|

市场调查报告书

商品编码

1642052

服务提供平台:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Service Delivery Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

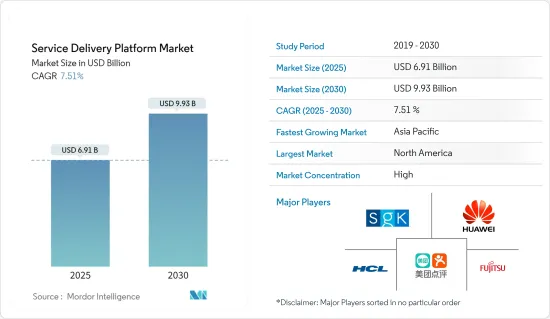

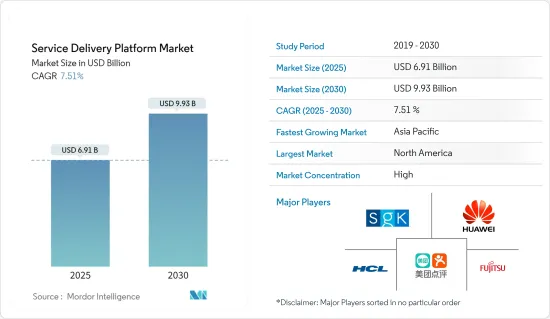

服务提供平台市场规模预计在 2025 年为 69.1 亿美元,预计到 2030 年将达到 99.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.51%。

主要亮点

- 为了促进通讯业者、服务供应商者、内容提供者和使用者之间优化的服务交换,营运商解决方案服务配送平臺(SDP)提供了统一的中介基础。医疗系统强化(HSS)的兴起正在影响全球医疗保健趋势并推动服务配送平臺市场的发展。 SDP 是一个支援广泛应用程式、面向广泛网路并为使用者提供广泛服务的框架。 SDP需要整合IT功能,提供一个会话控制、服务创建、通讯协定实现、跨越技术和网路边界的平台。

- 为了建立更实体的配送平台,企业正在针对不同产业客製化服务,升级配送调度系统,并增强配送基础架构。 2022年,英特尔透过发布英特尔网路平台并加强针对5G和边缘的新产品,维持了其作为网路硅片供应商的领先地位。

- 两家公司的目标是开发服务配送平臺,使通讯业者能够透过行动装置存取融合、多媒体和「Web 2.0」服务。

- 此外,2023 年 6 月,CWT 宣布建立策略伙伴关係,将 Spotnana 的下一代旅游即服务平台推向市场。此次合作标誌着 CWT 策略迈出的重要一步,该策略旨在利用其人才和整体的全球方法为寻求采用先进技术的客户提供创新解决方案。

- 此外,2023 年 11 月,Indosat Ooredoo Hutchison (IOH) 和 TIMWETECH 宣布成功实施 TIMWETECH 的数位服务提供平台。 DSDP 平台整合是 Indosat 合作伙伴加入的关键一步。这个领先的平台简化了整合过程,大大缩短了将服务推向市场所需的时间,并促进了与各个合作伙伴的顺利合作。它在与主导通讯业数位内容和服务领域的 OTT 服务提供商合作时尤其有效。

服务提供平台市场趋势

平台即服务 (PaaS) 的使用增加预计将推动市场成长

- 集中式服务提供平台可让企业结合内部和外部服务并实施扣回争议帐款机制。

- prpl高峰会2023将于2023年9月举行,透过来自整个行业的演讲者、通讯业者和行业利益相关者的主题演讲以及创新的应用演示,将重点关注如何开发用于使用者端设备(CPE)的运营开放原始码级开源相关人员来增强连网家庭体验。

- 企业云端采用率的提高为服务提供平台 (SDP) 创造了新的机会。 2022年10月,比利时跨国通讯服务公司BICS宣布推出其通讯平台即服务(CPaaS)平台。该平檯面向希望使用应用程式介面将语音、文字和 WhatsApp通讯等通讯服务无缝整合到现有工作流程中的企业。

- 软体定义的资料中心利用 API主导的自动化和控制,这是增加客户采用混合主机託管服务并增加收入的主要因素。

预计北美将占据较大的市场占有率

- 该地区联网汽车日益普及,为 SDP 公司带来了极为有利可图的市场机会。例如,HCL Technologies 正在投资开发下一代服务平台 AGORA,该平台将为科技公司和服务供应商企业授权、提供、聚合和分发云端和机器对机器 (M2M) 服务。 AGORA 是一个基于 SaaS 的解决方案加速器。

