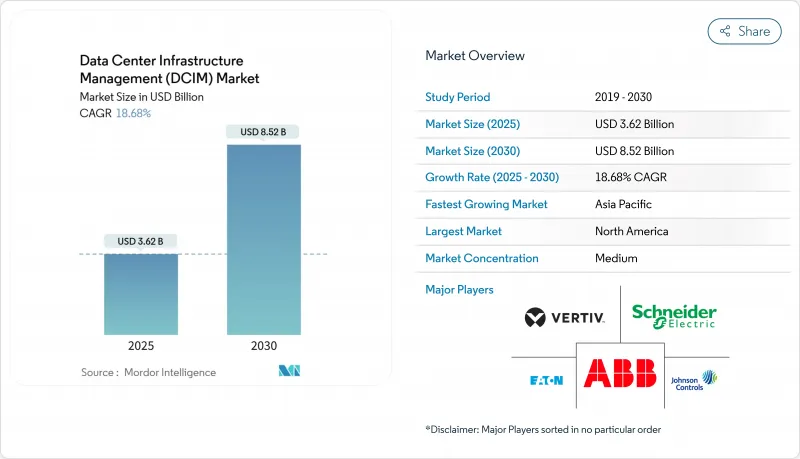

预计到 2025 年,资料中心基础设施管理市场规模将达到 36.2 亿美元,到 2030 年将达到 85.2 亿美元,复合年增长率为 18.68%。

人工智慧驱动的热负荷、欧盟强制性能源使用揭露规则以及全球范围内单园区容量超过500兆瓦的超大规模计划浪潮,共同推动了资料中心产业的成长。服务提供者正日益采用预测分析技术,以满足网路保险远端检测要求,并将合规性转化为可衡量的节能效果。由于资料中心营运商持续面临设施工程师短缺的问题,与託管资料中心基础设施管理 (DCIM) 相关的服务发展最为迅猛。竞争的焦点在于能够优化机架级冷却、电力和资产利用率的整合式软硬体组合。投资人将融资成本与检验的ESG 指标挂钩,使得经 DCIM检验的能源效率成为新建和维修的差异化优势。

全球资料中心基础设施管理 (DCIM) 市场趋势与洞察

加速实现净零排放目标并强制揭露能源使用情况

欧盟能源效率指令要求所有500kW以上的资料中心在2024年9月前揭露其电力、碳排放和水资源效率,这使得资料中心基础设施管理(DCIM)从可选的最佳化软体转变为必不可少的合规基础设施。已部署即时DCIM的营运商报告称,透过动态容量预测,节能高达18%,证明了监管投入的实际回报。跨国公司目前正在所有设施中采用相同的DCIM架构,以简化永续性报告流程并避免区域性审核。随着投资人要求统一的ESG(环境、社会和治理)资讯揭露,这项需求也正在欧洲以外蔓延。由于该指令也针对资料中心(资料中心消耗了欧盟近3%的电力消耗量),因此效率的提升将转化为全部区域电网的负载缓解。

超过 500MW丛集的超大规模资料中心建设

像Compass Datacenters在密西西比州投资100亿美元的园区级计划这样的大型投资项目,需要一个资料中心基础设施管理(DCIM)平台来协调分布在模组化电源和冷却撬装系统中的数千个机架。传统的楼宇管理系统无法在千兆瓦级规模下提供机架远端检测或故障预测警报。透过与西门子签订多年供货协议,整合预製电源模组,可加强DCIM软体与电力基础设施之间的连接。随着资本密集度的增加,营运商优先考虑即时了解气流和容量,以降低营运成本。因此,向500兆瓦及以上规模的转变,使得DCIM成为计划可行性研究的核心。

持续存在的OT-IT整合复杂性与传统BMS重迭问题

传统楼宇管理系统通常依赖专有通讯协定,无法与现代资料中心基础设施管理 (DCIM) API 互通。营运商缺乏统一的资产清单,同时重复部署感测器和仪表板,导致资本支出和营运成本双双上升。客製化中间件计划需要重新编码才能升级,这会延长部署週期并增加生命週期成本。在多供应商设施中,每个机械承包商都将自身功能锁定在封闭的工具链中,这可能会阻碍整体能源最佳化。

细分市场分析

由于58%的营运商表示难以招募到熟练的设施工程师,预计服务收入将以23.34%的复合年增长率成长。资产管理部署目前正从企划为基础的实施模式转向包含持续优化服务的订阅模式。託管服务也承担了调整人工智慧丛集配套液冷迴路的复杂性。儘管解决方案在2024年占据了资料中心基础设施管理市场66.2%的份额,但基于结果的合约的兴起预示着以服务为中心的未来。企业倾向于透过外包感测器校准、韧体管理和合规性彙报来控制人事费用。

