|

市场调查报告书

商品编码

1642066

法国包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)France Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

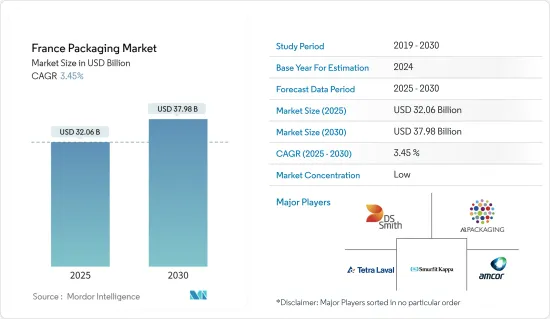

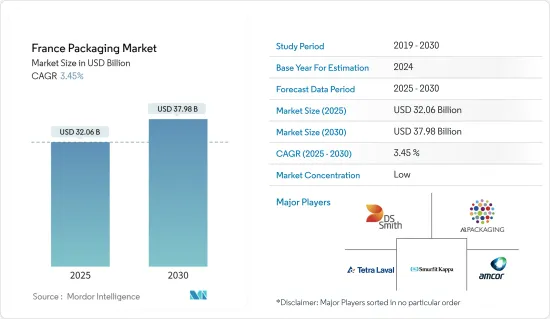

预计 2025 年法国包装市场规模将达到 320.6 亿美元,预计 2030 年将达到 379.8 亿美元,在市场估计和预测期(2025-2030 年)内,复合年增长率为 3.45%。

法国对食品和饮料包装的需求不断增长,原因是重视便利、即食和高价格食品的游客数量的增加。

关键亮点

- 根据美国农业部(USDA)的数据,2023 年国内生产总值(GDP)预计为 28,090 亿美元。法国是世界第七大经济体,欧盟第二大经济体。法国拥有蓬勃发展的食品配料产业,生产各种各样的配料供国内使用并出口到世界各地。

- 此外,前往法国旅游的人数增加也刺激了对法国菜的需求,因为法国菜结合了丰富的风味和独特的烹饪方法。法国烹饪在法国的不断发展和扩大是该国食品产业发展的主要推动力。

- 法国包装製造商致力于透过创新新的永续产品来减少包装废弃物。消费者对环保产品的需求正在推动永续包装解决方案的明显转变。生物分解性、可堆肥和可回收的材料越来越受欢迎。同时,企业正在优先减少塑胶的使用并采取符合循环经济的做法。

- 然而,该国对塑胶使用的监管日益严格,预计将对该国的塑胶包装市场产生影响。例如,2020 年 12 月,法国议会下院通过了一项法律,规定从 2040 年起禁止使用所有一次性塑胶製品和包装,此外还推出了多项增加重复使用和回收的倡议。

法国包装市场的趋势

软包装占很大份额

- 软包装是一种使用非刚性材料包装产品的方法,在法国可以提供更经济、更可客製化的选择。廉价、轻量包装在该国的流行,鼓励製造商在食品、化妆品、个人护理和电子商务等领域使用小袋、袋子和包装纸等软包装。因此,这些因素正在推动市场的成长。

- 袋装包装在法国迅速流行起来,因为它是一种非常方便且便携的解决方案。袋装包装越来越受欢迎,因为与其他容器相比,它使用的材料要少得多,而且可以减少食物废弃物,从而推动了市场成长。过去十年来,消费者对立式袋(用于零食、食品和饮料、婴儿食品以及工业用油和润滑剂)的需求呈指数级增长。

- 法国软包装製造商如安姆科集团提供有助于延长生鲜食品保质期的柔性纸包装解决方案。 2023 年12 月,瑞士安姆科集团(Amcor Group) 将为法国起司製造商Fromagerie Milleret 提供可回收的纸质柔软剂,用于生产其优质起司「Le Baron Brie」和「l'Ortolan Bio」。并提供包装。 Amcor 的 AmFiber Matrix 包装使软乳酪生产商能够控制其产品内的水分含量和成熟过程。

- 法国消费者越来越意识到包装对环境的影响。他们正在寻找平衡功能性和环保性的包装解决方案。根据法国纸板、造纸和纤维素工业联合会(COPACEL)的数据,预计到 2020 年,法国包装纸和纸板产量将增加 64.3%,到 2023 年将成长 70%。

