|

市场调查报告书

商品编码

1642025

金属加工设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Metal Fabrication Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

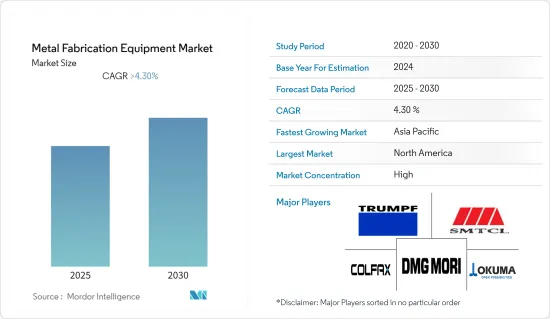

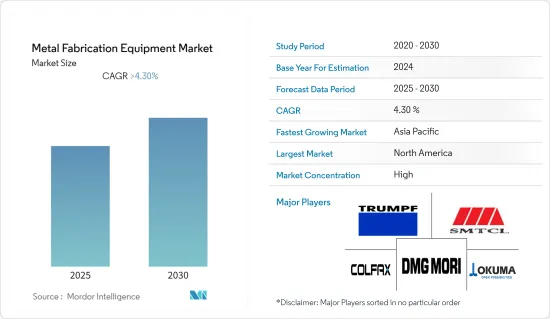

预测期内,金属加工设备市场预计将以超过 4.3% 的复合年增长率成长。

主要亮点

- 冠状病毒的爆发给金属製造市场带来了困难。政府为防止疾病传播而实施的进出口禁令、社交距离要求和限制措施严重扰乱了製造流程,中断了原材料的跨境供应链并影响了市场。结果,市场遭受了严重的财务挫折。上述决定因素可能会考虑预测期内市场的收益走势。

- 印度、中国和印尼等新兴经济体以及日本和韩国等已开发工业国家正在帮助亚太地区 (APAC) 占据製造业主导地位,尤其是在金属加工设备的需求方面。

- 欧洲是第二大金属加工设备市场。预计德国、法国和义大利等工业国家将在不久的将来推动进一步的需求。

- 德国凭藉其庞大的汽车及配套产业成为欧洲最大的市场,其次是义大利、瑞士和俄罗斯等市场。

- 需求不断增长是全球工业和金融领域格局变化的直接结果。由于该地区人口不断增长且某些行业市场规模庞大,企业被迫将製造地迁至这些新兴经济体。

- 汽车产业及其支援产业是製造设备的最大消费者,其次是製造业企业。预计预测期内金属加工市场关键产业(如航太和国防)的需求和供应将会恢復。

- 能源的使用和需求是由世界人口的成长所驱动的。快速的工业化预计将增加对加工设备的需求。然而,原物料价格上涨预计将成为市场扩张的一大障碍。然而,技术改进和设计客製化设备的努力预计将在不久的将来为生产商带来新的机会。

金属加工设备市场趋势

更加重视工业 4.0 的实施

关键趋势工业 4.0 或物联网 (IoT) 的发展预计将对工具和製造设备产生重大影响,因为它与工具机和工程师/操作员的资讯流有关。智慧工具有望提供即时回馈并向工程师发出振动等问题警报。

向工业 4.0 的过渡始于日常运作中一致的处理环境。在这个过程的开始阶段,刀具预设至关重要。一旦刀架组件被预设,资料就可以直接发送到工具机(节省时间并防止潜在的加工错误)或传输到附在刀架上的 RFID 晶片。

製造商发现预设过程是减少生产过程中废品的重要因素。随着企业转向更一致、更有效率的加工,对工业 4.0 解决方案的需求也日益增长。

市场的成长潜力是由数位化和网路普及率不断提高的趋势所推动的,这导致各个行业都注重效率和盈利生产力。

数位技术和工业电脑化的最新趋势开始有可能颠覆工业价值链。随着第四次工业革命(4.1)的到来,企业受益于更高的生产力、个人化的产品、成本的降低,最重要的是,新的收入和经营模式的产生。

随着全球市场环境受到新冠疫情衝击,各产业数位化正快速加速。这为数位领导者创造了新的机会来开发和采用创造性的解决方案,以加速企业各层面的数位转型。

冠状病毒流行加速了第四次工业革命(工业 4.0)的采用,推动各行业的公司走向更先进的物联网 (IoT) 技术和工作流程。新冠肺炎疫情影响全球,全球供应链陷入前所未有的不确定性。一些製造公司已经完全停止生产,其他公司的需求大幅下降,许多公司的需求甚至增加。

加工中心和工具机市场的成长

加工中心市场的发展受到製造业自动化程度不断提高的推动。近年来,金属加工业务大幅成长。

随着对高精度、低误差和大规模生产的需求不断增长,对加工中心的需求也日益增长。此外,製造商希望大幅降低营业成本以增加其产品的吸引力。由于可用于生产的空间越来越小,製造商正致力于减少週期时间和物料输送、提高品质和消除转换时间。所有这些因素都有望增加对加工中心的需求。

未来几年,亚太地区金属加工市场可能会显着成长,这得益于各应用产业(主要是汽车、航太和国防市场)的强劲成长。

另一个预期的好处是,由于 CNC 加工中心的普及,加工中心市场的收益将增加。这进一步归因于生产过程控制的加强和透明度的提高,从而改善了工具的移动。

先进的 CNC 编程可以精确控制位置、速度、进给速率和同步等众多变数。此外,CNC技术的普及还在于它能够轻鬆加工复杂的表面。

由于对操作员安全性、高精度、即时监控、更大灵活性和更高切削参数的需求不断增加,加工中心市场正在不断扩大。此外,工业4.0解决方案的使用将增加对智慧设备的需求。因此,连桿型加工中心的市场预计将扩大。

2021年全球工具机市场由中国、德国和日本主导。同年,中国生产了全球31%的工具机,而德国和日本分别占13%和12%。

金属加工设备产业概况

据称全球金属加工设备市场正在整合。该报告介绍了金属加工设备市场的主要国际参与者。从市场占有率来看,目前少数几家大公司占据着市场主导地位。然而,它面临着来自区域参与者和专注于提供自订设备的中小型企业的激烈竞争。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场技术趋势

第五章 市场区隔

- 按地区

- 北美洲

- 拉丁美洲

- 亚太地区 (APAC)

- 欧洲

- 中东和非洲 (MEA)

- 按服务类型

- 加工和切割

- 加工中心

- 车床

- 钻床、研磨、搪光机、研磨机

- 雷射、离子束、超音波加工机

- 齿轮加工机

- 锯切机

- 其他搬运和切割设备

- 焊接

- 电弧焊接

- 富氧燃烧焊接

- 雷射焊接

- 其他焊接

- 成型

- 锻造机和锤子

- 折弯机、折弯机、矫正机

- 剪切机、冲孔机和开槽机

- 线材成型机

- 其他压力机及金属成型机

- 其他服务类型

- 加工和切割

- 按最终用户产业

- 汽车

- 建造

- 航太

- 电气和电子

- 其他最终用户产业

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Trumpf

- Shenyang Machine Tool

- Amada

- Okuma

- DMG MORI

- FANUC Corp.

- Colfax

- Atlas Copco

- BTD Manufacturing*

第七章:市场的未来

第八章 免责声明

The Metal Fabrication Equipment Market is expected to register a CAGR of greater than 4.3% during the forecast period.

Key Highlights

- The market for metal manufacturing suffered as a result of the coronavirus outbreak. Government-imposed import/export prohibitions, social distance requirements, and a plethora of regulations meant to prevent the spread of illness have severely disrupted manufacturing processes and stopped the cross-border supply chains for raw materials, which impacted the market. The market suffered a severe financial setback as a result. The aforementioned determinants will take the market's revenue trajectory into consideration over the projection period.

- Developing economies, such as India, China, and Indonesia, among others, along with industrialized countries, such as Japan and South Korea, have assisted the Asia-Pacific (APAC) region to dominate the manufacturing industry, in terms of demand, particularly with the demand for metal fabrication equipment.

- Europe is the second-largest market for metal fabrication equipment. Industrialized countries, such as Germany, France, and Italy, are expected to fuel the demand further in near future.

- Germany is the largest market in Europe, owing to the presence of huge automotive and ancillary industries, followed by Italy, and other markets, such as Switzerland and Russia.

- Growing demand is a direct result of global industrial and finance sectors experiencing changing patterns. Companies were pushed to relocate their manufacturing operations to these emerging economies by the growing population in the Asia Pacific region and the sizeable markets for several industry verticals.

- The automotive industry and its auxiliary sectors are the biggest consumers of fabrication equipment, closely followed by manufacturing companies. Over the course of the forecast period, demand and supply for key industries in the metal fabrication market, such as aerospace & defense, are anticipated to pick up.

- The use and demand for energy are being driven by the growing world population. The demand for fabrication equipment is expected to increase due to rapid industrialization. The high price of raw materials, however, is anticipated to be a significant barrier to the market's expansion. Nevertheless, it is projected that in the near future, new opportunities will be opened up for the producers thanks to technical improvements and efforts to design customized equipment.

Metal Fabrication Equipment Market Trends

Increasing Focus on the Implementation of Industry 4.0

The growth of Industry 4.0, or the Internet of Things (IoT), which is a key trend, is expected to have a profound influence on tooling and fabricating equipment, as it relates to the flow of information to machine tools and engineers/operators. Smart tooling is expected to provide real-time feedback about problems, such as vibration, and send alerts to the engineer.

The transition to Industry 4.0 starts with machining environments that are highly consistent in day-to-day operations. Tool presetting is vital to the beginning of this process. Once the tool holder assembly is preset, data can be sent directly to the machine tool (saving time and preventing potential machining mistakes) or it can be transferred to an RFID chip installed in the tool holder.