随着边缘节点的扩展,对网路和连线管理功能的需求也将随之成长。供应商正在推出整合加速器,以连接传统的建筑管理系统 (BMS),从而为客户提供统一的管理介面。这一发展趋势凸显了从一次性软体授权转向由专家支援保障的经常性收入模式的策略转变。

容量超过 150MW 的巨型资料中心预计将以 21.96% 的复合年增长率成长,取代先前云端运算浪潮中占据主导地位的大型资料中心。随着 GPU 互连带来的优势远大于延迟带来的损失,营运商将集中部署 AI 训练丛集。巨型资料中心将利用规模经济效应,实现多个机房共用液冷迴路,将冷却设备的 PUE 值提升至 1.1 或更低。随着感测器数量达到数百万,编配复杂性不断增加,该领域的资料中心基础设施管理市场规模也将迅速扩张。

超大型园区的转型也推动了模组化电源撬装设备和预製机房单元的创新,这些设备和单元均经过工厂测试,并整合了资料中心基础设施管理(DCIM)功能。规模较小的企业设施在延迟敏感型工作负载方面仍然发挥作用,但预算限制了先进数位双胞胎模组的应用。

资料中心基础设施管理 (DCIM) 市场报告按资料中心规模(小型、中型、其他)、部署类型(本地部署、託管)、元件(解决方案、服务)、最终用户产业(IT 和通讯、银行、金融服务和保险 (BFSI)、其他)以及地区(北美、欧洲、其他)对产业进行细分。市场预测以美元计价。

区域分析

北美地区预计到2024年将占总收入的42.4%,这主要得益于超大规模资料中心建置和人工智慧培训中心的早期应用。该地区的营运商正在采用液冷和数数位双胞胎,将机架密度提升至50kW及以上,并增加资料中心基础设施管理(DCIM)的投入。联邦和州政府的节能奖励进一步强化了即时监控的商业价值。

亚太地区预计到2030年将以35.23%的复合年增长率成长,这主要得益于中国力争在2027年成为规模达1,250亿美元的资料中心经济体,以及印度在其「数位印度」计画下加速发展。日本面临着全球最高的资料中心建置成本之一,这促使人们对自动化资料中心基础设施管理(DCIM)越来越感兴趣,以最大限度地利用每一平方公尺的空间。新加坡和澳洲作为区域枢纽,提供跨境云端服务,这些服务必须满足各种不同的合规要求。

在能源效率指令的推动下,欧洲的资料中心基础设施管理(DCIM)市场持续稳定成长。营运商正竞相将DCIM整合到现有棕地维修和新建专案中,以满足2024年9月的报告截止日期。随着区域云端服务供应商将基础设施在地化以降低延迟,中东和南美市场的需求也不断增长。非洲的DCIM市场仍处于起步阶段,但随着行动网路使用量的成长,预计非洲也将采用轻量级DCIM。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速推动净零排放目标和强制揭露能源使用情况

- 超过 500MW丛集的超大规模资料中心建设

- 5G/物联网边缘和微型资料中心的普及

- AI/ML驱动的热负载需要即时CFD耦合DCIM

- 网路保险需要基于资料中心基础设施管理(DCIM)的风险远端检测

- 由DCIM检验的、以效率指标评分的ESG相关贷款

- 市场限制

- 持续存在的OT-IT整合复杂性与传统BMS重复性

- 云端託管资料中心基础设施管理平台的资料主权问题

- 缺乏熟悉资料中心基础设施管理(DCIM)的设施工程师

- AI机架密集化超越感测器网路维修

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

- 定价分析

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 资产与产能管理

- 电源和冷却管理

- 网路和连线管理

- 服务

- 咨询与整合

- 管理与支援服务

- 解决方案

- 按资料中心规模

- 小的

- 中等的

- 大的

- 巨大的

- 百万

- 透过部署模式

- 本地部署

- 搭配

- 零售共址

- 批发/超大规模託管

- 云端/资料中心基础设施管理即服务

- 按最终用户行业划分

- 资讯科技和电信

- BFSI

- 医疗保健和生命科学

- 政府和国防部

- 製造业和工业

- 零售与电子商务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 新加坡

- 澳洲

- 马来西亚

- 亚太其他地区

- 南美洲

- 巴西

- 智利

- 阿根廷

- 其他南美洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd

- Eaton Corporation plc

- Johnson Controls International plc

- IBM Corporation

- Siemens AG

- CommScope(Nlyte and iTRACS)

- Sunbird Software

- FNT GmbH

- Device42

- Panduit Corp.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

- Raritan Inc.(Legrand)

- Siemens Smart Infrastructure

- EkkoSense Ltd

- RFcode Inc.