- 因此,消费者偏好的变化推动了对永续和可回收软包装的需求。作为回应,软包装製造商正在适应这些不断变化的需求并创造优先考虑环境因素的创新解决方案。

食品领域可望主导市场

- 法国快速发展的食品和餐饮服务业正在推动该国的包装市场的发展。这些变化使得新包装样式的需求日益增加,包括多件装和更小、更方便的单份包装。软包装和硬质塑胶是法国包装市场上最受欢迎的材料。

- 法国製造商正致力于扩大其纸张生产设施,以满足该地区日益增长的纸质包装需求。 2024 年 5 月,英国跨国公司 DS Smith 宣布将向其位于法国的 La Chevrolière 工厂投资 600 万欧元(645 万美元)。

- 据法国有机农业发展促进机构Agence Bio称,法国有机食品市场(不包括餐厅和其他食品服务场所)的年销售额预计在2019年和12年分别达到114亿欧元(123.3亿美元)。 ,其销售额将达到8,000 万欧元(137 亿美元)。有机食品市场的兴起也将带动全国包装产业市场的发展。

- 法国消费者欣赏简洁、美观且体现品质的设计。将功能性与美观性结合的包装越来越受到关注。该趋势倾向于极简主义,提倡减少标籤混乱并突出优质材料。

- 消费者对食品的来源和生产方式比以前更感兴趣。品牌正在采用强调可追溯性、具有成分标籤和采购细节的包装解决方案,包括单份包装、可重新密封的袋子和专为份量控製而设计的产品。

法国包装产业概况

法国包装市场的竞争格局较为分散,主要参与者有 DS Smith PLC、AR Packaging Group AB、Smurfit Kappa Group PLC 和 Tetra Pak International SA 等。此外,由于各公司都在进行各种创新和投资,供应商之间的竞争水平也非常激烈。公司也透过收购来增强产品系列併扩大市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 人口变化和消费者偏好变化等宏观经济因素

- 旅游业成长

- 市场问题

- 加强国内塑胶使用监管

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 材料

- 塑胶

- 玻璃

- 金属

- 其他的

- 包装类型

- 软包装

- 硬包装

- 按最终用户产业

- 食物

- 饮料

- 医疗和製药

- 美容与个人护理

- 其他最终用户细分市场

第六章 竞争格局

- 公司简介

- AR Packaging Group AB

- DS Smith PLC

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- Amcor PLC

- Ball Corporation(Rexam PLC)

- RPC Group PLC

- Owens Illinois Inc.

- Ardagh Group

- Mondi PLC

- Ametek Inc.

- Crown Holding Inc.

- Constantia Flexibles GmbH

第七章投资分析

第八章 市场机会与未来趋势

The France Packaging Market size is estimated at USD 32.06 billion in 2025, and is expected to reach USD 37.98 billion by 2030, at a CAGR of 3.45% during the forecast period (2025-2030).

The growing demand for packaging in France for the food and beverage industry is attributable to increasing tourism with increased emphasis on convenience, ready-to-eat, and value-priced foods.

Key Highlights

- According to the United States Department of Agriculture (USDA), the gross domestic product (GDP) in 2023 is estimated at USD 2.809 trillion. France is the world's seventh-largest economy and the second-largest in the EU. France has a flourishing food ingredient industry, producing a wide range of ingredients used domestically and exported worldwide, which signifies the demand for packaging in the country.

- Additionally, the growth in the number of tourists in France has stirred the demand for French food, an amalgamation of rich flavors and unique processes. The constant development and expansion of French food options in the country significantly drive the food industry in the country.

- French packaging manufacturers focus on reducing packaging waste by innovating new sustainable products. Consumer demand for eco-friendly products propels a notable shift towards sustainable packaging solutions. Materials that are biodegradable, compostable, and recyclable are becoming increasingly favored. In tandem, companies are prioritizing reducing plastic usage and embracing practices aligned with the circular economy.

- However, increasing regulations in the country against the use of plastic are anticipated to affect the market for plastic packaging in the country. For instance, the French Parliament's lower chamber passed a law in December 2020 that banned all single-use plastic products and packaging after 2040, in addition to several initiatives to increase reuse and recycling.

France Packaging Market Trends

Flexible Packaging to Have a Significant Share

- Flexible packaging is a means of packaging products using non-rigid materials, which allows for more economical and customizable options in France. As cheap and lightweight packaging is gaining popularity in the country, manufacturers are encouraged to use flexible packaging such as pouches, bags, and wraps for food, cosmetics, personal care, and E-commerce applications. Hence, these factors are responsible for boosting the market's growth.

- Pouch packaging is rapidly gaining popularity in France, as it is a highly convenient and portable solution. The growing popularity of pouch packaging, as it significantly uses less material than other containers and reduces food waste, drives the market growth. Consumers drove the demand for stand-up pouches (for snacks, beverages, baby food, or industrial oils and lubricants) exponentially over the past decade.

- French flexible packaging manufacturers, such as Amcor Group, provide flexible paper packaging solutions that help extend the shelf life of perishable food products. In December 2023, Amcor Group, a Swiss-based brand, supplied France-based cheese producer Fromagerie Milleret with recycle-ready paper flexible packaging for the company's Le Baron Brie and l'Ortolan Bio premium cheeses. Amcor's AmFiber Matrix packaging allows soft cheese producers to control the level of moisture within the product and the ripening process.

- French consumers are increasingly aware of the environmental implications of packaging. They are on the lookout for packaging solutions that strike a balance between functionality and eco-friendliness. According to the French Union of Carboard, Paper and Cellulose Industries (COPACEL), the distribution of paper and paperboard production in France for packaging, in 2020 was 64.3% and it has increased to 70% in 2023.

- Therefore, this shift in consumer preference has led to a heightened demand for sustainable and recyclable flexible packaging materials. In response, manufacturers of flexible packaging are pivoting towards these evolving demands, crafting innovative solutions that prioritize environmental consciousness.

Food Segment Expected to Dominate the Market

- France's rapidly growing food and food service industry drives the country's packaging market. As a result of these changes, new packaging styles, such as multi-packs and more miniature and more convenient single-serve packs, are becoming increasingly necessary. Flexible packaging and rigid plastics are the most popular materials in the French packaging market.

- French manufacturers are focusing on expanding paper manufacturing facilities to cater to the region's increasing demand for paper packaging. In May 2024, DS Smith, a British multinational company, announced an investment of EUR 6 million (USD 6.45 million) in its La Chevroliere facility in France.

- According to Agence Bio, the French Agency for the Development and Promotion of Organic Agriculture, the annual turnover of the organic food market in France, excluding restaurants and other food service facilities, was EUR 11.4 billion (USD 12.33 billion) in 2019 and reached EUR 12.08 billion (USD 13.07 billion) in 2023. The rise in the organic food market also promotes the packaging industry market across the country.

- French consumers have a penchant for clean, attractive designs that exude quality. Packaging that marries functionality with aesthetic appeal captures attention. This trend leans towards minimalism, advocating for less clutter on labels and emphasizing premium materials.

- Consumers are more curious than ever about their food's origins and production methods. Brands adopt packaging solutions that underscore traceability, featuring ingredient labels and sourcing details, including single-serve packages, resealable bags, and products designed for portion control.

France Packaging Industry Overview

The competitive landscape of the French packaging market is fragmented, with major players such as DS Smith PLC, AR Packaging Group AB, Smurfit Kappa Group PLC, and Tetra Pak International SA vying for larger market share. Moreover, the competition level among these vendors is high due to the various innovations and investments made by the companies. Companies are also undergoing acquisitions to strengthen their product portfolios and increase their market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Macroeconomic Factors, such as Demographic Changes and Changing Consumer Preferences

- 4.2.2 Increasing Tourism in the Industry

- 4.3 Market Challenges

- 4.3.1 Increasing Regulations in the Country against the Use of Plastic

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Other Materials

- 5.2 Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.3 End-user Verticals

- 5.3.1 Food

- 5.3.2 Beverages

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Beauty and Personal Care

- 5.3.5 Other End-user Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AR Packaging Group AB

- 6.1.2 DS Smith PLC

- 6.1.3 Smurfit Kappa Group PLC

- 6.1.4 Tetra Pak International SA

- 6.1.5 Amcor PLC

- 6.1.6 Ball Corporation (Rexam PLC )

- 6.1.7 RPC Group PLC

- 6.1.8 Owens Illinois Inc.

- 6.1.9 Ardagh Group

- 6.1.10 Mondi PLC

- 6.1.11 Ametek Inc.

- 6.1.12 Crown Holding Inc.

- 6.1.13 Constantia Flexibles GmbH