|

市场调查报告书

商品编码

1642063

英国包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

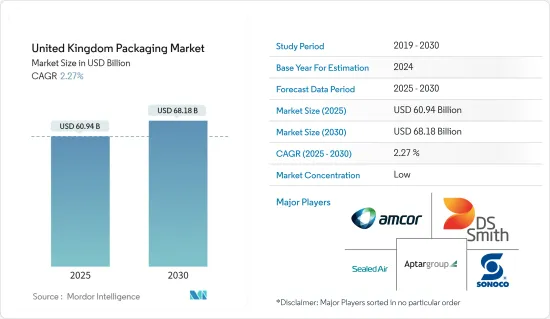

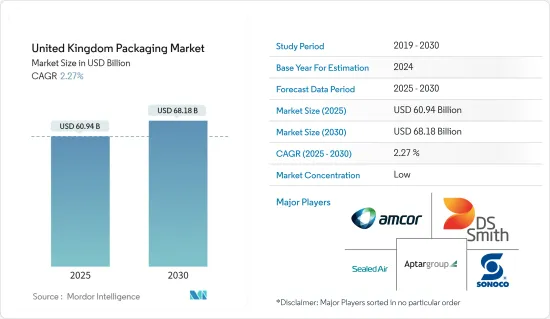

预计 2025 年英国包装市场规模为 609.4 亿美元,到 2030 年将达到 681.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.27%。

主要亮点

- 由于製造业活动的增加,英国包装市场正在经历显着的成长。 2024 年 2 月,可口可乐计划暂时去除雪碧和零度雪碧便携瓶上的标籤,并在英国进行「无标籤」包装的有限试验,在 500 毫升瓶子的包装正面印上标誌,以表明该国包装市场的需求。

- 电子商务销售额的成长、食品和饮料製造商对环保和可回收包装的需求不断增加、产品个人化需求不断增长以及工业包装领域的成长,正在推动该国包装市场的成长。根据英国国际贸易部 2023 年 11 月的报告,英国拥有仅次于中国和美国的全球第三大电子商务市场,预计未来几年将支持该国对包装解决方案的需求。

- 预计塑胶使用法规的加强将对市场产生重大影响。透过阻止使用不可持续材料,英国政府同时提高了可回收塑胶的市场价值,培育了具有全球影响力的永续循环经济。 2024年4月,英国推出CAPA(药品初级包装循环性加速器)倡议,制定并实施製药设备和药品包装报废回收战略,在该国启动可回收包装解决方案。

- 在英国包装市场上,包装选择的永续性和可负担性之间的衝突变得越来越明显。随着消费者在环保选择的经济影响方面苦苦挣扎,更便宜、更不永续的选择趋势变得越来越普遍,影响了采用永续包装解决方案日益增加的市场挑战。

- 然而,COVID-19 疫情对市场产生了影响,市场上的一些公司开始转向使用一次性塑胶。供应链不堪重负,难以满足一次性塑胶包装和医疗用品不断增长的需求。塑胶需求的大幅成长可能会暂时改变向循环经济转型的短期努力和目标。除此之外,预计这也将为塑胶包装生产链带来压力。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

英国包装市场趋势

食品领域预计将推动市场成长

- 加工食品的需求不断增加以及轻质和软包装的日益普及正在推动市场发展,并在短期、中期和长期产生各种影响。由于消费者对产品品质的重视,冷冻食品包装市场正在快速成长。生活方式的改变推动了英国对冷冻食品包装的需求增加。

- 为了追求永续性,该国的食品製造商越来越多地用纸质产品取代塑胶产品,预计将推动市场成长。例如,2023年9月,永续包装和纸张领域的全球领导者Mondi与屡获殊荣的大米供应商Veetee合作推出了英国首款纸盒干米,标誌着食品包装领域的市场成长。