- Modius Inc.

- OpenDCIM(open-source)

第七章 市场机会与未来展望

The Data Center Infrastructure Management market is valued at USD 3.62 billion in 2025 and is forecast to reach USD 8.52 billion by 2030, expanding at an 18.68% CAGR.

Growth is propelled by AI-driven thermal loads, mandatory energy-use disclosure rules in the European Union, and a global wave of hyperscale projects that now top 500 MW per campus. Providers increasingly embed predictive analytics to meet cyber-insurance telemetry requirements and to convert regulatory compliance into measurable energy savings. Services linked to managed DCIM operations are accelerating fastest because data-center operators face persistent shortages of facility engineers. Competitive activity centres on integrated hardware-software portfolios that optimise cooling, power, and asset utilisation at rack level. Investors are tying financing costs to verifiable ESG metrics, turning DCIM-verified efficiency into a differentiator for new builds and retrofits.

Global Data Center Infrastructure Management (DCIM) Market Trends and Insights

Accelerated Pursuit of Net-Zero and Mandatory Energy-Use Disclosure

The EU Energy Efficiency Directive requires all data centers above 500 kW to disclose Power Usage Effectiveness, Carbon Usage Effectiveness, and Water Usage Effectiveness by September 2024, repositioning DCIM from optional optimisation software to mandatory compliance infrastructure. Operators that deployed real-time DCIM report 18% energy savings through dynamic capacity forecasting, demonstrating tangible returns on regulatory spending. Multinationals now standardise identical DCIM stacks in every facility to streamline sustainability reporting and to avoid region-specific audits. Demand is spreading beyond Europe because investors demand harmonised ESG disclosures. The directive also covers centres consuming nearly 3% of EU electricity, so incremental efficiency gains translate into region-wide grid relief.

Hyperscale Build-Outs Exceeding 500 MW Clusters

Campus-scale investments such as Compass Datacenters' USD 10 billion Mississippi project require DCIM platforms that coordinate thousands of racks across modular power and cooling skids. Traditional building-management systems cannot deliver rack-level telemetry or predictive failure alerts at gigawatt scale. Integration with prefabricated power modules, exemplified by Siemens' multi-year supply agreement, tightens the link between DCIM software and electrical infrastructure. Operators prioritise real-time visualisation of airflow and capacity to shave operating expenses as capital intensity rises. The shift to 500 MW-plus footprints thus anchors DCIM at the heart of project feasibility studies.

Persistent OT-IT Integration Complexity and Legacy BMS Overlap

Legacy building-management systems often rely on proprietary protocols that do not interoperate with modern DCIM APIs. Operators then duplicate sensors and dashboards, inflating both capex and opex while still lacking a unified asset inventory. Custom middleware projects add months to deployment schedules and raise lifecycle costs because upgrades must be recoded. In multi-vendor estates, each mechanical contractor may lock functionality inside closed toolchains, hampering holistic energy optimisation.

Other drivers and restraints analyzed in the detailed report include:

- Edge and Micro-Data-Center Proliferation for 5G/IoT

- AI/ML-Driven Thermal Loads Demanding Real-Time CFD-Coupled DCIM

- Data-Sovereignty Worries About Cloud-Hosted DCIM Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is projected to climb at 23.34% CAGR because 58% of operators report difficulty hiring qualified facility engineers. Asset-management rollouts now shift from project-based implementations to subscription frameworks that bundle continuous optimisation. Managed services also absorb the complexity of tuning liquid-cooling loops that accompany AI clusters. Though Solutions held 66.2% of Data Center Infrastructure Management market share in 2024, the rise of outcome-based contracts points to a service-centric future. Enterprises prefer to cap labour overheads by outsourcing sensor calibration, firmware management, and compliance reporting.

Demand for Network and Connectivity Management functions also increases as edge nodes expand, while Power and Cooling Management stays critical for hyperscale sites. Vendors package integration accelerators that bridge legacy BMS so clients see a single pane of glass. The evolution underscores a strategic pivot from one-off software licences toward recurring revenue backed by expert support.

Mega facilities, defined as campuses above 150 MW, are expected to post a 21.96% CAGR, displacing Massive facilities that dominated earlier cloud waves. Operators centralise AI training clusters because GPU interconnect benefits outweigh latency penalties. Mega campuses unlock economies of scale, allowing liquid cooling loops to be shared across several halls and driving cooling plant efficiency below 1.1 PUE. The Data Center Infrastructure Management market size for this segment will expand rapidly as orchestration complexity multiplies with sensor counts running into millions.