- 美国致力于实现基础设施现代化,并透过投资资料中心来实现这一目标。例如,美国计划花费高达 2.49 亿美元部署私有云端运算服务和模组化资料中心。由于 SDP 在资料中心有广泛的应用,此类投资可能会促进服务提供平台市场的发展。

- 各国政府正在探索透过新的数位方法、使用虚拟助理和第三方应用程式为公民提供更顺畅、更有效率的服务提供的方案。这为该地区的 SDP 提供者提供了潜在的机会。例如,加拿大正在探索使用 Alexa、Google Home 和其他平台来提供政府服务。

- 2023 年 8 月,面向客户的计划管理解决方案产业领导者之一 Rocketlane 宣布向专业服务自动化 (PSA) 策略扩张。透过此次尝试,Rocketlane 将帮助 PS 组织实现前所未有的计划盈利、效率和客户满意度。

服务提供平台产业概览

服务提供平台市场由华为技术有限公司、HCL科技有限公司、富士通有限公司、SGK国际公司和美团点评公司等主要企业主导。这些参与者透过不断的产品创新来获得竞争优势。大量投资于研发、策略联盟和併购使这些公司提高了盈利和市场占有率。

- 2023年10月-富士通为食品流通产业开发EDI共用操作平台。富士通为加强食品流通产业非竞争领域的协作与合作,建构了EDI(电子资料交换)共用营运平台,支援食品流通企业之间的业务标准化。 JII 已开始经营富士通为参与该计划的国内食品分销公司开发的新平台。

- 2022 年 2 月—德勤宣布扩展其数位服务提供平台,以帮助政府机构从云端转型中获得目标收益并应对多重云端挑战。这些全面、可扩展的计划旨在满足各政府机构的特定需求,包括建立具有客製化服务产品和功能的可携式、可互通的多重云端设定的能力。

- 2022 年 4 月-Quantum Corporation 宣布推出新的服务配送平臺: MyQuantum。安全的入口网站为 Quantum 客户提供对关键资源的单一登入 (SSO) 访问,提供管理支援问题、搜寻Quantum 知识库和文件、下载软体以及使用基于云端的分析 (CBA) AIOps 软体监控 Quantum 资产的单一入口点。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 对资料和内容相关服务的需求不断增加

- 对高性能智慧型手机的需求不断增加

- 平台即服务 (PaaS) 的使用日益增多

- 市场限制

- 初期投资高

第五章 市场区隔

- 按类型

- 软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- Huawei Technologies Co. Ltd

- HCL Technologies Ltd

- Fujitsu Ltd

- SGK International Inc.

- Meituan Dianping Inc.

- QTS Realty Trust Inc.

- Accenture PLC

- Telenity Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Service Delivery Platform Market size is estimated at USD 6.91 billion in 2025, and is expected to reach USD 9.93 billion by 2030, at a CAGR of 7.51% during the forecast period (2025-2030).

Key Highlights

- To facilitate the exchange of optimized services among operators, service and content providers, and users, service delivery platforms (SDPs) - which are operator solutions - provide a unified middle ground. The rising trend of "health system strengthening" (HSS) has become influential in global health circles, boosting the service delivery platform market. SDPs are a framework that supports a wide range of applications, targets different networks, and offers users extensive services. To provide a platform for session control, service development, protocol execution, and technology and network boundary crossing, SDPs require the integration of IT capabilities.

- To establish more physical delivery platforms, companies are customizing services for different industries, upgrading the delivery dispatch system, and enhancing delivery infrastructure. In 2022, Intel maintained its position as the top network silicon vendor by introducing the Intel Network Platform, as well as new product enhancements for 5G and Edge.

- Companies are aiming to develop a service delivery platform that allows telecom operators to access convergent, multimedia, and "Web 2.0" services on their mobile devices

- Furthermore, In June 2023, CWT announced a strategic partnership to provide Spotnana's next-generation Travel-as-a-Service platform to the market. This collaboration is an important step in CWT's strategy to bring innovative solutions to customers looking to deploy pioneering technology, driven by the strength of CWT's people and holistic, global approach.

- Moreover, in November 2023, Indosat Ooredoo Hutchison (IOH) and TIMWETECH announced the successful deployment of TIMWETECH's Digital Service Delivery Platform. Integrating the DSDP platform is a significant step for Indosat's partner onboarding. This advanced platform facilitates integration processes, significantly reducing the time required to bring services to the market and fostering smooth collaboration with various partners. It is especially effective in engaging with OTT service providers, who dominate the telco industry's digital content and service sector.

Service Delivery Platform Market Trends

Increasing Use of Platform-as-a-service (PaaS) is Expected to Drive the Market Growth

- A centralized service delivery platform allows enterprises to combine internal and external services and implement a chargeback mechanism, enabling them to charge business units for the services they use.

- In September 2023, The prpl Summit 2023 would focus on how developments in carrier-grade, open-source middleware for customer premises equipment (CPE) would enhance the connected home experience by featuring speakers from across the industry, keynotes from operators and industry stakeholders, and innovative application demonstrations.

- The rise in cloud adoption by companies presents new opportunities for the Service Delivery Platform (SDP). In October 2022, BICS, a Belgian multinational telecom services firm, launched its Communications Platform as a Service (CPaaS) platform, which is aimed at businesses that want to seamlessly integrate communication services like voice, text, and WhatsApp messaging into their existing workflows by utilizing Application Programming Interfaces.

- Software-defined data centers are taking advantage of API-driven automation and control, which is a significant factor contributing to the increased usage and sales of hybrid colocation services among customers.

North America is Expected to Hold Significant Market Share

- With connected cars gaining popularity in the region, they present a very lucrative opportunity for the SDP offering companies to tap the market. For instance, HCL Technologies has invested in developing AGORA, a next-generation services platform that allows, provides, aggregates, and distributes cloud and Machine to Machine (M2M) services for technology and service provider firms. AGORA is a SaaS-based solution accelerator.

- The United States was instrumental in modernizing its infrastructure, and the country aims to achieve this by investing in data centers. For instance, the US Army is planning to spend up to USD 249 million to deploy private cloud computing services and modular data centers. As SDP has a great application in the data centers, such investments may, in turn, boost the service delivery platform market.

- The governments are looking for options to ensure smooth and efficient service delivery to the public in new digital ways, either through virtual assistants or third-party applications. This offers a potential opportunity for the SDP offering firms in the region. For instance, Canada is looking to explore its government service delivery with Alexa, Google Home, or any other platforms.

- In August 2023, Rocketlane, one of the industry leaders in customer-facing project management solutions, announced its strategic expansion into Professional Services automation (PSA). With this foray, Rocketlane empowers PS organizations to achieve unprecedented project profitability, efficiency, and client satisfaction.

Service Delivery Platform Industry Overview

The service delivery platform market is consolidated with several major players, such as Huawei Technologies Co. Ltd, HCL Technologies Ltd, Fujitsu Ltd, SGK International Inc., and Meituan Dianping Inc. These players have gained a competitive advantage by continuously innovating their products. Significant investments in research and development, strategic partnerships, and mergers and acquisitions have enabled these companies to increase their profitability and market share.

- October 2023 - Fujitsu develops EDI shared operating platform for the food distribution industry. As part of this initiative that focuses on improving cooperation and collaboration in non-competitive areas in the food distribution industry, Fujitsu constructed an Electronic Data Interchange (EDI) shared operating platform to support food distributors in standardizing operations. JII started operations of the new platform developed by Fujitsu for food distribution companies in Japan participating in the initiative.

- February 2022 - Deloitte announced the expansion of its digital service delivery platform to assist government agencies in gaining targeted advantages from cloud transformation and navigating multi-cloud difficulties. This comprehensive and scalable plan is designed to meet the specific demands of various government entities, including the ability to build portable, interoperable multi-cloud setups with customized service offers and capabilities.

- April 2022 - Quantum Corporation announced the launch of its new service delivery platform, MyQuantum. This secure web portal provides Quantum clients with single sign-on (SSO) access to key resources, enabling them to manage support issues, explore the Quantum knowledge base and documentation, download software, and monitor their Quantum assets using Cloud-Based Analytics (CBA) AIOps software from a single point of entry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rise in Demand for Data and Content-related Services

- 4.3.2 Rising Demand for High Performance Smartphones

- 4.3.3 Increasing Use of Platform-as-a-service (PaaS)

- 4.4 Market Restraints

- 4.4.1 High Initial Investments

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Huawei Technologies Co. Ltd

- 6.1.2 HCL Technologies Ltd

- 6.1.3 Fujitsu Ltd

- 6.1.4 SGK International Inc.

- 6.1.5 Meituan Dianping Inc.

- 6.1.6 QTS Realty Trust Inc.

- 6.1.7 Accenture PLC

- 6.1.8 Telenity Inc.