- 立式袋预计将在整个预测期内保持标准包装形式,因为它们能够保持食品新鲜度并延长产品保质期。此外,袋子的外观美观,增强了产品的行销效果。由此,小袋包装被广泛采用作为其他形式的稳定替代品,预计在预测期内,其需求和客户接受度将进一步提高。

- 在英国,永续性和可回收性在提高消费者对品牌的偏好方面发挥关键作用。为满足市场对消费后回收 (PCR) 包装解决方案日益增长的需求,软包装公司 ProAmpac 宣布推出其 ProActivePCR杀菌袋。此杀菌袋适用于包装宠物食品和人类食品,符合 FDA 和 EU 在蒸馏应用中的食品接触要求。杀菌袋由至少 30% 的消费后回收 (PCR) 包装材料製成,并且使用最少的原生树脂。这些巧妙的袋子也符合英国塑胶包装税(PPT)的规定。

- 在新冠疫情期间大幅增长并推动消费行为转向线上订餐行为后,网路食品销售额的年变化率已达到疫情前的水平。 2023 年 12 月,Eviosys 重新启动了位于剪切机旺蒂奇的研发中心,致力于成为食品业首选的永续包装合作伙伴,展示了该国的市场需求。

PET(聚对苯二甲酸乙二醇酯)预计将占据主要市场占有率

- 在英国,随着饮料公司增加可回收塑胶的使用,宝特瓶被广泛应用于各行各业。食品和饮料市场是宝特瓶和容器的主要用户之一。宝特瓶宝特瓶成本低、重量轻,其在食品、饮料、化妆品和药品等各种终端用途的使用日益增多,推动了该国塑胶瓶市场的发展。

- 此外,新灌装技术和耐热宝特瓶的发展为市场提供了新的可能性和选择。虽然宝特瓶已成为多个行业的标准,但聚乙烯 (PE) 瓶在饮料、化妆品、卫生产品和清洁剂领域占据主导地位,这支持了国内市场的成长。

- 英国快速消费品品牌所有者对 PET 塑胶材料的需求仍然很高。 2024 年 5 月,回收技术公司 Polytag 任命英国零售商 M&S 为 Polytag Ecotrace 计画的创始成员,该计画旨在优化英国一次性塑胶包装的追踪和回收。 Polytag EcoTrace 计画将在大量废弃物回收中心部署 Polytag 的隐形紫外线标籤侦测设备,帮助该国回收宝特瓶。

- 宝特瓶市场正在见证瓶子设计的进步,以便更容易装载到托盘上并运输到超级市场,这表明市场对宝特瓶的需求。例如,2024 年 3 月,英国Aldi 推出了自有品牌的扁平再生 PET 葡萄酒瓶,据称该瓶由 100% 再生 PET 製成,这表明该市场未来具有增长潜力。

- 根据英国国家统计局的报告,英国消费者在食品和非酒精饮料上的支出正在增加,这将支持对瓶子包装的需求并推动PET的采用,这与可回收PET的需求和这种材料在饮料包装中的优势相一致。

英国包装产业概况

英国包装市场较为分散,由多家全球和地区参与者组成。目前,一些参与者在整体份额上占据市场主导地位。凭藉显着的市场占有率,这些领先的公司正致力于扩大其终端用户的基本客群。这些公司包括 Amcor PLC、DS Smith PLC、AptarGroup Inc.、Sealed Air Corporation 和 Sonoco Products Company,正在利用战略合作计划来增加市场占有率和盈利。

- 2024 年 2 月欧洲造纸和包装公司 DS Smith PLC 计划在其位于英格兰东南部的 Kemsley 再生纸厂投资约 6000 万美元建设一条新的纤维准备生产线。这将使公司透过提高效率和节省成本而获益。这表明供应商进行了投资以支持所研究市场的内部成长。

