|

市场调查报告书

商品编码

1642062

义大利包装产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Packaging Industry In Italy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

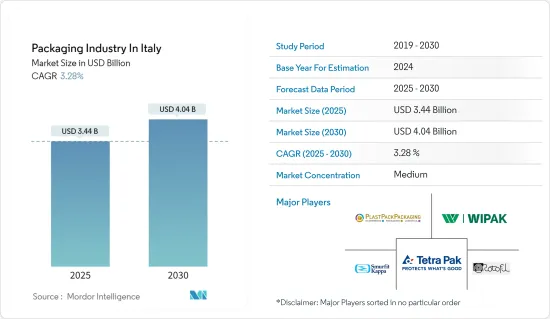

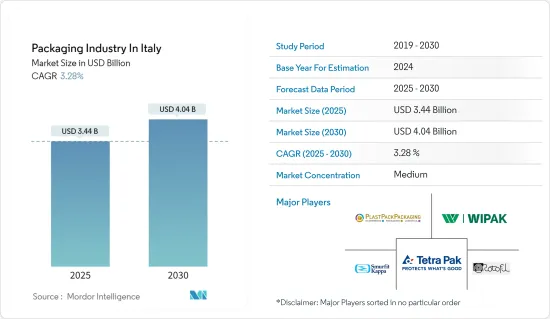

义大利包装产业市场规模预计在 2025 年为 34.4 亿美元,预计到 2030 年将达到 40.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.28%。

在义大利,包装在多个终端产业中发挥关键作用。其主要作用是保护产品免受损坏,这是市场成长的主要动力。

主要亮点

- 义大利生活水准和可支配收入的提高推动了包装需求的激增。随着消费者对产品种类的喜爱,食品饮料、化妆品和药品等行业的包装需求尤其高。

- 此外,轻量化包装在国内越来越受到青睐,其中塑胶包装凭藉其重量优势占据主导地位。义大利对极简包装的青睐既是产业趋势,也是减少环境影响的有意识的努力。利乐国际公司 (Tetra Pak International SA) 等知名製造商已走在前列,以创造性的品牌名称提供各种优质包装,进一步促进市场扩张。

- 塑料,尤其是硬质包装和软质包装,在国内的需求正在激增。它的强度、耐用性和阻隔性等优良特性使其成为从瓶子、容器到瓶盖和封盖等产品的理想选择。特别是在化妆品、食品和药品等领域,使用 PE、PP 和 PET 等材料进行包装的趋势明显转变。

- 义大利包装产业的未来看起来很有希望,但并非没有挑战。原物料价格波动构成了一大障碍,尤其是在製造商面临的高通膨率的情况下。这些价格波动受到许多因素的影响,从动态到自然灾害、政治不稳定和外汇波动,所有这些都可能阻碍市场成长。

义大利包装市场的趋势

塑胶产业占据主要市场占有率

- 塑胶是一种用途广泛且耐用的聚合物,在包装中起着至关重要的作用。它们保护并维持义大利个人护理、化妆品和製药行业产品的新鲜度和品质。

- 义大利快速成长的食品和饮料产业很大程度上得益于电子商务的兴起。消费者对更短的供应链以及天然和有机食品的消费日益增长的偏好推动了对特种塑胶包装的需求。这些包装类型包括刚性和柔性两种类型,不仅可以保护食品和饮料,还可以改善其运输。

- 在大量医疗保健投资的推动下,义大利不断扩张的製药业正在推动对先进包装解决方案的需求。特别是,Farmindustria 的资料凸显了义大利在研发方面不断增长的投资,为包装产业以及研究市场奠定了坚实的基础。

- 义大利的塑胶产量正在上升,主要受多个行业对包装的需求不断增长的推动。 Plastics Europe 的统计数据显示,2022 年产量将达到 3,672 千吨,预计 2023 年将达到 3,785 千吨,证实了市场的成长轨迹。

食品领域可望主导市场

- 义大利是欧洲第二大製造业国,专门从事机械、服饰、汽车零件和医药等。该国以食品出口而闻名,包括葡萄酒、义式麵食、起司和橄榄油。义大利市场对有机、机能性食品和低脂食品的前景看好,这推动了巨大的包装需求。

- 美国农业部的资料显示,义大利食品加工产业透过小公司合併呈现明显的整合趋势。技术进步、「义大利製造」产品的吸引力以及食品出口的激增,推动了该国对食品原料的需求,从而推动了对包装的需求。义大利消费者特别喜欢烘焙点心、加工肉品、鱼贝类和乳製品。

- 由于旅游业的成长以及人们对外国食材和菜餚的兴趣日益浓厚,义大利的食品消费量正在上升。义大利拥有欧洲第三大食品产业,越来越多的消费者开始追求更健康的饮食习惯,包括纯素饮食、素食饮食和弹性素食饮食。此外,中国对「无添加」产品的需求和对超级食品的兴趣不断增长,推动了对创新包装解决方案(如罐子、瓶子、小袋和袋子)的需求不断增长。

- 2023年,义大利将进口357亿美元的消费品,其中85%来自其他欧洲国家。这些进口产品主要是乳製品、肉类、水果和蔬菜,凸显了该国对包装日益增长的需求。值得注意的是,根据美国的数据,义大利的主要食品进口来自德国、荷兰和法国。

义大利包装产业概况

义大利包装产业呈现逐步整合的趋势,主要企业包括: Tetra Pak International SA、Smurfit Kappa Group、Wipak Bordi Srl 等公司都在积极争夺市场份额。

- 2024 年 7 月义大利包装公司 Wipak Bordi Srl 以其突破性的 FlexPod 解决方案荣获永续性类别的着名德国包装奖。该包装由 95% 的 PE(聚乙烯)製成,彰显了该公司对可回收性的承诺。

- 2024 年 6 月,总部位于爱尔兰但在义大利设有业务的 Smurfit Kappa 集团宣布在西班牙建立两家最先进的生产工厂。对这些工厂的 3,000 万欧元(3,286 万美元)投资凸显了该公司对循环生产的承诺。该设施拥有 12,000 块太阳能板,预计将大幅减少排放。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 全球包装产业概况

第五章 市场动态

- 市场驱动因素

- 轻量化包装在义大利发展势头强劲

- 各个终端市场对塑胶包装的需求不断增加

- 市场挑战

- 义大利原物料价格波动

第六章 行业法规、政策与标准

第七章 市场区隔

- 按材质

- 纸

- 塑胶

- 金属

- 玻璃

- 按包装类型

- 硬包装

- 软包装

- 按最终用户产业

- 食物

- 饮料

- 药品

- 个人护理

- 其他最终用户产业

第八章 竞争格局

- 公司简介

- Tetra Pak International SA

- Smurfit Kappa Group

- Wipak Bordi Srl

- Plast Pack Packaging Srl

- Rotofil SRL

- AFG Srl

- Carton Pack SpA

- Zignago Vetro

- International Paper

第九章投资分析

第十章 市场机会与未来趋势

The Packaging Industry In Italy Market size is estimated at USD 3.44 billion in 2025, and is expected to reach USD 4.04 billion by 2030, at a CAGR of 3.28% during the forecast period (2025-2030).

In Italy, packaging serves a crucial function across multiple end-use industries. Its primary role is to safeguard products from damage, a factor that significantly drives the market's growth.

Key Highlights

- Rising living standards and disposable incomes in Italy are fueling a surge in packaging demand. Consumers indulging in a wider array of products particularly boost the need for packaging in sectors like food and beverages, cosmetics, pharmaceuticals, and more.

- Moreover, the country is increasingly favoring lightweight packaging, with plastics taking the lead due to their weight advantage. Italy's embrace of minimalist packaging is a trend and a conscious effort to reduce the industry's environmental impact. Noteworthy manufacturers like Tetra Pak International SA are at the forefront, offering a diverse range of creatively branded, premium packaging, further driving market expansion.

- Plastics, especially rigid and flexible packaging, are witnessing a surge in demand in the country. Their appeal lies in attributes like strength, durability, and barrier properties, making them ideal for products ranging from bottles and containers to caps and closures. Notably, the market studied is witnessing a notable shift toward using materials such as PE, PP, and PET in packaging, especially in sectors like cosmetics, food, and pharmaceuticals.

- While the future of the packaging sector in Italy looks promising, it is not without its challenges. Fluctuating raw material prices pose a significant hurdle, especially given the high price inflation that manufacturers are grappling with. These price swings are influenced by a host of factors, from supply and demand dynamics to natural disasters, political instability, and currency fluctuations, all of which can potentially impede market growth.

Italy Packaging Market Trends

Plastic Segment to Hold Significant Market Share

- Plastic, a versatile and durable polymer, is pivotal in packaging. It safeguards products, preserving their freshness and quality, across industries such as personal care, cosmetics, and pharmaceuticals in Italy.

- Italy's burgeoning food and beverage sector owes much to its thriving e-commerce landscape. Consumers, increasingly favoring shorter supply chains and consumption of natural and organic foods, are driving the demand for specialized plastic packaging. These packaging variants, including rigid and flexible types, not only protect but also enhance the transportation of food and beverages.

- Italy's expanding pharmaceutical sector, bolstered by substantial healthcare investments, is fueling the need for advanced packaging solutions. Notably, Farmindustria's data underscores Italy's rising investments in research & development, creating a strong ground for the packaging industry and, consequently, the market studied.

- Plastic production in Italy is on the rise, largely driven by the escalating demand for packaging across diverse sectors. Figures from Plastics Europe reveal production of 3,672 kilotons in 2022, which was projected to climb to 3,785 kilotons by 2023, underlining the market's growth trajectory.

Food Segment Expected to Dominate the Market

- Italy is the second-largest manufacturer in Europe, excelling in machinery, clothing, automotive components, and medicines. The country is renowned for exporting food products such as wine, pasta, cheese, and olive oil. The Italian market shows promise for organic, functional, and low-fat foods, which significantly propels the demand for packaging.

- USDA data highlights a consolidation trend in Italy's food-processing sector, with smaller firms merging. Factors like technological advancements, the allure of "Made in Italy" products, and a surge in food exports have heightened the country's appetite for food ingredients, subsequently spiking the demand for packaging. Italian consumers notably favor baked goods, processed meats, seafood, and dairy.

- Italy's food consumption is on the rise, driven by increasing tourism and a growing interest in foreign ingredients and cuisines. Italy boasts the third-largest food industry in Europe, with its consumers increasingly leaning toward healthier diets, including vegan, vegetarian, and flexitarian options. The country also sees a rising demand for "free-from" products and a keen interest in superfoods, further driving the need for innovative packaging solutions such as jars, bottles, pouches, and bags.

- In 2023, Italy imported consumer-oriented products valued at USD 35.7 billion, with a substantial 85% coming from other European nations. These imports, dominated by dairy, meat, fruits, and vegetables, underscored the nation's heightened demand for packaging. Notably, Italy's key food imports were from Germany, the Netherlands, and France, as per the USDA.

Italy Packaging Industry Overview

The Italian packaging industry exhibits moderate consolidation, with key players such as Tetra Pak International SA, Smurfit Kappa Group, Wipak Bordi Srl, and others actively vying to enhance their market shares. Notably, many of these firms are intensifying their R&D efforts and launching innovative products, bolstering the sector's growth. Furthermore, on a global scale, mergers and acquisitions are shaping the competitive landscape in Italy.

- July 2024: Wipak Bordi Srl, an Italian packaging company, clinched the prestigious German Packaging Award in the sustainability category for its groundbreaking FlexPod solution. This packaging, predominantly composed of 95% PE (polyethylene), underscores the company's commitment to recyclability.

- June 2024: Smurfit Kappa Group, an Ireland-based company with operations in Italy, unveiled two cutting-edge production facilities in Spain. The company's investment of EUR 30 million (USD 32.86 million) in these plants underscores its commitment to circular production practices. The facilities boast 12,000 solar panels, a move poised to significantly slash emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Overview of the Global Packaging Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Lightweight Packaging in Italy

- 5.1.2 Increasing Demand for Plastic Packaging Across Various End-Use Markets

- 5.2 Market Challenges

- 5.2.1 Fluctuating Raw Material Prices in the Country

6 INDUSTRY REGULATION, POLICIES, AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Material

- 7.1.1 Paper

- 7.1.2 Plastic

- 7.1.3 Metal

- 7.1.4 Glass

- 7.2 By Packaging Type

- 7.2.1 Rigid Packaging

- 7.2.2 Flexible Packaging

- 7.3 By End-User Industry

- 7.3.1 Food

- 7.3.2 Beverages

- 7.3.3 Pharmaceuticals

- 7.3.4 Personal Care

- 7.3.5 Other End-User Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Tetra Pak International SA

- 8.1.2 Smurfit Kappa Group

- 8.1.3 Wipak Bordi Srl

- 8.1.4 Plast Pack Packaging Srl

- 8.1.5 Rotofil SRL

- 8.1.6 AFG Srl

- 8.1.7 Carton Pack SpA

- 8.1.8 Zignago Vetro

- 8.1.9 International Paper