Manufacturers find the presetting process to be a huge factor in reducing scrap during production. The demand for Industry 4.0 solutions is increasing as companies move toward consistent, highly productive machining.

The market's growth potential are being driven by rising trends of digitization and internet penetration brought on by various sectors' increased focus on effectiveness and profitable productivity.

The potential for disrupting the industrial value chain has started to grow as a result of recent developments in digital technologies and industrial computerization. With the arrival of the fourth industrial revolution (4.1), businesses are benefiting from higher productivity, individualized products, decreased costs, and, most crucially, the creation of new income and business models.

With the global market environment being ravaged by the COVID-19 pandemic, digitalization across industries are accelerating at a rapid rate. This presents a new opportunity for digital leaders to develop and adopt creative solutions to accelerate digital transformation at all levels of the company.

The outbreak of the coronavirus is hastening the introduction of the fourth industrial revolution (Industry 4.0), propelling businesses across sectors to a higher level of Internet of Things (IoT) technology and workflow. The global supply chain is undergoing unprecedented instability as a result of the COVID-19 pandemic that has affected the entire planet. Some manufacturing firms have completely stopped production while others have seen a significant decrease in demand and a few witnessed an increase in demand

Growth of Machining Centers and the Machine Tools Market

The market for machining centers is being driven by the manufacturing industry's growing automation. Over the past few years, there have been substantial developments in the metal fabrication business.

The demand for machining centers is rising as a result of increased demand for high accuracy, decreased mistakes, and mass manufacturing. Additionally, manufacturers anticipate that a large reduction in operating costs will increase the attractiveness of their products. With less space available for production, manufacturers are concentrating on reducing cycle times and material handling, improving quality, and doing away with changeover times. It is anticipated that all of these causes will increase demand for machining centers.

The metal fabrication market in Asia-Pacific is likely to experience substantial growth over the next few years, owing to the robust growth in various application industries, especially in the automotive, aerospace, and defense markets.

Further anticipated effects include an increase in machining centers market revenue due to rising CNC machining center adoption. This is further due to the improved tool movement brought about by greater control and growing production process transparency.

Numerous variables, including position, speed, feed rate, and synchronization, can be precisely controlled thanks to the sophisticated CNC programming. Furthermore, the popularity of CNC technology is being driven by the simplicity of producing complicated surfaces.

The market for machining centers is expanding as a result of the rising demand for worker safety, high precision, real-time monitoring, higher flexibility, and high cutting parameters. Additionally, when Industry 4.0 solutions are used, there is an increase in there is an increase in demand for smart instruments. Thus, the market for linked machine centers is anticipated to expand.

China, Germany, and Japan dominated the global machine tool market in 2021. China produced 31% of the world's machine tools in that year, compared to 13% produced by Germany and 12% produced by Japan.

Metal Fabrication Equipment Industry Overview

The Global metal Fabrication Equipment Market is said to be consolidated. The report covers major international players operating in the metal fabrication equipment market. In terms of market share, a few of the major players currently dominate the market studied. However, they face stiff competition from regional players and mid-size and smaller companies that are focused on providing custom equipment in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Trends in the Market

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.2 Latin America

- 5.1.3 Asia-Pacific (APAC)

- 5.1.4 Europe

- 5.1.5 Middle East and Africa (MEA)

- 5.2 Service Type

- 5.2.1 Machining and Cutting

- 5.2.1.1 Machining Centres

- 5.2.1.2 Lathe Machines

- 5.2.1.3 Drilling, Grinding, Horning, and Lapping Machines

- 5.2.1.4 Laser, Ion Beam, and Ultrasonic Machines

- 5.2.1.5 Gear Cutting Machines

- 5.2.1.6 Sawing and Cutting-off Machines

- 5.2.1.7 Other Handling and Cutting Equipment

- 5.2.2 Welding

- 5.2.2.1 ARC Welding

- 5.2.2.2 Oxy-fuel Welding

- 5.2.2.3 Laser Beam Welding

- 5.2.2.4 Other Types of Welding

- 5.2.3 Forming

- 5.2.3.1 Forging Machines and Hammers

- 5.2.3.2 Bending, Folding, and Straightening Machines

- 5.2.3.3 Shearing, Punching, and Notching Machines

- 5.2.3.4 Wire Forming Machines

- 5.2.3.5 Other Presses and Metal Forming Machines

- 5.2.4 Other Service Types

- 5.2.1 Machining and Cutting

- 5.3 End-user Industries

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Aerospace

- 5.3.4 Electrical and Electronics

- 5.3.5 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Trumpf

- 6.2.2 Shenyang Machine Tool

- 6.2.3 Amada

- 6.2.4 Okuma

- 6.2.5 DMG MORI

- 6.2.6 FANUC Corp.

- 6.2.7 Colfax

- 6.2.8 Atlas Copco

- 6.2.9 BTD Manufacturing*