- 2023年11月,Amcor与Saputo Dairy UK在英国包装奖中荣获「年度最佳软塑胶包装」奖。这两家公司因美国最受欢迎的起司品牌 Cathedral City 开发新的可回收碎起司包装而获得认可。这表明了该国对乳製品包装的需求以及相关人员之间的合作,以在英国保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 对包装产业的影响

- 包装永续性技术分析

- 全球包装市场概况

第五章 市场动态

- 市场驱动因素

- 千禧世代对消费品优质包装的需求日益增长

- 电子商务包装需求激增

- 软包装持续成长

- 市场限制

- 开发成本上升和回收意识增强

- 日益严重的环境问题

第六章 市场细分

- 按行业

- 食物

- 饮料

- 卫生保健

- 化妆品、个人护理和家居用品

- 工业

- 透过塑胶包装

- 材料类型

- PE(聚乙烯)

- PP(聚丙烯)

- PVC(聚氯乙烯)

- PET(聚对苯二甲酸乙二醇酯)

- 其他材料类型

- 按类型

- 硬质塑胶包装

- 瓶子和罐子

- 托盘和容器

- 其他产品类型

- 软质塑胶包装

- 袋子和包包

- 薄膜和包装

- 其他产品类型

- 材料类型

- 依包装材料类型

- 纸

- 纸板

- 瓦楞纸和箱板纸

- 其他类型

- 玻璃

- 金属(罐、桶、盖子、封盖、散装容器)

- 纸

第七章 竞争格局

- 公司简介

- Amcor PLC

- DS Smith PLC

- Owens Illinois Inc.

- Crown Holdings Inc.

- Berry Global Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Graphic Packaging International LLC

- Greif Inc.

- Ball Corporation

- Westrock Company

- Silgan Holdings Inc.

- AptarGroup Inc.

- Huhtamaki Oyj

- Mondi Group

- Tetra Pak International SA

- Can-Pack UK Ltd

- Ardagh Group

第八章投资分析

第九章:市场的未来

The United Kingdom Packaging Market size is estimated at USD 60.94 billion in 2025, and is expected to reach USD 68.18 billion by 2030, at a CAGR of 2.27% during the forecast period (2025-2030).

Key Highlights

- The packaging market in the United Kingdom has been witnessing significant growth owing to increased manufacturing activities. In February 2024, Coca-Cola planned to temporarily remove labels from Sprite and Sprite Zero on-the-go bottles in a limited trial of "label-less" packaging for 500-ml bottles with an embossed logo on the front of the pack in the United Kingdom, which shows the demand for the packaging market in the country.

- The growth of e-commerce sales, increased demand from food and beverage manufacturers for eco-friendly and recyclable packaging, increasing demand for product personalization, and the growing industrial packaging sector are driving the growth of the packaging market in the country. In November 2023, the International Trade Administration reported that the United Kingdom has the third-largest e-commerce market in the world after China and the United States, which is expected to support the demand for packaging solutions in the country in the coming years.

- The increase in regulations for plastic use is anticipated to affect the market significantly. By disincentivizing the usage of unsustainable materials, the UK government is simultaneously incentivizing the market value of recyclable plastic, fostering a sustainable circular economy that will have global repercussions. In April 2024, the United Kingdom launched the Circularity in Primary Pharmaceutical Packaging Accelerator (CAPA) initiative to develop and implement strategies for the end-of-use recycling of medicinal devices and pharmaceutical packaging, fueling the country's recyclable packaging solutions.

- The conflict between sustainability and affordability in packaging choices has been increasingly evident in the UK packaging market. As consumers grapple with the financial implications of eco-friendly alternatives, a trend toward cheaper, non-sustainable options is becoming more prevalent, impacting a rising market challenge for adopting sustainable packaging solutions.

- However, with the COVID-19 pandemic affecting the market studied, multiple companies in the market shifted toward the usage of single-use plastics. Supply chains strained to meet a surge in demand for single-use plastic packaging and medical supplies. Such a significant spike in plastic demand is likely to lead to a temporary change in the short-term initiatives and goals of transitioning toward a circular economy. Apart from this, it is also expected to put pressure on the plastic packaging manufacturing chain. Furthermore, the war between Russia and Ukraine has an impact on the overall packaging ecosystem.

United Kingdom Packaging Market Trends

Food Segment Expected to Drive Market Growth

- The increasing demand for processed food and the growing adoption of lightweight, flexible packaging drive the market, with varying impacts over the short, medium, and long term. The market for frozen food packaging is witnessing an upsurge due to the country's consumer appreciation of product quality. The demand for frozen food packaging has increased in the United Kingdom due to changing lifestyles.

- The country's food manufacturers are increasingly replacing plastic-based products in line with their paper-based counterparts for sustainability, which is expected to fuel the market's growth. For instance, in September 2023, Mondi, a global leader in sustainable packaging and paper, launched paper-packed dry rice in the United Kingdom for the first time by collaborating with award-winning rice supplier Veetee, showing the market's growth in the food packaging segment.

- Stand-up pouches are anticipated to become a standard form of packaging throughout the forecast period due to their capacity to maintain the freshness of food products and increase product shelf life. Furthermore, the pouches also offer a great visible aesthetic, which adds to the product's marketing benefits. This has led to the wide adoption of pouches as a stable alternative to other formats and is expected to take further momentum in terms of demand and customer acceptance during the forecast period.

- In the United Kingdom, sustainability and recyclability play a significant role in raising consumer preference for brands. Responding to the expanded market demand for post-consumer recycled (PCR) packaging solutions, a flexible packaging company, ProAmpac, announced the launch of its ProActivePCR Retort pouches. The retort pouches are intended for pet and human food packaging and are both FDA and EU-compliant for food contact in retort applications. They provide packaging with a post-consumer recycled (PCR) content of 30% or more, minimizing the use of virgin resins. These inventive pouches also adhere to United Kingdom Plastics Packaging Tax regulations (PPT).

- The percentage change in annual internet food sales has reached a pre-pandemic level after a significant increase during the COVID-19 pandemic, which has raised consumer behavior to prefer online ordering of foods. In December 2023, Eviosys relaunched Eviosys's R&D center in Wantage, Oxfordshire, to become the food industry's sustainable packaging partner of choice, which shows the demand for the market in the country.

PET (Polyethylene Terephthalate) Expected to Hold Major Market Share

- Plastic bottles are widely used in various industries in the United Kingdom due to the beverage companies' growing use of recyclable plastics. The food and beverage market is one of the major users of plastic bottles and containers. The rising use of PET bottles drives the country's plastic bottle market due to their low cost and lightweight in various end-user applications, including food, beverage, cosmetics, and pharmaceuticals.

- Furthermore, newer filling technologies and the development of heat-resistant PET bottles provided new possibilities and options in the market. While PET bottles are standard in multiple segments, beverages, cosmetics, sanitary products, and detergents are largely sold in polyethylene (PE) bottles, which is supporting the market's growth in the country.

- PET plastic materials sustain high demand from FMCG brand owners in the United Kingdom. In May 2024, the recycling technology firm Polytag named the UK retailer M&S as a founding member of its Polytag Ecotrace Programme, an initiative set to optimize the tracing and recycling of single-use plastic packaging in the United Kingdom. The Polytag Ecotrace Programme would deploy a vast network of Polytag's invisible UV tag detection equipment in strategically chosen recycling centers that handle high volumes of waste, which would support the recycled PET bottles in the country.

- The market has been registering advancements in the design of bottles to make them easy to load onto pallets and transport to supermarkets, which shows the demand for PET bottles in the market. For instance, in March 2024, Aldi in the United Kingdom launched its own-brand flat recycled PET wine bottles, which it said are made from 100% recycled PET, showing the market's future growth potential.

- The Office for National Statistics (United Kingdom) reported that consumer spending on food and non-alcoholic beverages in the United Kingdom has been increasing, which would support the demand for bottle packaging and fuel PET adoptions in line with the demand for recyclable PET and the advantage of PET material in beverage packaging.

United Kingdom Packaging Industry Overview

The packaging market in the United Kingdom is fragmented and consists of several global and regional players. Some of the players currently dominate the market in terms of overall share. These major players with prominent market share focus on expanding their customer base across end users. These companies, such as Amcor PLC, DS Smith PLC, AptarGroup Inc., Sealed Air Corporation, and Sonoco Products Company, leverage strategic collaborative initiatives to increase their market share and profitability.

- February 2024: The European paper and packaging company DS Smith PLC planned to invest about USD 60 million in a new fiber preparation line at its Kemsley recycled paper mill in southeast England. This would enable the company to deliver returns through improved efficiency and reduced costs. This shows the investments by the market vendors to support their organic growth in the market studied.

- November 2023: Amcor and Saputo Dairy UK won 'Flexible Plastic Pack of the Year' at the UK Packaging Awards. The companies were recognized for developing new, recycle-ready grated cheese packaging for the nation's favorite cheese brand, Cathedral City. This shows the demand for dairy product packaging in the country and the collaborations among the stakeholders to be competitive in the United Kingdom.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Packaging Industry

- 4.5 Analysis of Technologies for Sustainability in Packaging

- 4.6 Overview of the Global Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand from the Millennials for Luxury Packaging for Consumer Goods

- 5.1.2 Soaring Demand for E-commerce Packaging

- 5.1.3 Flexible Packaging Continues to Grow Faster

- 5.2 Market Restraints

- 5.2.1 High Cost of Development and the Rising Concept of Recycling

- 5.2.2 The Rising Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By End-User Vertical

- 6.1.1 Food

- 6.1.2 Beverage

- 6.1.3 Healthcare

- 6.1.4 Cosmetics, Personal Care, and Household Care

- 6.1.5 Industrial

- 6.2 By Plastic Packaging

- 6.2.1 Material Type

- 6.2.1.1 PE (Polyethylene)

- 6.2.1.2 PP (Polypropylene)

- 6.2.1.3 PVC (Poly Vinyl Chloride)

- 6.2.1.4 PET (Polyethylene Terephthalate)

- 6.2.1.5 Other Material Types

- 6.2.2 By Type

- 6.2.2.1 Rigid Plastic Packaging

- 6.2.2.1.1 Bottles and Jars

- 6.2.2.1.2 Trays and Containers

- 6.2.2.1.3 Other Product Types

- 6.2.2.2 Flexible Plastic Packaging

- 6.2.2.2.1 Pouches & Bags

- 6.2.2.2.2 Films and Wraps

- 6.2.2.2.3 Other Product Types

- 6.2.1 Material Type

- 6.3 By Packaging Material Type

- 6.3.1 Paper

- 6.3.1.1 Carton Board

- 6.3.1.2 Containerboard and Linerboard

- 6.3.1.3 Other Types

- 6.3.2 Glass

- 6.3.3 Metal (Cans, Drums, Caps and Closures, and Bulk Containers)

- 6.3.1 Paper

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 DS Smith PLC

- 7.1.3 Owens Illinois Inc.

- 7.1.4 Crown Holdings Inc.

- 7.1.5 Berry Global Inc.

- 7.1.6 Sealed Air Corporation

- 7.1.7 Sonoco Products Company

- 7.1.8 Graphic Packaging International LLC

- 7.1.9 Greif Inc.

- 7.1.10 Ball Corporation

- 7.1.11 Westrock Company

- 7.1.12 Silgan Holdings Inc.

- 7.1.13 AptarGroup Inc.

- 7.1.14 Huhtamaki Oyj

- 7.1.15 Mondi Group

- 7.1.16 Tetra Pak International SA

- 7.1.17 Can-Pack UK Ltd

- 7.1.18 Ardagh Group