The migration toward mega-scale campuses also seeds innovation in modular power skids and prefabricated hall segments that arrive with factory-tested DCIM integrations. Smaller enterprise facilities retain a role for latency-sensitive workloads, but budget constraints limit adoption of advanced digital-twin modules.

Data Center Infrastructure Management (DCIM) Market Report Segments the Industry Into Data Center Size(Small and Medium, and More), Deployment Type (On -Premise, Colocation), Component(solutions, Services), End-User Industry(IT and Telecom, BFSI and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 42.4% of 2024 revenue thanks to hyperscale builds and early adoption of AI training centres. Operators there deploy liquid cooling and digital twins to push rack densities past 50 kW, amplifying DCIM spending. Federal and state energy-efficiency incentives further reinforce the business case for real-time monitoring.

Asia-Pacific is forecast to grow at 35.23% CAGR through 2030 as China targets a USD 125 billion data-center economy by 2027 and India accelerates under the Digital India initiative. Japan faces the world's highest construction costs, driving interest in automated DCIM to extract maximum capacity from every square metre. Singapore and Australia act as regional hubs, supplying cross-border cloud services that must meet diverse compliance mandates.

Europe maintains steady expansion on the back of the Energy Efficiency Directive. Operators race to meet September 2024 reporting deadlines, integrating DCIM into both brownfield retrofits and new builds. Middle Eastern and South American markets show rising demand as regional cloud providers localise infrastructure to cut latency. Africa remains nascent but is expected to adopt lightweight DCIM as mobile-internet use increases.

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd

- Eaton Corporation plc

- Johnson Controls International plc

- IBM Corporation

- Siemens AG

- CommScope (Nlyte and iTRACS)

- Sunbird Software

- FNT GmbH

- Device42

- Panduit Corp.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

- Raritan Inc. (Legrand)

- Siemens Smart Infrastructure

- EkkoSense Ltd

- RFcode Inc.

- Modius Inc.

- OpenDCIM (open-source)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated pursuit of net-zero and mandatory energy-use disclosure

- 4.2.2 Hyperscale build-outs exceeding 500 MW clusters

- 4.2.3 Edge and micro-data-center proliferation for 5G/IoT

- 4.2.4 AI/ML-driven thermal loads demanding real-time CFD-coupled DCIM

- 4.2.5 Cyber-insurance policies now requiring DCIM-based risk telemetry

- 4.2.6 ESG-linked financing that scores DCIM-verified efficiency metrics

- 4.3 Market Restraints

- 4.3.1 Persistent OT-IT integration complexity and legacy BMS overlap

- 4.3.2 Data-sovereignty worries about cloud-hosted DCIM platforms

- 4.3.3 Shortage of DCIM-literate facility engineers

- 4.3.4 Rising AI rack densities outpacing sensor network retrofits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

- 4.9 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Asset and Capacity Management

- 5.1.1.2 Power and Cooling Management

- 5.1.1.3 Network and Connectivity Management

- 5.1.2 Services

- 5.1.2.1 Consulting and Integration

- 5.1.2.2 Managed and Support Services

- 5.1.1 Solutions

- 5.2 By Data-Center Size

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.2.4 Massive

- 5.2.5 Mega

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Colocation

- 5.3.2.1 Retail Colo

- 5.3.2.2 Wholesale / Hyperscale Colo

- 5.3.3 Cloud / DCIM-as-a-Service

- 5.4 By End-User Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare and Life-Sciences

- 5.4.4 Government and Defence

- 5.4.5 Manufacturing and Industrial

- 5.4.6 Retail and E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirate

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Group Corp.

- 6.4.3 ABB Ltd

- 6.4.4 Eaton Corporation plc

- 6.4.5 Johnson Controls International plc

- 6.4.6 IBM Corporation

- 6.4.7 Siemens AG

- 6.4.8 CommScope (Nlyte and iTRACS)

- 6.4.9 Sunbird Software

- 6.4.10 FNT GmbH

- 6.4.11 Device42

- 6.4.12 Panduit Corp.

- 6.4.13 Cisco Systems Inc.

- 6.4.14 Huawei Technologies Co. Ltd

- 6.4.15 Raritan Inc. (Legrand)

- 6.4.16 Siemens Smart Infrastructure

- 6.4.17 EkkoSense Ltd

- 6.4.18 RFcode Inc.

- 6.4.19 Modius Inc.

- 6.4.20 OpenDCIM (open-source)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment